IRS moves to block Illinois lawmakers’ tax credit workaround scheme

New IRS rules make clear that lowering the actual tax burden, not complicated workarounds, is the correct way to respond to tighter federal restrictions on SALT deductions.

Newly proposed rules from the Internal Revenue Service will prevent Illinois and other high-tax states from pursuing workaround schemes to blunt the effects of their heavy state and local taxes. Instead of attempting to mask the pain of high taxes in Illinois, lawmakers should pursue policies targeted toward reducing the actual tax burden in the Prairie State.

The recently enacted Tax Cuts and Jobs Act, or TCJA, made a number of changes to federal tax policy, including lowering the corporate tax rate to 21 percent from 35 percent, reducing personal income taxes by $2,059 for a family earning the median household income, and limiting the state and local tax, or SALT, deduction.

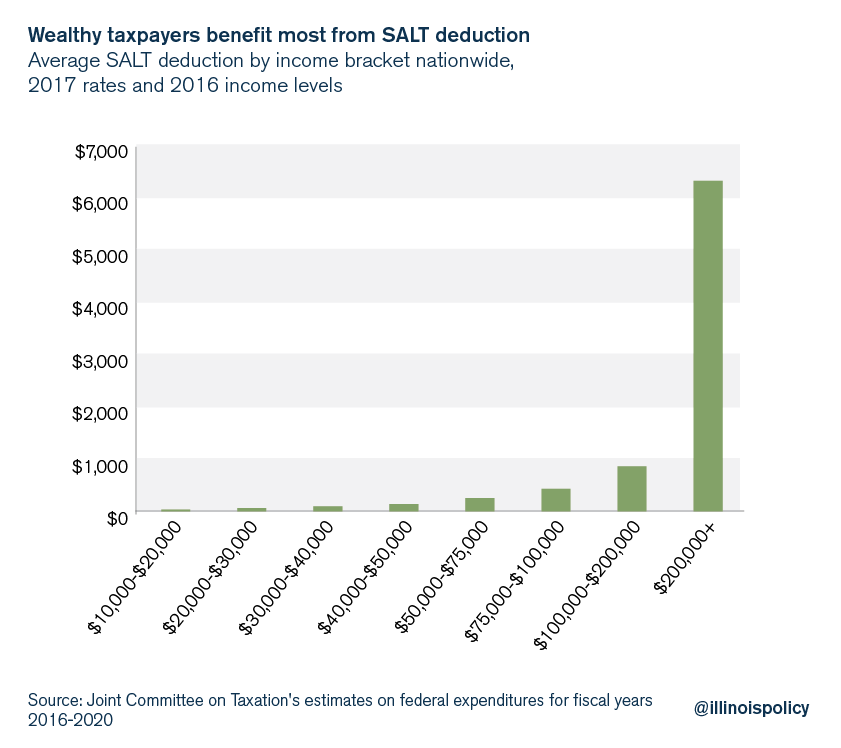

Under the TCJA, taxpayers are only allowed to deduct $10,000 of their state and local taxes from their federal income tax liability. Previously, the SALT deduction was uncapped and acted as a subsidy for states with high taxes, such as Illinois.

The new cap will primarily affect wealthier taxpayers who have a state and local tax liability of more than $10,000.

In spring 2018, Illinois state lawmakers attempted to pass a workaround bill, House Bill 4237. The amended bill would have created a new “Illinois Education Excellence Fund,” a so-called public charity for education to which state taxpayers could contribute amounts that could be credited against their state income tax liability. The bill also would have authorized counties to establish charitable funds to which residents could contribute amounts that could be credited against their property tax liability. Thus, in theory, the measure would have circumvented the new SALT cap by redefining certain payments as charity instead of taxes, allowing the payments to be fully deductible at the local, state and federal levels.

The bill passed in the House of Representatives by a vote of 93-15 and in the Senate by a vote of 54-1-1. However, because the Senate amended the bill and the House never voted to approve the amended version, the bill has not been sent to the governor for signature.

Critics of SALT workaround schemes, such as the Tax Foundation, argue these plans are nothing more than a recharacterization of tax payments as charitable deductions.

In May, the IRS signaled it would block any attempt to circumvent the new SALT cap using methods such as those in HB 4237. Charitable tax deductions must be for expenses that primarily serve a public purpose, not a private purpose such as reducing a taxpayer’s own tax liability. And of course, if lawmakers had succeeded in passing their workaround scheme, the individuals attempting to take advantage of the plan would face penalties from the IRS – not the lawmakers who came up with it.

Now, the IRS has officially proposed the rules it foreshadowed in May. Essentially, the regulations would prevent double counting of deductions for state and federal taxes. For example, if a $20,000 charitable contribution results in a $15,000 state tax credit, only $5,000 can be deducted for federal tax purposes. However, the rules do allow for an exemption for small state tax credits of 15 percent or less of a contribution. If a $1,000 contribution creates a state tax credit of $150 or less, the full $1,000 can still be deducted for federal tax purposes.

Rather than continue to search for a way to mask Illinois’ high taxes, lawmakers should adopt meaningful spending reforms – such as a spending cap and pension reform – that will ultimately facilitate actual tax cuts for Illinoisans.