Cook County soda tax could cost Illinois $87 million in federal food stamp funding

Certain provisions of Cook County’s penny-per-ounce soda tax could cost Illinois more than $86 million in federal administrative funding.

An error in implementing Cook County’s wildly unpopular penny-per-ounce sweetened beverage tax could cost the state millions in federal aid.

Although federal law requires drinks purchased through the Supplemental Nutrition Assistance Program, or SNAP, commonly known as food stamps, to be exempt from the county’s new penny-per-ounce sweetened beverage tax, the county’s ordinance does not adhere to federal food stamp regulations, according to state officials.

A retailer selling sweetened beverages to a customer with food stamps may comply with the tax in one of three ways, according to Cook County. Retailers can include the tax in the selling price of the beverage, add the tax at the point of sale, or POS, or by modifying their POS systems to not charge for the tax when food stamps pay for the transaction. If retailers choose one of the former two options, they are obligated to refund the customer with food stamps the amount of tax paid.

The U.S. Department of Agriculture’s Food and Nutrition Services, or FNS, which runs SNAP, deems these logistics illegal because FNS does not permit food stamp users to be charged with a sales tax at any point in the sale.

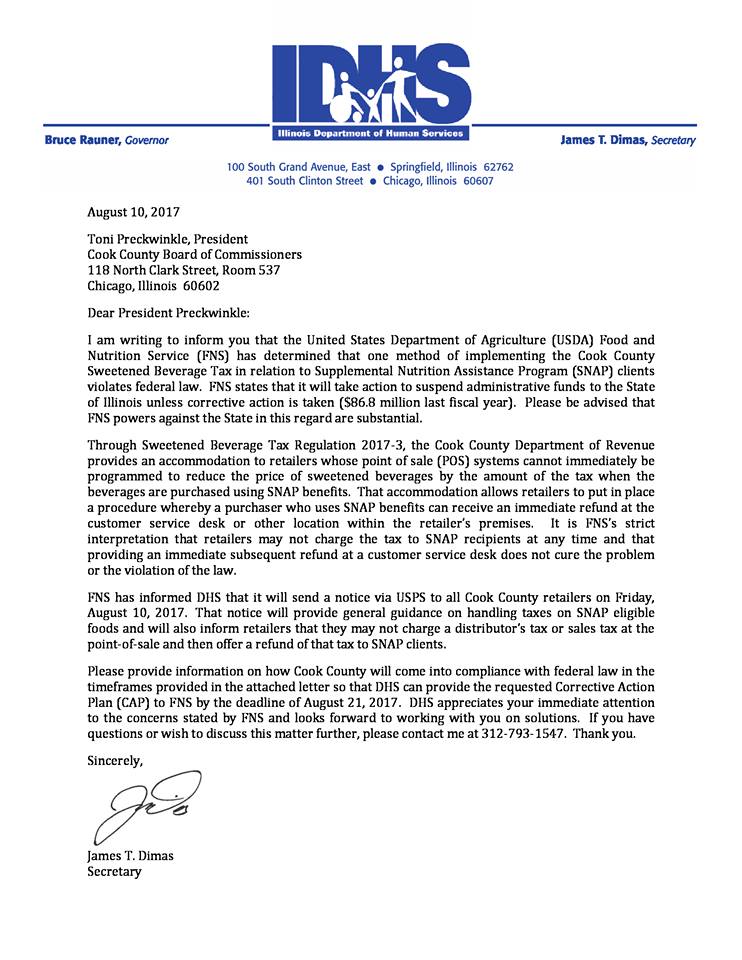

An Aug. 10 letter from Illinois Department of Human Services, or DHS, Secretary James Dimas to Cook County Board President Toni Preckwinkle reveals FNS informed DHS about the misconduct.

“It is FNS’s strict interpretation that retailers may not charge the tax to SNAP recipients at any time and that providing an immediate subsequent refund at a customer service desk does not cure the problem or the violation of the law,” Dimas’ letter states.

If the error continues, Dimas says FNS will work to suspend administrative funds to Illinois, worth $86.8 million last fiscal year.

According to Dimas’ letter, Cook County needs to inform DHS how it will overcome this implementation failure so DHS can provide a Corrective Action Plan to FNS by Aug. 21.

Cook County’s sweetened beverage tax was supposed to take effect July 1, but a lawsuit filed by the Illinois Retail Merchants Association and a temporary restraining order delayed its implementation.

One of the concerns retailers presented included potential difficulties in distinguishing food stamp customers, fearing litigation if they failed to tax various customers correctly.

A spokesperson for Preckwinkle noted the retailers had several months to prepare for the tax’s implementation and seek guidance if they had questions.

Polling commissioned by the Illinois Manufacturers Association shows that 87 percent of Cook County residents oppose the sweetened beverage tax, with 80 percent of respondents saying they believe that the tax was meant to raise money and not improve public health. Several Cook County commissioners have filed an ordinance to repeal the sweetened beverage tax.