Illinois state spending has grown nearly 50% faster than taxpayer incomes

A spending cap proposal filed by state Sen. Tom Cullerton, D-Villa Park, would ensure growth in government spending doesn’t exceed taxpayers’ ability to pay for it.

Illinois is in dire fiscal straits for a simple reason: The state perpetually spends more than it takes in. Illinois has not had a balanced budget since 2001, despite the fact that the state constitution requires it.

One long-term solution to Illinois’ budget woes? Smart spending growth. State Sen. Tom Cullerton, D-Villa Park, introduced a spending cap constitutional amendment Feb. 15 that would tie growth in state government spending to growth in Illinois’ economy. That means Illinoisans can rest assured they’re getting a state government they can afford – a crucial first step toward restoring confidence for families and business alike.

A similar proposal garnered bipartisan support last year.

State spending outruns Illinois incomes

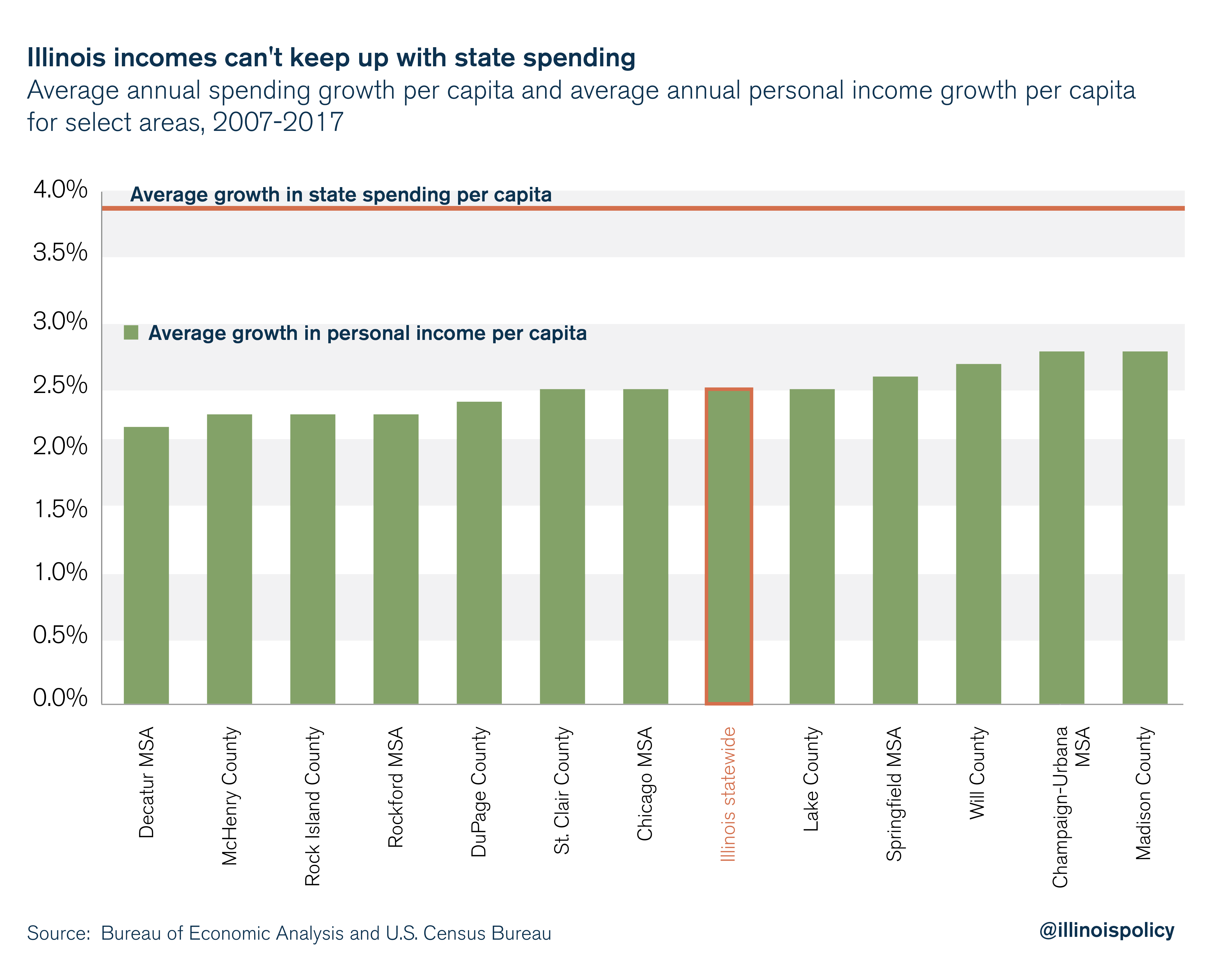

Illinois lawmakers have been on a spending spree. State spending per capita grew 48 percent faster than Illinoisans’ personal income per capita from 2007 to 2017. And without reforms such as Cullerton’s, there’s no sign it will slow down anytime soon.

State spending growth outpaced personal income growth across Illinois by an average of 48 percent between 2007 and 2017: Illinoisans’ personal incomes grew at an average annual rate of 2.52 percent, while state spending grew by 3.72 percent annually.

In some areas of Illinois, such as the Decatur Metropolitan Statistical Area, where annual incomes grew by 2.19 percent annually, per capita state spending growth outpaced per capita personal income growth by 70 percent per year from 2007-2017.

Illinois is already facing a $2.8 billion deficit for fiscal year 2020, which is projected to swell to $3.4 billion in fiscal year 2021. Gov. J.B. Pritzker’s campaign promises carry a tab of $13 billion to $18 billion in additional annual expenses.

Unrestrained growth in state government spending injects uncertainty into the lives of Illinoisans. That’s because lawmakers can do only one of two things when government spending outpaces growth in the state’s economy: raise taxes or mortgage the incomes of future generations by borrowing money.

The threat of future tax hikes makes it more difficult for families to plan their futures in the Land of Lincoln. Increasingly, they’re planning those futures in other states.

Illinois needs a mechanism to ensure lawmakers spend at a level taxpayers can afford.

Years of reckless spending

One gimmick Springfield politicians have used to “balance” the budget is not appropriating funds to pay their bills. The state’s backlog of unpaid bills alone reached $16 billion toward the end of 2017 – before the state borrowed more money to pay them down to $8 billion.

Illinoisans may have expected that additional revenues from the largest permanent income tax hike in state history in 2017 would have led to a balanced budget.

But shortly after the General Assembly passed the budget bill over then-Gov. Bruce Rauner’s veto, the Governor’s Office of Management and Budget found the budget resulted in a $1.5 billion deficit.

Even with the $5 billion tax hike, state government had failed to do what families across Illinois do every day: spend within their means.

This is not new in Illinois.

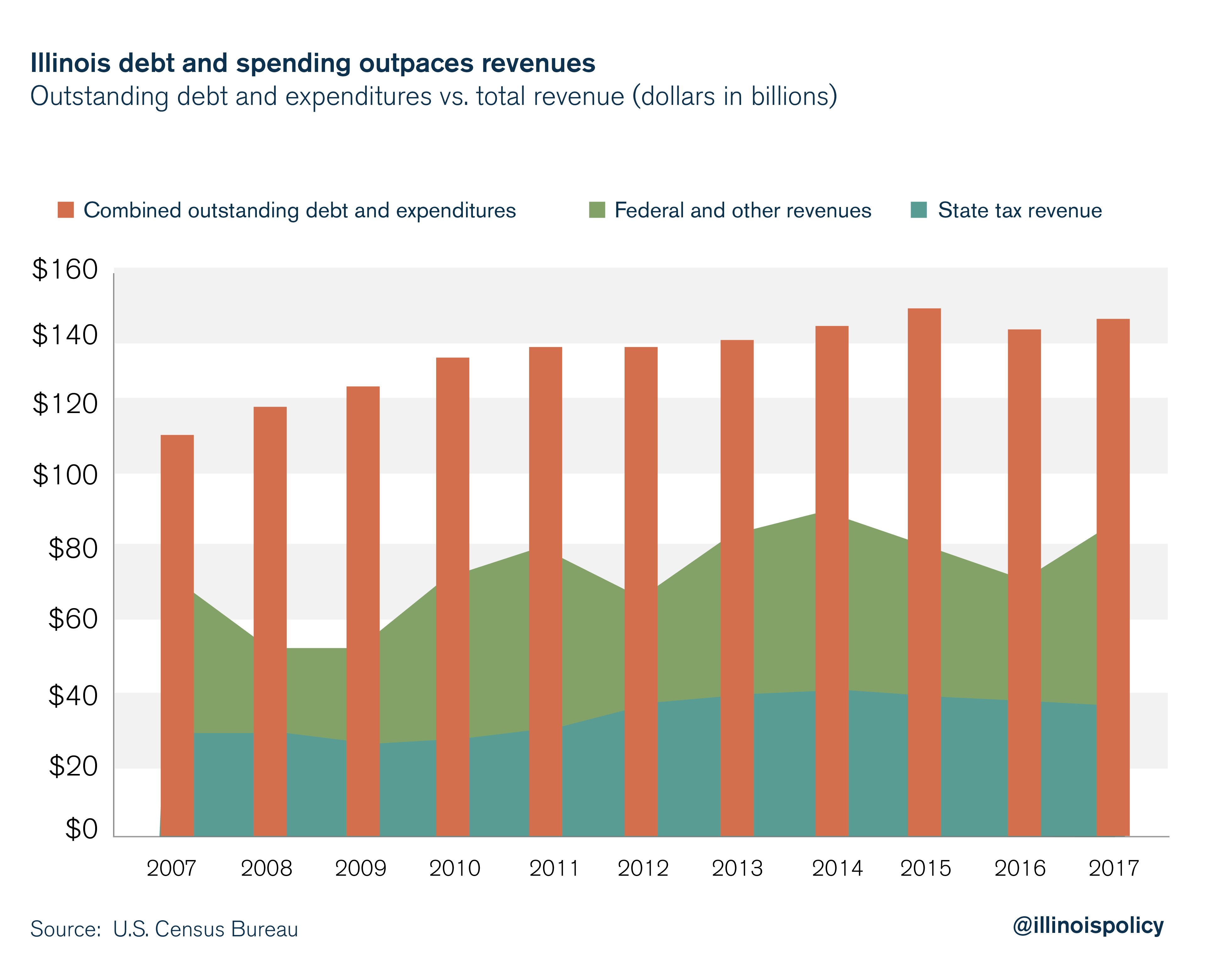

In fact, over the past 10 years, state spending and outstanding debt have consistently outpaced revenues. The state needs a tool to rein in the rapid growth of its debt and spending – an explicit cap on the growth of state spending, set at the growth rate of Illinois’ economy.

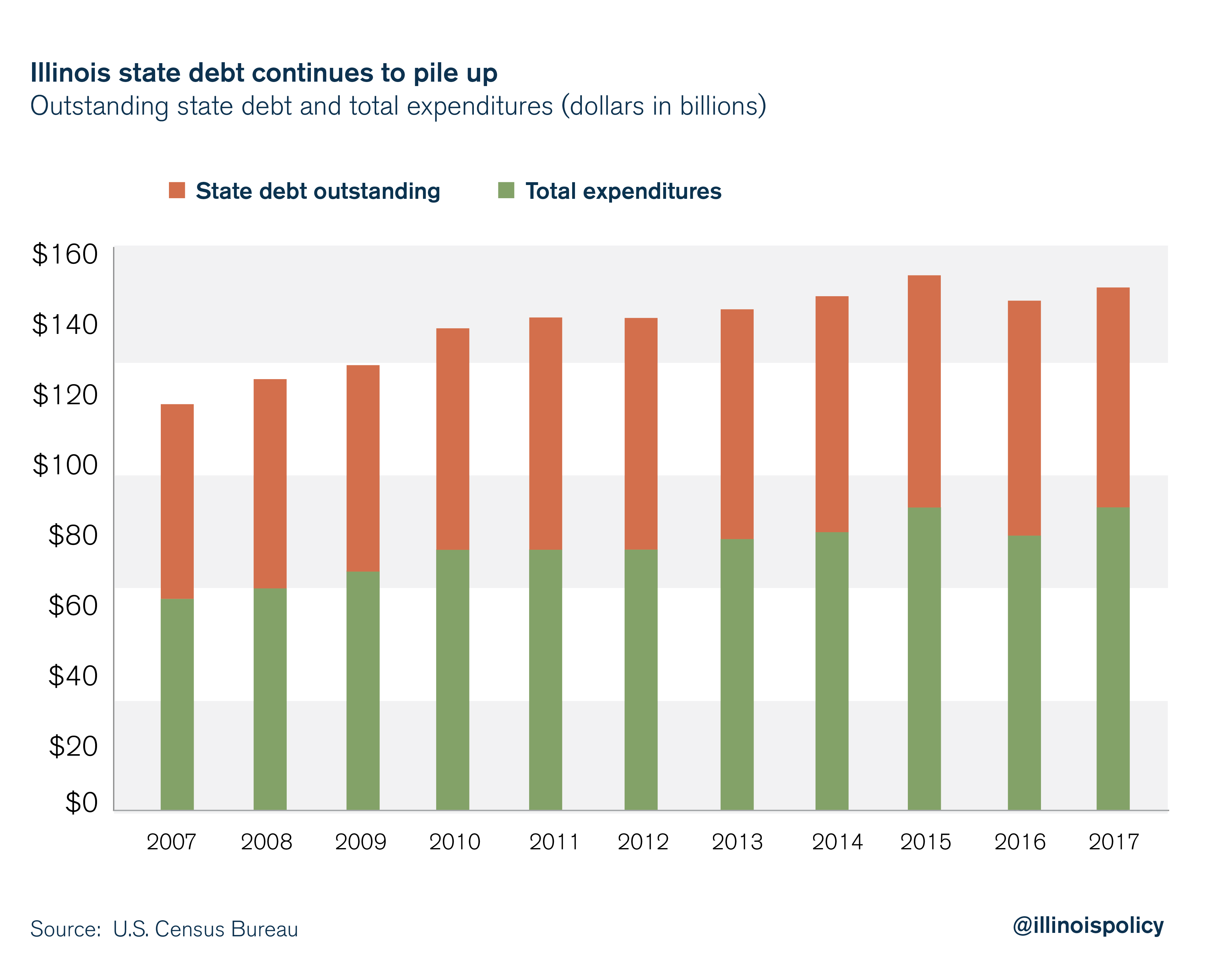

According to the U.S. Census Bureau, Illinois’ outstanding state debt grew to $62 billion in 2017 from $55 billion in 2007 – an increase of $7 billion. This includes all debt obligations remaining unpaid as of 2017. But that $62 billion in outstanding debt does not even include accrued state liabilities for pension benefits, which Moody’s Investors Service estimates at $250 billion.

Total state expenditures grew even faster. Between 2007 and 2017, total state expenditures grew to $86 billion from $60 billion, an increase of $26 billion in spending.

Illinois’ outstanding debt is already sky-high, due not only to borrowing, but also to the interest that collects on the principal each year. And if the General Assembly continues to spend at the current pace, the state’s revenues will never be able to catch up.

Without a way to limit the growth in spending to sustainable levels, Illinois’ future holds more punishing tax hikes for already overburdened residents.

The economic impact of an income tax increase

Continuously hiking taxes to pay for years of budget mistakes is a recipe for poor economic performance, meaning fewer job opportunities and slower wage growth for working Illinoisans.

Most economists agree that when lawmakers raise taxes, economic growth suffers because higher taxes have a negative impact on investment. This was the case with Illinois’ 2011 tax hike, which cost the state $56 billion and 9,300 jobs from 2012 to 2016, and will be the case with the 2017 tax hike as well.

Illinois has experienced a decline in investment because of the 2011 tax hike. This is made clear by data from the Bureau of Economic Analysis, which show that noninvestment spending in the private and public sectors has taken up an increasing share of Illinois’ economy.

Declining investment means a reduction in not just the number of jobs in Illinois, but also in the quality of those jobs.

Uncertainty over future tax hikes itself can be enough to drive investment out of the state toward a more investment-friendly, fiscally sound climate.

Spending cap could restore confidence

A spending cap means restraining the growth of government spending to what taxpayers can afford, providing the certainty individuals and businesses need to thrive.

Business owners make investment decisions with expectations of future returns. Given the risks involved with any business decision, economists agree it is important that public policy does not add to the risk business owners face. Illinois already has an unfriendly business environment, and any uncertainty over the future tax burden from unsustainable increases in state spending will likely lead to business owners holding off on investment and hiring decisions, ultimately resulting in slower economic growth.

A spending cap also incentivizes efficient use of tax dollars.

Using data from 29 countries, research by the International Monetary Fund reveals that fiscal rules have led to stricter prioritization and greater efficiency in spending. When expenditure rules are enshrined in law and not just a political promise that can easily be broken, they are associated with spending control and improved fiscal discipline. Higher public sector efficiency would free up resources for more high-quality public investments such as certain infrastructure projects that benefit Illinoisans and can help to jumpstart the state’s sluggish economy.

It also means averting future tax increases.

The ability to rein in Illinois’ major cost drivers is limited at present, as the Illinois Supreme Court has ruled pension benefits for government workers – and the skyrocketing taxpayer costs of funding them – are not subject to change. A constitutional amendment is necessary to fix this problem.

However, discretionary spending is one area in which lawmakers can practice fiscal responsibility without running afoul of the courts.

Illinois would not be alone in trying to enforce fiscal discipline on its lawmakers, 27 other states have some sort of tax or expenditure limitations and 15 of those are enshrined in their constitutions.

The Texas Constitution, for example, restricts growth in appropriations to the growth rate in state personal income, with exceptions for constitutionally mandated appropriations or in case of emergencies. Meanwhile, the Colorado Constitution limits growth in state spending to an index of population and inflation.

If the Illinois General Assembly would simply restrict the growth of state spending to the average annual growth in Illinois’ gross domestic product for the last 10 years – 2.43 percent for 2008 to 2017 –Illinois would be on its way to paying off its backlog of bills and eventually repealing the income tax hike.

When lawmakers control spending and provide a basic level of certainty about the long-term growth of state government – thus warding off future tax hikes – Illinois can once again become an attractive destination for families and businesses.