651 new Illinois public pensioners average $1.3M in estimated retirement benefits

Newly retired government workers’ lifetime pension benefits will far exceed what they contributed toward their own retirements

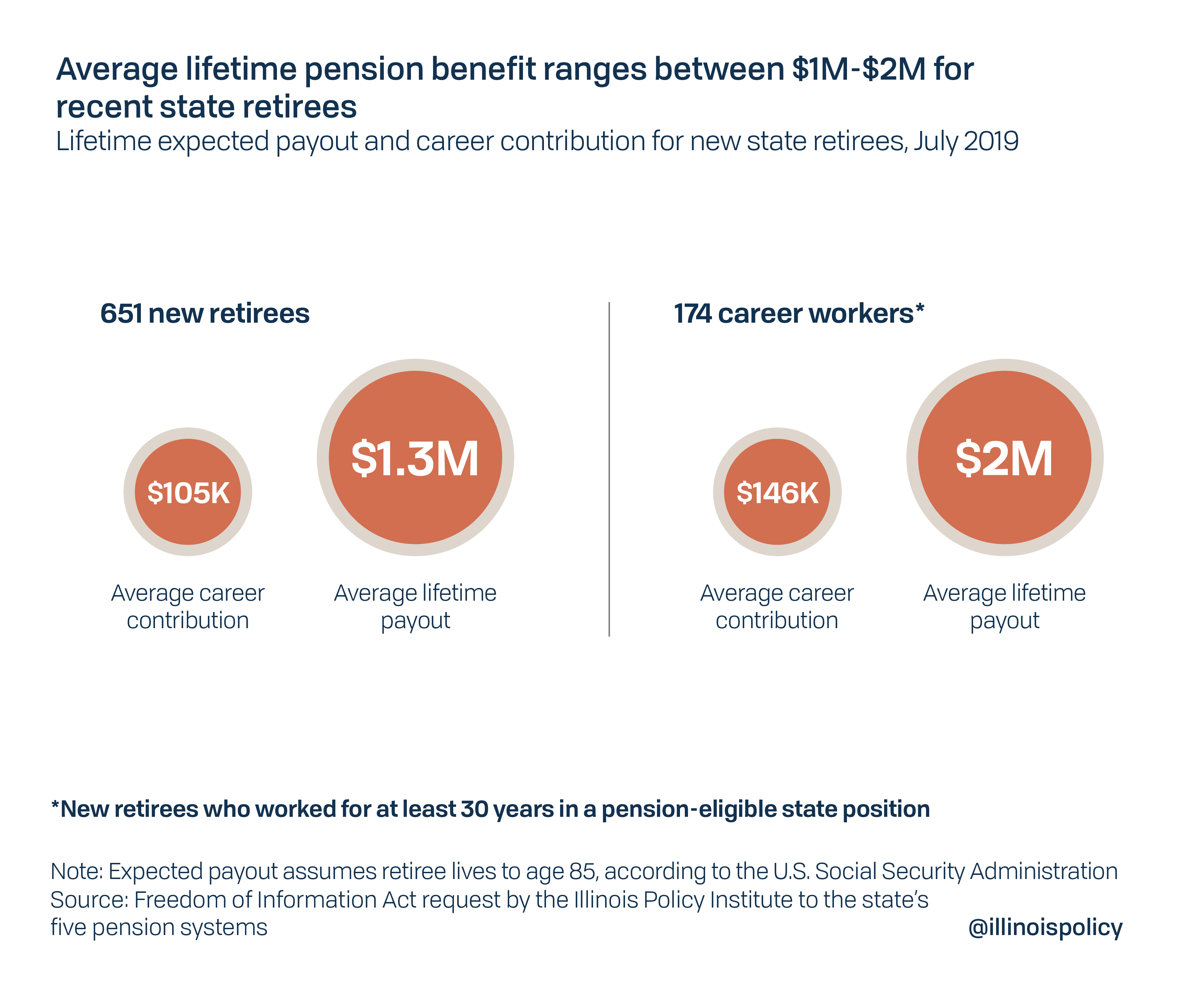

Since July 1, Illinois’ state-run pension systems added 651 newly retired government workers who started collecting benefits. They are projected to average $1.3 million in lifetime pension benefits during their retirements. They contributed an average of just $105,000 toward their retirements while working.

But to really understand Illinois’ pension crisis, focus on the 174 new retirees classified as “career workers” because for at least 30 years they were in pension-eligible positions. That group will average $2 million during retirement – despite having contributed an average of just $146,000 toward their pensions.

The average annual benefit among all July retirees is $40,000 for the first year of retirement. But for many, excessive annual cost-of-living adjustments, or COLAs, grow those benefits faster than the state can afford. In Illinois, public pensioners enrolled in a Tier 1 plan automatically receive an annual 3% compounding raise throughout retirement, regardless of how low inflation may be.

Altogether, these 651 new pensioners will cost the state pension funds $26 million – no small cost for a state with $137 billion in pension debt. Importantly, Illinois’ pension problem is not the fault of government workers or retirees. Rather, it is lawmakers in Springfield who created the unsustainable system.

Consolidation of the pension funds cannot solve Illinois’ pension problem, as more workers continue to enter retirement systems that are fast approaching insolvency. The only solution to restore state finances – and protect pensioners’ retirement security – is constitutional pension reform.