Lakewood, Ill., votes to eliminate TIF district

The Lakewood Village Board’s decision to end a 2015 TIF district is a win for local taxpayers.

On June 13, the board of trustees of Lakewood, Illinois, voted to dissolve a recently created tax increment financing, or TIF, district, a special designation for property tax-funded property development districts.

The $66 million TIF in Lakewood was created in 2015 but has yet to invest in any development project. Newly elected Village President Paul Serwatka pushed to dissolve the TIF. Serwatka was part of a four-candidate slate that ran on the elimination of the TIF.

The Lakewood Village Board was right to dissolve the TIF.

While TIFs were originally devised to encourage development of “blighted” areas, they allow government to pick winners and losers among private enterprises and public projects, foster the proliferation of special taxing districts, promote a lack of transparency, and contribute to Illinois’ sky-high property taxes.

Illinois already has too many units of local government, the most in the nation. And it has thousands more special taxing districts like TIFs, as well.

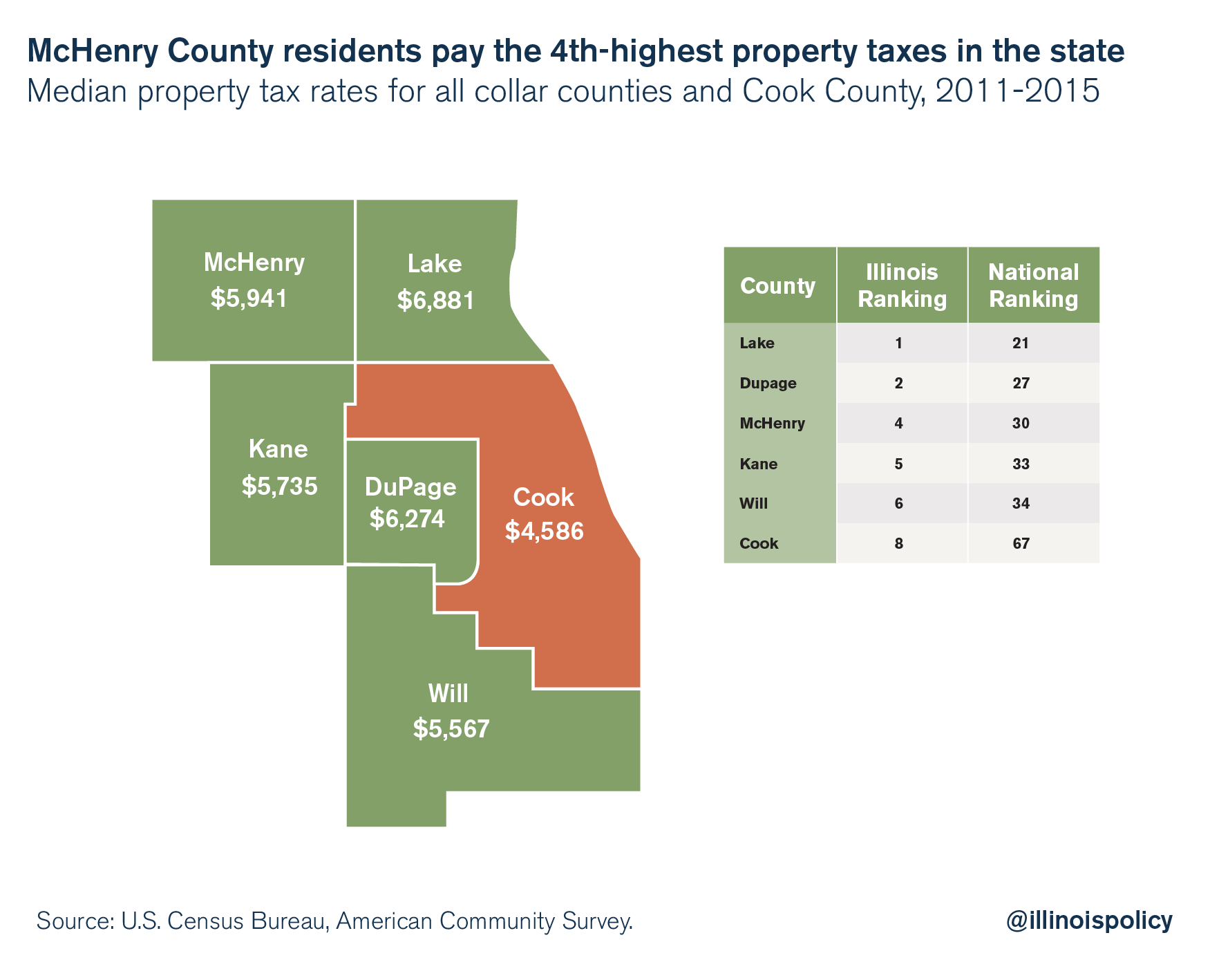

As a result, Illinois residents pay the highest property taxes in the nation, and McHenry County property taxes rank in the top four in the state and among the top 30 in the U.S., according to U.S. Census data.

The property tax process is already far too opaque, and TIFs will only worsen the situation for the 3,800 residents of Lakewood.

Lakewood established a 600-plus-acre TIF district with the promise to develop sports complexes and other facilities, but at the time of the dissolution vote, TIF funds had not yet been committed to any project. The village had, however, already spent more than $200,000 in legal and setup costs related to the TIF.

Under the rules for TIFs, the property values local government bodies can levy taxes on are frozen for the life of the TIF, typically 23 years. For that time, local governments such as school districts must raise taxes based on those frozen property values.

TIFs are a controversial and nontransparent way for municipal governments to dole out property tax dollars to select developers, and the funds allow governments to pick winners and losers among private enterprises and public projects and services. TIF funds can give a village president, for instance, power to grant development rights to whomever he or she wishes.

Serwatka argued that different projections of the TIF had not shown tangible benefits to Lakewood residents. And if the TIF had failed, the risk would have fallen on the backs of taxpayers.

Illinois needs fewer overlapping, duplicative units of local government and fewer districts with taxing authority – not more.

The village’s decision to end the Lakewood TIF is a step in the right direction.