Illinois House bills would reverse Pritzker’s car trade-in tax

A pair of proposals recently filed by state lawmakers would kill the vehicle trade-in sales tax before it kicks into gear at the start of 2020.

Two new proposals in the Illinois General Assembly would end a sales tax on car trade-ins before it gets started.

State Reps. Tom Bennett, R-Gibson City, and Ryan Spain, R-Peoria, introduced bills that would halt the new trade-in tax that became law during the summer and is to be collected starting Jan. 1. Both proposals – House Bill 3890 and House Bill 3891 – would amend the Use Tax Act and Retailers’ Occupation Tax Act by reversing a new law that expands the scope of sales taxes in the state to include used cars’ trade-in value greater than $10,000. State Rep. Andrew Chesney, R-Freeport, signed on as co-sponsor of both.

The state currently collects no sales tax on a car’s trade-in value, which in practice acts as credit toward a new vehicle purchase. By law, sales tax only applies to the difference between trade-in value and the new vehicle’s purchase price.

But that changes Jan. 1 after Gov. J.B. Pritzker in June signed into law a proposal to apply state and local sales taxes to any trade-in value above $10,000. The new tax will generate $60 million a year, according to official estimates. Rather than using these vehicle taxes for roads, the revenue will go toward “vertical infrastructure” such as new state buildings and renovations.

The least a driver looking to trade-in will face is 6.25% in sales tax, the state’s rate. Municipalities often add their own sales tax, averaging 2.49%. Statewide the average combined state and local sales tax is 8.74%, but it ranges as high as 10.25% in Chicago.

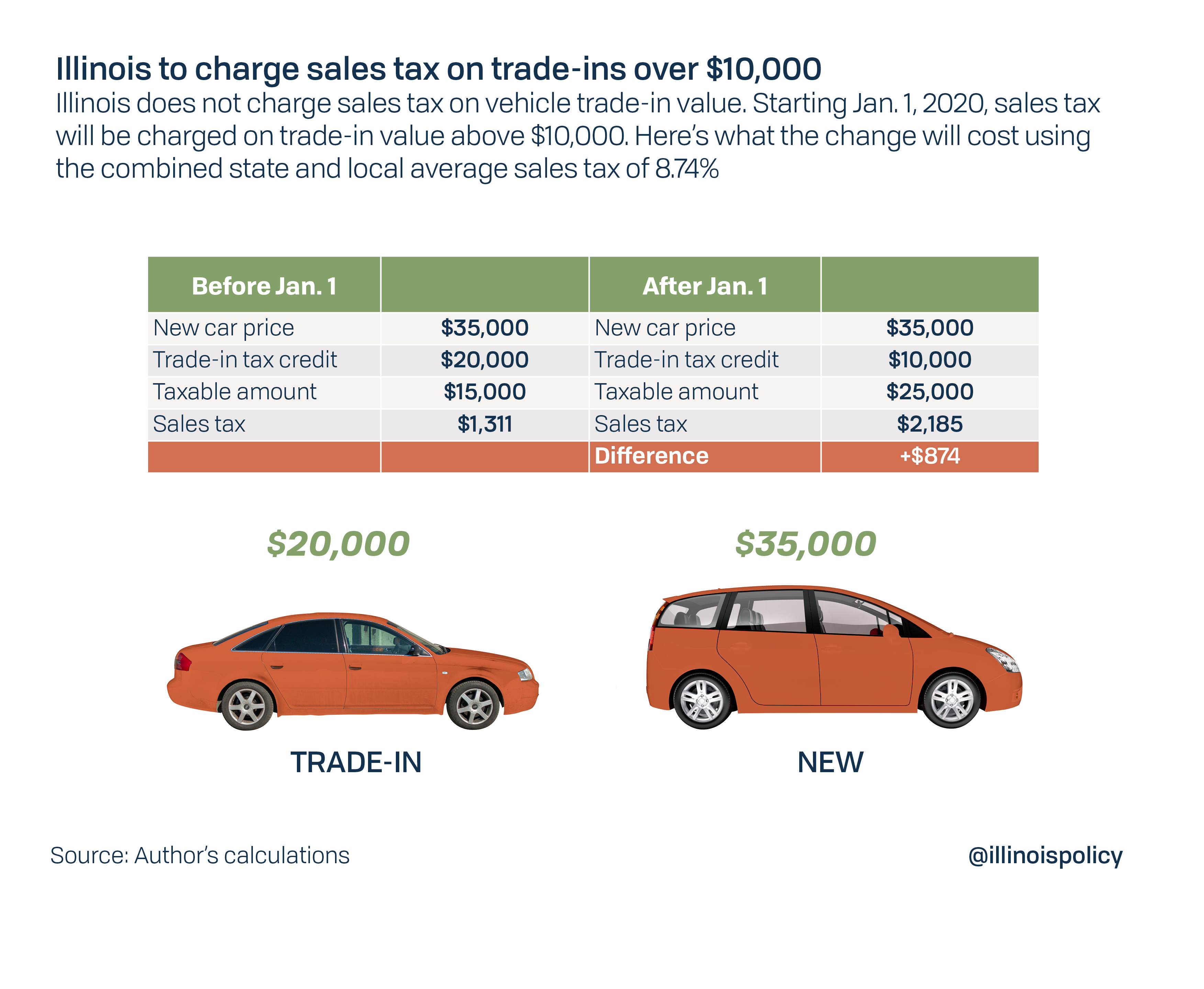

Take, for example, an Illinoisan buying a new vehicle for $35,000 – about the average cost in 2018 – and trading in her car valued at $20,000. Currently, she would only pay sales tax on the difference, or $15,000. The average sales tax on this transaction would be roughly $1,311.

In 2020, trade-in credit above $10,000 will be taxed in addition to the difference between the new and used car prices. In this example, the $20,000 trade-in will not be taxed on the first $10,000 in value, but the remaining $10,000 gets taxed along with the $15,000 difference between the new and used car values. So sales taxes will be applied to $25,000 of the transaction, which will cost her $2,185.

So the same car deal will cost her an extra $874 in sales taxes if she waits until Jan. 1.

Because the state already collected sales tax on the retail transaction when she first bough the used car, many have likened the trade-in tax to “double taxation.”

While drivers can avoid Illinois’ doubled gasoline tax by buying across the state line, they can’t escape the trade-in tax because it applies to out-of-state purchases. State leaders passed 20 new or expanded taxes and fees to fund a $45 billion infrastructure bill and record $40 billion state budget.

Illinois’ motor fuel tax increase went into effect July 1, doubling the state gas tax to 38 cents and making Illinois’ pain at the pump No. 3 in the nation. Based on Illinois Policy Institute calculations, Illinoisans will pay $100 more in the first year under the 38-cents-per-gallon state gas tax. And now the gas tax is tied to inflation, meaning it will automatically rise in future years without requiring lawmaker approval. It is projected to hit 43.5 cents by 2025.

Illinois drivers will pay the nation’s highest base fee and fifth highest overall fee for vehicle registration, also meant to raise funds for Pritzker’s $45 billion infrastructure plan. Drivers of standard passenger cars will see registration fees jump from $98 to $148 in 2020. The $50 increase is estimated to raise $441 million in revenue. Registration fees for large vehicles – buses, trailers and semi-trucks – will increase by $100, raising $49 million in new revenue.

The gas tax hike and increased vehicle registration fees erase Pritzker’s promise of middle class income tax relief – a major selling point of his plan to replace Illinois’ constitutionally-protected flat income tax with a progressive income tax system. The progressive tax question will be before voters in November 2020.

Should Bennett or Ryan’s bills reach Pritzker’s desk, the governor will have the opportunity to give working Illinoisans some of the tax relief he promised by reversing one of the many new taxes he’s imposed on them in his first year in office.