Millennials could be key to Illinois’ housing recovery – but they are fleeing the state

Illinois loses more millennial taxpayers and dependents to other states than any state except New York.

Illinois had the nation’s third-highest share of seriously underwater properties as of March 2017, according to a May 2017 report by RealtyTrac. Millennials could be the key to propping up home values: Robust homebuying forces property values up, and millennials were the largest group of homebuyers for each of the past four years, according to NBC News. Unfortunately, Illinois’ millennials are leaving instead of putting down roots.

A home is underwater when the homeowner owes more to the mortgage lender than the home is worth at current prices. If a home is seriously underwater, the homeowner owes at least 25 percent more on the mortgage than the current value of her home. Any money she’s invested in her home in the form of a down payment and mortgage payments is effectively lost if she goes to sell. She will not get any of that money back unless home values rise.

No homeowner wants her home to sink beneath the surface. However, an underwater or seriously underwater homeowner won’t really feel the pain unless she wants or needs to sell her property. Then she faces dim prospects:

- She could be stuck in her home to avoid taking a loss while hoping the property value recovers.

- She could absorb the loss and pay more money just to walk away.

- She could default on her mortgage and allow the home to go into foreclosure.

None of these options is ideal.

Nearly eight years after the Great Recession’s end, 16.5 percent of Illinois’ home mortgages were still seriously underwater as of March 2017, according to RealtyTrac. Only Nevada’s 18.9 percent and Ohio’s 17.1 percent were worse. Nevada’s worst-in-the-nation ranking makes sense because the state was front and center in the national housing crisis: It was the fastest-growing state in the past quarter-century, according to SFGate, which caused a housing construction boom in the early 2000s. Then the housing bubble burst, and Las Vegas became the “center of the housing crisis.”

Illinois’ housing recovery should not be chugging along nearly as slowly as Nevada’s.

But economic weakness and burdensome tax policies keep Illinois’ home values suppressed. And these factors send Illinois’ population and housing demand flooding across state borders.

According to Genworth Mortgage Insurance’s new “First-Time Homebuyer Market Report,” “First-time homebuyers have been the largest growth driver in the housing market since 2014, and that trend is continuing into 2017.” The report notes millennials will likely grow the first-time homebuying market even more in coming years.

Millennials are a key group among today’s first-time homebuyers: As they grow their families, they are buying homes and spurring housing demand. First-time homebuyers’ movement at the bottom of the property ladder serves as the housing market’s engine, because it allows established homeowners to climb up to bigger, more expensive homes.

But Illinois is losing millennials to other states, and their exodus represents a loss of thousands of potential first-time homebuyers – which could slow down the state’s housing recovery.

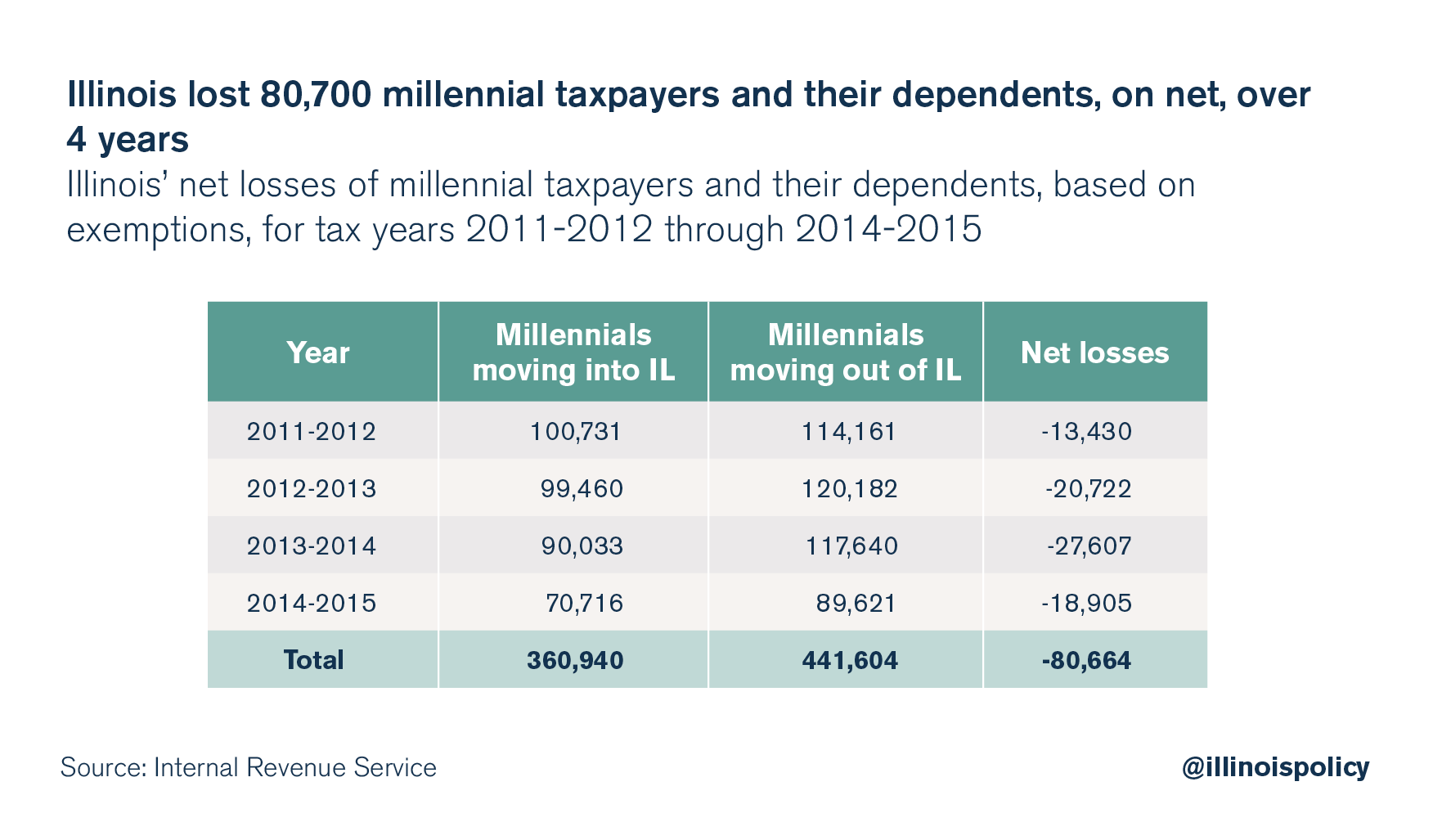

Illinois lost 80,700 millennial taxpayers and their dependents to other states, on net, over tax years 2011-2012 through 2014-2015, according to the most recent Internal Revenue Service data.

Illinois’ net loss of millennial taxpayers and their dependents over that four-year period ranked second-worst in the nation to New York’s 136,800 net loss.

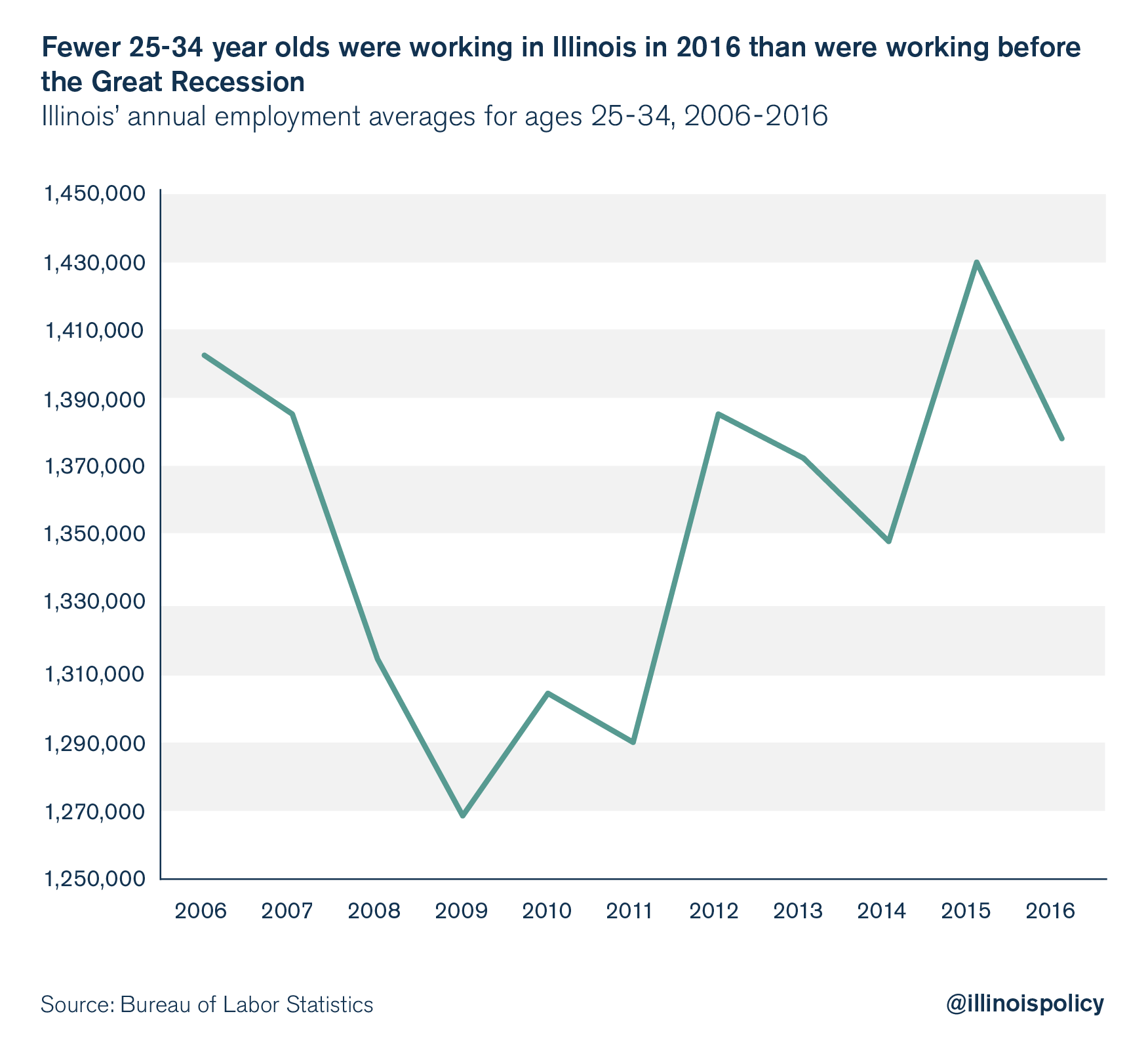

Employment growth in Illinois has been weak for millennials over the recession era, which could be prompting them to seek more stable labor markets in other states. Fewer Illinoisans ages 25-34 were working in 2016 than were working before the Great Recession, according to data from the Bureau of Labor Statistics, or BLS. This is critical because 25-34 is the age group of many first-time homebuying millennials. The unemployment rate for this demographic in Illinois also increased 1 percentage point to 6.4 percent in 2016 from 5.4 percent in 2015, according to BLS data.

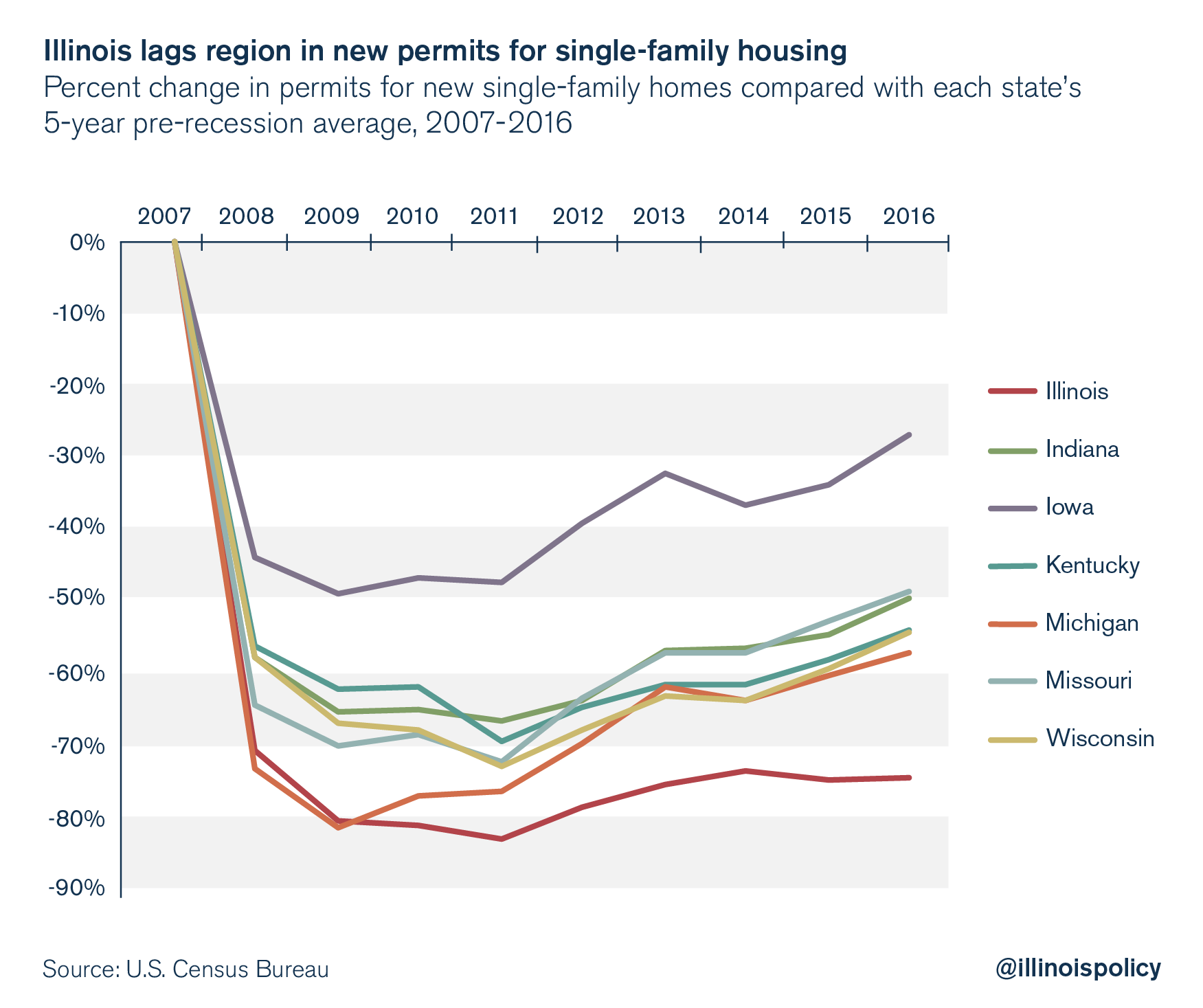

The housing market will likely have a hard time recovering if there’s a shrinking number of first-time buyers. Indeed, single-family housing starts are down 75 percent in Illinois over the recession era, the worst such drop in the country.

Illinois’ mass millennial departure will have far-reaching ramifications. These young people are entering their prime earning years and taking their productivity and earning power to other states. Fewer young people are investing in Illinois, and fewer companies will have reason to as the state’s population ages and the economy sputters. This reduced demand to stay in Illinois could lead home values to recover more slowly compared with states that fare better with millennials, thus prolonging homeowner distress in Illinois.

Policymakers must make Illinois a state worthy of investment. Illinois suffers from the worst personal income growth in the nation over the Great Recession era; 160,000 fewer people are working in Illinois today than before the recession; the labor force is shrinking; and the state’s economic activity has grown at a slower rate over the past decade than U.S. growth during the Great Depression.

On top of that, cost drivers such as government worker retirement benefits create a crushing tax burden for Illinoisans, while some of the nation’s highest property taxes drive down home values and increase homeowner liabilities.

Millennials are getting out while they can. And this could spell trouble for Illinois’ sea of seriously underwater properties that need strong housing demand to bring underwater and seriously underwater homes back above water.

Illinois’ state and local policymakers must break the cycle of spending more than they have and raising taxes. This pattern is driving out jobs and workers, and millennials are leading the way out as it becomes harder to stay afloat in Illinois’ high-cost, low-growth environment.