Nearly 80 percent of Alton property tax levy consumed by pensions

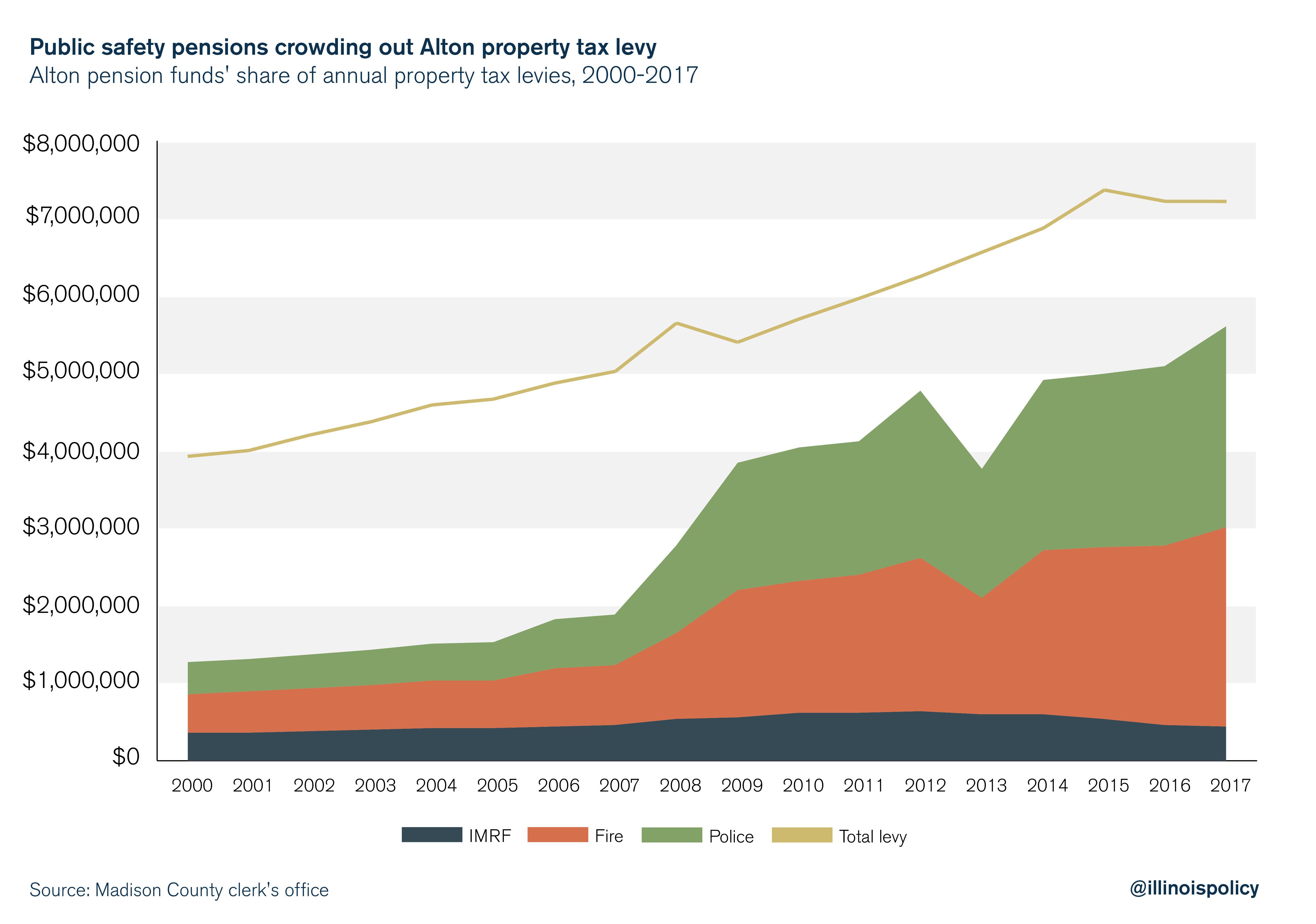

The share of Alton’s annual property tax levy going to pension payments has more than doubled over the past decade.

In the city of Alton, homeowners know their property tax bills are a heavy burden, but they likely don’t know how few of those tax dollars go toward filling potholes, catching criminals and fighting fires.

During the past 17 years, the portion of the property tax levy used to support government worker pensions increased to 78 percent from 30 percent. That leaves 22 cents of every property tax dollar for current public services.

That dynamic isn’t unique to Alton or southwestern Illinois’ communities, where growing pension costs have inflated residents’ property tax bills and left local governments struggling to maintain basic services.

Pension pressure

The reason for more taxes and fewer services? Pension costs for government retirees are eating up a larger and larger share of Alton’s property tax levy. Of every dollar the city levied in property taxes in 2017 – payable in 2018 – 78 percent was reserved for the city’s police and fire pension funds and the Illinois Municipal Retirement Fund, or IMRF.

In 2017, Alton officials approved a property tax levy of just over $7.2 million. But the amount earmarked for pensions hovered above $5.6 million, leaving the city with less than a quarter of the total levy to spend on core government services.

In 2007, pension funds demanded only 36 percent of Alton’s property tax levy. But by 2017, pensions consumed 78 percent of Alton’s total property tax levy. While the city’s annual property tax levy grew by more than 40 percent from 2007 to 2017, the pension portion of that levy grew by 117 percent.

Police and fire pension portions of the city’s property levy decreased sharply in 2013. Unfortunately, that temporary drop did not provide real relief for taxpayers. Instead, that drop occurred because the city shorted the public pension funds, paying significantly less than what was recommended by the Illinois Department of Insurance and leaving taxpayers to fill the gap later.

Breaking point

Alton taxpayers can’t afford to keep shoveling property tax dollars into a broken system. While taxpayers’ contributions to the city’s police and fire pensions have ballooned, neither pension fund has been more than 33 percent funded since at least 2008, according to state records.

In April, the Alton City Council voted to sell the city’s sewer system after recent changes to the state’s funding formula pegged the city’s combined public safety pension debt at nearly $114 million.

While the city is selling off assets to pay down pension debt, many Alton residents are vacating their own largest assets – their homes – to relieve themselves of the obligation. Between 2010 and 2017, Alton’s population declined by more than 1,150 residents, according to U.S. Census Bureau data.

Pensions have made property taxes in the state among the most painful, feeding southwestern Illinois’ population losses to other states.

Road to reform

Defined-benefit pension systems are fundamentally unsustainable, an unfortunate reality that has plunged a growing number of municipalities across the state into financial turmoil. Unaffordable pension promises made by state lawmakers – and enshrined in the state constitution – along with extravagant promises by local leaders jeopardize the retirement security of government workers, while burdening Illinoisans with routine tax hikes.

Fortunately, reforming this system is fully within the control of those who created it: state lawmakers. When Springfield reconvenes next session, taxpayers should pressure lawmakers to aggressively push for a constitutional amendment that allows for adjustments to future, not-yet-earned pension benefits while ensuring that already-earned benefits remain protected. An ideal constitutional amendment would include the following:

- Increasing the retirement age for younger workers, bringing them in line with their private-sector counterparts

- Capping maximum pensionable salaries

- Replacing permanent compounding benefit increases with true cost-of-living adjustments, or COLAs

- Implementing periodic COLA holidays to allow inflation to catch up to past benefit increases

- Automatically enrolling all new government employees into 401(k)-style retirement plans

Unless state lawmakers muster the courage to amend the Illinois Constitution’s pension clause, pension benefits for yesterday’s government retirees will continue to cast uncertainty over today’s government workers – and deliver more property tax pain to local taxpayers.