Groups debate gasoline tax hike on Illinois drivers

Contracting and fuel industry experts sounded off on a recent idea to raise Illinois’ fuel tax.

Illinoisans pay higher gasoline prices than residents in all neighboring states, according to AAA. Yet some groups are pushing a hike on gas taxes as a way to raise revenue, though research indicates that doing so would hit lower-income families hardest.

Joe Sweeney of the Indiana, Illinois, Iowa Foundation for Fair Contracting claims that Illinois’ fuel tax isn’t high enough because the state hasn’t raised the tax since 1993. Sweeney proposes tying the growth in the gas tax rate to inflation.

“If the motor fuel tax had kept up with inflation in 2015, we would have been at 31 cents per gallon and the diesel tax would have been at 35 cents per gallon,” Sweeney said, according to the Illinois News Network.

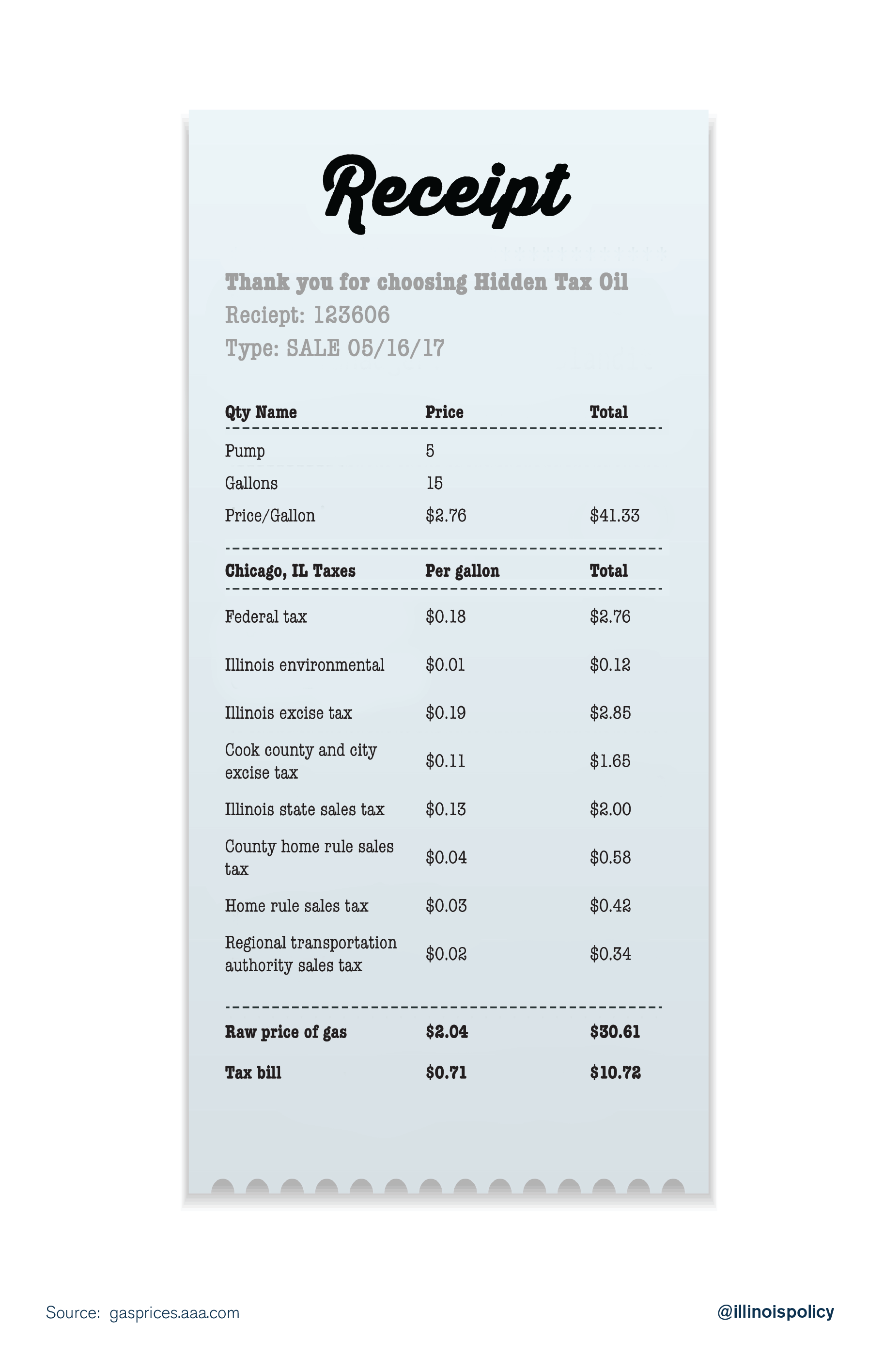

The current state excise tax on gasoline is 19 cents per gallon. But Illinois’ gas taxes are multilayered. In addition to the state excise tax, Illinois also levies an environmental gas tax and applies the state’s sales tax

Illinois Petroleum Marketers Association and Association of Convenience Stores Executive Vice President Bill Fleischli criticized Sweeney’s proposal, saying that increasing the gas tax would put Illinois at a competitive disadvantage with neighboring states, Illinois News Network reports.

“The last time the motor fuel tax was raised, volumes decreased by 7 percent. If you allow us to compete and not raise taxes, gallonage and revenue will increase,” Fleischli said in a statement reported by Illinois News Network.

How gas taxes affect Illinois drivers

The average retail price of a gallon of unleaded gas in Illinois is $2.36, while the national average is $2.33, according to AAA. Though Illinois’ gas price is only 3 cents higher than the national average, Illinois’ gas prices are higher than those in all of its neighboring states. Of Illinois’ bordering states, Missouri pays the lowest, at only $2.10 per gallon on average.

A 2012 study from the Brookings Institution showed that increases in the price of gas hurt lower-income families. The report studied 2010 gas prices and found that low-to-moderate income households that owned cars drove 10,000 miles and spent $1,500 on fuel at 2010’s average price of $2.80 per gallon. The study found that each $1 increase in the price of gas would cost these low-to-moderate income motorists an additional $530 annually.

Though Springfield lawmakers are all too happy to pitch new tax hikes – without making spending reforms – tax hikes on widely consumed products like gasoline are regressive. Tax increases on fuel would make trips to the gas station more costly for middle-class and lower-income drivers. Illinois also has the seventh-highest combined state and average local sales tax burden in the country and some of the highest property taxes nationwide, further hurting struggling residents. Taxing consumption – the buying and selling of goods – is a better model than taxing work (in the form of income taxes). Nine states do not even have state income taxes on wages. But taxing both consumption and income at the same time, and then continuing to increase the tax burden, is unfair.

And Illinois’ budget stalemate hasn’t changed residents’ tax fatigue.

Polling conducted in February and March by Fabrizio, Lee & Associates and commissioned by the Illinois Policy Institute shows that a majority of Illinois voters want a budget without tax hikes, and increasing the gas tax would go against this.

Moreover, not all gas tax dollars go toward infrastructure. Revenue accrued from the state sales tax portion of the gas tax goes into the state’s general fund. And historically, new revenue from other kinds of tax hikes hasn’t even gone to new or existing services or projects, but to the state’s pension obligations. In fact, nearly 90 percent of the new revenue acquired through the 2011 tax hikes went to pensions.

Lawmakers should think twice before raising the state gas tax.