Illinois’ new budget already has $1.7B hole despite largest permanent tax hike in state history

Every budget through 2023 will likely be unbalanced as well.

It didn’t take long for Illinois’ state budget to fall apart again.

For more than two years, politicians debated whether the state needed massive spending reforms to change the way Illinois does business, or whether tax hikes would fill the hole and allow government business to continue as usual. Tax hike supporters won the fight and state lawmakers raised taxes by a record $5 billion while spurning reforms.

Now the state’s finances are on track to lurch right back into crisis. The 2018 budget is already staring at a $1.7 billion hole for the year, meaning the streak of unbalanced budgets in Illinois will continue.

Illinois hasn’t had a truly balanced budget since 2001, and the latest numbers from the Governor’s Office of Management and Budget, or GOMB, reveal it may not have one through 2023.

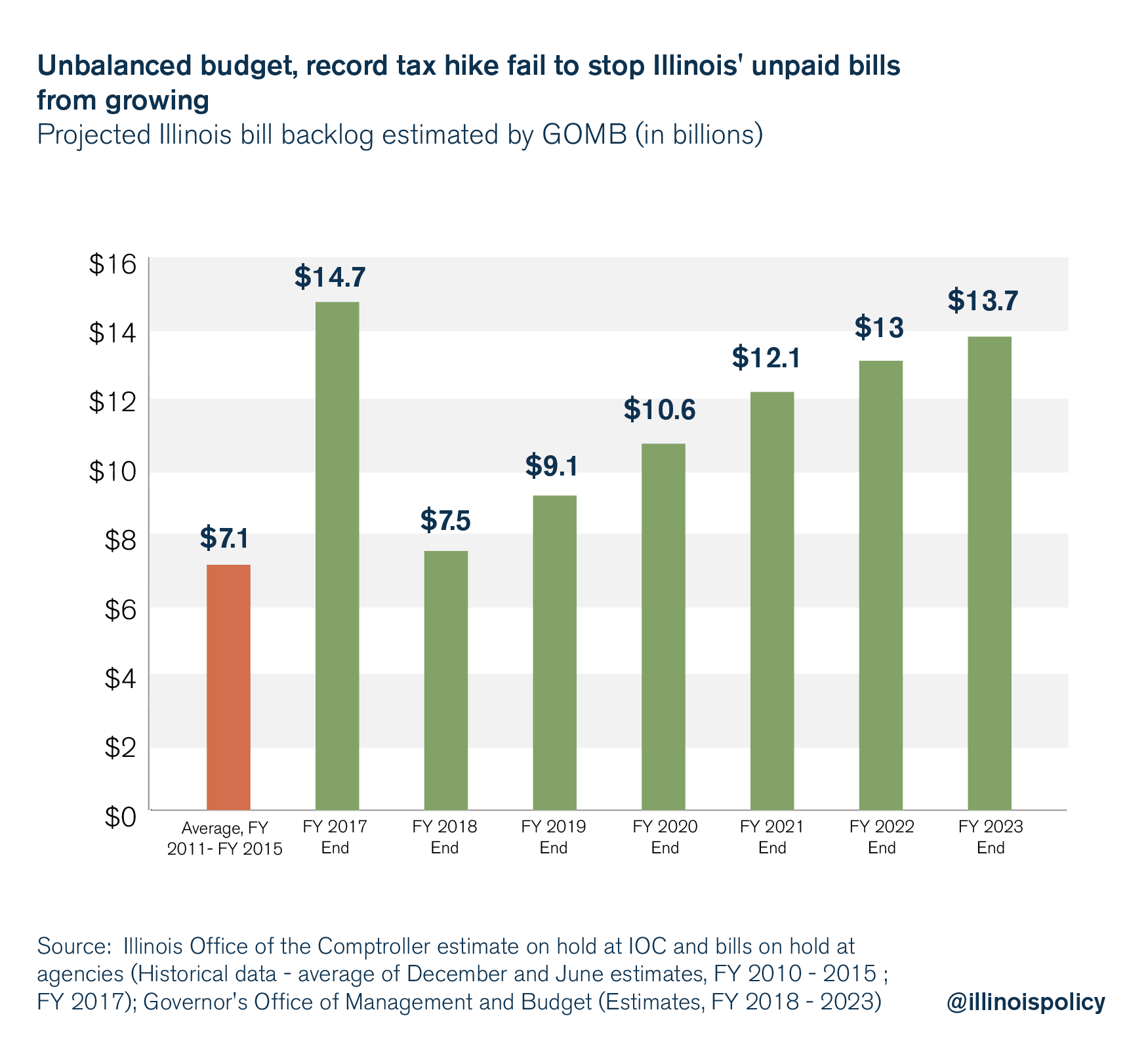

In addition to the $1.7 billion shortfall in 2018, GOMB projects a $2 billion-plus budget deficit in 2019. The office also predicts unpaid bills will continue to rise, even after the state borrows $6 billion to pay down part of the state’s $15 billion bill backlog. And a national recession in the next few years could precipitate an even worse situation.

The 2017 tax hike, just like the “temporary” 2011 tax hike, was a failed path for Illinois. It’s destroying the state’s tax base as Illinoisans leave in record numbers. The proper path forward was the passage of a balanced budget without tax hikes.

GOMB findings

GOMB highlighted the reasons why the 2018 budget is already in the red, including:

- The budget overestimated revenues by $500 million.

- The budget failed to “lock in” fiscal year 2018 pension payment reductions. That failure overestimated budget savings by $585 million.

- The budget plan did not account for estimated debt service costs of the $6 billion bonds to be issued to pay down unpaid bills. That failure adds an estimated cost of $535 million to the budget.

- The budget plan did not account for the impact of one-time transfers out of the General Revenue Fund, costing an estimated $216 million.

Lawmakers’ failed budget means more deficits going forward and that means more unpaid bills. Even though the state plans to issue $6 billion in debt to pay down a portion of its $15 billion in unpaid bills, GOMB estimates that by 2023 the backlog will jump back up to $13.5 billion.

Illinoisans should expect ratings agencies to once again look at the prospect of giving the state a junk rating, despite the $5 billion tax hike. Moody’s continues to maintain its “negative outlook” on Illinois’ rating, meaning that a downgrade continues to be a real possibility. From Moody’s recent ratings update from the upcoming Illinois bond issue:

“The negative outlook is based on expectations of continued pension liability growth and pension funding pressures; the fact that the state’s budget remains imbalanced, despite the enactment of substantial tax increases; and the state’s heightened vulnerability to national economic downturns or other external factors.”

Reforms, not tax hikes, are the solution

Too many politicians on both sides of the aisle craved a budget, any budget, that they claimed would end the impasse.

And like the many previous budgets, tax hikes and pension compromise plans that perpetuated the state’s fiscal crisis, “just any budget” has the state back in the hole again.

The Institute predicted this outcome back in July when the budget was first passed:

“Even if all the 2018 budget’s assumed savings are successfully implemented, the state will be back to deficit spending again by 2021 based on conservative projections of the state’s revenues and expenditures. [But] if the presumed savings, revenues or additional expenditures are off in any way, the state could be deficit-spending as soon as fiscal year 2019.”

This prediction was correct. Revenues are lower, expenditures are higher and expected savings are off. That’s put the state in deficit spending just three months after the passage of the 2018 budget.

GOMB’s latest projections is pointing that deficits that have been par for the course in Illinois for decades – under leadership from both Republicans and Democrats. Since nothing has structurally changed in terms of how Illinois spends, the deficits will continue. For GOMB to project otherwise would have been misleading.

The failed 2018 budget points once again to the need for state lawmakers to finally look at spending reforms, and not tax hikes, as the solution to bringing back tax relief, jobs and higher private sector incomes.

If not, expect the credit downgrades to return and the exodus from Illinois to continue.