Doubling Illinois’ gas tax, other tax hikes will go to fund more than $1.4 billion of waste and pork

Lawmakers sold 20 new taxes and fees as necessary to rebuild crumbling roads and bridges and balance the budget. Instead, taxpayers will be funding dog parks, swimming pools, snowmobile paths, a vacant theater and pickleball courts.

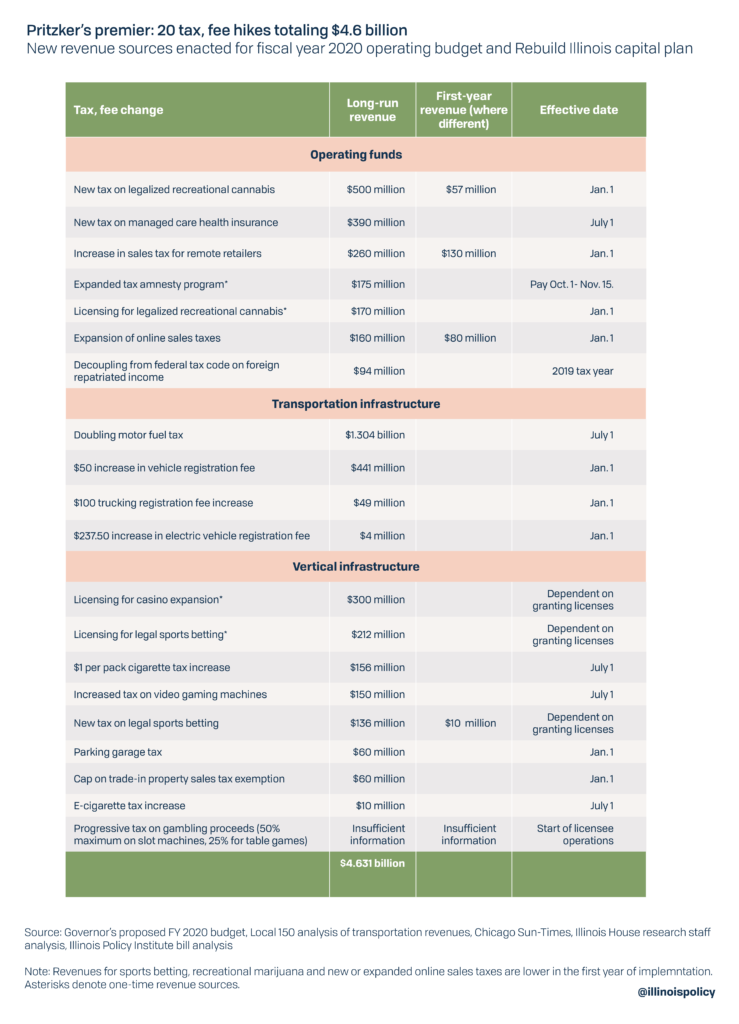

Gov. J.B. Pritzker and the Illinois General Assembly went on a spending spree at the end of the recent legislative session, including a $40.6 billion operating budget out of balance by as much as $1.3 billion, a $45 billion capital plan to be partially funded through $20.6 billion of new bond debt and 20 new taxes that will take $4.6 billion from the pockets of Illinois taxpayers.

Pritzker has defended tax and fee hikes as necessary to repair “bridges and roads and highways” that are “falling apart.”

But in both the operating budget and the capital plan, Illinoisans are now obligated for spending that takes a lot of imagination to define as “necessary,” including at least $1.4 billion in waste and pork projects. Included in that tab are dog parks, snowmobile paths, pickleball courts, school playgrounds, swimming pools, arts grants to be handed out by the wife of House Speaker Mike Madigan and much more.

Wasteful, pork-barrel spending in the operating budget totals almost $139 million

Both wasteful and pork-barrel spending are prominent in the fiscal 2020 operating budget. Waste can be defined as spending that serves no legitimate government purpose. Pork-barrel spending is for projects that lawmakers insert into the budget so they can tell constituents they are “bringing home the bacon.”

Wasteful state spending in the operating budget totals at least $92.5 million and includes:

- $40.7 million for the development of bicycle, snowmobile, pedestrian and other recreational paths and trails

- $17.3 million for outdoor recreation programs

- $13.5 million for the Illinois Arts Council, an organization chaired by Madigan’s wife

Some of these projects might make sense for a state with healthy finances. But unless Illinois fixes its worst-in-the-nation fiscal problems, it should be up to local governments to justify local projects as worthwhile and pay for them with local funds. Projects that are nice to have but which don’t serve an essential government function, including spending for arts and recreation, should be delayed until more serious needs are met.

Madigan’s wife, Shirley Madigan, has served on the Illinois Arts Council since 1976, nearly as long as Mike Madigan has been in the Illinois House. The organization encourages the development of the arts throughout the state, a questionable function for a state government with billions of dollars in debt and chronically unbalanced budgets. The Arts Council has been criticized in the past for, among other things, misuse of taxpayer funds, ignoring conflicts of interest and violating the Freedom of Information Act.

Pork project spending in the operating budget totals at least $45.1 million and includes:

- $15.3 million in capital grants for parks and recreational improvements

- $10 million for improvements to the privately-owned Uptown Theatre in Chicago

- $7.6 million for water recreation facilities including pools, aquatic centers, marinas and boat launches

- $3.7 million to build a sports recreation facility in the Morgan Park neighborhood of Chicago

- $3 million for an aquatic center expansion for the Decatur Park District

- $2 million for a racetrack in Madison County

- $600,000 for infrastructure improvements at a park in Alton

- $475,000 for five dog parks around the state

- $450,000 for the modification and installation of traffic lights in Arlington Heights

- $350,000 for construction of a field house at Harris Memorial Park in Chicago

- $300,000 for construction of a playground at Independence Park in Chicago

If any of these projects are necessary, local leaders should defend spending local funds on them rather than using state taxes from the operating budget. The Uptown Theatre, a private entity, has been closed since 1981. It is not deserving of state taxpayer funds if private investors cannot make it profitable. At the very least, if renovations on the theater are to be made with public funds it should be supported solely by Chicago taxpayers.

The capital plan: A feast for lawmakers at the expense of taxpayers

In addition to the annual operating budget, the Illinois General Assembly passed a capital infrastructure plan for the first time in 10 years. Pritzker proposed a $41.5 billion “Rebuild Illinois” capital plan that included $17.8 billion in new debt. That did not satisfy legislators, who passed their own $45 billion capital plan that included over $20 billion in new debt and allocated $1.25 billion in pork-barrel spending for their districts.

Pork-barrel projects in the capital plan total at least $1.25 billion, and include:

- $98 million for “noise abatement” at the Chicago Belt Railway Yard in Bedford Park, which happens to be in the suburban portion of Madigan’s district.

- Another $50 million for the Illinois Arts Council chaired by Madigan’s wife

- $50 million for capital grants to parks and recreational units for improvements such as pickleball courts

- $15 million to the Chicago Park District to build a field house at Jackie Robinson Park

- $14 million for a grant to Rush University Medical Center

- Another $8 million for bike paths and pedestrian trails on top of the amount allocated in the operating budget

- $5.2 million for construction, upgrades or improvements at 36 playgrounds throughout the state

- $5 million to Northwestern University for the purchase of science equipment

In addition to another $50 million for his wife’s arts council, Madigan did very well for his district under the capital plan. The Chicago Tribune reported that the $98 million for noise abatement at the railway yard addresses complaints from local residents and hotel guests about noise caused by equipment installed to eliminate the possibility of runaway trains. Other grants in his district include $31 million for the independent charter school Academy of Global Citizenship for a new building and $9 million for upgrades to the Hancock College Preparatory School.

Rush University Medical Center is part of a private health system with annual revenues of $2.4 billion, $1.3 billion in cash and investments, and net assets of $2.4 billion as of June 30, 2018. While it certainly provides valuable health services to Chicago, it can afford a $14 million investment for ADA accessibility improvements on its own – especially when it can attract a private donation of $450 million. Likewise, Northwestern University should not be using $5 million of taxpayer money to purchase science equipment.

A broken process when a fix was available

Rather than running to the taxpayer ATM, the General Assembly could have passed a no-tax-hike capital plan that prioritized maintenance infrastructure over new construction, as recommended by the Illinois Policy Institute. Repairs to existing infrastructure have a better economic return on investment and discourage pork. The Institute demonstrated how Illinois could add $10 billion in additional capital spending to $18 billion in existing capacity for a total of $28 billion in infrastructure spending – without raising taxes. That strategy would have allowed the state to take advantage of the anticipated federal infrastructure plan to help fund new construction projects.

The General Assembly also could have followed the advice of the Government Finance Officers Association, whose best practices in capital planning include multi-year evaluations of funding capacity and significant commitments to maintenance infrastructure, or Virginia’s Smart Scale method for project selection. Virginia uses a quantifiable and objective prioritization process for project selection that includes a cost-benefit analysis.

Instead, lawmakers allowed the capital plan to become a vehicle for more wasteful spending, more tax hikes for Illinois residents and handouts to Springfield insiders. According to The Civic Federation, the $45 billion capital program “shows no evidence of comprehensive planning to prioritize projects” and contains spending for which there is no justification. It includes 42 separate appropriations totaling $580 million to the Department of Commerce and Economic Opportunity for “grants to local governments, school districts and community based providers for costs associated with infrastructure improvements.” Many of those were grants of up to $6 million that the Chicago Tribune reported were allotted for so-called “member initiatives” that amount to slush funds for lawmakers’ pet projects.

Politico reported that Senate Democrats would receive about $6 million for projects in their districts compared to about $3 million for Senate Republicans. In the Illinois House, the split was about $3 million for Democrats and about $1.5 million for Republicans. Senate President John Cullerton said that because Democrats supported a $1-per-pack increase in the cigarette tax, they should get more tax revenue for their districts.

Giving lawmakers special pots of money to spend at their own discretion violates best practices in infrastructure spending by limiting transparency and failing to ensure a good return on investment. Furthermore, the reported differential discriminates against residents through no fault of their own. A resident living in a Republican district is no less deserving of community improvements funded by their taxes than a resident living in a Democratic district.

Illinois’ taxpayers received little consideration as lawmakers enthusiastically took more of their hard-earned money. The $45 billion plan will be funded by $20.6 billion of new debt and 14 of the 20 new taxes and fees, including a doubling of the Illinois motor fuel tax, increases in motor vehicle and truck registration fees, and licensing and taxes on expanded gambling.

Taxpayers deserve greater diligence, transparency from elected leaders

Wasteful spending in the operating budget is a recurring habit for Illinois lawmakers. But passing the first capital plan in 10 years without a comprehensive plan to prioritize projects is especially reckless.

Lack of planning was equaled by a lack of transparency. Lawmakers did not see the operating and capital budgets until hours before they were to vote on them, leaving no time for debate or public comment.

The fiscal year 2020 operating budget and the Rebuild Illinois capital plan demonstrate once again that Illinois needs serious budget process reform. Aspects of the state’s budget process that are problematic include:

- Unreliable revenue estimates that cause Illinois to consistently overestimate revenue

- Poor savings habits and the lack of a rainy day fund to address fiscal shocks

- Reliance on debt to cover overspending

- Bad accounting practices that allow lawmakers to not report spending until bills are paid, carry over bills from one year to the next and then claim budgets are balanced

To address those issues, Illinois should reform its budget process by:

- Adopting a spending cap to improve the accuracy of budget planning rather than relying on imperfect revenue estimates

- Using surpluses from the spending cap to pay down the backlog of unpaid bills and build up a rainy day fund

- Limiting lawmakers’ ability to use debt and other accounting gimmicks to cover overspending

- Ending bad accounting practices that hide the true size of budget deficits and strengthening the balanced budget provision of the Illinois Constitution to require year-end balance rather than estimates of a balance

Illinois taxpayers already bear one of the highest overall tax burdens in the nation. The state’s $216 billion debt burden, or $50,800 per taxpayer, is the third highest total among the 50 states and the highest per person, according to Truth in Accounting. Those burdens will grow worse thanks to a reckless budget process that treats taxpayers as a bottomless piggybank and misuses their money through wasteful spending on pickleball courts and empty theaters.