15 former Chicago aldermen collecting 6-figure pensions

In the midst of Chicago’s $36 billion pension crisis, former city officials are seeing big payouts.

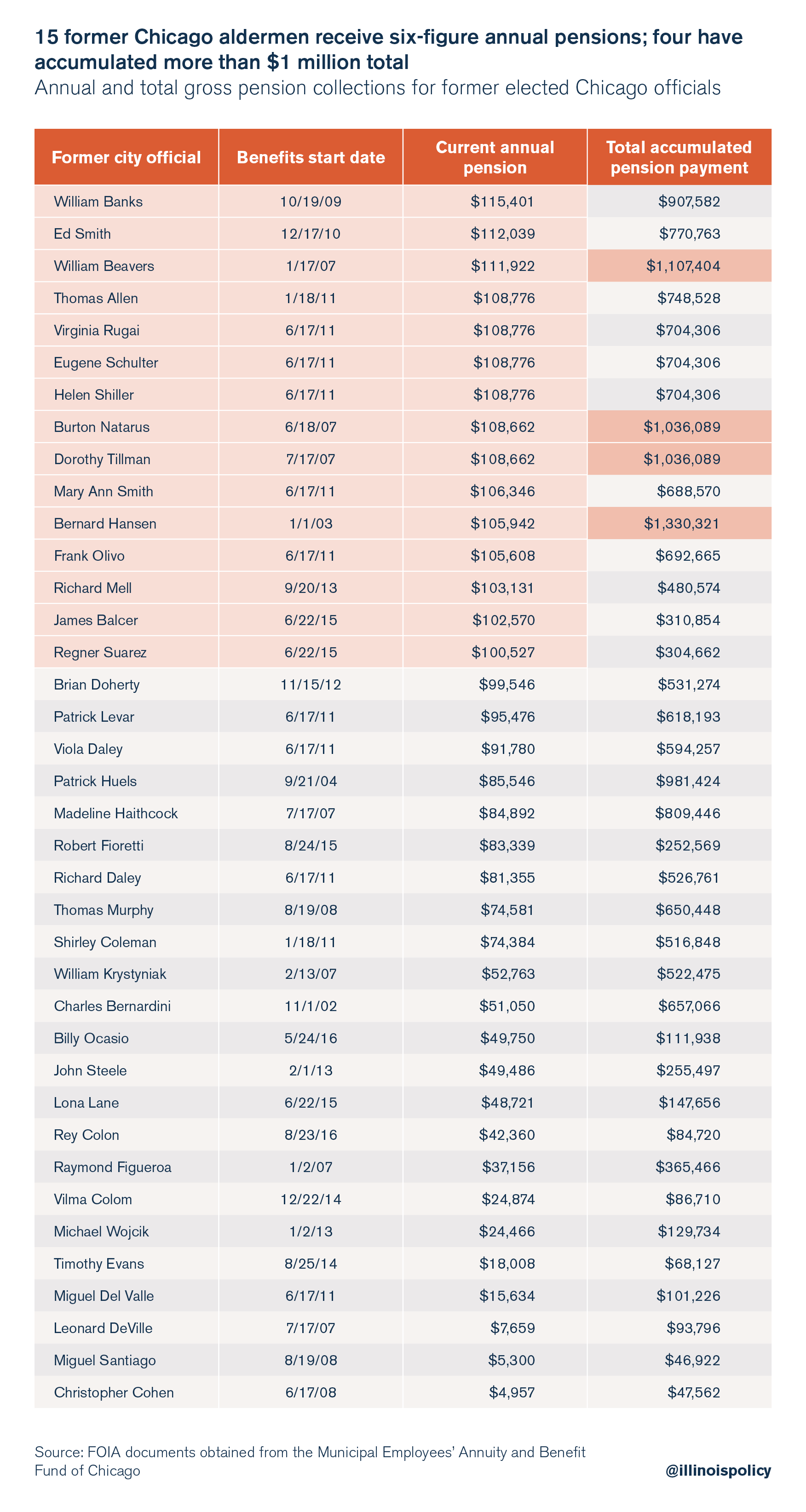

Of the 38 former elected Chicago officials currently receiving pensions, 15 former aldermen see yearly payouts exceeding $100,000, according to documents from the Municipal Employees’ Annuity and Benefit Fund of Chicago, or MEABF. Two additional aldermen receive annual pension payouts just a few thousand dollars shy of $100,000.

On average, the 15 former aldermen collecting six-figure annual pensions have accumulated $768,500 in total gross pension benefits. Four of those ex-aldermen have accumulated more than $1 million in gross benefits.

Some of the same officials responsible for fueling the city’s $36 billion pension crisis are among the system’s biggest beneficiaries. Taxpayers, on the other hand, are not benefitting from this unstable pension system. In 2016, Chicago City Council approved a new tax on water and sewer services proposed by Mayor Rahm Emanuel to help shore up the city’s underwater pensions.

But the water-and-sewer tax isn’t the only recent example of local leaders turning to taxpayers in an attempt to rescue a broken pension system. In August 2017, Cook County implemented a short-lived tax on soda and other sugary drinks. The county’s collapsing pension plan would have consumed most of the revenues from the tax. Fortunately, the Cook County Board of Commissioners quickly voted to repeal the soda tax after it was met with significant backlash from taxpayers.

Overpromising pension benefits while underfunding the system that delivers those benefits has led to a growing burden for Chicago taxpayers and looming uncertainty for city retirees. As with state worker pensions, retirement systems for Chicago and Cook County employees are in desperate need of reform.

Pension loopholes enabled by a 1991 state law have contributed to the substantial pension payouts received by retired Chicago aldermen. The plan, pushed by Mayor Richard M. Daley, gave special pension perks to Chicago aldermen and other city officials. Among these perks is eligibility for elected officials to receive monthly retirement benefits amounting to up to 80 percent of their final month’s salary. Nonelected city employees enrolled in MEABF are eligible under the law to receive retirement benefits amounting to up to 70 percent of their average monthly salary earned during their last four years of service. The law also allowed aldermen and other elected officials to earn maximum pension benefits after 20 years of service, compared with the nearly 30 years required for all other employees enrolled in the system.

But that’s not all. The law also permits aldermen to effectively buy their way to eligibility for maximum pension benefits, without having served the required 20 years. Former Ald. Thomas Allen, 38th Ward, for example, served only 17 years but was able to purchase additional “pension credits” at a cost lower than the value of the retirement benefits he’d receive. Allen currently receives a gross annual pension of nearly $106,000, according to MEABF records. But that isn’t the only lofty income the former alderman collects from taxpayers. Since 2010, Allen has also earned an annual salary upwards of $190,000 serving as a Circuit Court of Cook County judge.

While these loopholes have certainly driven the growth of the city’s pension liabilities, the precarious nature of defined-benefit pensions are the fundamental cause of their unsustainability. Establishing a 401(k)-style retirement system for future government employees would serve as a prudent alternative to defined-benefit pensions. This system, in fact, has already served more than 20,000 state university employees over the last 20 years.

To cure the fiscal dysfunction plaguing Chicago and Illinois, state and local lawmakers must address the instability of defined-benefit pensions. Until then, the short-term advantages of inflated retirement benefits will continue to fuel growing costs for taxpayers – and uncertainty for future retirees.