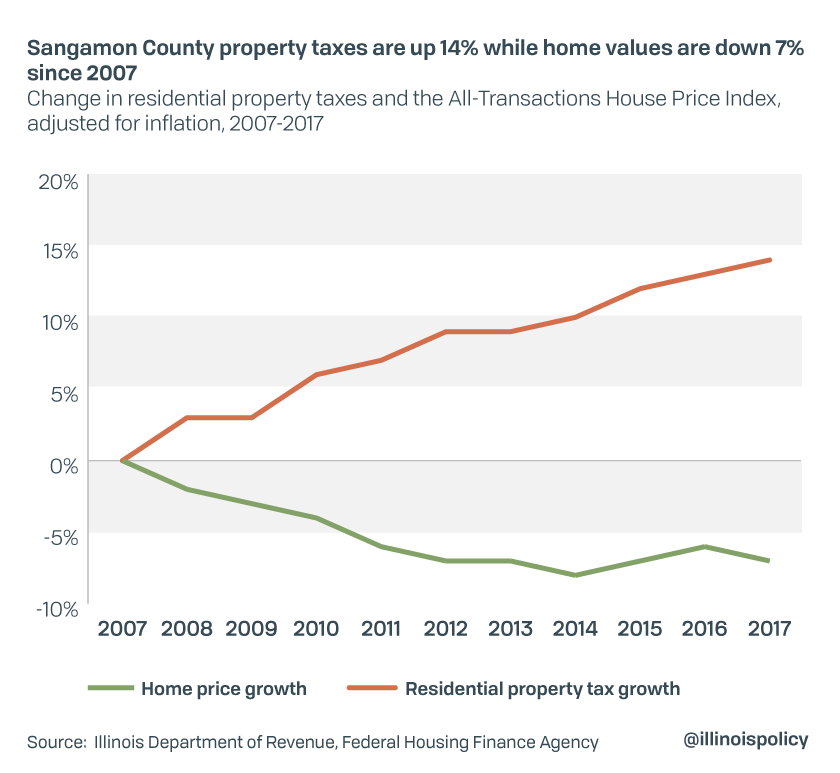

Sangamon County home values down 7%, property taxes up 14% since recession

Without true pension reform, Sangamon County homeowners will only continue to see the gap between their property taxes and home values grow.

Many central Illinois homeowners have yet to recover much of the home value they lost after the 2007 housing market crash. But that hasn’t stopped area homeowners’ property tax bills from climbing.

Average home prices in Sangamon County are 7.4% lower today than in 2007, adjusted for inflation, according to data from the Federal Housing Finance Agency.

Even though homes are worth less than they were prior to the Great Recession, inflation-adjusted Sangamon County property tax bills have increased by 14.2% on average. Local homeowners paid the first installment of their property taxes June 7, and the second installment Sept. 6.

Sangamon County’s poor housing recovery is slightly better than the national average and well above the state average. While home prices nationwide have yet to return to their pre-recession peak, they were down just 9% between 2007 and 2017. Illinois as a whole was down 22% during that period.

Property taxes are another matter. Sangamon County’s 14.2% growth in property taxes is well ahead of the statewide average of 9%.

The biggest factor driving rising property taxes? Unsustainable growth in pension costs for government workers. Pension liabilities have risen faster than taxpayers’ ability to pay, forcing state and local governments to make cuts or constantly scramble for new sources of revenue – often in the form of property tax hikes. The city of Springfield needs to pay $269 million into its pension funds over the next 20 years.

This diminishes homeowners’ standard of living, and potentially their home equity, while jeopardizing government workers’ retirement security.

With constitutional pension reform, Illinois can protect workers’ already-earned benefits while slowing the accrual of future benefits not yet earned – and eliminate the need for endless property tax hikes.