86 Illinois counties see population loss in 2018

Fleeing residents continue to fuel population loss, with Cook County leading the nation for population decline.

Illinois’ inability to keep its people is spreading to more of the state’s counties, according to data released April 18 by the U.S. Census Bureau.

Late last year, the U.S. Census Bureau released data confirming Illinois experienced its 5th straight year of population loss driven by residents moving out. The big concern is prime working-age Illinoisans are leading the exodus, thanks to the state’s underwhelming labor market driven by high taxes and by policies that hinder job creation.

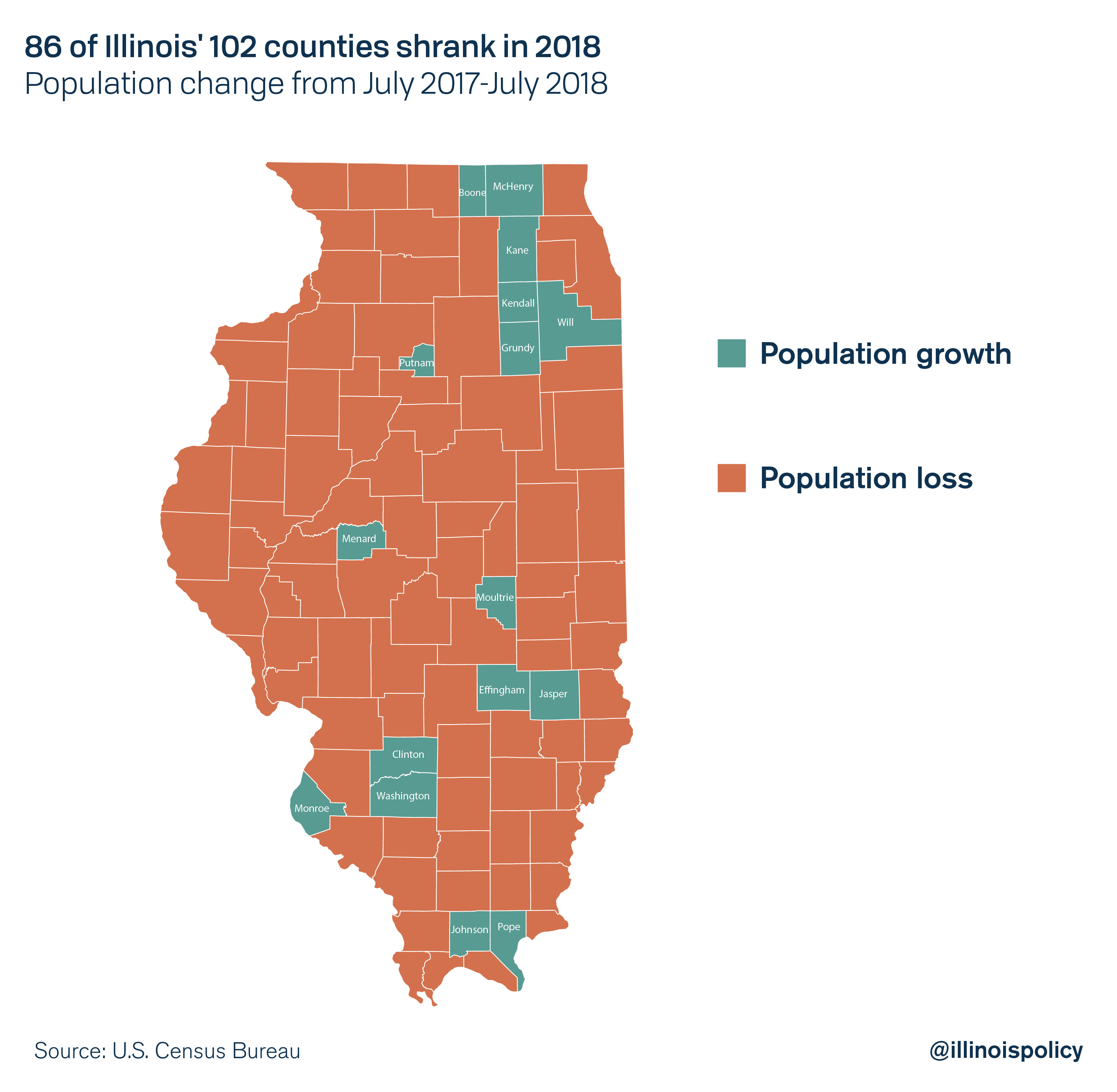

In 2018, 86 of Illinois’ 102 counties experienced population decline. In 2017, 80 counties experiencing population decline – the 2017 number was revised in the 2018 data release.

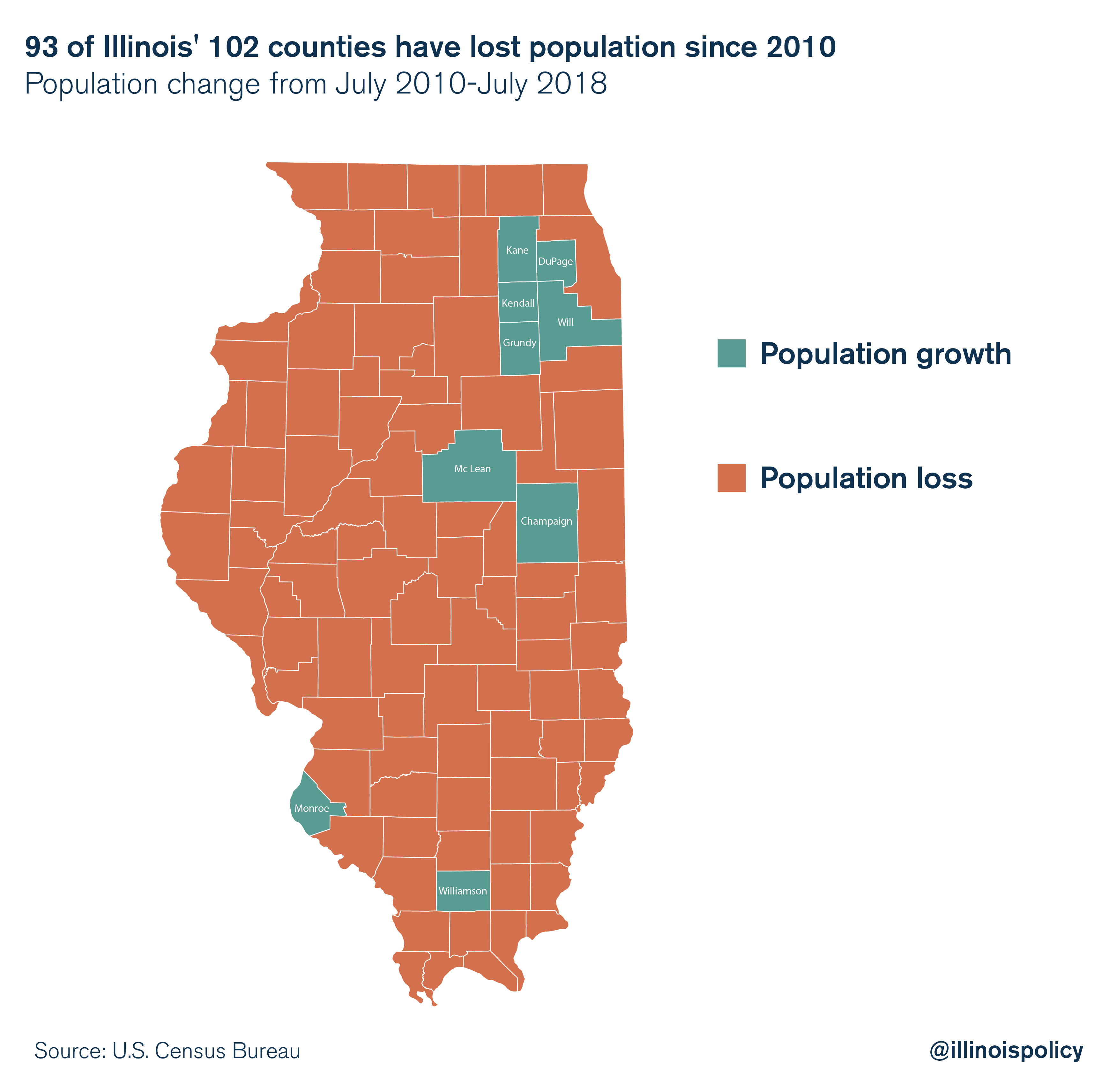

The picture gets even worse when comparing counties to what they looked like at the end of the Great Recession. Since 2010, 93 of Illinois’ 102 counties have experienced population decline.

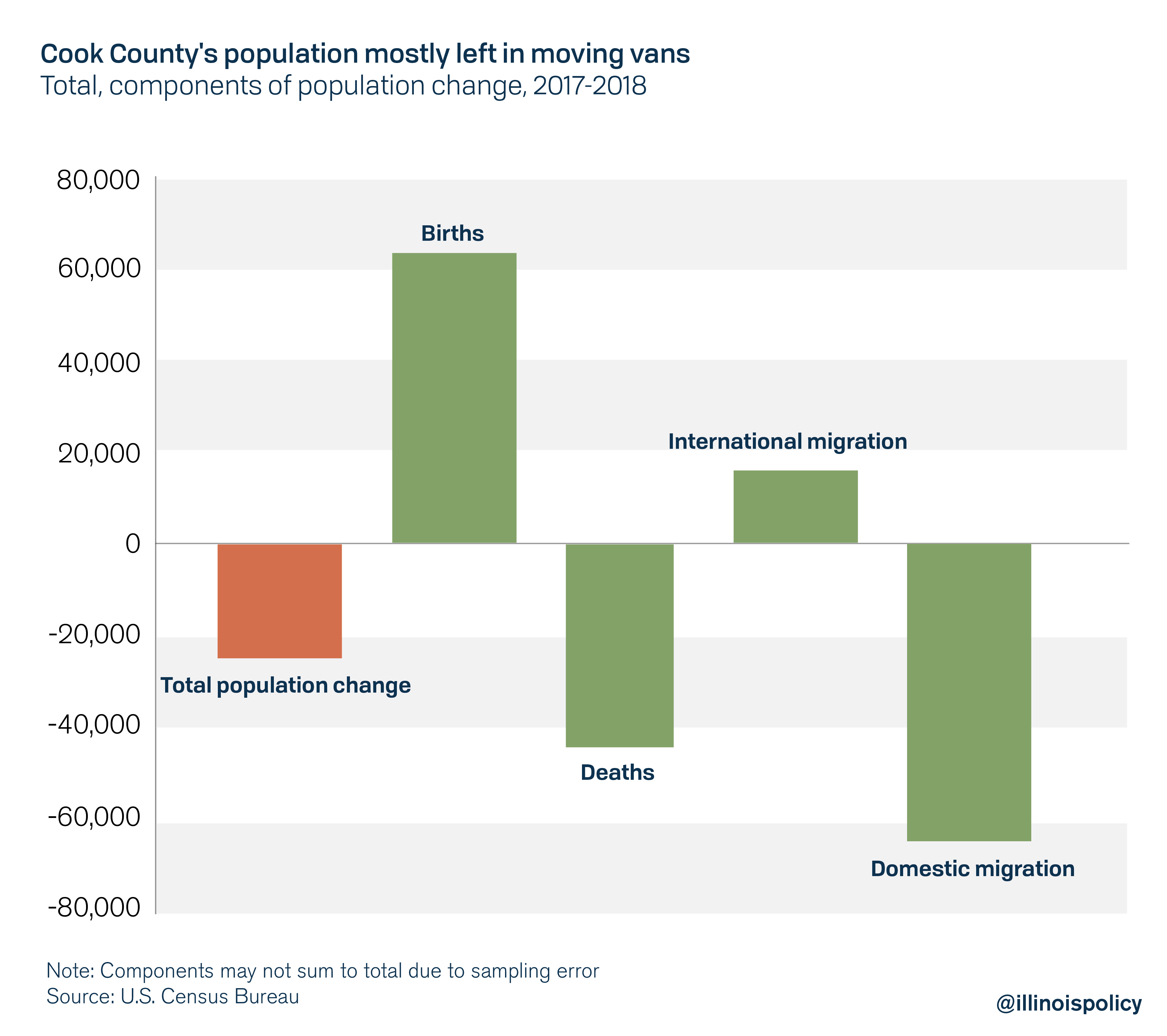

Cook County once again experienced the largest population decline of any county in the nation, losing more than 24,000 people from July 2017 to July 2018.

Cook County’s population decline is thanks to residents leaving. While births still outpace deaths and international migration remains positive, domestic outmigration has been dragging down the Cook County population.

That has been true for the past four consecutive years. Given the state’s persistent people problem, it is important to understand who is leaving and why.

Who’s leaving?

The primary driver of Illinois’ outmigration crisis is prime working-age residents (ages 25-54) seeking opportunity.

An analysis of the most recent government data reveals those leaving tend to be more highly educated than those staying, and that the state’s population loss has led to a shrinking of both the skilled and unskilled workforces. That is a bad sign for Illinois’ already weak labor market.

Those college-educated migrants who leave the state tend to make 14 percent more in wages and salaries than non-migrants, and 18 percent more than the migrants moving into the state. This signals that Illinois is continuing to experience significant wealth flight.

The data also reveal Illinois is shedding migrants who are in the labor force and seeking a job, while attracting migrants who are less likely to be labor force participants.

Why are they leaving?

It’s important to understand why people move from Illinois.

Yes, warmer states have been attracting more people, especially retirees, as America’s population continues to age. But people also move because of taxes and labor market conditions. Illinois’ population decline is driven primarily by prime working-age Illinoisans seeking jobs, not retirees seeking sunshine.

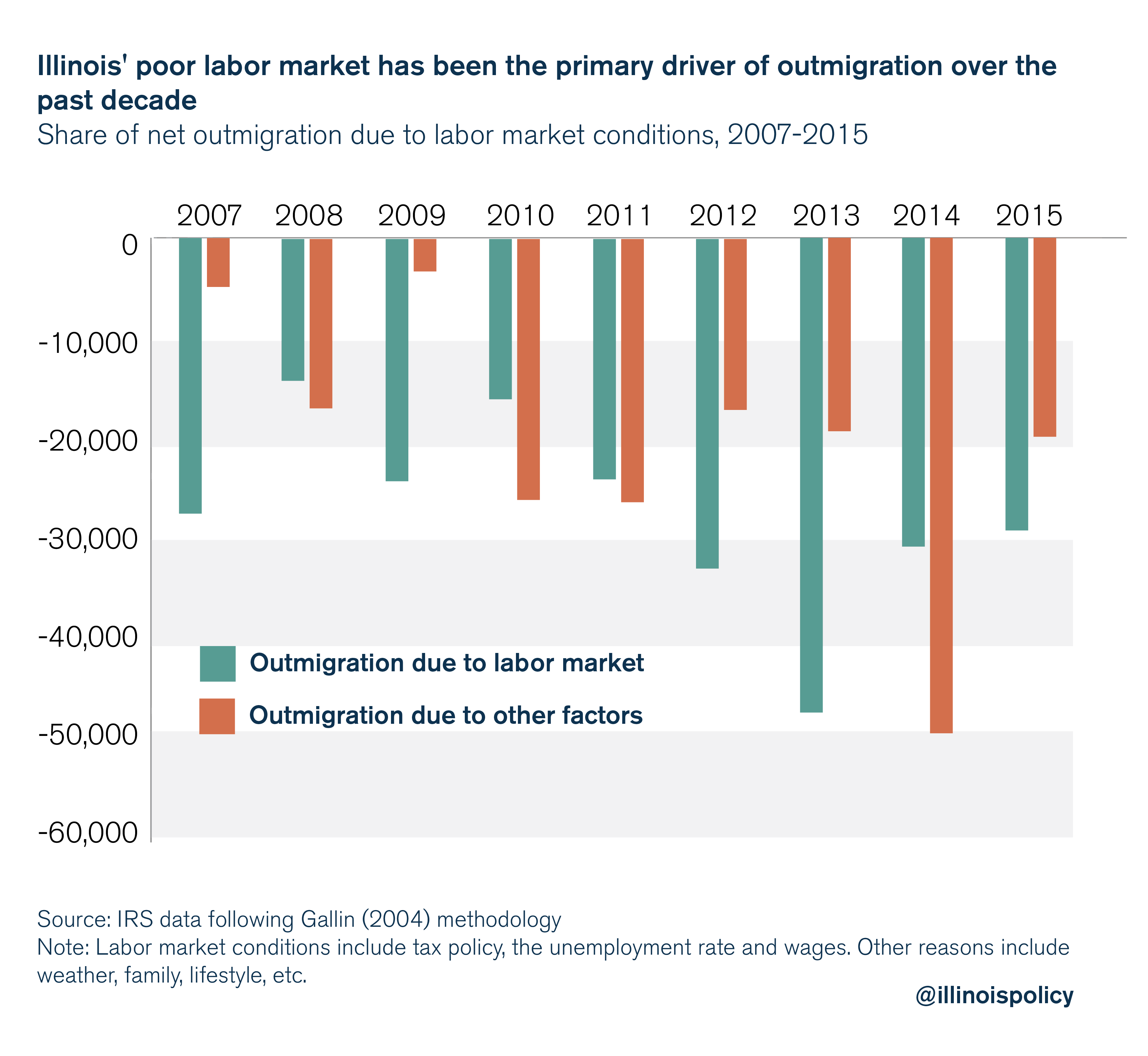

The labor market is the most important factor in Illinois’ population loss. The labor market has been crushed by the state’s hostile tax policies and business climate.

Following the methods of Federal Reserve economist Joshua Gallin (2004), which take into account the effects of climate, age and labor market conditions on migration decisions, IRS data reveal Illinois’ poor labor market has been the primary driver of outmigration since 2006, accounting for 57 percent of Illinois’ net migration losses to other states (see Appendix A).

The state’s lackluster economy is directly responsible for the loss of most residents in the past decade. In other words, had the state fostered a healthy labor market, Illinois’ population would have continued to grow in 2014 and 2015 instead of experiencing persistent declines.

Unfortunately, the state’s losses may get even worse, as the 2017 tax hike will continue to hurt Illinois’ economy. By costing the state thousands of jobs and billions of dollars in economic activity, the recent tax hike made the state less attractive for families looking to plant roots. State lawmakers cannot continue to rely on tax hikes if they want families to choose Illinois.

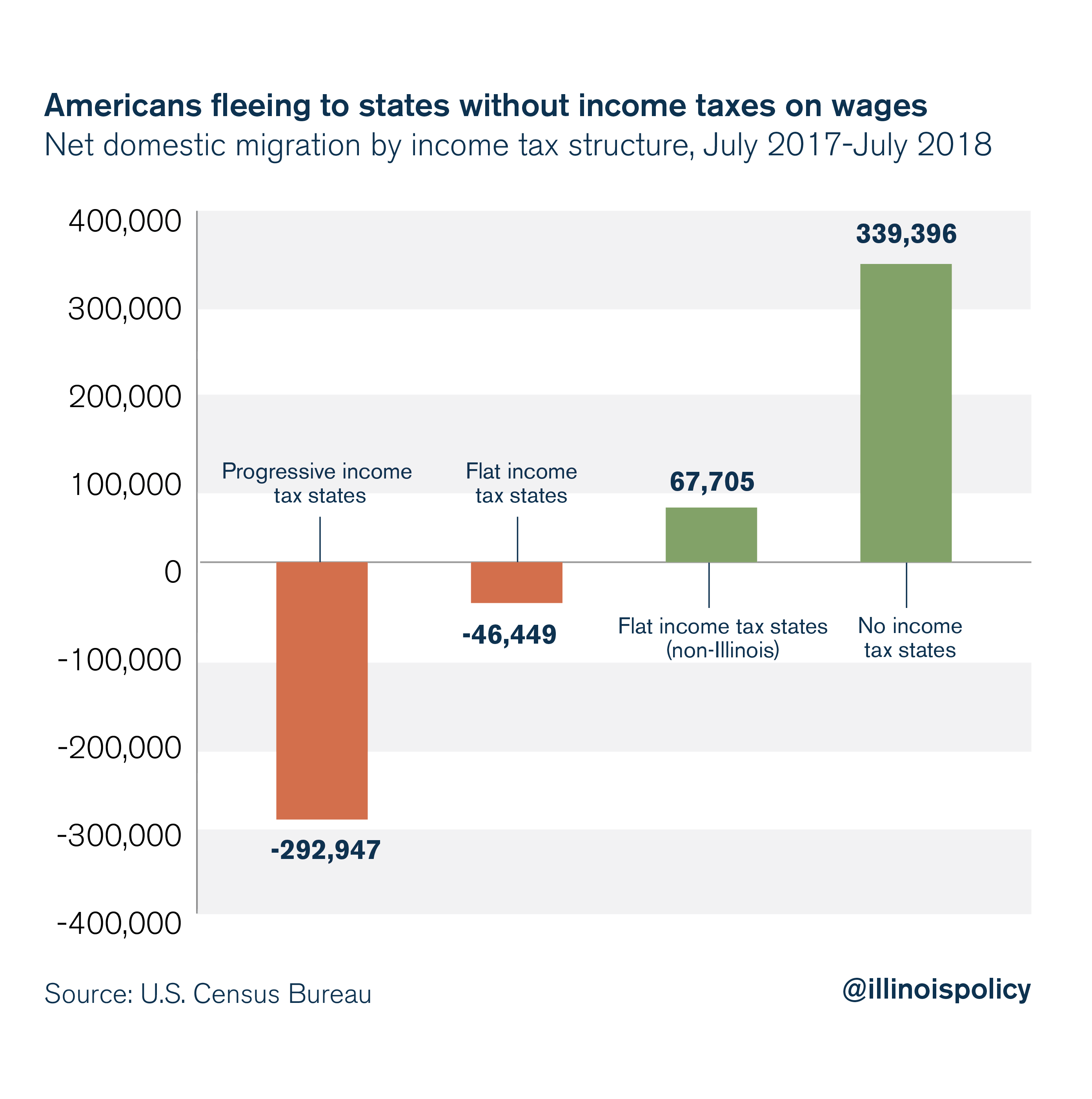

The county-level results come as no surprise. State-level data already indicated Illinois residents were fleeing and were part of a nationwide trend of Americans leaving burdensome progressive income tax states for more competitive tax environments.

Reversing the trend: Rein in spending, don’t hike taxes

Illinois state lawmakers have the opportunity to put the state on a path toward a more prosperous future through policy reform. But what kind of reform should a shrinking state pursue?

One clear mistake, given the state’s population losses, would be scrapping Illinois’ constitutionally protected flat income tax.

A graduated income tax will only aggravate Illinois’ outmigration crisis. Illinoisans – and particularly those on whom Gov. J.B. Pritzker wants to raise taxes – are already leaving at record pace.

The proposal will raise taxes on small businesses, subjecting them to one of the highest tax rates in the nation, and will make it harder for struggling Illinoisans to find a job. When this happens, it won’t just be the wealthy who head for the state line.

Instead, lawmakers should focus on reining in government spending through a spending cap to provide certainty about future government spending and to help avoid tax hikes as their primary solution for balancing the budget.

Controlling pension costs is critical to holding down spending. Pension obligations, which state estimates put at $134 billion and other analyses peg at as much as $250 billion, are one of the largest cost drivers of government spending and now eat up more than a quarter of the state budget. This means Illinoisans are paying more for government worker retirement costs, and fewer dollars are available for the services valued by taxpayers. Despite paying billions of dollars a year into the state retirement systems, these funds are becoming less solvent over time, as returns on investment are frequently below their projected targets and 3 percent compounding benefit increases outpace inflation.

An amendment to the Illinois Constitution that protects already-earned pension benefits, but allows for a slower growth in accrual of future benefits – such as a true cost of living adjustment tied to inflation – would help to reduce the state’s pension debt.

Bringing spending down to a level taxpayers can afford and avoiding tax hikes would foster better employment growth within the state through a friendlier business environment that encourages more investment and job creation.

A lower tax burden would stimulate investment and job creation, making the state a more attractive place for families and businesses to grow. Continue to tax and spend, and the population will continue to move and shrink.