Illinois employment growth continues to lag the nation through the first quarter of 2019

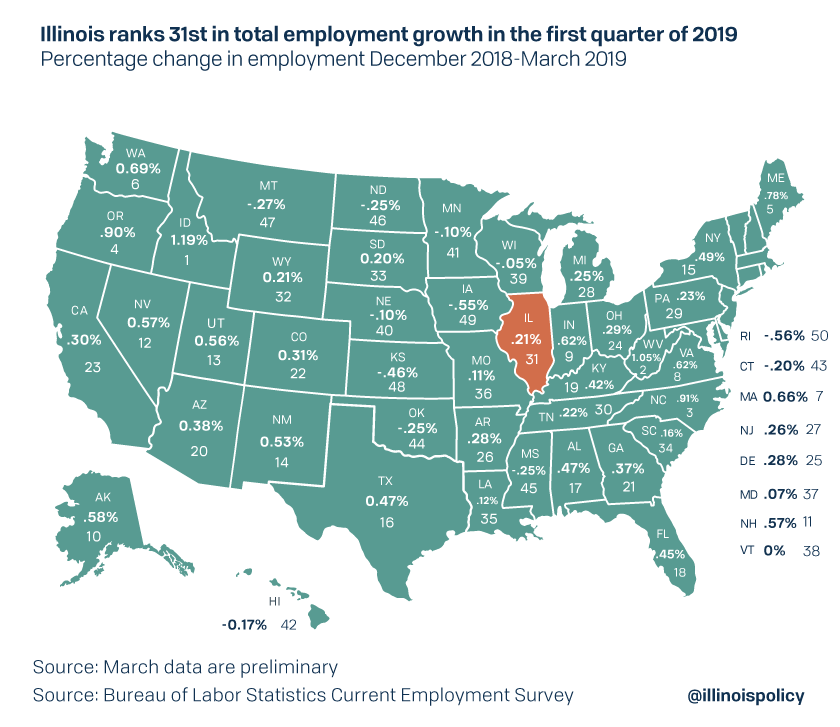

Illinois’ total employment growth ranks 31st from December 2018 to March 2019. Continued population loss likely to follow poor job growth.

After a massive jump in employment to kick off the year in January, Illinois has faced two consecutive months of employment losses.

This places Illinois in the bottom half of U.S. states for first quarter jobs growth, which is more bad news for the state in the wake of the April 18 Census data revealing Illinois-based metro areas all suffered net population losses in 2018.

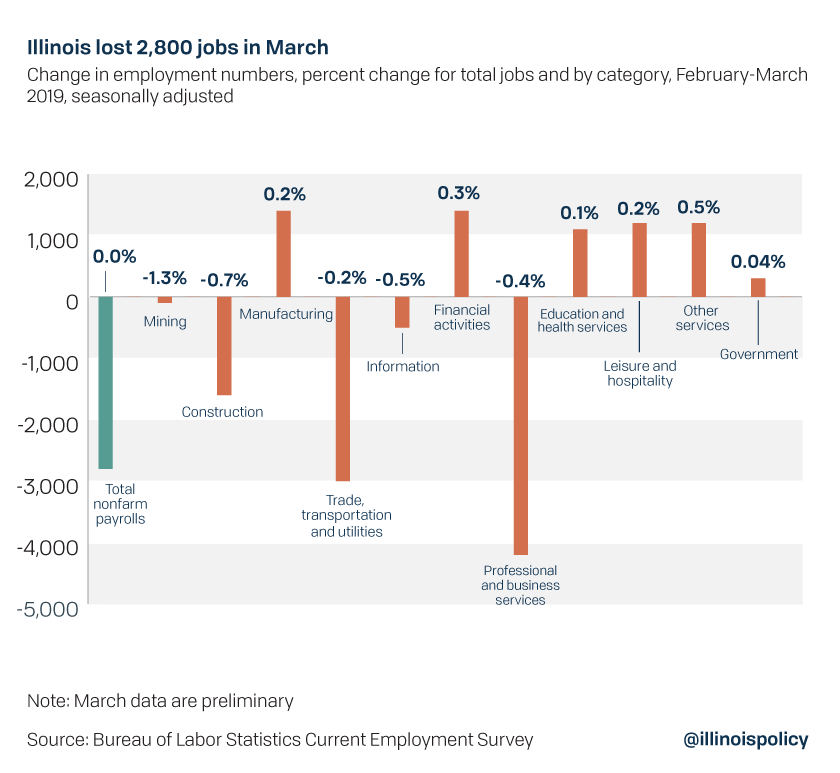

In March, the Prairie State shed 2,800 jobs, with the largest loss coming from the professional and business services sector, down 4,200 jobs (-0.4%).

Other sectors losing jobs were trade, transportation and utilities which lost 3,000 jobs (-0.2%); construction shrank by 1,600 jobs (-0.7%); the information sector reduced payrolls by 500 jobs (-0.5%); and mining shed 100 positions (-1.3%).

While Illinois experienced job losses on net during March, some industries expanded their payrolls. Financial activities created 1,400 new positions (+0.3%); manufacturing added 1,400 jobs (+0.2%); other services expanded payrolls by 1,200 (+0.5%); leisure and hospitality added 1,200 jobs as well (+0.2%); education and health grew by 1,100 jobs (+0.1%); and government added 300 jobs (+0.04%).

The March decline in jobs resulted in Illinois’ unemployment rate rising to 4.4 percent, one of the highest in the nation.

2019 so far

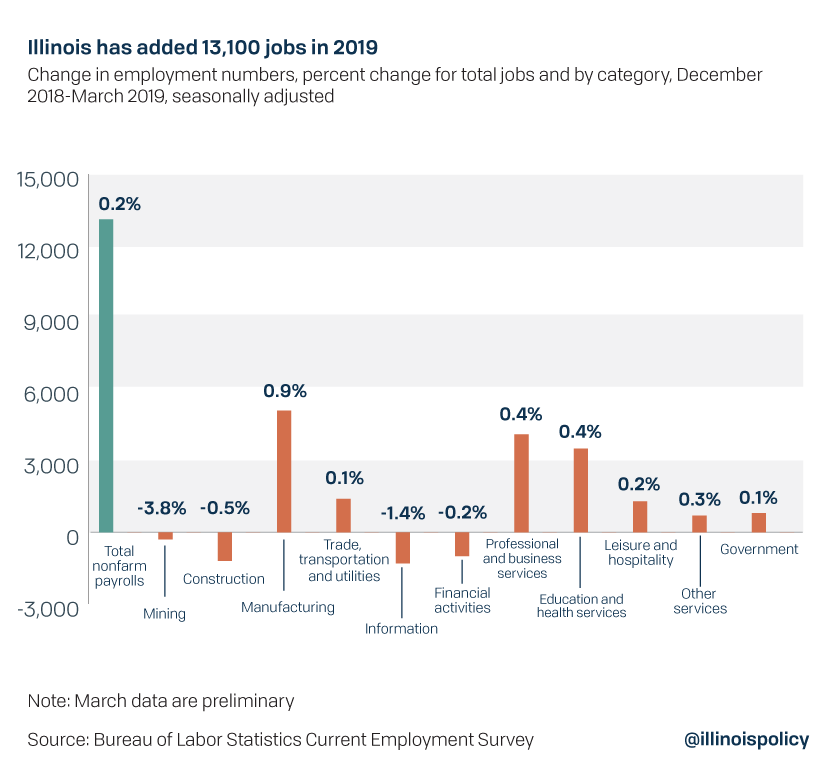

Despite two consecutive months of employment losses, Illinois job creation figures remain positive in 2019. The state has added 13,100 jobs, primarily driven by gains in manufacturing, professional and business services, and education and health sectors.

While the addition of 13,000 jobs is welcome, 2019 is in line with a long-standing trend of Illinois’ jobs growth lagging the nation.

Through the first quarter of 2019, Illinois ranks 31st in total employment growth.

During the first quarter of 2019, Illinois lagged most other states in terms of job creation. Making matters worse, Illinois just received bad news from the U.S. Census Bureau: the state’s population loss spread to all Illinois-based metro areas, all 10 of which suffered net population losses in 2018. The primary loss is in prime working-age residents (ages 25-54) seeking opportunity outside Illinois.

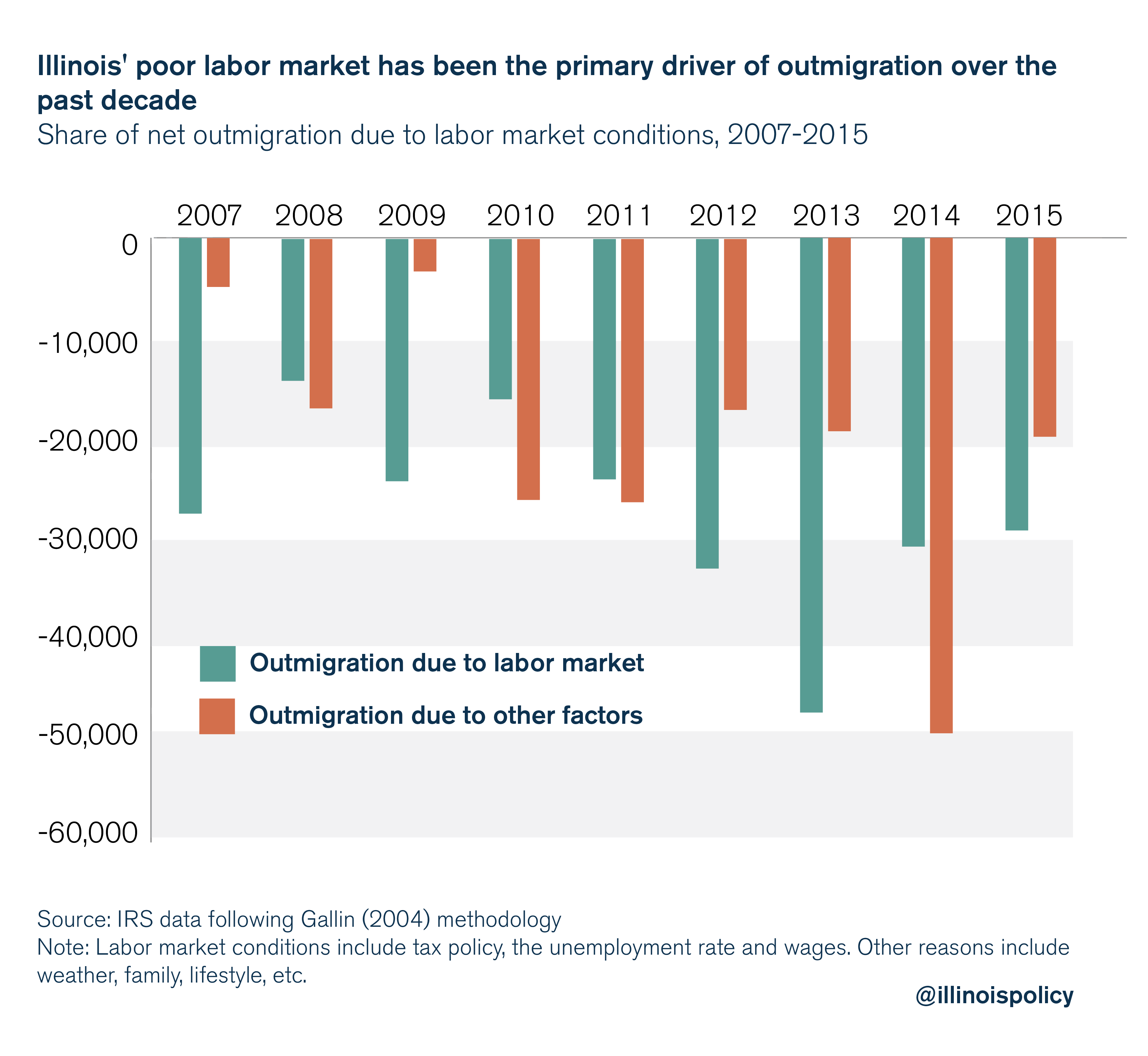

Starting 2019 with anemic job growth creates little hope Illinois will avoid a sixth straight year of population decline. Residents mainly leave Illinois’ because of the labor market, which has been crushed by the state’s unfriendly tax policy and business climate.

Following peer-reviewed methodology published in the Journal of Labor Economics, which take into account the effects of climate, age and labor market conditions on migration decisions, IRS data reveal Illinois’ poor labor market has been the primary driver of outmigration since 2006, accounting for 57 percent of Illinois’ net migration losses to other states (see Appendix A).

The state’s lackluster economy is directly responsible for the loss of most residents in the past decade. The exodus may get worse, as the 2017 tax hike continues to hurt the Illinois economy, and the state’s labor market continues to fall behind. By costing the state thousands of jobs and billions of dollars in economic activity, the recent tax hike has made the state less attractive for families. State lawmakers cannot continue hiking taxes if they want families to move to or stay in Illinois.

Reversing the trend: Illinois should rein in spending while protecting core services, not hike taxes

Illinois state lawmakers have the opportunity to put the state on a path toward a more prosperous future through policy reform. But what kind of reform should a shrinking state pursue?

One clear mistake, given the resident exodus, would be scrapping Illinois’ constitutionally protected flat income tax.

Americans are fleeing high-tax, progressive income tax states for more competitive tax environments. These states have also been the most successful at creating jobs, which continues to be a sore spot for the Illinois economy.

The progressive income tax constitutional amendment pending in the General Assembly would only aggravate Illinois’ outmigration crisis. Illinoisans – and particularly those on whom Gov. J.B. Pritzker wants to raise taxes – are already leaving at a record pace.

Pritzker’s progressive income tax rate proposal would raise taxes on small businesses, subjecting them to one of the highest tax rates in the nation. That will make it harder for struggling Illinoisans to find a job and result in even more workers leaving Illinois.

Instead, lawmakers should focus on reining in government spending through a spending cap. A spending cap constitutional amendment already earned support from Senate Democrats this year.

Controlling pension costs is a critical component of holding down spending. Pension obligations, which official estimates put at $133 billion and other analyses peg at as much as $250 billion, now eat up more than a quarter of the state budget without delivering the services taxpayers value. An amendment to the Illinois Constitution that protects already-earned pension benefits, but allows for a slower growth in accrual of future benefits, would help reduce the state’s pension debt.

Both proposals are part of the Illinois Policy Institute’s five-year plan to balance the state budget, pay down debts and provide a path to tax relief.

Instead of more tax hikes on Illinois families and businesses, state lawmakers must cut spending to a level taxpayers can afford. Only then can Illinois foster investment and job creation, again making Illinois a place residents want to be.