Pair of Des Plaines park district retirees have taken home $1M each in pension benefits

Active Des Plaines Park District pensioners – including two pension millionaires – have put taxpayers on the hook for more than $7.6 million in pension payouts since 1996.

Despite serving some of the most overtaxed residents in Illinois, Des Plaines Park District’s active pensioners have collected over $7.6 million in pension benefits over the last two decades – with two retirees having each collected more than $1 million.

Records from the Illinois Municipal Retirement Fund, or IMRF, show 38 active pensioners from the park district enrolled in the fund since 1996. Among them, two former employees – David Markworth and Steve Smuk – have each received more than $1 million over the course of their retirements. Markworth retired in 2003 at age 59, and has since received more than $1.8 million in total pension benefits, with an annual payout of $144,500, despite only investing $93,500 into his retirement over 38 years of work. Smuk, who retired in 1996 at age 58, has accumulated nearly $1.1 million since retiring, with an annual payout just under $60,000, despite just investing $37,400 for his retirement over 40 years of work.

These workers, however, are not to blame for these extreme pension benefits. State lawmakers set the rules for IMRF pension plans. And they’ve allowed the costs of those benefits to grow well beyond what taxpayers can afford.

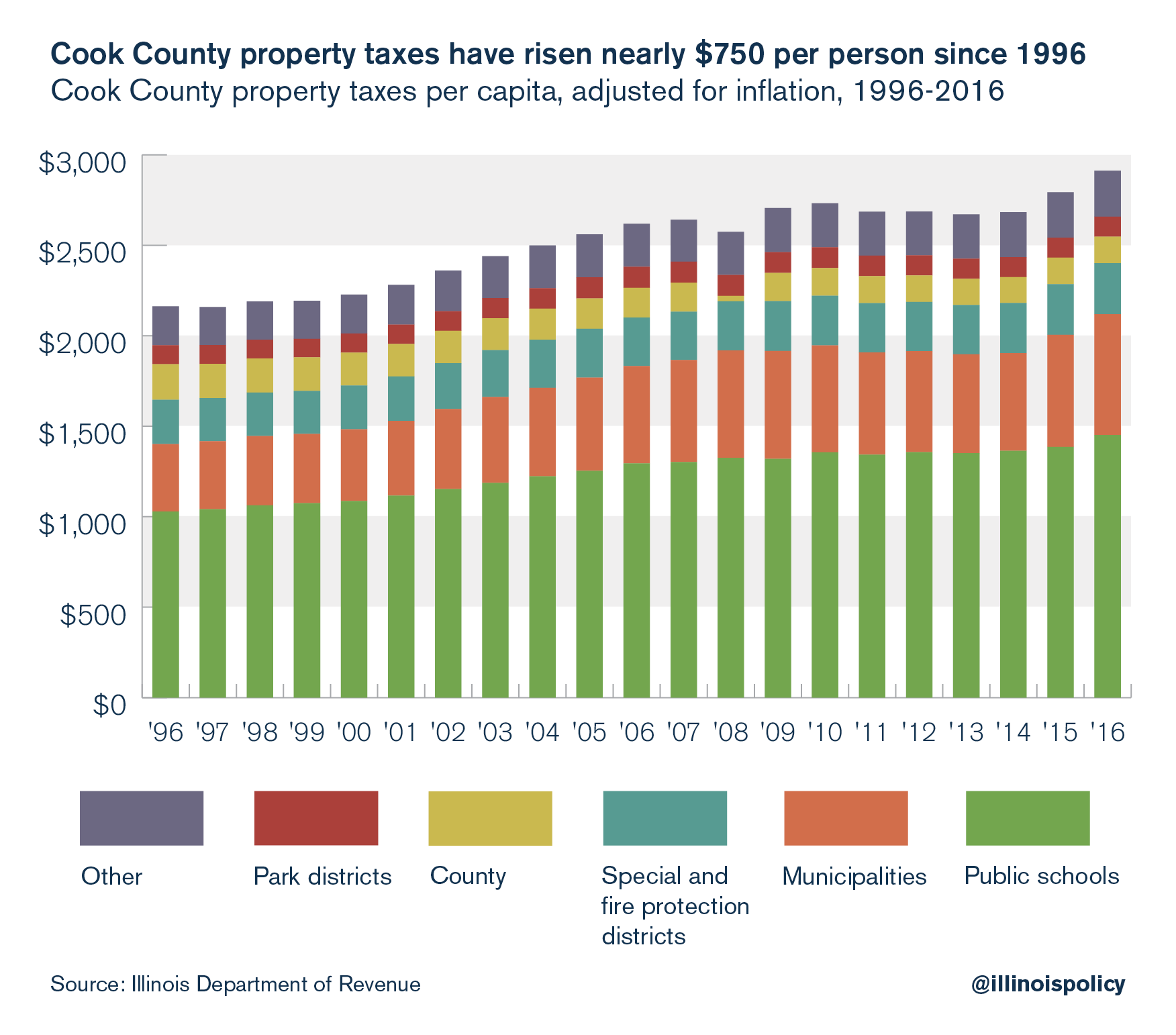

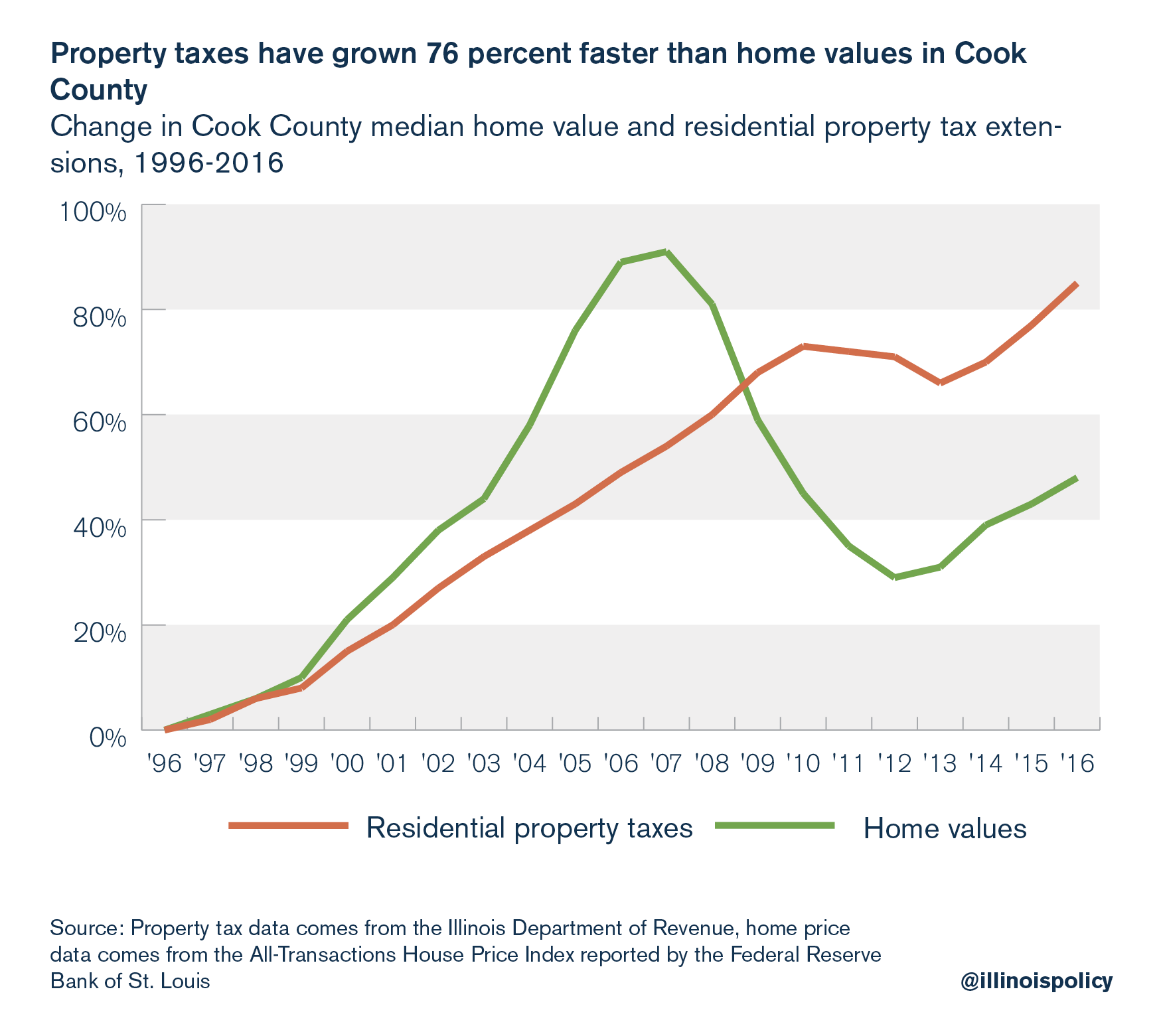

Taxpayers contribute far more to IMRF retirements than employees themselves, and benefits are growing at a rate far too fast for taxpayers to keep up with. IMRF accrued pension benefits have been growing at the pace of 7.2 percent per year since 2000, placing an ever-increasing burden on taxpayers. For example, property taxes in Cook County, where Des Plaines is located, have increased nearly $750 per person since 1996. And those increases have been out of proportion with home values: Cook County property taxes outgrew home values by 76 percent during that timeframe.

Out-of-control pension costs have placed an unsustainable burden on taxpayers. State and local lawmakers must introduce reforms that bring pension benefits in line with what taxpayers can afford. In the short term, lawmakers should implement 401(k)-style retirement plans for new workers. This system would provide fairness and security to taxpayers and government retirees alike. In the long term, lawmakers must amend the Illinois Constitution to allow for changes to future, unearned pension benefits for current government workers.

Otherwise, the pain caused by property tax hikes and outsized pension costs will only worsen for taxpayers in Des Plaines and elsewhere.