‘Fair tax’ backer spreading falsehoods, misinformation

Lawmakers using the Center for Tax and Budget Accountability to convince constituents how great a progressive tax could be for Illinois are doing a disservice. Here are the straight tax facts.

Taxpayers thought they were getting a town hall meeting to tell state Rep. Terra Costa Howard, D-Glen Ellyn, what they thought about a progressive income tax hike. Instead they got a 30-minute speech from one of the governor’s backers that was more fiction than fact.

Howard held the event April 23 while the Illinois General Assembly was on a two-week spring break and allowed Ralph Martire to deliver a “fair tax” sales pitch riddled with inaccuracies and misleading information. Martire is the director of the Center for Tax and Budget Accountability, or CTBA, and was also a member of Gov. J.B. Pritzker’s transition team.

Among the most blatant falsehoods touted during the presentation was that state income taxes have no effect on state economies. Martire has made this claim in interviews and opinion columns for years.

It flies in the face of the vast body of the empirical academic literature, which comes to the consensus that tax hikes hurt economies.

Experts ranging from Nobel Prize winners such as Edward Prescott, to former Obama Administration chair of the Council of Economic Advisors Christina Romer, to Congressional Budget Office Director Douglas Holtz-Eakin, to George W. Bush economic advisors Harvey Rosen and Greg Mankiw – whose textbooks are the most widely used in college macroeconomics classes – agree on the following: higher taxes hurt economic growth; and higher marginal tax rates reduce small business employment, employee wages and firm growth.

New studies consistently confirm these results.

So how does Martire ignore overwhelming evidence debunking his claim? He cites a white paper written by the Institute for Taxation and Economic Policy, or ITEP, and the alleged findings of three studies.

ITEP report

The ITEP report is a direct rebuttal to the annual “Rich States Poor States” publication by the American Legislative Exchange Council, or ALEC. The ITEP report suggests the performance of state economies from 2006-2016 shows arguments claiming that cutting or raising taxes affects state economies are overblown.

But both the methods of ITEP and ALEC are descriptive, making no attempt to investigate the impact of tax policy on economic performance. In addition, the studies only pay attention to the nine states with the highest marginal income tax rates and the nine states without broad-based income taxes.

The main disagreement between the two reports is how to handle population growth. The states without income taxes have seen far faster population growth than those with the top income tax rates. ITEP attributes superior growth in nearly all measured variables to faster population growth, and insists on looking at per capita growth, which benefits states where population grows slower.

The only measure that was worse among no-income-tax states during that 10-year period was GDP. ALEC attributes this mainly to the decline of energy prices, which are vital to the economies of Texas and Wyoming.

ALEC claims dismissing population growth is irresponsible, as a quickly rising population shows low-tax environments are more attractive for families and businesses. For example, Illinois has been losing population from outmigration for five consecutive years. Looking only at per capita GDP growth, Illinois’ economic performance would appear healthier than it actually is despite hundreds of thousands of people fleeing the state.

Both of the studies focus on a problematic time period because they include data from the Great Recession, which affected states in vastly different ways. The Illinois Policy Institute has also performed a similar exercise focusing on different outcomes in progressive and non-progressive income tax states in the post-recession period, finding support for ALEC’s theory that high progressive income tax states have underperformed.

ALEC’s analysis also examines the long-run growth of personal income across states, finding that since the 1960s, states without income taxes have consistently had faster-growing economies than the states with the highest top marginal income tax rates. Not only does simply looking at the data reveal the significant underperformance of high-tax states, the vast body of peer-reviewed empirical literature agrees that higher taxes harm economic growth.

Other studies

Beyond the ITEP paper, Martire points to three studies for his claim that tax hikes don’t harm state economies. And in all three cases, Martire horribly misrepresents these studies’ findings.

The first comes from the Small Business Administration. Martire implies the study confirms his pro-progressive income tax position. He often takes this quote from the study out of context: “We find no evidence of an economically significant effect of state tax portfolios on entrepreneurial activity.” This quote is particularly misleading because “state tax portfolios” refer to the share of revenue generated by certain taxes in a given state – not the level of taxation.

Martire leaves out this key detail. Income tax differences across states matter for where researchers found the most entrepreneurs. The study reveals states with lower top marginal tax rates have a larger share of entrepreneurs. Additionally, “progressive” income taxes – meaning effective rates increase with income levels, just like Illinois’ flat tax – also encourage greater entrepreneurship rates. Taking both of these conclusions together, one would think Illinois could foster the friendliest entrepreneurial environment by levying a low, flat income tax with large exemptions and deductions for those below the median income level.

The paper concludes that “Rather than attempt to target tax breaks to small businesses, then, states should focus on traditional tax reforms involving lower tax rates, broader tax bases, and simpler tax systems that will create a more neutral and productive tax environment for small businesses, large businesses, and individuals alike.”

The second paper Martire references comes from the University of Missouri. It mentions that tax cuts accompanied by a corresponding drop in public spending result in a net economic loss. It is true that public spending can provide a small initial boost to the economy. However, in the long-run, the depressing effects of tax hikes outweigh the benefits of additional spending, resulting in a smaller economy. This is because higher taxes and government spending have a strong negative effect on investment spending.

More importantly, the positive effects of government spending are often attributed to meaningful investments such as education. However, during the past 20 years in Illinois, state education spending, adjusted for inflation, has increased by $5.4 billion annually, but two-thirds of this increase has gone to pensions instead of to classrooms.

Despite that syphoning of state education funds, Illinois still spends more per pupil than every Midwestern state except for North Dakota. Illinois’ spending yields below average educational outcomes. Without structural reforms, a progressive income tax will be a tax for pensions, not for school funding.

The third study Martire mentions is actually part of congressional testimony given by the Congressional Budget Office, or CBO. The testimony discusses how to best increase employment, and thereby economic growth, after the recession. The testimony came during a time when employment was still low compared to the pre-recession peak. Martire suggests the CBO research finds no correlation between tax policy and job creation, but this is simply not what the testimony says.

While the testimony does say private sector demand is the most important factor for job creation, it also states that “[i]f widely anticipated changes to current law, such as an extension of tax cuts that are scheduled to expire under current law, were enacted, economic growth would be notably stronger in 2013, according to CBO’s projections.” That’s because tax cuts provide both families and businesses with more disposable income to consume or invest. The testimony also adds that in order to prevent crowding out private investment, the extension of tax cuts should not yield greater debt burdens.

Once again, Martire’s conclusions are politically motivated and far removed from what these studies actually found.

Income taxes matter for states’ economic growth

Despite Martire’s false claims, there are statistically significant differences between states that collect income taxes and states that don’t. States with no income taxes grow faster.

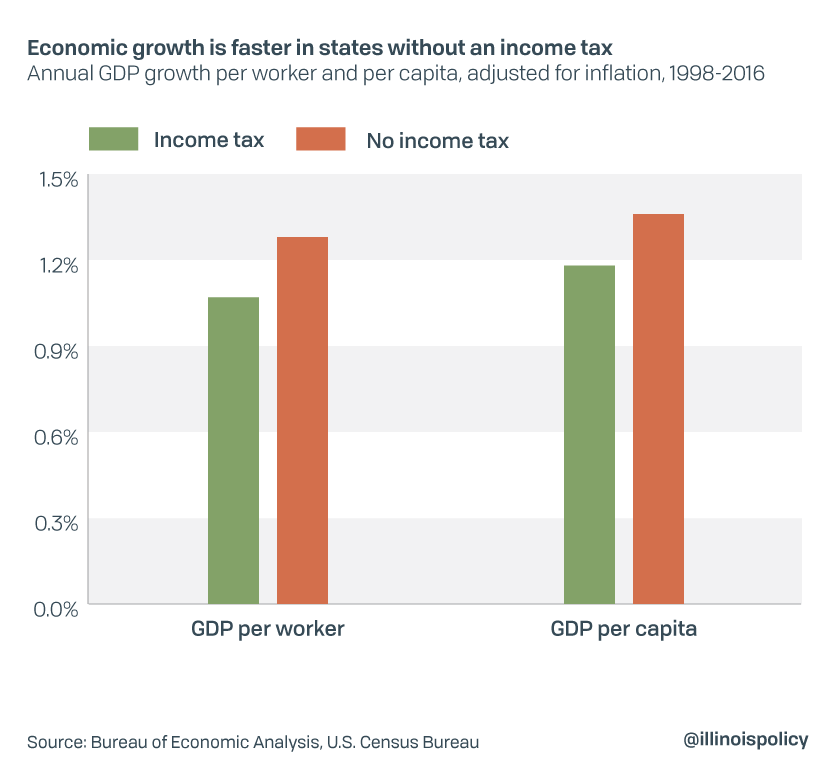

While the ITEP and ALEC exercises recorded the experience of states in recent years, the Illinois Policy Institute examined a larger sample and extended the analysis to the 1998-2016 period, in order to include two recessions and two economic expansions. Due to the well-established connection between taxes and economic growth, the Institute includes all 50 states in this analysis to examine the differences between states with income taxes and states with no income taxes.

Here are the results, in contrast with myths claimed by Martire and implied by the ITEP study.

Myth No. 1: States levying the highest top personal income tax rates are experiencing faster economic growth.

Reality: From 1998 to 2016, per capita GDP growth was 6.3% higher in states with no income tax, after adjusting for inflation. This difference is not statistically significant (see appendix).

However, per worker GDP growth was 10.3% higher in states without an income tax, after adjusting for inflation. This difference is statistically significant (see appendix). Per worker GDP growth is a better measure of states’ economic performance, because it better accounts for age and other demographics across states.

While there are many factors that influence state economic growth, descriptive statistics support the existing economics literature, which suggests tax policy plays an important role in explaining differences across states.

On one hand, there may be vast pre-existing differences that are correlated with the tax regime across states that can explain why some states grow faster than others. On the other hand, tax policy could also by itself be the reason. Regardless, this exercise reveals life is simply better for residents of states that do not collect income taxes.

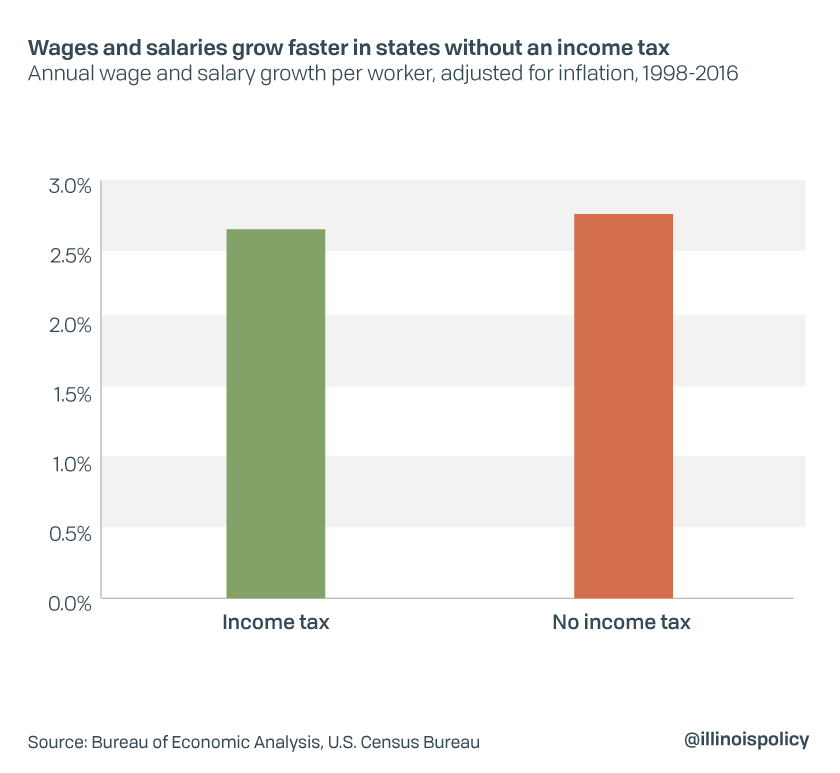

Myth No. 2: Average incomes are growing more quickly in the states with the highest top tax rates. Per capita personal income and disposable per capita personal income both grew more rapidly in these states during the past decade. Per capita personal consumption growth is also more robust in the states with the highest top tax rates.

Reality: Wages and salaries grew 4.2% faster on average in states with no income tax when compared with states that levy an income tax. The difference is statistically significant (see appendix).

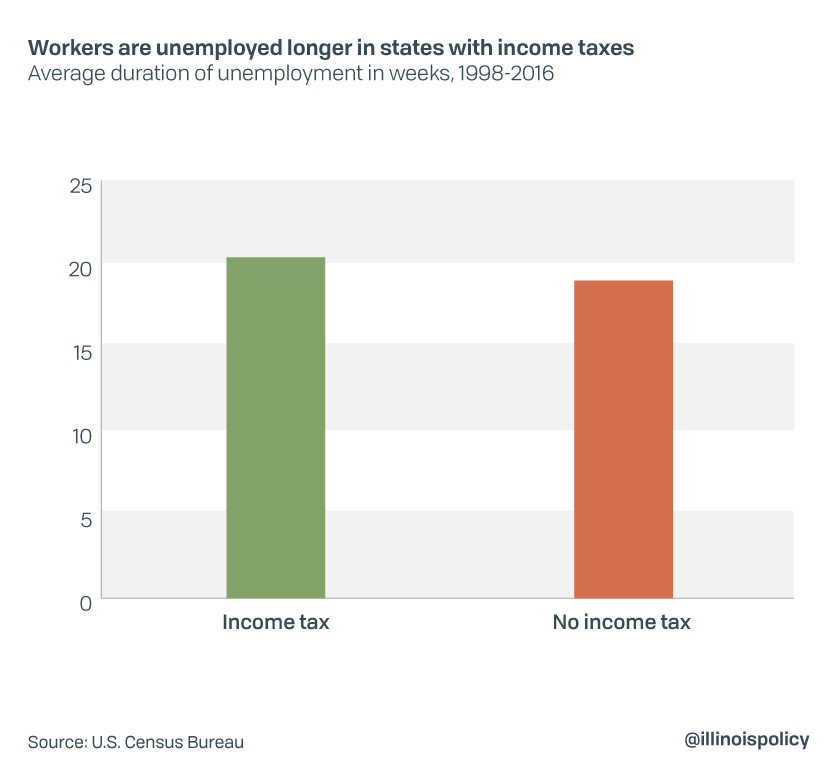

Myth No. 3: Residents of states with the highest top income tax rates are more likely to have a job than people living in states lacking income taxes. Compared with states that do not levy an income tax, a larger share of people in their prime working years (ages 25 to 54) have found work in the states levying the highest top tax rates.

Reality: Job seekers find jobs faster in states with no income tax, with a 6.9% lower unemployment duration on average.

When comparing states with an income tax with states that don’t collect income taxes, job seekers in states with an income tax are unemployed for 10 more days on average than job seekers in states with no income tax. The difference in unemployment duration across income tax regimes is statistically significant (see appendix).

Conclusion

The broader analysis reveals the results from the ITEP study are highly dependent on the sample size and cannot be generalized. When looking at a larger sample over a greater number of years, residents of states without an income tax see greater GDP growth (in all measures), greater wage and salary growth per worker, and shorter durations of unemployment.

Illinoisans should reject calls for the $3.4 billion graduated income tax hike. Proponents of the governor’s tax plan rely on lies and misinformation in the hopes of tricking Illinoisans into accepting higher taxes.

Families and businesses in Illinois already suffer from a weak economy. They cannot afford political efforts to worsen it.