Pritzker ‘fair tax’ hike would depress jobs growth, raise taxes on middle class

The governor’s progressive income tax hike will not deliver on promised revenue and will drag down Illinois’ struggling economy.

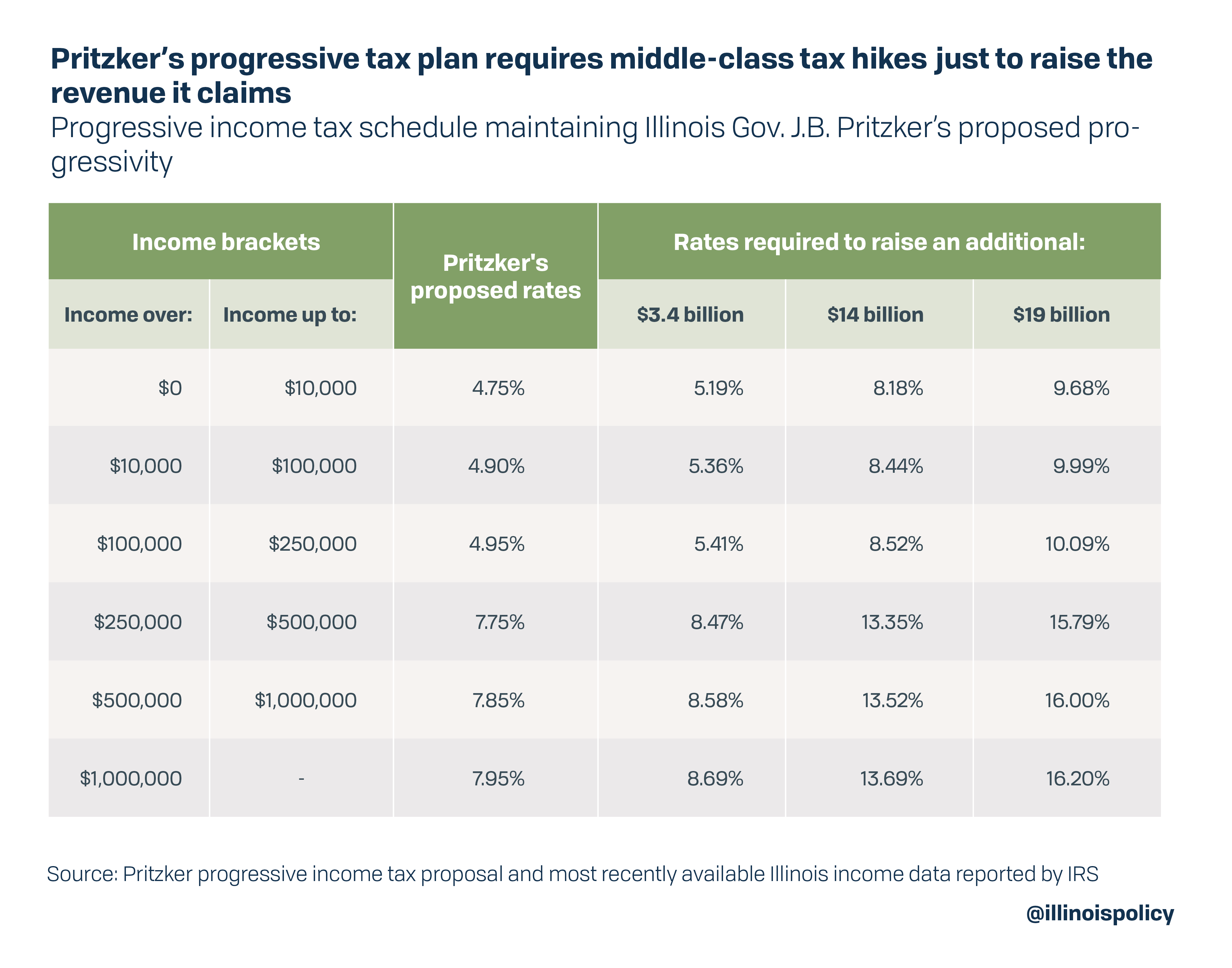

Gov. J.B. Pritzker unveiled his long-awaited progressive income tax plan on March 7. While the governor claims his proposed changes to the personal and corporate income taxes will bring in another $3.4 billion in revenue, static and dynamic scoring of his plan reveal it will result in far less. Moreover, in order to raise his promised revenue, lawmakers will have to hike tax rates on all Illinoisans.

Not only will the tax hike fail to add the hoped-for revenue to the state’s coffers, but raising income tax rates using a progressive income tax will also harm Illinois’ economy.

Investments in human and physical capital have large positive effects on economic growth, but tax increases deter investment. Progressive income taxes deter investment even more than equivalent flat taxes for two reasons: 1) If individuals are taxed at a lower rate while less skilled and at a higher rate when they become more skilled, the incentive to becoming skilled will be diminished; and 2) Top earners who have a higher propensity to invest are also more responsive to tax policy changes. The decline in new investments negatively affects labor demand. That means fewer new jobs for everyone and a decline in economic growth.

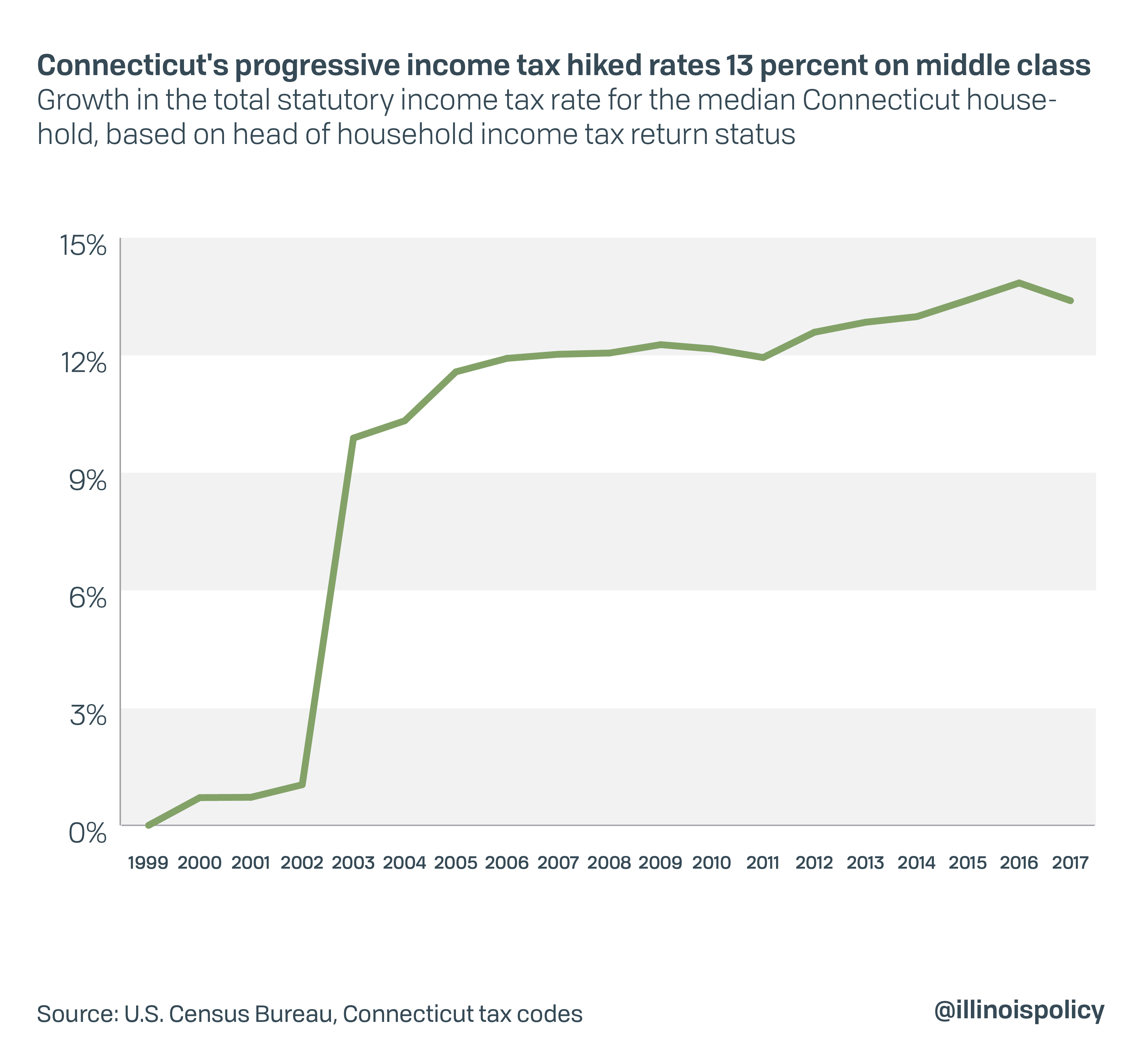

This is consistent with the bulk of empirical evidence and with what happened in the last state to adopt a progressive income tax: Connecticut, in 1996. While sold as “middle-class tax relief” – just like Pritzker’s proposal – the typical Connecticut household has been hit with repeated tax hikes. The typical Connecticut household has seen a 13 percent hike in their income tax rates since 1999, when the progressive income tax was fully phased in. And property taxes as a share of income are up more than 35 percent.

Using empirical methodology known as the synthetic control method, Illinois Policy Institute research has revealed that the tax policy change cost Connecticut’s economy more than $10 billion in the decade that followed the state’s progressive tax experiment.

At the same time, the tax did nothing to fix the state’s finances. Connecticut’s progressive income tax has failed to alleviate the state’s dire fiscal condition. The state has run budget deficits in 12 of the past 15 years and has more debt per capita than nearly any other state. The state is also plagued by persistent population decline driven by domestic outmigration in recent years.

Illinois cannot afford to follow Connecticut down this economically dangerous path. The Prairie State should turn away from tax hikes and focus instead on reining in and reprioritizing state spending.