Cook County soda tax exempts food stamp purchases

While supporters of the tax claim success in the fight against obesity, the law exempts a vulnerable segment of the population.

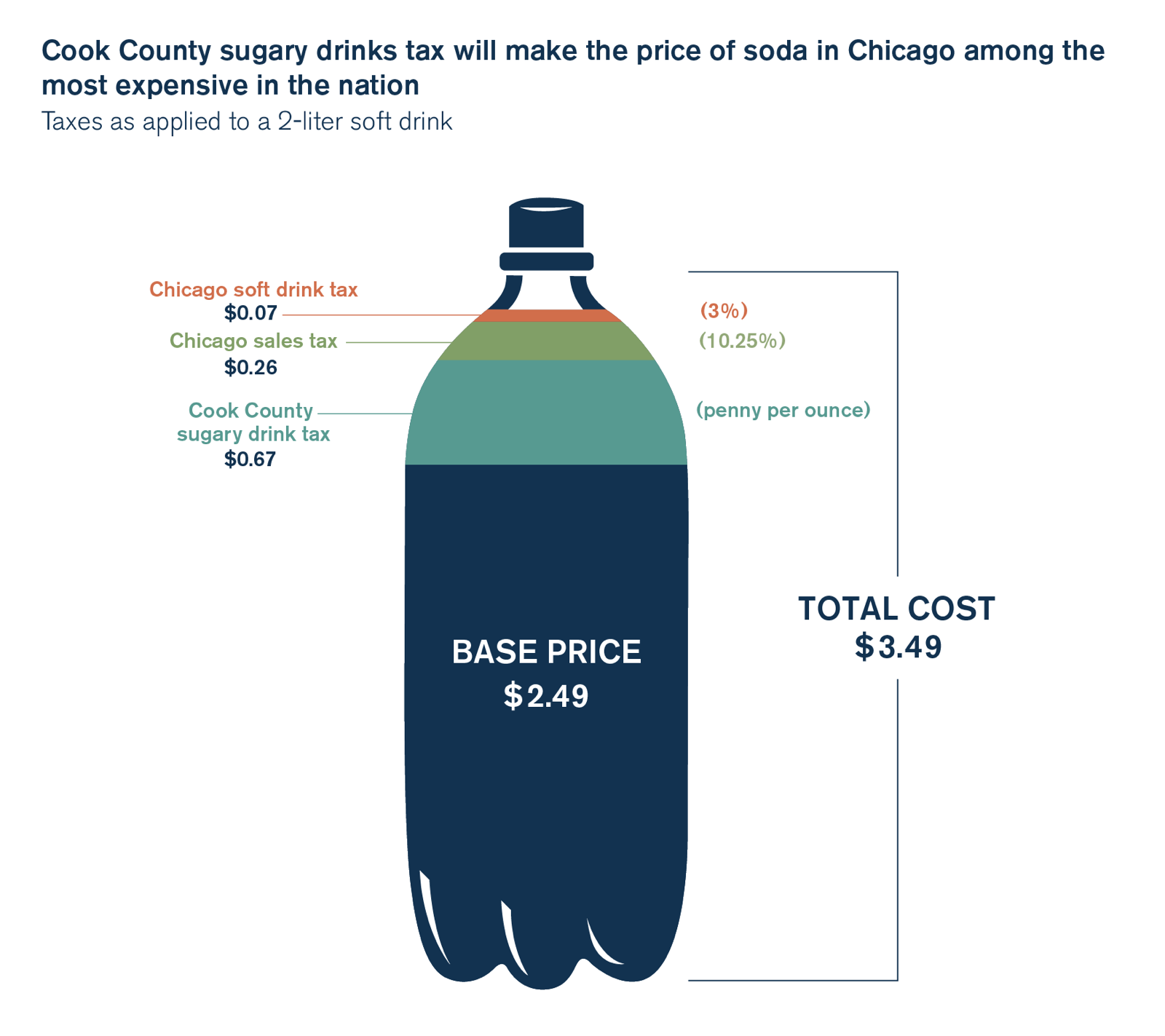

On Aug. 2, a new Cook County penny-per-ounce sugary drink tax took effect after a Cook County Circuit Court judge dismissed a lawsuit challenging the tax. The tax is added on top of Chicago’s 10.25 percent combined sales tax and the city’s 3 percent tax on nonalcoholic beverages. With the new sugary beverage tax, soda in Chicago will be some of the most expensive in the nation, as a $2.49 2-liter bottle of soda will cost $3.49, an effective tax rate of 40 percent.

This tax also is charged on fountain drinks, and some consumers have found that the tax is even applied to “free refills.” Cook County officials expect the tax to bring in over $200 million a year in revenue to help close a budget gap.

Cook County Board President Toni Preckwinkle has defended the tax as a means to reduce consumption of sugar. However, it’s unlikely to help the most vulnerable population of the county, as people in the Supplemental Nutrition Assistance Program, or SNAP, are exempt from paying the tax. Due to federal regulations that prevent applying state and local taxes to purchases made with food stamps, nearly 900,000 people who receive SNAP benefits won’t have to pay the sugary drink tax, according to the Chicago Tribune.

Yet polling shows people with lower incomes are more likely to drink soda.

One Gallup study showed that 45 percent of people making under $30,000 a year consume regular (nondiet) soda, as opposed to only 20 percent of those making at least $75,000 a year. The study also found that people making less money are more likely to drink soda in general.

Supporters of the tax celebrate it as a means to reduce the negative health effects of sugar consumption but refuse to see this tax for what it is: a cash grab. Instead of piling on residents who already face some of the highest property and sales taxes in the nation, the Cook County Board should find real solutions to the county’s fiscal crisis. Until they do, residents will feel the pain of yet another tax increase.