Progressive income tax uncertainty likely to put brakes on Illinois’ weak housing recovery

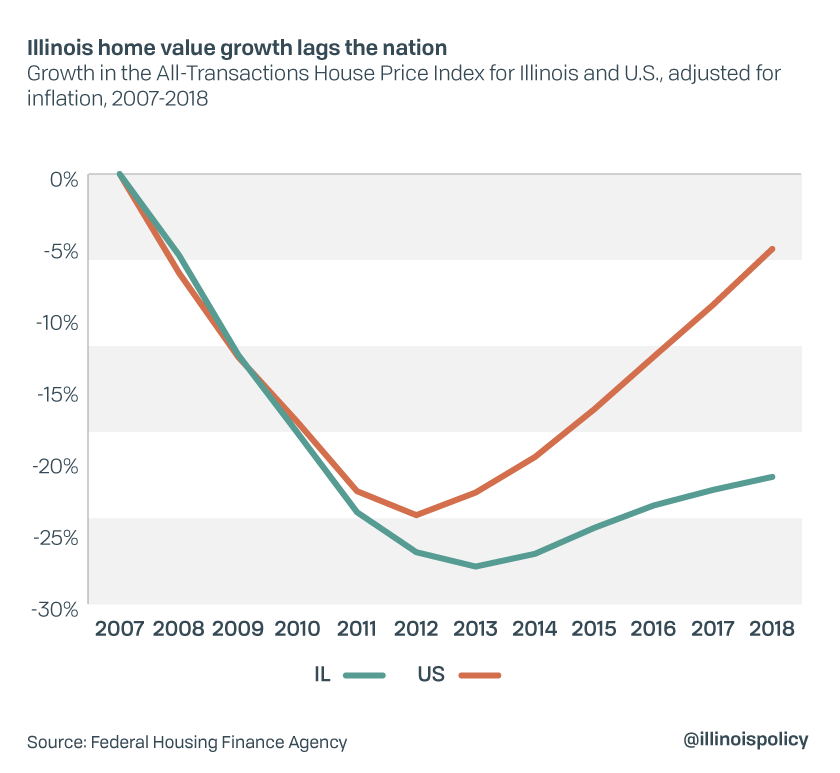

Illinois’ housing price growth remains well below the national average because of lagging demand, caused in large part by tax policies that make people hesitant to spend.

The past few years have been tough for the Illinois housing market. The poor performance relative to other states in 2018 led realtor.com to forecast the Chicago-Naperville-Elgin Metropolitan Area would have the biggest housing slowdown in the 2019 U.S. market, the second time it would hold that distinction since 2017.

Unfortunately for Illinois homeowners, the housing market’s recovery will again be limited in the coming year by anxiety over proposed state income tax hikes as well as the rude surprises too often found in property tax bills.

Illinois’ tax climate leads to weak demand and lagging growth in home values

The year started slow and Illinois had a particularly bad June, in which statewide home sales declined 11.2% compared to June 2018. July recorded small gains in home sales (up 0.3%) and median home prices (up 2.6%) from July 2018. A reversal of monetary policy at the Federal Reserve should help stimulate demand. The average commitment rate for a 30-year fixed mortgage has declined about 75 basis points since last year, so price growth would normally accelerate. However, a less competitive tax climate that includes recent property tax increases and proposed income tax hikes in Illinois and in the Chicago area could offset any benefit created by lower borrowing costs.

Despite declining housing inventory, Illinois house price growth remains well below the national average due to weak demand. Had demand for housing matched that of the rest of the nation, housing prices would have increased at a rate much closer to the national average as housing inventory declined.

Progressive income tax uncertainty and economic growth

Election years bring a lot of uncertainty. Changing government policies can have a huge impact on the business climate, and the economic uncertainty that surrounds changing policies has been shown to foreshadow declines in investment and employment.

When there’s uncertainty about who will be making policy decisions, what those decisions will be and how they will affect the economy, individuals and businesses who have money to spend will pause before writing a check.

Economists Scott Baker, Nicholas Bloom and Steven Davis found that to be the case: a rise in policy-related uncertainty is associated with lower economic growth. Over time, policy uncertainty has risen alongside: 1) the growth in government spending, taxes and regulation; and 2) the increased political polarization and its implications for the policy-making process and policy choices.

Because the payoffs associated with private economic decisions are increasingly affected by government policies that are subject to change – such as Illinois’ income tax structure – people and businesses are cautious. They spend less and save more, resulting in lower growth and declining interest rates. The three economists also found that policy uncertainty leads to an increase in stock price volatility. Increased policy uncertainty foreshadows declines in investment, output and employment.

Nothing to fear but fear itself

Business confidence and consumer confidence are the cheapest forms of stimulus, but when businesses and families are unsure about the future policy climate and about the effects these policies will have on themselves or the economy, they will often hesitate before making large financial decisions.

During the 2007-2009 crisis, policy-related uncertainty alone caused two-thirds of the drop in corporate investments across the country. An increase in policy uncertainty equal to the actual change between 2006 and 2011 foreshadowed large and persistent declines in aggregate outcomes, with peak declines of 2.2% in real gross domestic product, 13% in private investment and 2.5 million in aggregate U.S. employment.

Currently, both nationwide business confidence and consumer confidence are in decline amid uncertainty over potential changes in the policy climate and the health of the economy. For Illinois, this uncertainty is magnified by the November 2020 ballot question on whether to scrap the state’s flat income tax protections for a progressive income tax. With near-stagnant housing inventories and uncertainty regarding the future, demand is expected to decline and sales will continue to fall. Slowing growth in home values coupled with rising costs of homeownership means many homeowners will never realize the expected returns that homebuyers are expecting to gain in other states.

Illinois’ declining population lowers demand

A falling population is making the problem worse. Illinois for five consecutive years has lost population – primarily working-age adults – as people move away. Chicago has had four consecutive years of population loss. Fewer people means less housing demand. That means lower spending on housing, less business investment, lower business profits and no improvements in living standards for workers.

When housing demand falls, the time it takes to sell a home increases and housing prices fall. For local government budgets, it means that for a given tax rate, property tax revenues fall. Unfortunately, Illinois local governments face large pension debt obligations, which mean that without pension reforms, they will be forced to raise taxes on a shrinking tax base.

Illinois homeowners already face the second-highest property taxes in the country, and that is not expected to change. Meanwhile, Illinois’ more fiscally responsible neighbors have consistently been able to lower both their income and property tax rates in an effort to become more competitive.

In addition, research shows job prospects and housing market performance go hand in hand. In the year immediately following the state’s July 2017 tax hikes, private sector employment growth lagged the rest of the U.S. Along with a weak housing market performance in 2018, Illinois’ private sector job growth ranked 46th in the nation.

The prospect of a steady paycheck is a major contributor to the health of any local housing market. Individuals cluster around job opportunities, raising housing demand in healthy labor markets. In addition, homeowners who see the value of their homes appreciate feel wealthier and therefore consume more, resulting in higher profits for businesses and more job creation.

Lower demand for housing in Illinois, falling housing inventory and sales are a natural result of an underperforming local economy.

Solutions

For Illinois in 2020, scrapping the Illinois Constitution’s flat income tax protection and allowing state lawmakers to set different rates for smaller groups of taxpayers has been touted as a way to close persistent state budget deficits. That is the argument, despite previous tax hikes failing to balance Illinois’ budget and failing to stop Illinois’ debts from growing.

Illinois hasn’t had a balanced budget since 2001. The current budget also spends more than Illinois has, with research showing the 2020 state budget is between $574 million and $1.34 billion out of balance.

Uncertainty over the tax climate and the fiscal condition of the state is likely to cause economic activity to slow even more, further depressing housing demand and housing appreciation.

Despite how it was marketed, the progressive income tax – initially a $3.4 billion income tax increase – is likely to harm the local economy. It would give state lawmakers greater freedom to divide taxpayers into smaller income groups and continue spending and raising taxes without the political blowback when rates are raised on everyone.

Reforms to state spending must be implemented to reduce uncertainty regarding the tax climate that continues to drive the vicious cycle of decline in housing values, job creation, population and the overall economy. Pensions take up a significant portion of the state budget – more than 25% of general fund expenditures – yet the funds are no more solvent. Unaffordable pension debt can be addressed by amending the Illinois Constitution. Adjusting the growth rate of not-yet-accrued benefits to match current economic realities, increasing the retirement age for younger workers, capping maximum pensionable salaries and making pensions more closely resemble 401(k)s for new workers are all ways of reducing the long-term debt burden caused by pensions.

More generally, a spending cap could be introduced to fix the Illinois balanced budget requirement that has been ignored for 18 years. One interesting proposal would be a smart spending cap that ties government spending growth to Illinois’ total growth in GDP. Texas and Tennessee have implemented something similar to this, and both have budget surpluses, no state income tax and lower property tax rates than Illinois.

Responsible government spending growth that taxpayers can afford would provide more stability for families and businesses and would place Illinois in a better position to deal with an economic slowdown. A spending cap induces more efficient government spending and drops the risk of another income tax hike.

Without spending reforms in early 2020, Illinois’ economy is expected to slow and Illinois residents will continue to vote with their feet, moving to states that provide them more employment opportunity – and that let them keep more of their money. As other states have demonstrated, fixing the state’s finances by enacting spending reforms – not continuing to ask taxpayers for more by switching to a progressive income tax – is ultimately the best way to create a better environment for both families and businesses to plant roots or stay in Illinois.