Slowest-growing states have progressive income taxes

Fewer people want to live in states with progressive income taxes. So after 6 straight years of population loss, why would Illinois want to join them?

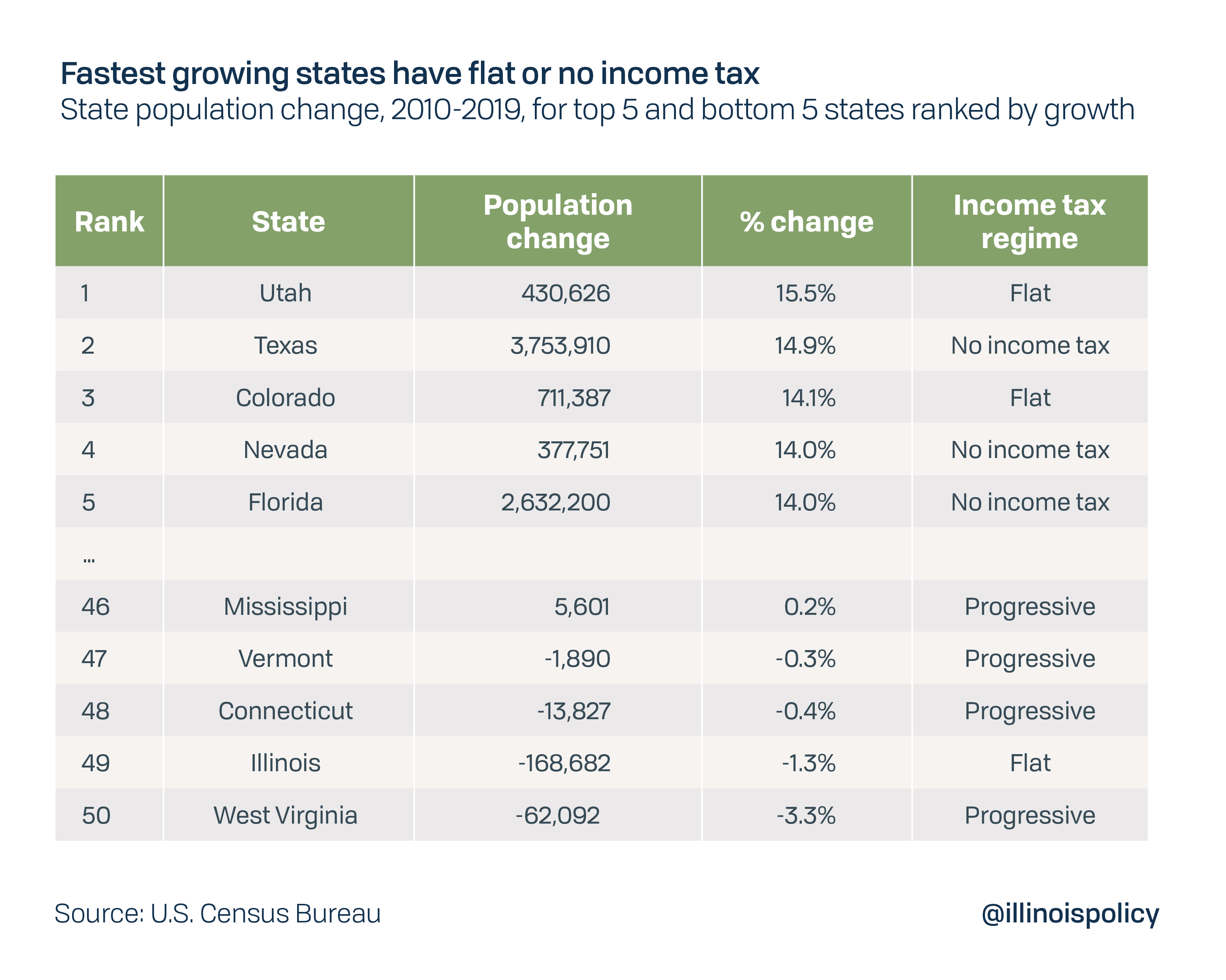

Four of the five slowest-growing states during the past decade had progressive income taxes in common. The fifth state in that group of underachievers was Illinois, and its political leaders are pushing for a progressive income tax.

Illinois experienced its sixth consecutive year of population decline in 2019, and ended the decade with the worst total population decline in the nation, according to recent data from the U.S. Census Bureau. State leaders are asking voters on Nov. 3 to allow it to join the other slow-growth states by replacing its flat state income tax with a progressive tax intended to pull another $3.7 billion from Illinois taxpayers, $3.4 of which would go to the state’s general revenue fund.

There was a common theme among the five top population performers, also. All of them had either a flat or no state income tax.

While Illinois’ population decline was the worst in raw terms, West Virginia’s was worst in percentage terms.

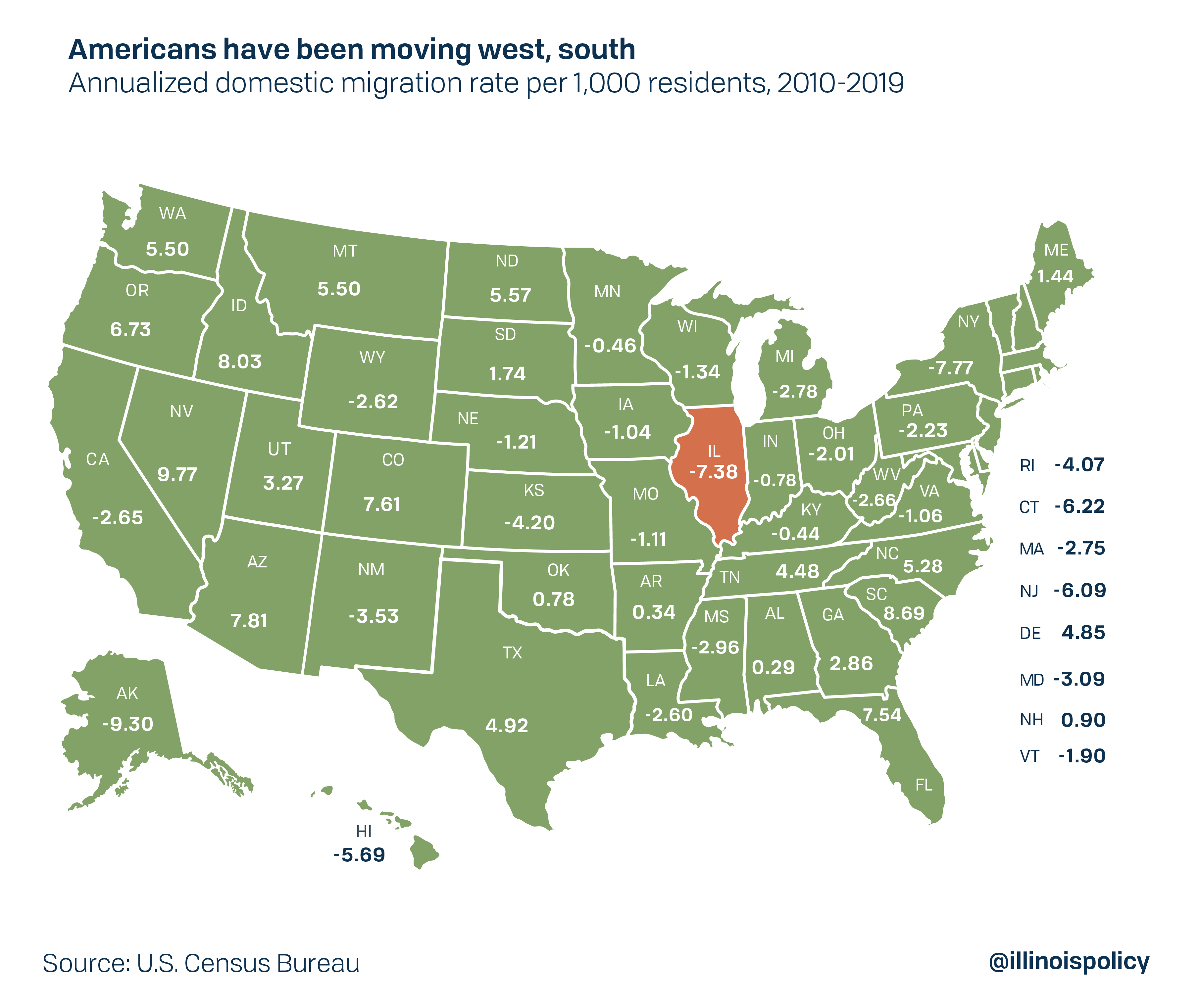

For many states, the biggest factor in population change has been movement between states. Domestic migration will become especially important for state population growth as the nation’s population ages and fertility rates fall below replacement rates. With population growth hinging ever-more on domestic migration, the reasons Americans are choosing to move become more important.

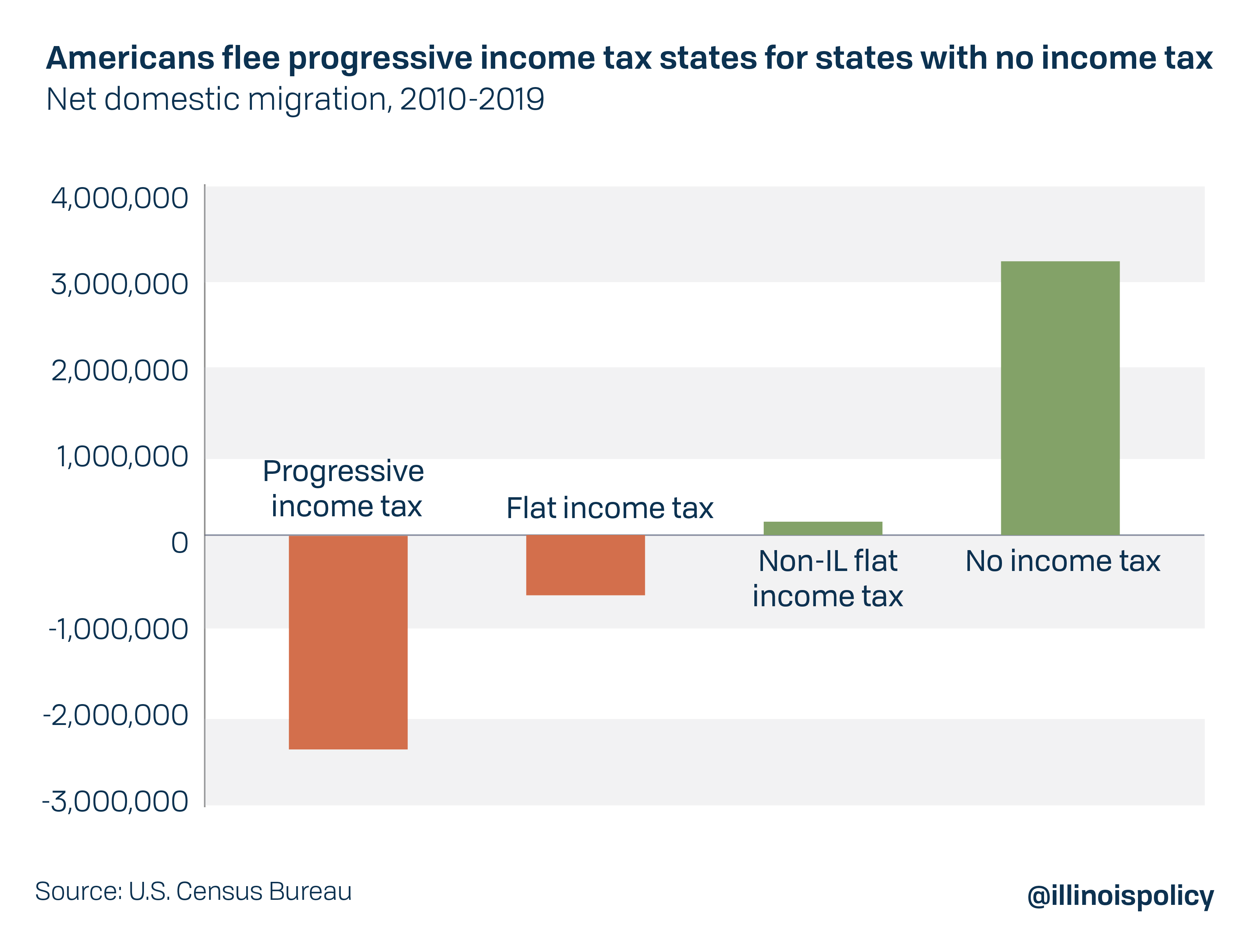

During the past decade, there has been a well-documented exodus of Americans from the Northeast and Midwest to the West and South. However, there has also been another less-documented trend: Americans moving from progressive income tax states to states with no income taxes.

During the past decade, Americans have consistently chosen to move to states with no income tax rather than states with progressive income taxes. Nearly 3.2 million Americans have moved to states without income taxes, while 2.5 million Americans left states with progressive income taxes. And when looking at flat tax states, removing Illinois from the equation shows a slight uptick (+154,221) in population due to domestic migration for flat income tax states.

Why this matters for Illinois

A poll conducted late last year by NPR Illinois and the University of Illinois-Springfield revealed the No. 1 reason Illinoisans said they considered leaving was taxes. With each person who leaves, taxes become a bigger problem for Illinoisans who stay.

Population decline, and more specifically the decline in the prime working-age labor force, has serious negative implications for the state’s economy and the growth in state tax revenue needed to pay for current liabilities. As the population shrinks, so too does the potential tax base. Unfortunately, many of Illinois’ costs, such as pension liabilities, are fixed costs that exist independently of population trends. That means that even though the taxpayers are gone, the tax revenue needs mainly stay the same.

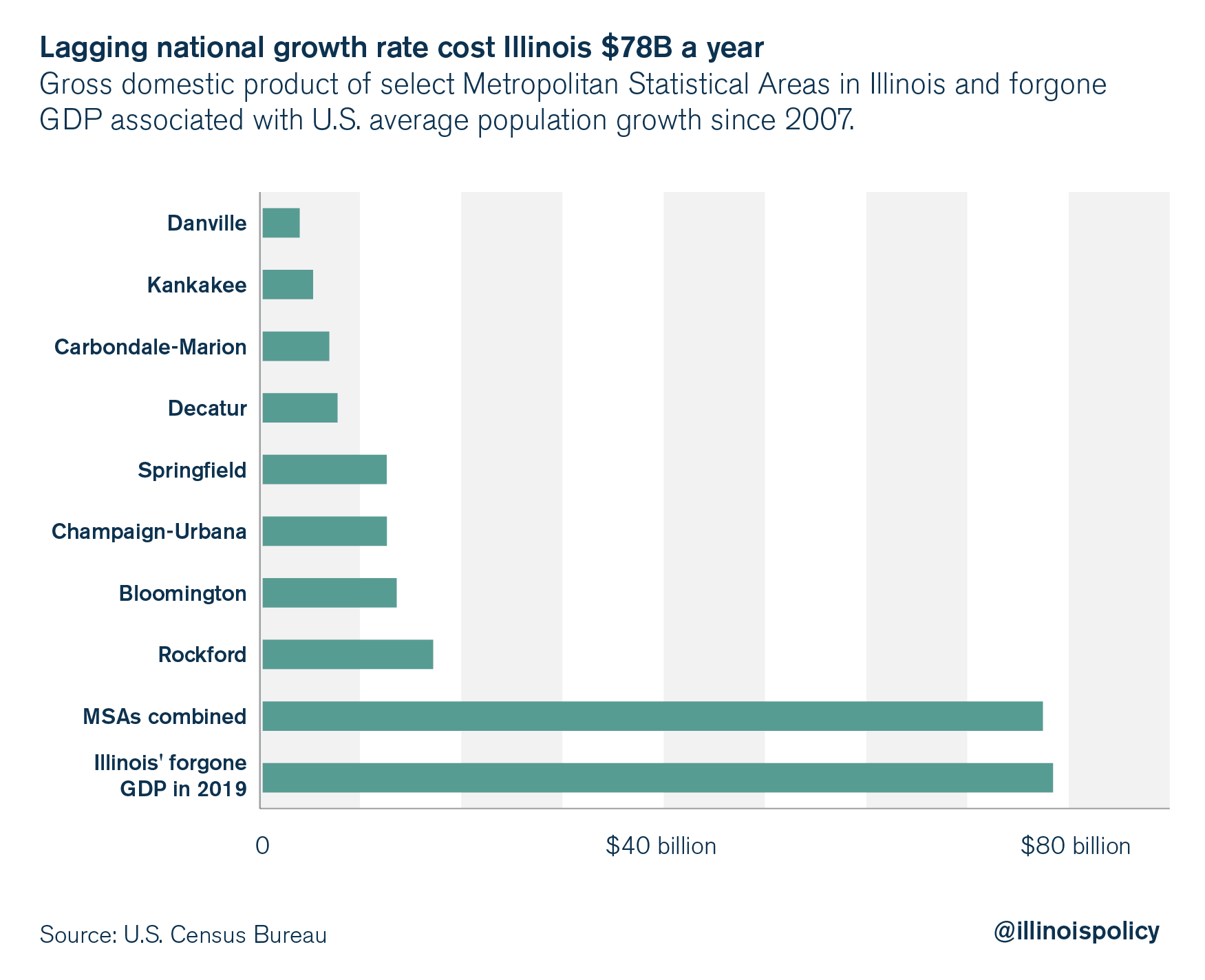

If Illinois had kept pace with average state population growth since the start of the Great Recession, it would generate $3.45 billion more in state tax revenue annually.

That’s more than the $3.4 billion in new general revenue funds Gov. J.B. Pritzker’s controversial graduated income tax hike is claimed to generate as the state’s share.

If the state had simply grown at the same rate as the national average, the Land of Lincoln would have seen population growth and nearly 1.14 million more residents – 9% more than it has today. This population growth would also be the equivalent of at least an estimated $78 billion in additional economic activity in the state. That’s equivalent to adding the combined economies of Bloomington, Carbondale-Marion, Champaign-Urbana, Danville, Decatur, Kankakee, Rockford and Springfield.

Unfortunately, lawmakers have failed to take steps to make the state a more attractive place for businesses and families to locate – choosing to squeeze more taxes from a shrinking population rather than growing more revenue by drawing more people to Illinois. They can still fix the problem by introducing policies that address Illinois’ high debt, high taxes and shrinking population.

Voters on Nov. 3 will decide whether to scrap the state’s constitutionally protected flat income tax and hand state lawmakers greater taxing power through a progressive tax, which proponents initially estimate will generate $3.7 billion, including $3.4 billion in general revenue funds. The revenue projections for a progressive income tax didn’t account for the decline in population that the new census data just revealed, meaning $3.7 billion is likely an overstatement.

Recent history proves that pursuing further tax hikes won’t solve Illinois’ problems. In the eight years since lawmakers imposed the “temporary” income tax hike of 2011, outmigration has continued and state finances have deteriorated. The Land of Lincoln is now in even worse fiscal condition and saddled with the most debt ever.

Instead of pursuing the same tax hike policies that have failed to fix state finances while driving thousands of jobs and opportunities away from the state, likely exacerbating the state’s people problem, Illinois needs real reform that would put the state on a firm fiscal footing and give much needed certainty and tax relief to families and businesses.

First, Illinois must address its pension problem, which continues to grow despite two record income tax hikes within the past decade. Though pensions take up more than 25% of general fund expenditures, the pension funds are no more solvent. But by amending the Illinois Constitution to allow for the adjustment of the growth rate of not-yet-accrued benefits, the state can reduce pension debt and ensure the plans can continue to support retirees without overwhelming taxpayers. Such changes could include increasing the retirement age for younger workers, tying annual benefit increases to the actual cost of living and making retirement plans more closely resemble 401(k)s for new workers.

Second, a spending cap could help the state meet Illinois’ constitutional balanced budget requirement, which has been ignored for 18 years. One interesting proposal would be a smart spending cap that ties government spending growth to Illinois’ total growth in gross domestic product. Texas and Tennessee have implemented something similar to this, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Responsible government spending growth that taxpayers can afford would provide more stability for families and businesses. But if the state substitutes tax hikes for necessary reforms, Illinois can expect to continue seeing population declines as residents find better opportunities elsewhere.