Chicago aldermen move to challenge lowball assessments on some of Chicago’s priciest properties

Alderman Ricardo Munoz's proposal highlights seven expensive properties in or around the Loop that aldermen contend were underassessed, shifting the property tax burden to other property owners.

A proposed Chicago City Council ordinance would have the city’s law department challenge assessments on seven large commercial buildings in or around the Loop, according to the Chicago Tribune.

Alderman Ricardo Munoz, 22nd Ward, introduced the measure Jan. 17. Munoz said the order addresses buildings that were sold for more than twice as much as the value at which Cook County Assessor Joseph Berrios’ office assessed them, the Tribune reported. The proposal has been co-signed by 21 other aldermen.

“Those that are best positioned to pay their fair share of taxes aren’t paying it,” Munoz said, according to the Tribune. “So we’re going after these huge multimillion-dollar properties.”

Those properties are: 181 W. Madison St., 123 N. Wacker Dr., 1 N. LaSalle St., 1 S. State St., 1000 West Fulton Market, 363 W. Erie St. and 20 S. Clark St.

Mayor Rahm Emanuel dodged questions about the measure, though he said he would review it, according to the Tribune. Emanuel’s administration has not yet challenged any of Berrios’ assessments.

Those assessments came under scrutiny in 2017 after a Tribune investigation revealed assessments made by the Cook County assessor’s office regularly lowballed expensive properties while overvaluing properties in less wealthy areas.

In a subsequent part of that investigation, the Tribune and ProPublica Illinois showed the assessor’s office had made significant errors in thousands of commercial and industrial parcel valuations. These errors fostered an unequal system wherein owners of high-value commercial and industrial properties received breaks, and owners of less valuable properties did not.

Munoz’s move is a shot across the bow at the Cook County property tax appeals process in which some of Illinois’ most powerful politicians engage. It coincides with Gov. Bruce Rauner’s announcement that he plans to have legislation introduced banning lawmakers from making money as property tax appeals lawyers.

One politician who profits handsomely from Cook County’s property tax system is Illinois House Speaker Mike Madigan, who is a co-founder of a law firm that specializes in property tax appeals.

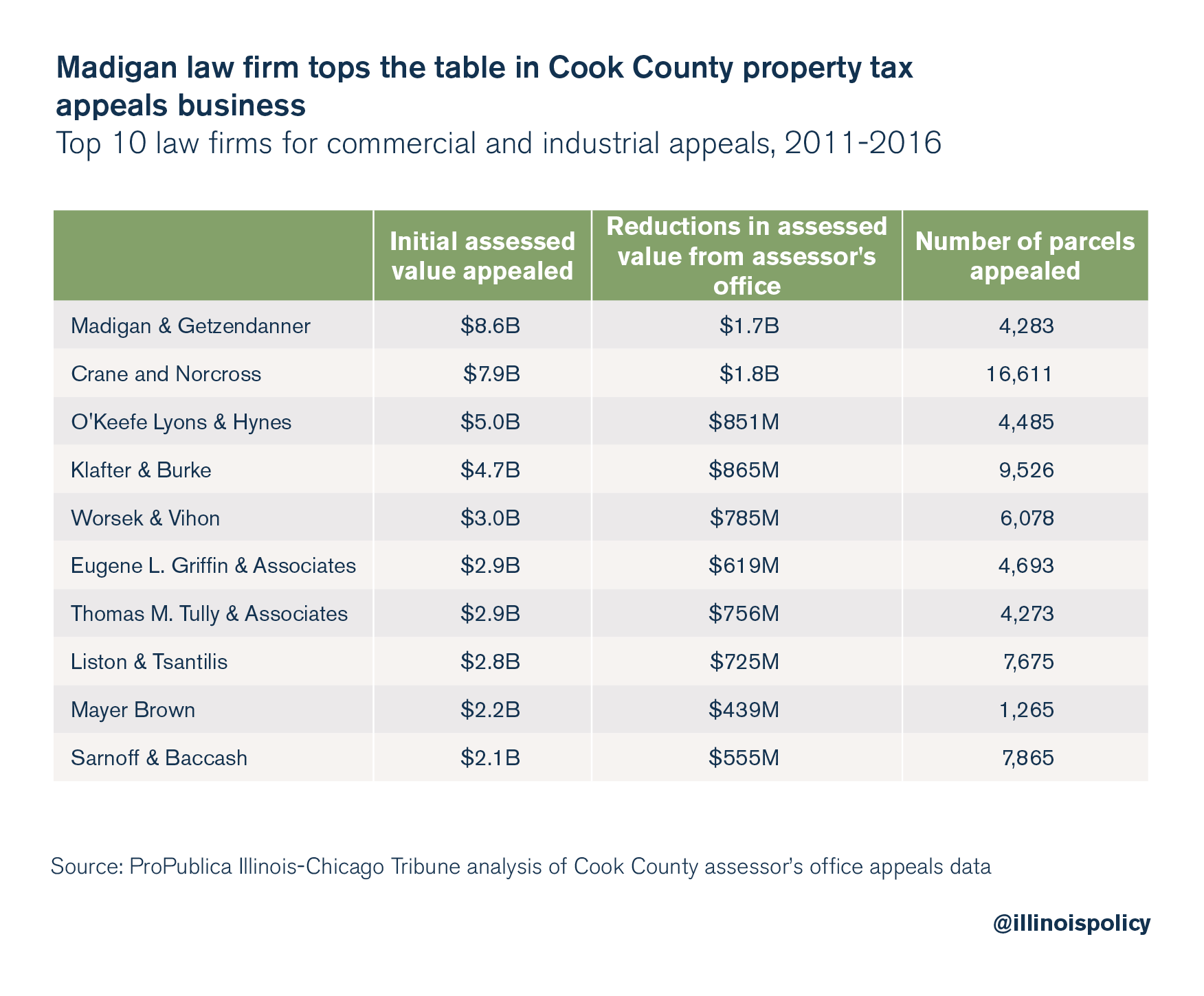

The ProPublica-Tribune investigation revealed that Madigan’s law firm, Madigan & Getzendanner, was the top law firm for Cook County commercial and industrial appeals, as measured by the total initial property values appealed between 2011 and 2016. Madigan & Getzendanner appealed valuations for more than 4,200 commercial and industrial parcels from 2011 to 2016, totaling more than $8.6 billion in assessed value. During that time, the firm won $1.7 billion in assessed value reductions from the Cook County assessor’s office.

Berrios, a Madigan ally, has co-owned a consulting company that has performed lobbying work in the General Assembly, where Madigan serves. In his position as speaker of the Illinois House of Representatives, Madigan has vast power over which bills are even called for a vote.

However, conflicts of interest aren’t limited to Madigan. Other politicians such as Chicago Alderman Ed Burke, Senate President John Cullerton and state Rep. Robert Martwick, D-Chicago, all work at law firms that handle property tax appeals.

Munoz’s proposal now sits in City Council’s Rules Committee, which does not bode well for its success.