Haterade: 87% of residents disapprove of new Cook County soda tax

A new poll has found that nearly 87 percent of Cook County residents disapprove of the new Cook County Sugary and Sweetened Beverages tax that took effect Aug. 2.

In a poll conducted Aug. 3-6 commissioned by the Illinois Manufacturers’ Association, nearly 87 percent of Cook County residents surveyed expressed disapproval for the new Cook County Sugary and Sweetened Beverages tax.

In the poll, 80 percent of respondents also expressed they believe the tax was a cash grab created primarily to raise money rather than improve public health.

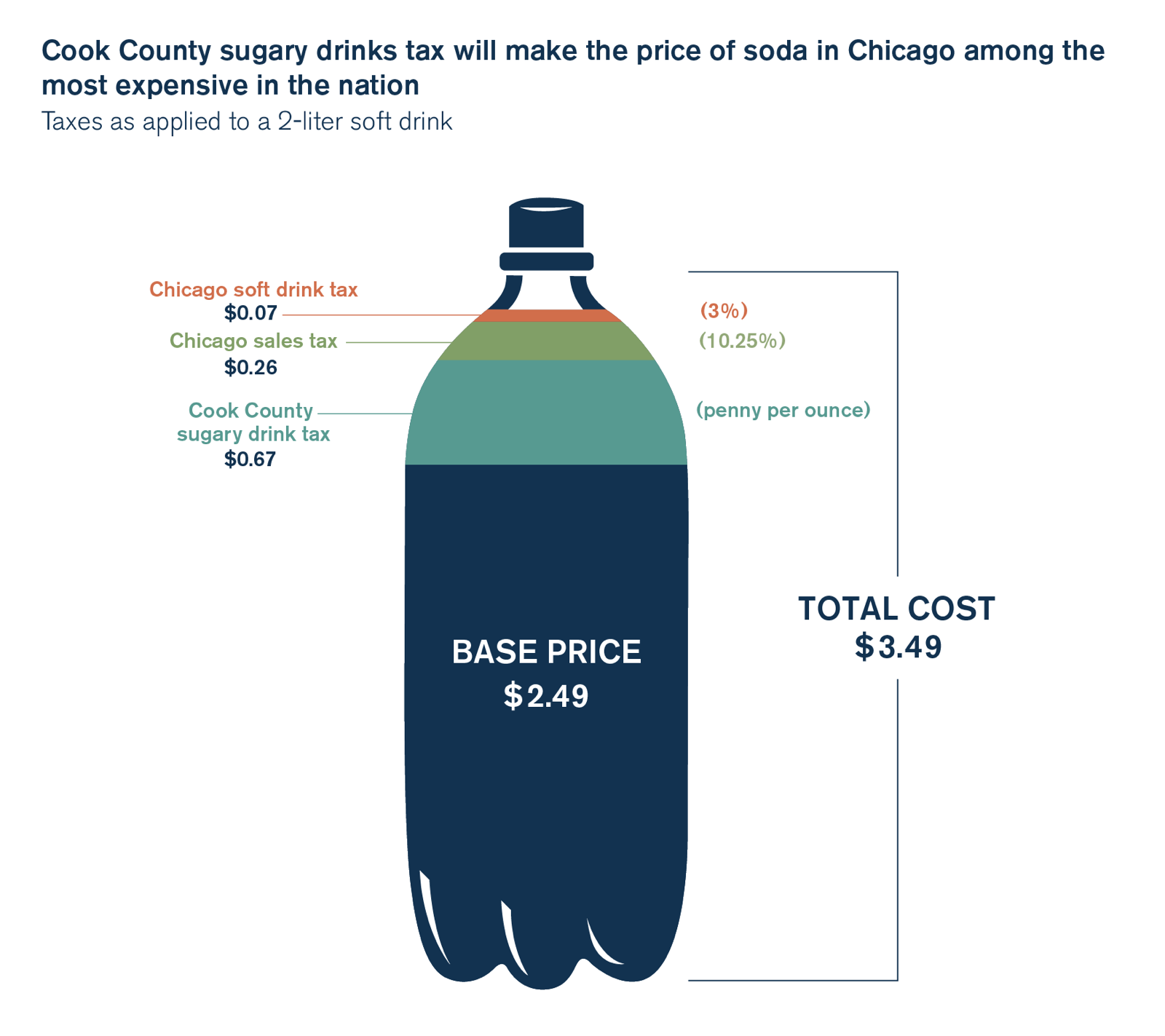

The county implemented the Soda Tax on Aug. 2, following a legal battle wherein the Illinois Retail Merchants Association, or IRMA, attempted to stop the tax. Soda in Chicago quickly became among the most expensive in the nation.

After the legal fight that delayed the implementation of the soda tax, attorneys acting on behalf of Cook County Board President Toni Preckwinkle began a lawsuit against IRMA for $17 million in damages.

Following implementation of the tax, a $4 12 pack of soda will cost $5.97, an effective tax rate of nearly 50 percent.

The tax affects a variety of beverages including soda, diet soda, ready-to-drink sweetened coffees and teas, sports and energy drinks, and juice products that aren’t 100 percent fruit or vegetable juice, among other beverages.