Income tax hike dropped Illinois’ economic freedom rank, ‘fair tax’ would drop it more

The largest permanent income tax hike in Illinois history was followed by a slide to 34th least-free state in the union, behind nearly every neighboring state.

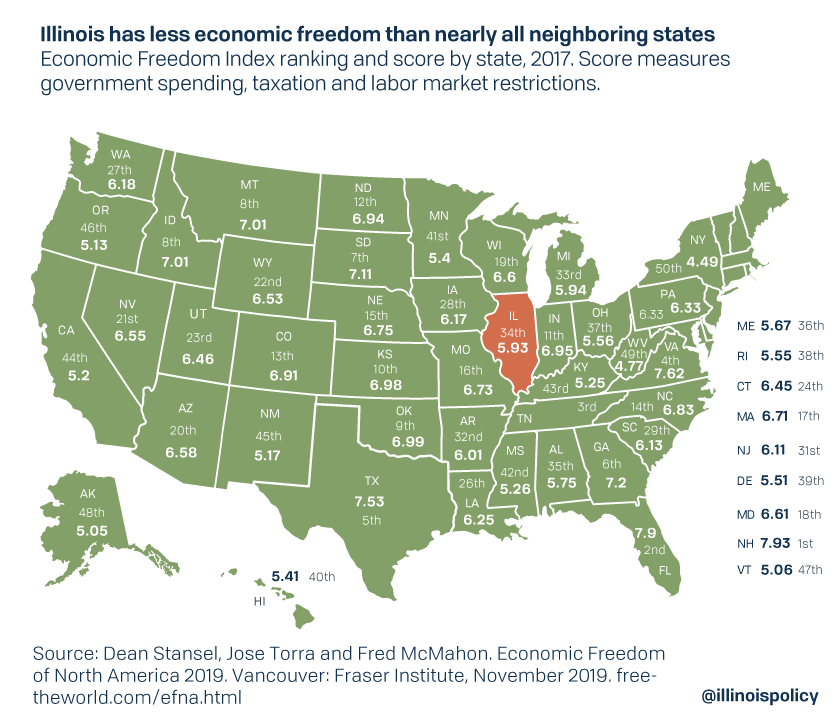

Illinois is one of the least free states in the nation, ranking 34th in the country when it comes to economic freedom. That’s according to a Nov. 7 report released by the Fraser Institute, a nonpartisan research and educational organization based in Canada. Illinois’ ranking was worse than every neighboring state other than Kentucky.

The report measures government spending, taxation and labor market restrictions to create an index for economic freedom within state economies. In 2017, the most recent year of comparable data, the freest states were New Hampshire, Florida, Tennessee, Virginia and Texas. Meanwhile, the least free states were New York, West Virginia, Alaska, Vermont and Oregon. New York was designated as the least free state in the nation for the fifth consecutive year.

Economic freedom is important for the health and wellbeing of an economy, and the living standards for a state’s residents. States with greater levels of economic freedom see higher per capita income, stronger growth in the economy and increased entrepreneurial activity. These states also attract more residents from other states and experience strong employment and income growth.

Illinois voters will decide in November 2020 whether to scrap the most competitive part of the state’s tax code, a constitutional flat income tax protection, and replace it with Gov. J.B. Pritzker’s progressive income tax rates. Doing so would further depress Illinois’ ranking on the Fraser index.

Illinois’ income tax hikes have hindered the state’s economic freedom

While Illinois used to rank in the middle of the pack for economic freedom, the state’s ranking has fallen in recent years.

Illinois’ ranking slipped immediately following the temporary income tax hike that lasted from 2011-2014. After rebounding to the No. 30 spot when the tax was allowed to sunset, the state immediately slipped back to 34th in the nation with the passage of the largest permanent income tax hike in state history in 2017. However, while the state’s income tax hike contributed to a slip in the rankings, Illinois’ flat income tax ranks ahead of most state income tax systems when it comes to economic freedom.

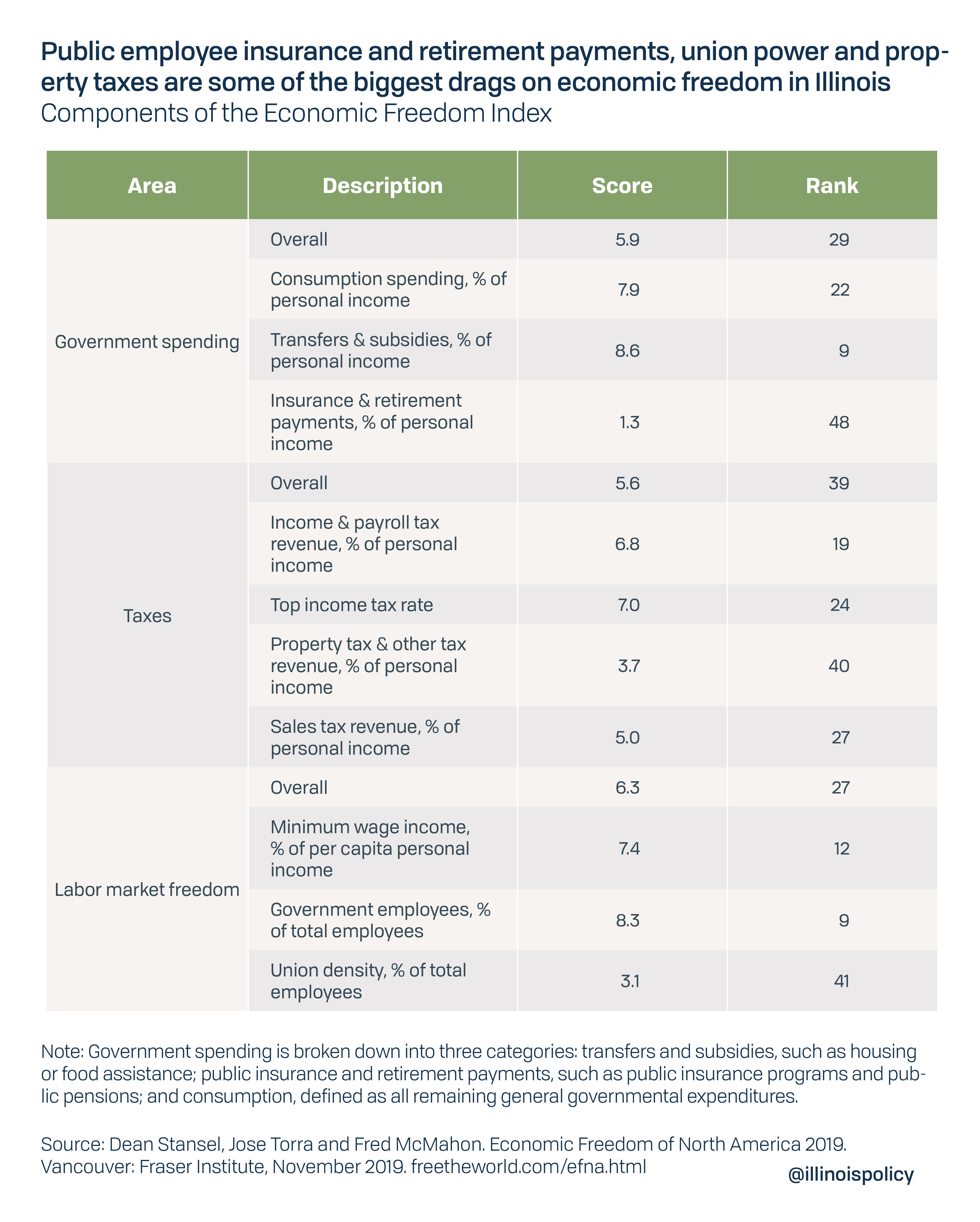

Pensions, property taxes and government union power hurt Illinois’ economic freedom

While it seems that income tax hikes in recent years have been pushing Illinois farther down the economic freedom rankings, there are other factors that are even bigger drags on the state’s performance in the index.

The most significant hindrances to Illinois’ economic freedom – the areas with the lowest index scores – are public employee insurance and retirement payments, primarily pensions. Pensions now eat up significant chunks of state and local budgets, with more than a quarter of the state’s General Revenue Fund budget dedicated to pension obligations, diverting resources away from services and requiring larger tax burdens on Illinoisans.

The next most significant drag is the extent of union power in the labor market. While Illinoisans in the private sector are more likely to be union members than private sector workers in the rest of the nation, the large disparities in union density between Illinois and most other states comes from the high concentration of union employees in the public sector. The state’s large density of public employees, who often make significantly more than their private sector peers, has severe negative implications for the labor market prospects of Illinoisans in the private sector. Not only does this require higher taxes but it can also raise the risk of unemployment for other Illinoisans.

Finally, the state’s exceptionally heavy property tax burdens place a damper on the economic freedom of Illinoisans. Illinoisans face the second-highest property taxes in the nation and much of the property tax burden is because of the state’s massive pension obligations and expensive public sector collective bargaining contracts.

Changing course

If Illinois continues on its current path, it can expect to slip farther down the economic freedom index. In 2019 the Illinois General Assembly passed legislation to nearly double the state’s minimum wage and enacted 20 new tax and fee hikes totaling $4.6 billion. Meanwhile, the state’s largest government union, AFSCME Council 31, received a contract costing taxpayers an additional $3.6 billion and further bolstering union power.

Noticeably absent from discussion in 2019 was any legislative movement toward constitutional pension reform. Absent reforms, not only will future obligations continue to eat a larger share of state budgets, but massive tax hikes will be required to pay for state and local pensions. Ever-increasing income and property taxes to pay for these pensions will continue to wreak havoc on the housing market and hinder growth in Illinois home values – which already lag the rest of the nation – while raising the cost of housing for both homeowners and renters.

Instead of addressing the cost drivers of Illinois state and local government, the conversation has turned to further income tax hikes, this time in the form of a progressive state income tax. Despite enacting two record income tax hikes within the past decade, Illinois’ pension problem continues to grow. Expect the same if the governor’s progressive income tax plan is approved by voters on the November 2020 ballot. If the measure passes, and Illinoisans scrap their constitutionally protected flat income tax, politicians will be able to more easily raise taxes on different income groups, inevitably reaching the middle class. That power was seen as a “blank check” for lawmakers by nearly half the voters polled.

Lower levels of economic freedom can have severe negative consequences for employment outcomes and reduce standards of living for Illinoisans. At the same time, states with greater economic freedom experience stronger migration from other states and stronger income and employment growth.