Metro East taxpayers struggle to keep up with state spending

Residents in Madison and St. Clair counties find themselves fleeced by lawmakers' failure to control state finances.

In July 2017, the Illinois General Assembly overrode Gov. Bruce Rauner’s veto to deliver a $5 billion tax increase. But despite the new revenues, the budget was still out of balance by more than $1 billion.

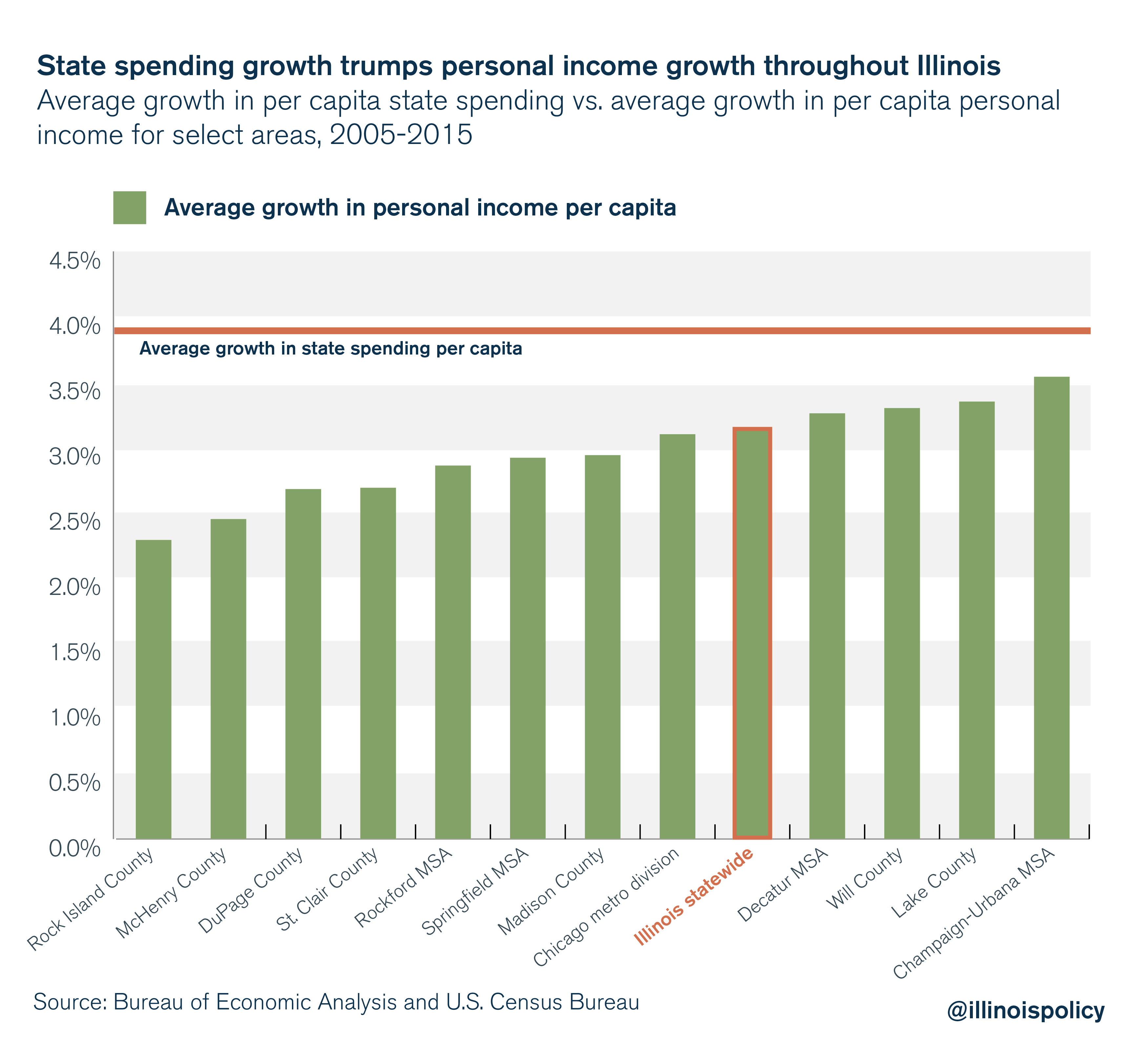

Why? Because state spending has grown far beyond taxpayers’ ability to pay.

The contrast between Illinoisans’ personal income growth and the spending patterns of their lawmakers has weighed heavily on Illinois’ Metro East residents. From 2005-2015, per capita income grew at an average of 2.8 percent annually between Madison and St. Clair counties. Meanwhile, per capita state spending climbed at an annual average of 3.9 percent.

While many Illinoisans were forced to tighten their budgets throughout this 10-year period, state spending outpaced personal incomes of Madison and St. Clair taxpayers by roughly 39 percent.

In Madison County alone, per capita personal income only grew at an average annual rate of 2.9 percent from 2005-2015. State spending grew roughly 33 percent faster over that time. In St. Clair County, taxpayers saw incomes grow at less than 2.7 percent, meaning state spending grew nearly 45 percent faster.

When governments spend beyond their means, they inevitably reach a point at which they must choose to hike taxes or issue debt.

This spells severe consequences for the state’s economy. A recent study from the Illinois Policy Institute found Springfield’s 2011 income tax hike cost the Land of Lincoln 9,300 jobs and nearly $56 billion in economic activity from 2012-2016. Illinoisans have little reason to believe the 2017 income tax hike won’t inflict further pain.

Giving long-term certainty to residents and avoiding future tax hikes means tying state spending to what taxpayers can afford. Thankfully, proposals in the Illinois House of Representatives and Senate would impose a smart spending cap tying state spending growth to economic growth.

But it isn’t just at the state level where lawmakers use tax hikes as short-term fixes to long-term budget problems. Residents in both Madison and St. Clair counties saw local governments hike property taxes last year. Both counties’ property tax burdens rank among the 25 highest in the state

Due to outmigration, Madison and St. Clair counties both saw population loss in the most recent year of U.S. Census Bureau data. Local officials cannot continue to hike taxes on a shrinking tax base. Rather, they need to pursue reforms that protect Metro East taxpayers, such as a property tax freeze and aggressive local government consolidation.

Madison and St. Clair County taxpayers should apply pressure to policymakers to advance practical reforms that help balance budgets and taxpayer pocketbooks alike.