Play money: Former Park District of Highland Park employees taking home 6-figure pensions

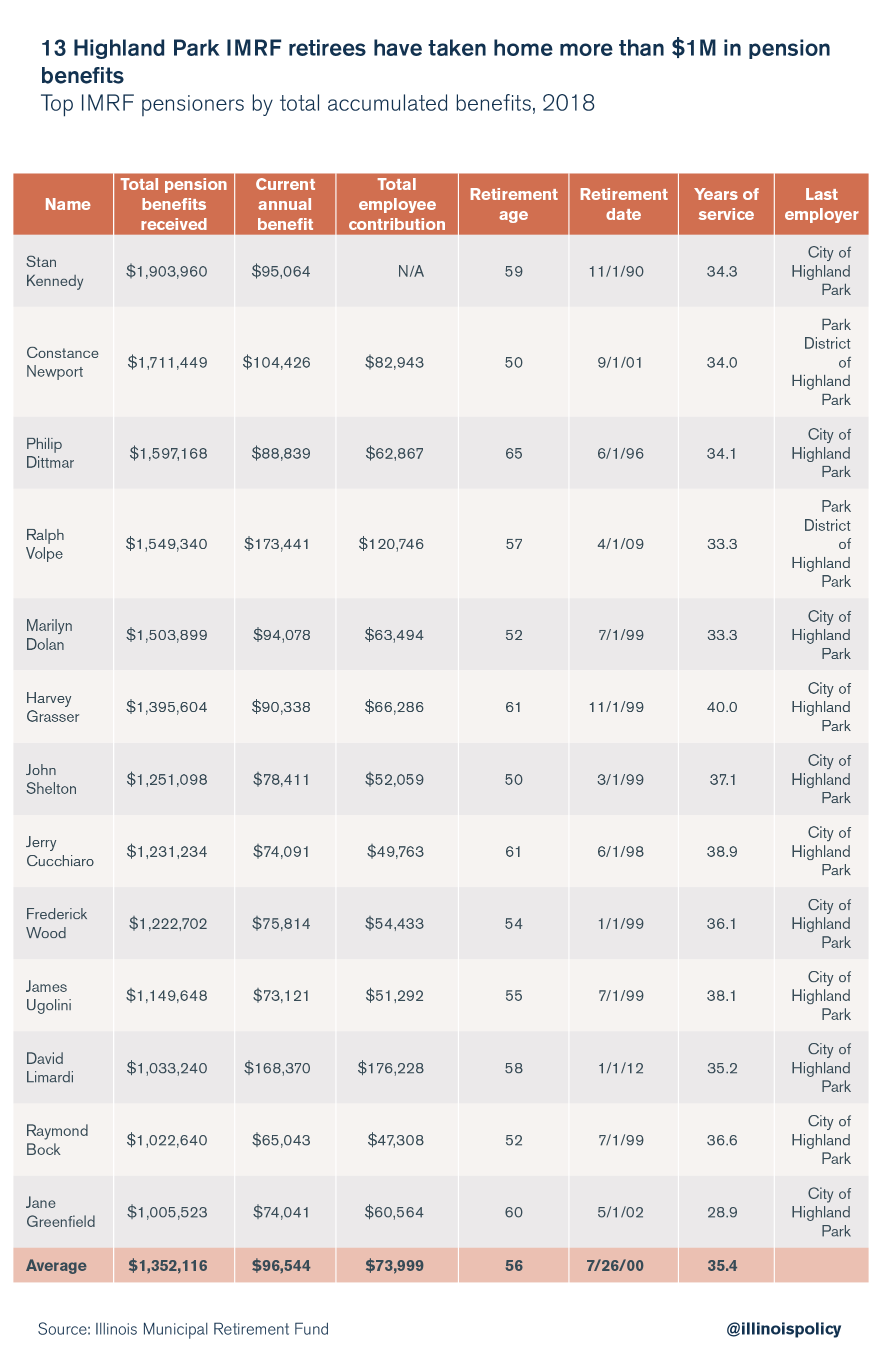

More than a dozen city and park district retirees in Highland Park have received more than $1 million in pension benefits each.

Across Illinois, homeowners have increasingly seen their property tax dollars flow to pensions rather than the improvement of government services. The Lake County city of Highland Park is no different.

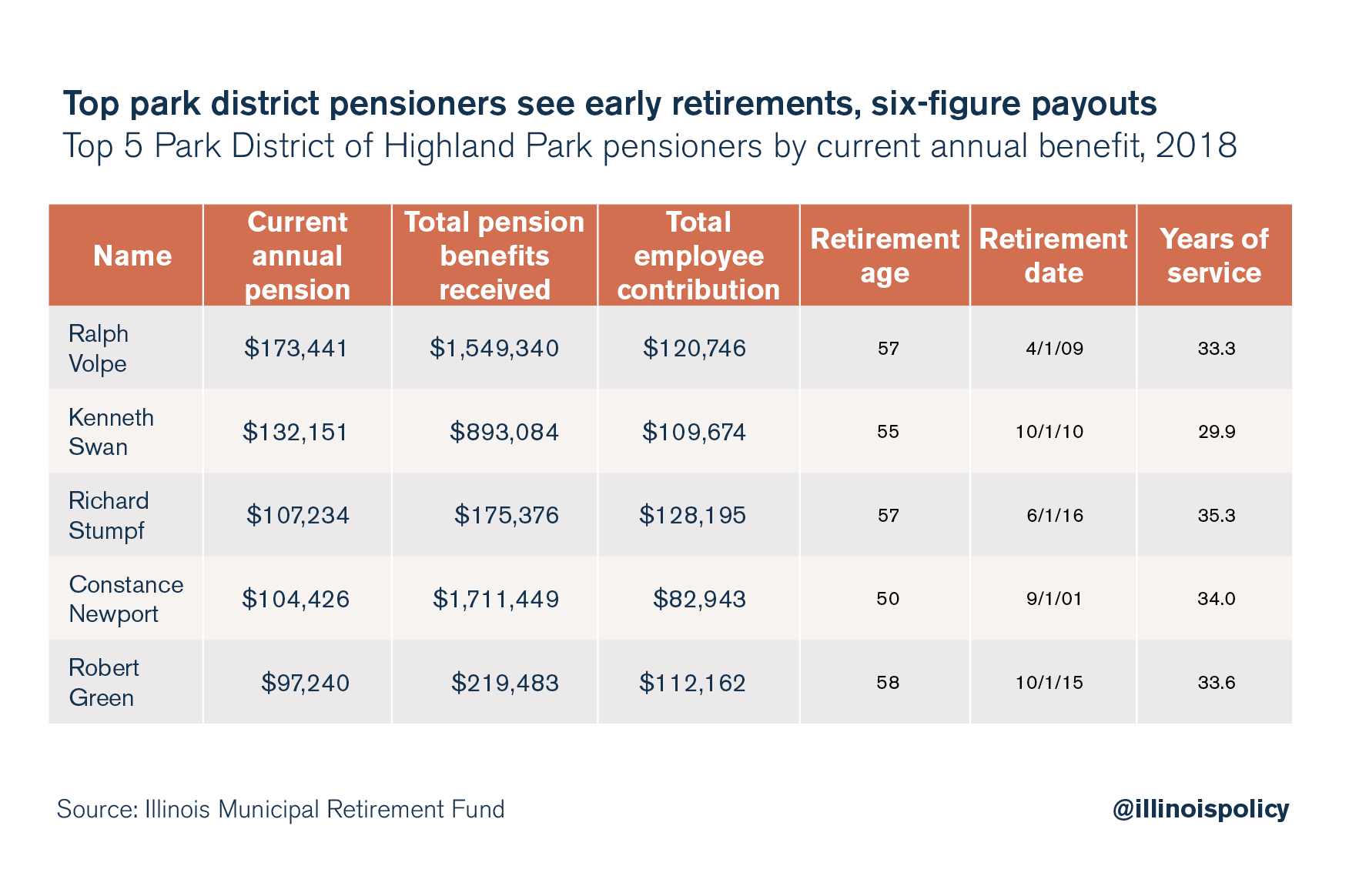

One reason: Four current retirees from the Park District of Highland Park are taking home annual pensions that exceed $100,000. Each retired before age 60 and contributed less than $130,000 to the Illinois Municipal Retirement Fund, or IMRF, over the course of their entire careers.

Municipal retirees are not to blame for these costly pension benefits. Rather, those benefits are dictated by overly generous rules established by state lawmakers. High pension payouts are also the result of high salaries. Out of 51 employees listed in compensation documents provided by the Park District of Highland Park in April, 18 earned more than $100,000 in total compensation – including two tennis pros.

IMRF documents, which exclude most teachers, firefighters and police officers, show hefty pension payouts to former city employees in Highland Park as well. Eleven former city employees have taken home more than $1 million in benefits over the course of their retirements.

The top lifetime recipient is former Highland Park City Manager Stan Kennedy, who has taken in more than $1.9 million over the course of his retirement, according to IMRF records. At $1.7 million, the second-highest beneficiary is former park district employee Constance Newport, who retired in 2001 at age 50.

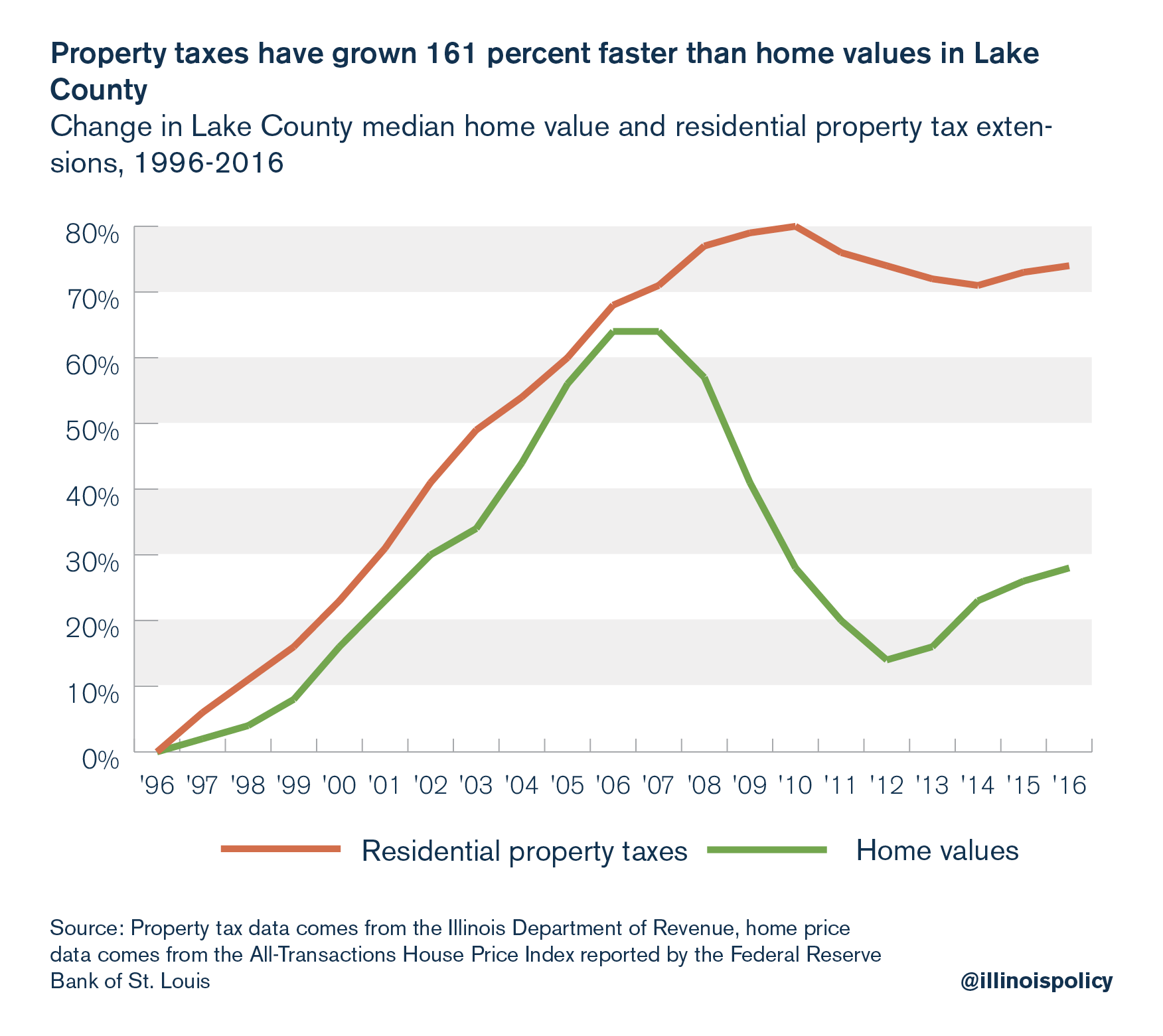

Pensions vs. property values

Lake County homeowners have seen their property taxes rise by more than $1,100 per person since 1996, after adjusting for inflation. Those bills have grown far faster than home values, which can be partly attributed to a growing share of additionally raised property tax dollars going toward pension costs rather than services that raise home values.

Pensions vs. services

Highland Park residents have seen this play out with their police and fire departments. From 2006 to 2016, the city’s annual contribution to its police and fire pension funds quadrupled – to more than $7 million from $1.7 million. Despite this boost in funding, both funds were worse off: As of 2016, each of the city’s public safety pension funds have around 50 cents for every dollar owed in future benefits, according to the Illinois Department of Insurance. In December 2017, Highland Park City Council hiked the city’s property tax levy to bring its annual contribution to public safety pensions up to $8 million.

Countywide, residents actually saw a decline in property tax dollars going toward municipal fire protection services from 1996 to 2016, while $12.6 million in additional property tax dollars went to fire pensions. Meanwhile, 82 cents of every additional property tax dollar levied for municipal police departments went to pensions – not protection.

Fixing the system

Without state-level reforms to rein in the cost of pensions, communities across the state will continue to see property tax hikes, often to the detriment of core services.

One short-term solution to this problem is enrolling every new government worker in a 401(k)-style retirement plan, similar to what more than 20,000 state university workers have opted into. A long-term solution must include a constitutional amendment to allow changes in future, unearned pension benefits for government workers. This would allow for reasonable changes such as ending automatic 3 percent annual benefit increases for retirees and bringing government worker retirement ages in line with the private sector.

Until state lawmakers address this overwhelming rise in pension costs, Lake County residents will not see meaningful property tax relief, and government workers will continue to see their retirements put in jeopardy.