Illinois Senate Democrats pass progressive income tax plan, pretend property tax freeze

The Senate’s progressive tax proposal already differs from Pritzker’s original plan while adding a property tax freeze full of loopholes.

Senate Democrats on May 1 approved Gov. J.B. Pritzker’s prized progressive tax constitutional amendment and a new income tax rate structure that would take effect should voters approve the amendment on the 2020 ballot.

Senate Joint Resolution Constitutional Amendment 1 passed on a straight party line vote: 40-19. SJRCA 1 would eliminate the state’s flat income tax protection, empower lawmakers to pass additional income taxes on the same dollar earned, and allow for the nation’s highest tax on business income. The amendment now heads to the House, where the amendment will require 71 votes to send a progressive tax question to Illinoisans on the 2020 ballot.

Three additional bills composing Senate Democrats’ progressive tax proposal also passed without Republican support.

Though the plan differs in some ways from Pritzker’s original proposal, the overall effect would be the same: a tax hike that would hurt small businesses, drag down economic growth, fail to close the budget deficit and serve as a bridge to higher taxes for the middle class.

What’s in the new progressive income tax proposal?

1) New income tax rates

The Senate passed three companion bills to the progressive tax amendment. First is the income tax rate structure, Senate Bill 687. SB 687 passed on a 36-22 vote, with all Republican senators voting “no.” They were joined by Democrat state Sens. Jennifer Bertino-Tarrant, D-Plainfield; Tom Cullerton, D-Villa Park; and Suzy Glowiak, D-Western Springs. Democratic state Sen. Rachelle Crowe did not vote. The bill is the first of Pritzker’s term to include potential rates for a progressive income tax.

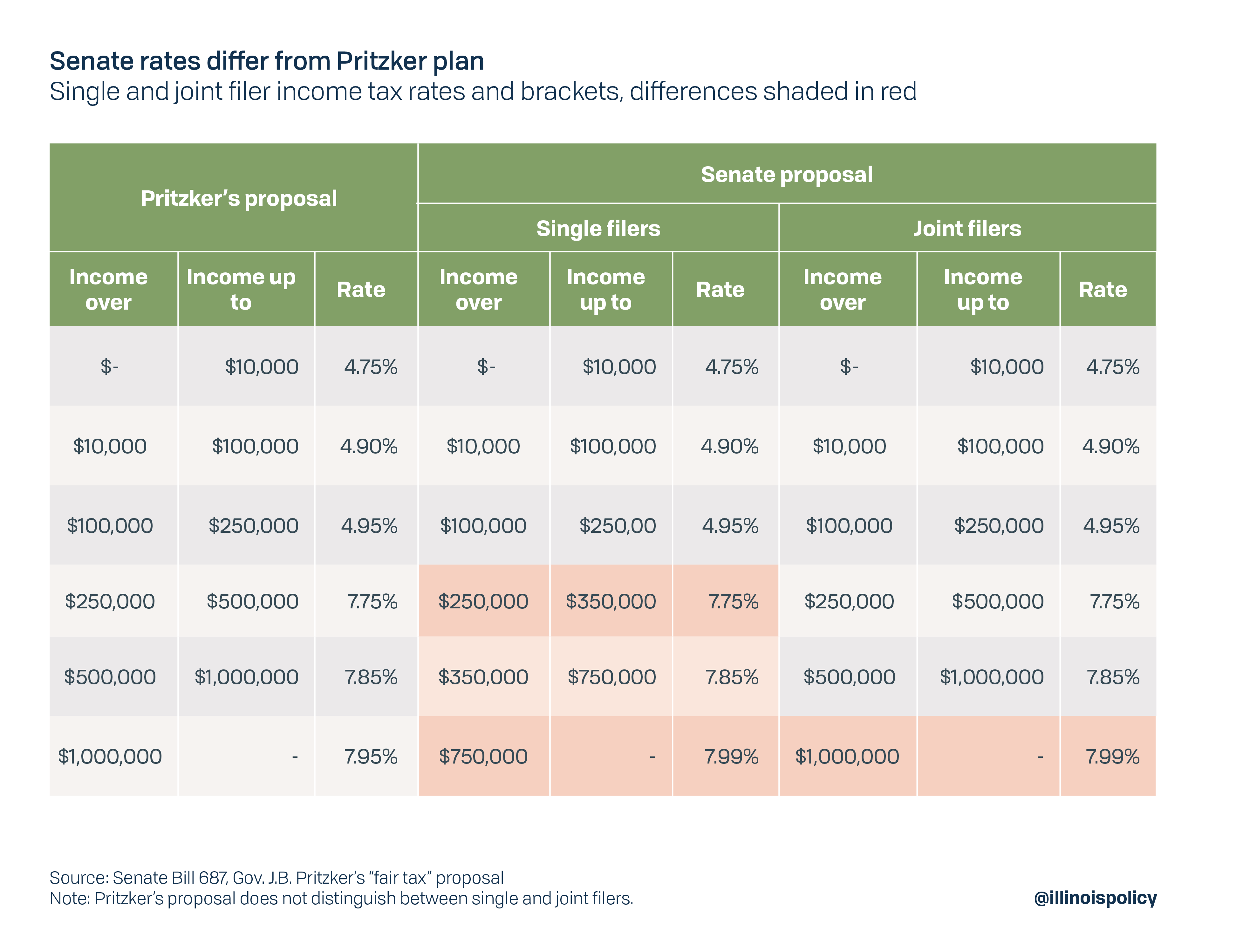

While Pritzker has been campaigning for months on his own proposal, the rates and brackets passed out of the Senate are different from the governor’s. Pritzker’s proposal levied a 7.95% flat rate on the highest income bracket while the plan passed out of the Senate features a 7.99% flat rate on the highest income bracket. That top bracket also now kicks in at a lower level for single filers: $750,000 instead of $1 million.

The state’s corporate income tax rate would also be bumped up to 7.99% from 7%. Pritzker’s plan hiked the corporate income tax to 7.95%.

Senate Democrats explained the changes as an attempt to rid Pritzker’s proposal of the widely criticized marriage penalty, which would subject joint filers to higher income tax rates than they would face if they were single filers. But the Senate plan also fails to eliminate the marriage penalty.

Because there were no changes to tax brackets below $250,000, the penalty still exists for those who would see a tax cut – provided the plan doesn’t change again. Married couples would receive less of a tax break than they otherwise would if they were single.

For those who would face a tax increase, the marriage penalty still hasn’t been fully eliminated. While the single filer brackets have been altered slightly, married filers would still face the possibility of higher taxes under this proposal than they would if they were single.

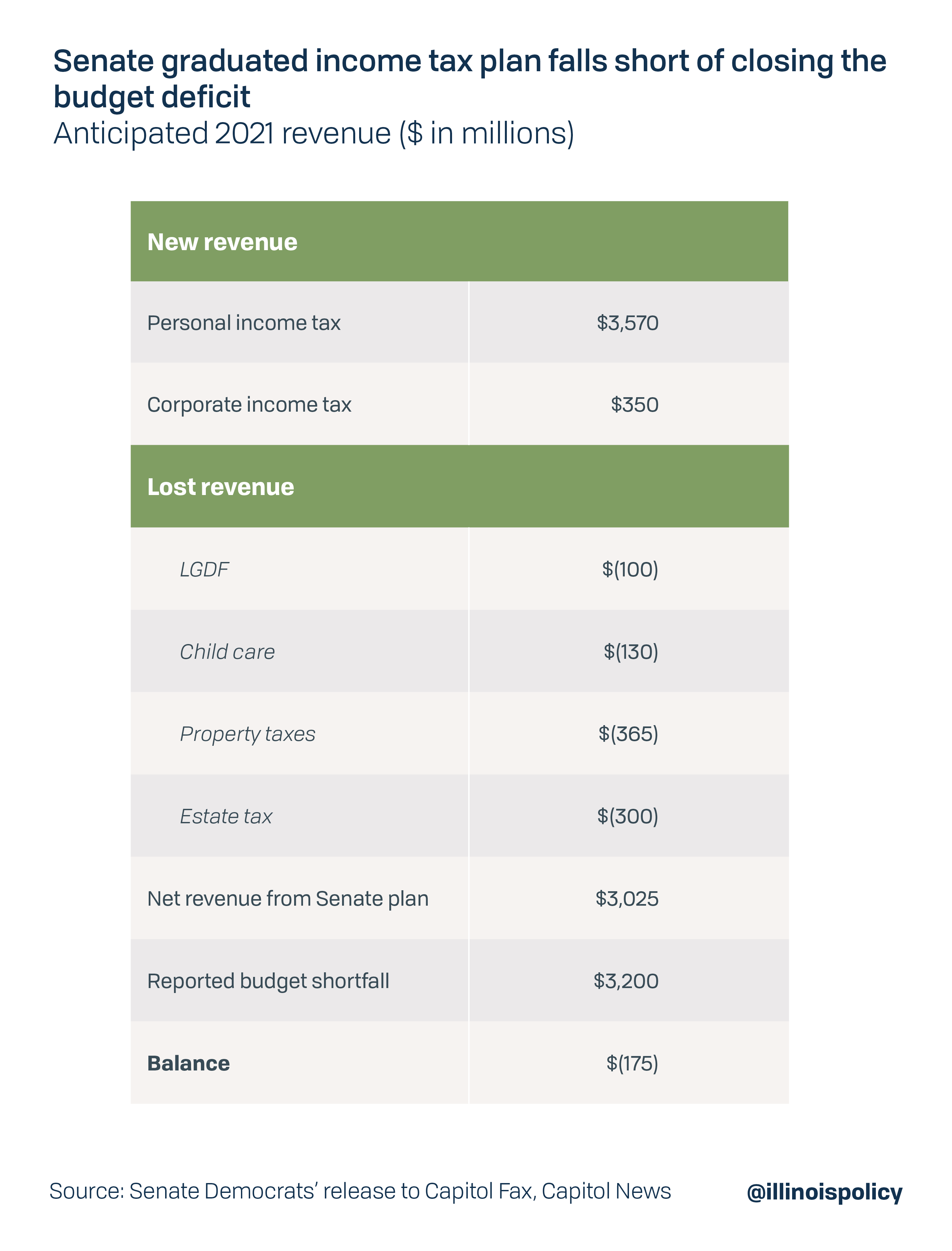

One of the most frequently stated reasons for enacting a progressive income tax is the need to close the anticipated budget shortfall, currently pegged at $3.2 billion due to further increases in discretionary spending. But the plan currently moving through the General Assembly would fall $175 million short of this goal, according to the Senate Democrats’ own numbers.

The plan’s shortfall is likely much larger due to irresponsible growth assumptions and faulty math.

Not only does the plan fall short of closing the budget deficit, it also means that there won’t be revenue to pay for additional spending priorities, like pensions, that Pritzker and others claim the progressive income tax can tackle. Furthermore, the current budget deficit projection is likely understated because it doesn’t account for a new AFSCME contract, the costs of the minimum wage increase or additional pension costs.

And that’s not the only bad math at play.

Senate Democrats allege the income tax rates they passed rake in an additional $3.325 billion in net income tax revenue (not including the estate tax repeal) – $75 million less than the governor claimed his rates generated. Both of those revenue estimates likely rely on the same faulty, contradicting math, which independent organizations such as the Civic Federation have been unable to replicate.

Previous analysis revealed the governor’s estimates were off by as much as $2 billion, likely meaning the Senate revenue estimates are off by even more.

The reason these revenue estimates cannot be replicated is because they make a litany of errors. Most notably, the estimates rely on the assumption that income growth will actually accelerate in the coming years. This is irresponsible given the national economy is currently in the 11th year of an economic expansion, with organizations like S&P Global Ratings anticipating a slowdown in economic growth – and criticizing the governor’s revenue projections. The majority of business economists anticipate a recession by the time the progressive income tax would take effect in Illinois.

Faulty revenue estimates ensure one thing: further tax hikes will be coming when revenues fall short.

2) Pretend property tax freeze

If passed, Senate Bill 690 would also take effect should voters approve the graduated income tax amendment in 2020. Lawmakers are selling this bill as a property tax freeze – but it would do little to nothing to address Illinoisans’ extraordinarily high property tax bills.

First, the bill only applies to school districts. While it’s true that school districts make up the majority of residents’ property tax bills, there are still more than 6,000 other local taxing bodies that would be able to raise property taxes under this proposal.

Furthermore, the bill still allows school districts plenty of loopholes through which they can hike property taxes without voter approval.

If the state fails to meet the funding requirements of “mandated categorical” spending or the evidence-based funding formula, then school district property taxes would still be allowed to rise. The state has failed to meet mandated categorical funding for a decade, meaning property tax bills are likely to rise statewide. The freeze also exempts property tax hikes to make debt and pension payments – two of the largest drivers of rising property tax bills in Illinois.

While most school district pension costs are funded by the state, there have been recent proposals for these costs to be paid by local school districts. Furthermore, because these growing pension costs are funded at the state level, pension spending could crowd out other types of state school funding that could lead to school districts being exempt from the property tax freeze.

3) Estate tax repeal

Repealing Illinois’ “death tax” is the final element of the Senate Democrats’ proposal, and would also take effect were voters to approve the progressive income tax constitutional amendment. Senate Bill 689 would repeal the Illinois estate tax, which brings in around $300 million annually. Senate President John Cullerton admitted the estate tax is driving wealthy residents out of the state, and hopes the repeal could reverse that trend.

Unfortunately, even if the estate tax is repealed, it could easily be reinstated. In fact, state lawmakers did exactly that in 2011.

A federal tax change effectively eliminated Illinois’ estate tax in 2010, and it was not scheduled to re-emerge until 2013. But Illinois lawmakers promptly reinstated the tax in January 2011. The estate tax is one of the easiest taxes to raise politically because it affects a relatively small number of constituents – mostly wealthy estates or large family farms.

Since the progressive tax plan falls well short of bringing in lawmakers’ desired revenue, a bait-and-switch on the estate tax could be especially appealing.

House lawmakers should reject this proposal

The Senate progressive income tax proposal is a bridge to higher taxes. The plan and the claims surrounding it have already changed several times since the governor unveiled his rates two months ago. Further, Senate Democrats have already stated that it is unlikely these will be the final rates and brackets and that the entire proposal is subject to change.

With no assurances about the proposal, the graduated income tax is essentially a blank check for a governor who plans to spend up to $19 billion more per year. That kind of spending could raise taxes on the typical family by $3,500 per year, and would be devastating to the state’s economy.

Illinois House members concerned about their constituents – many of whom already reject Pritzker’s plan, according to polling data – would be wise to reject this proposal.