Fixing Illinois’ busted budgets: Spending cap amendments filed in House and Senate

A proposal to tie state spending to what taxpayers can afford is earning bipartisan support in Springfield.

Illinoisans could finally see fiscal discipline from state lawmakers should a new spending cap proposal make its way to voters.

State Sen. Tom Cullerton, D-Villa Park, and state Rep. Allen Skillicorn, R-East Dundee, have both filed constitutional amendments tying growth in state spending to growth in the state’s economy: SJRCA 21 and HJRCA 38.

If either proposal passes by a three-fifths majority vote in both the House and Senate by May 6, voters at the ballot box in November will finally have a chance to rein in lawmaker’s out-of-control spending habits.

Why Illinois needs a spending cap

Illinois’ most recent budget, the one lawmakers passed over the governor’s veto in July 2017, is emblematic of how the state became such a fiscal basket case. Despite a $5 billion tax hike, it’s already out of balance by more than $1 billion. And that deficit is projected to exceed $2 billion next fiscal year without spending reforms.

Much more daunting than the state’s massive budget deficit, however, is the deficit in residents’ certainty about the future and their trust in the state.

How can Illinois possibly dig its way out all this debt? How much of the budget can pensions really eat up? When will the next tax hikes come – and how high will they be?

These have all become pressing questions because lawmakers have had free rein to grow spending far beyond what residents can afford.

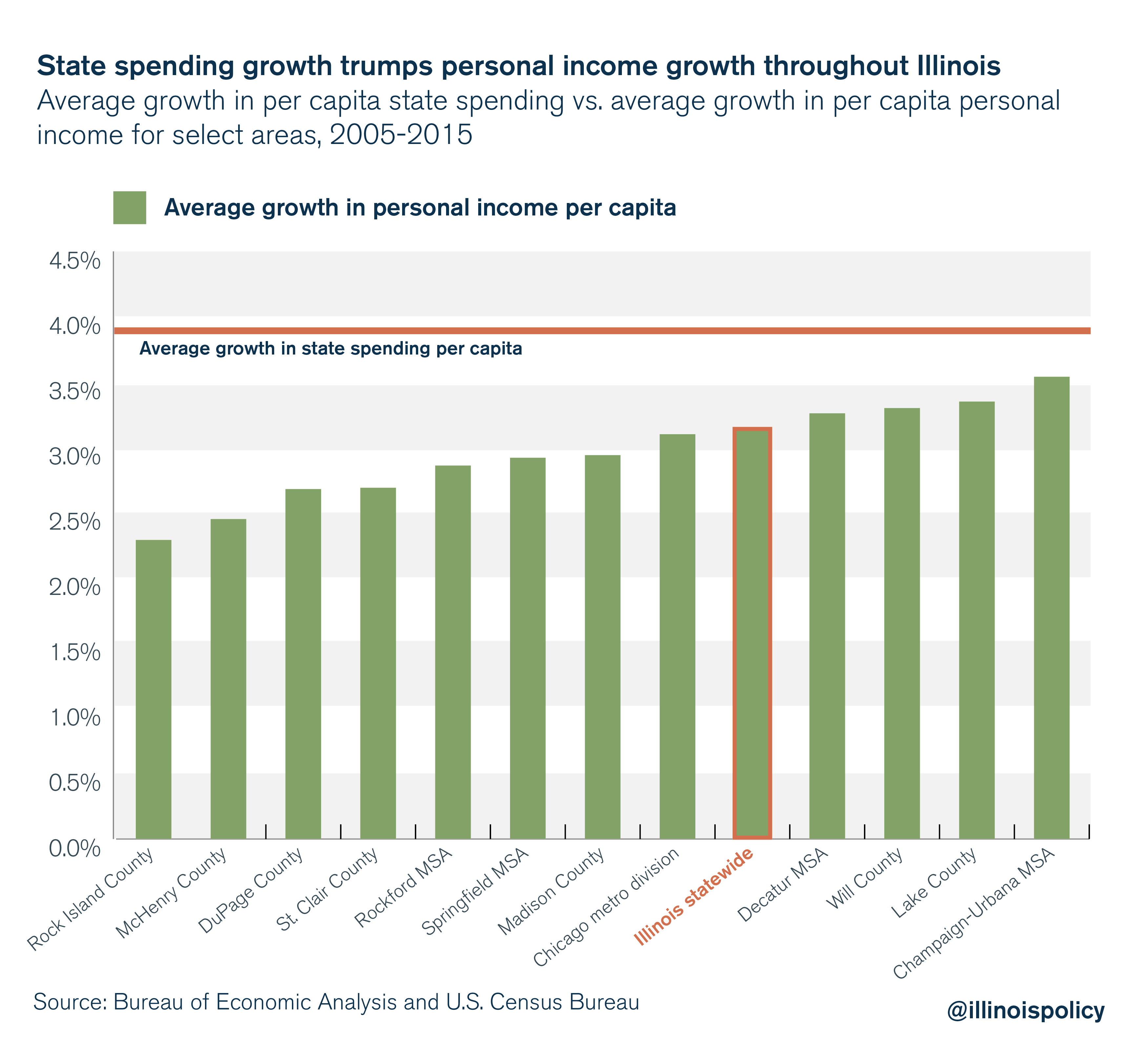

From 2005-2015, state spending per capita grew 25 percent faster than per capita personal income in Illinois. Many communities saw an even greater disparity. In Rock Island County, for example, state spending per capita grew 70 percent faster than residents’ incomes over that time.

In a healthy economy, it’s OK for government spending to grow. But when spending growth outpaces economic growth, it forces policymakers to raise taxes or borrow money. State lawmakers have been eager to do both. And that injects uncertainty into the lives of Illinoisans.

Families and businesses can’t plan for their futures without some degree of certainty about the world they’ll live in five, 10 or 20 years down the road. The state of the state meddles with those plans.

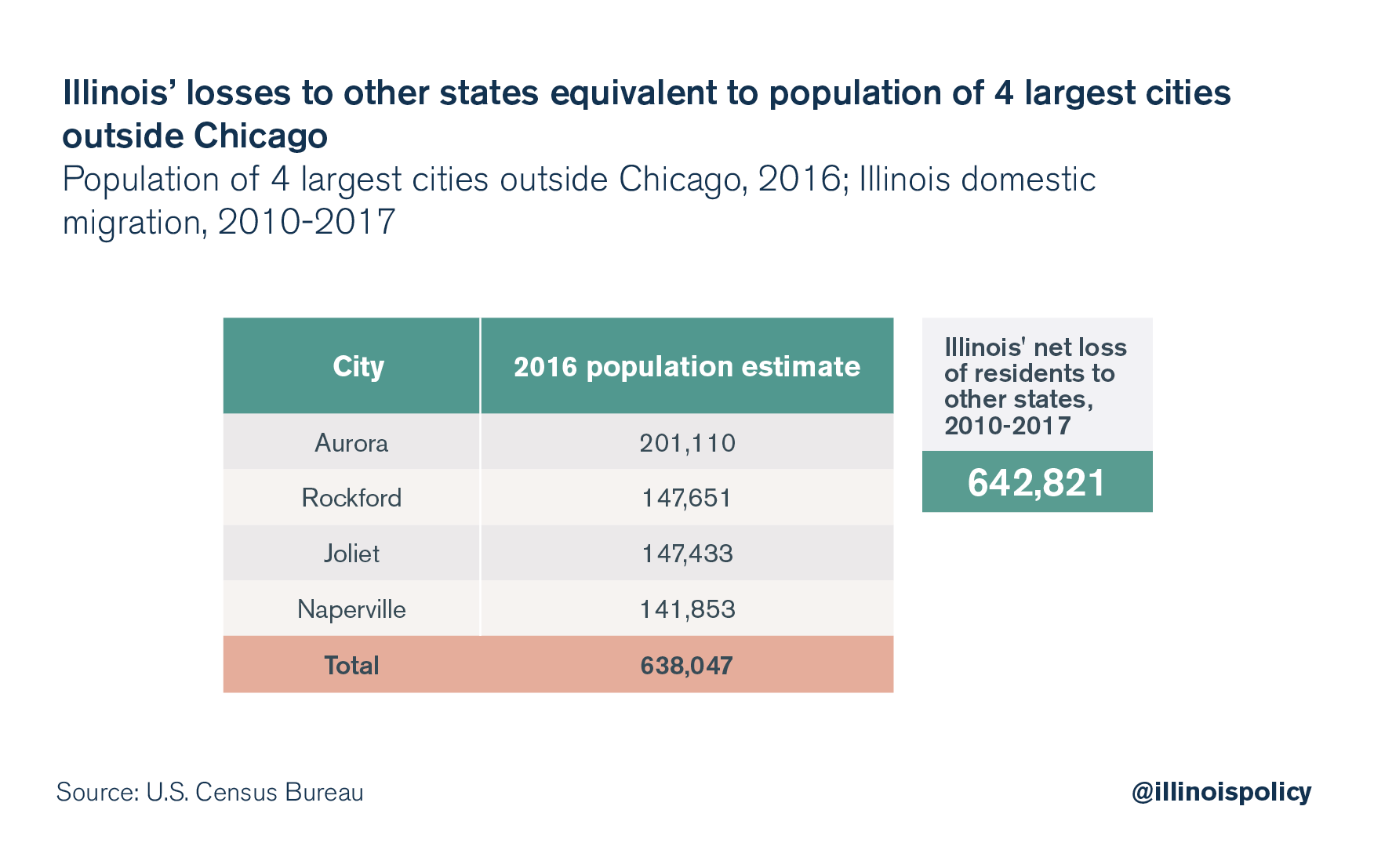

When faced with too much uncertainty, people leave. And potential newcomers take pause. Indeed, this is the biggest budget problem of all – a shrinking population for four years running, driven primarily by people leaving the state. The net outmigration of people from Illinois to other states since 2010 is equivalent to the population of the four largest cities outside Chicago combined.

State lawmakers have proven unable to constrain their fiscal recklessness absent a real requirement to do so. That’s lead to crippling uncertainty for too many families.

Putting Illinois on a path to prosperity

In its Budget Solutions 2019 recommendations, the Illinois Policy Institute is putting forth a real restraint. It’s called a smart spending cap: tie government growth to economic growth.

Thankfully, both Cullerton and Skillicorn’s proposals would tie state spending growth to the average annual per capita growth in Illinois’ gross domestic product, or GDP – in other words, growth in the state’s economy.

Providing a basic level of certainty about the long-term growth of state government, and thus avoiding future tax hikes, means Illinois could once again become an attractive destination for families and businesses.

Without fiscal discipline, lawmakers will be forced to continuously hike taxes to pay for years of budget mistakes. That’s a recipe for poor economic growth, meaning fewer job opportunities and slower wage growth for working Illinoisans.

State lawmakers should take Cullerton and Skillicorn’s lead. The spending cap provides certainty today for a more responsible state government tomorrow.