Illinois pension costs skyrocketed by 500%, crowding out government services

The rapidly increasing cost of pensions is crowding out core government services.

You can tell a lot about government’s priorities by looking at how it spends tax revenues.

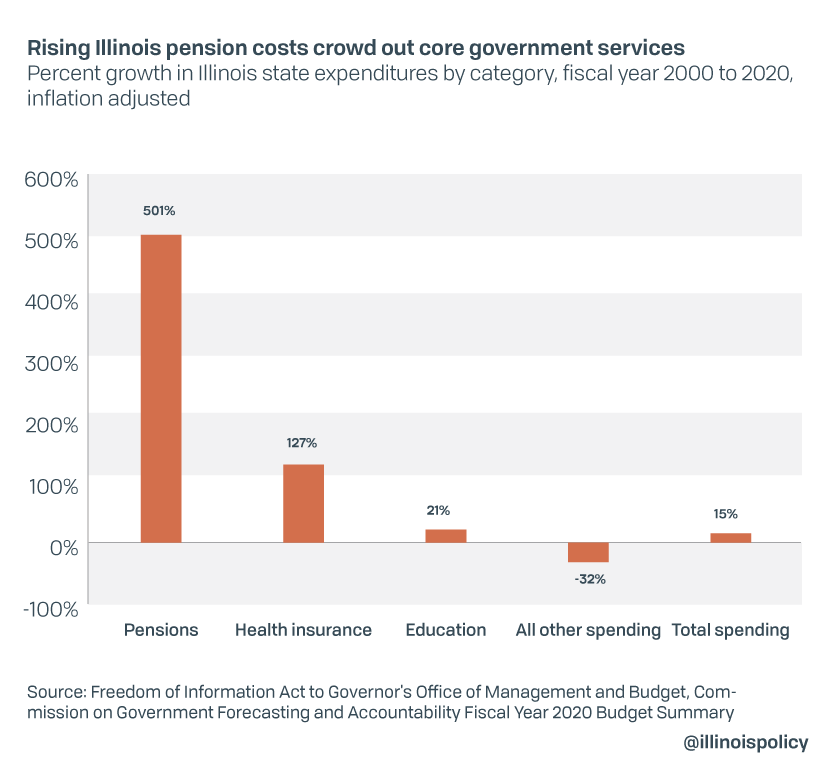

Consider education funding, which most agree is a fundamental government service. Since fiscal year 2000, after adjusting for inflation, state spending on education has grown by 21%.

State spending on everything from child protection, state police, college aid for low-income students and more has fallen by nearly one-third during that time.

State spending on pensions for government workers, meanwhile, grew by a whopping 501% – on top of a 127% increase in spending on health care costs for state workers.

Total state spending has increased by 15%, predominately driven by pensions and health care for government workers. Because the state is prioritizing pensions, everything else – social services and education included – takes a backseat.

Local government pension costs are no less burdensome. Fast-growing local pension costs are the primary driver of Illinois homeowners’ sky-high property taxes.

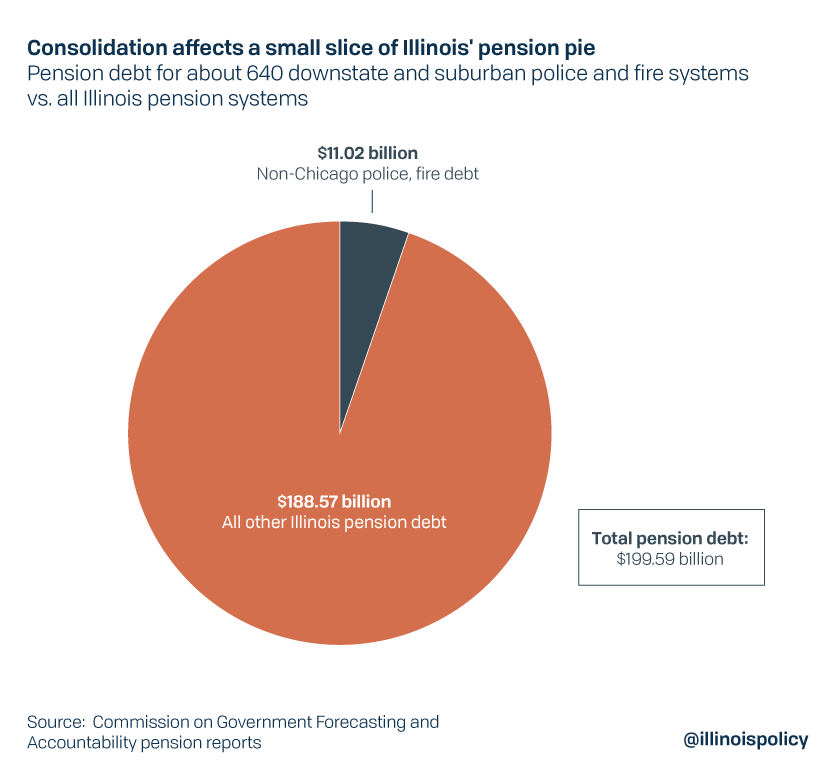

During veto session, state lawmakers sought to address the state’s pension crisis by sending a bill to Gov. J.B. Pritzker’s desk that would consolidate more than 640 suburban and downstate public safety pension funds.

As previously noted by the Illinois Policy Institute, consolidation of downstate police and fire pension funds made sense by itself, though it targets just a small fraction of the problem and falls far short of fully solving it. The problem with the bill that passed is that lawmakers didn’t run the numbers before voting in favor of the measure. Before adjourning for the end of veto session last week, lawmakers added to the consolidation bill pension benefit enhancements for employees hired after 2011 – without estimating the cost. While the governor’s task force publicly stated the enhancements would cost $14 million to $19 million more per year, this number was not backed up by any type of public data or methodology to justify it.

But beyond this lack of due diligence, the governor’s pension consolidation bill doesn’t touch Illinois’ true pension problem: the five state-run systems and their massive $137 billion shortfall.

The only real answer to Illinois’ pension crisis is a constitutional amendment that protects earned benefits but allows for changes to future benefit growth. Without such a change, Illinoisans face a future in which they are asked to pay more to receive less in services.