BLS jobs report shows weak economy in Illinois, recovery in neighboring states

Illinois saw a 0.23 percent increase in jobs in the first quarter of 2017, the third-worst growth rate in the region.

Illinois lost 8,900 jobs in March and still has fewer jobs than in the year 2000, while businesses are creating more opportunities in neighboring states. A new economic release from the Bureau of Labor Statistics shows that surrounding states continue to outpace Illinois on the road to economic recovery and prosperity.

Illinois’ economic weakness is a long-term problem that exacerbates the state’s near-term financial crisis. The Land of Lincoln is increasingly falling behind, as neighboring states have less debt, lower taxes, smarter regulations and pro-growth approaches that allow their economies to prosper and residents to find rewarding jobs.

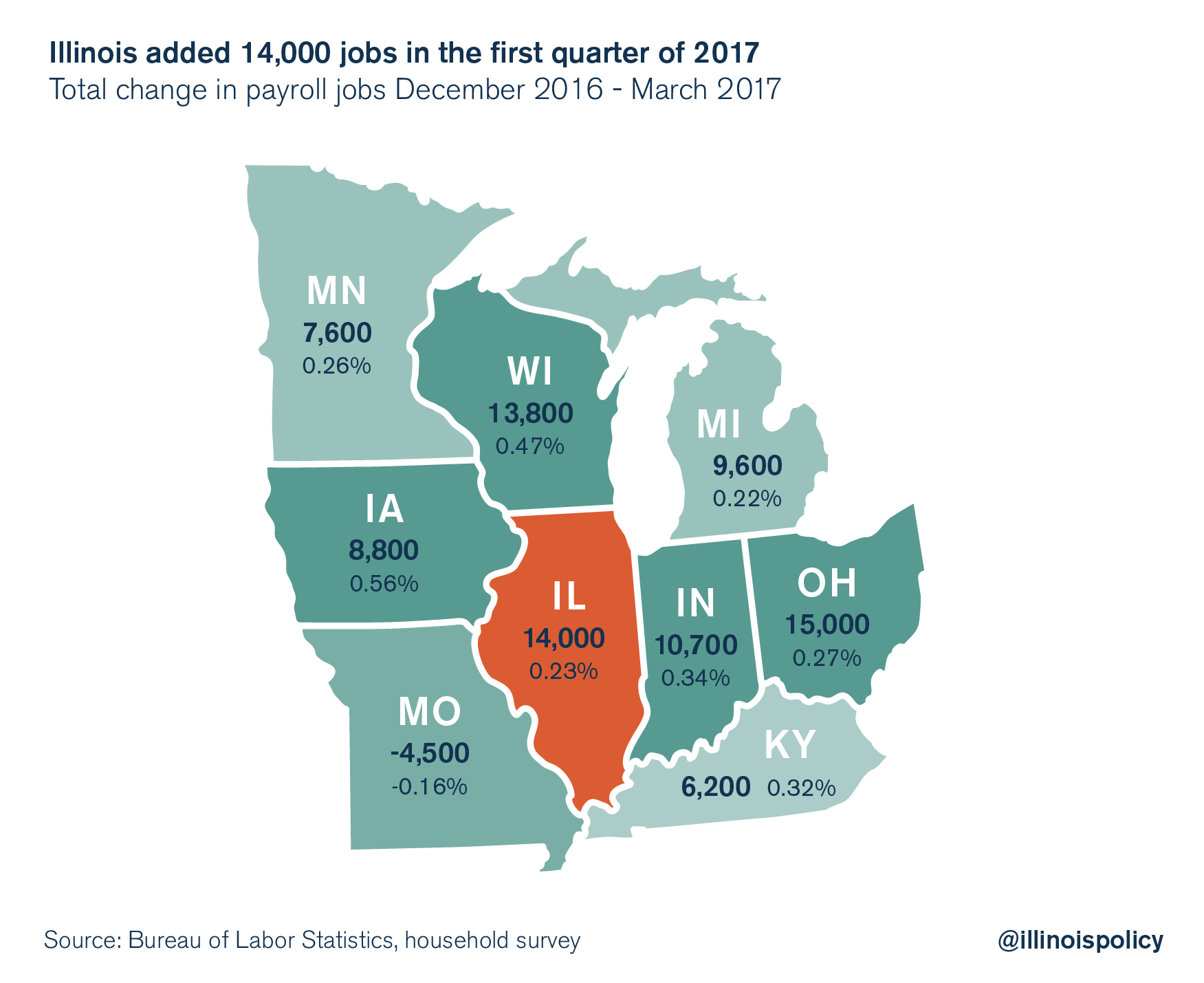

Employers created 14,000 jobs in Illinois in the first quarter of 2017. This jobs count compares well with those in neighboring states, but it doesn’t compare well when adjusted for the size of each state’s economy. For example, Illinois’ labor force is twice the size of Indiana’s, and therefore requires twice as many jobs just to keep up in terms of relative employment opportunities. That means it’s more important to measure Illinois’ performance in terms of percentages, as opposed to the total number of jobs created.

To measure the percentage growth, Illinois’ gain of 14,000 jobs should be considered in proportion to Illinois’ total workforce size. For example, Illinois’ increase of 14,000 jobs represents a 0.23 percent gain, while Indiana’s 10,700 jobs gain is a 0.34 percent increase for the Hoosier State. Relative to the size of its economy, Indiana’s jobs creation was better than Illinois’ in the first quarter of 2017, and has been for a long time.

Illinois has gained more jobs than most nearby states so far in 2017. But Illinois is the third-worst among states in the region in terms of percentage growth for the first quarter of 2017, outperforming only Michigan and Missouri.

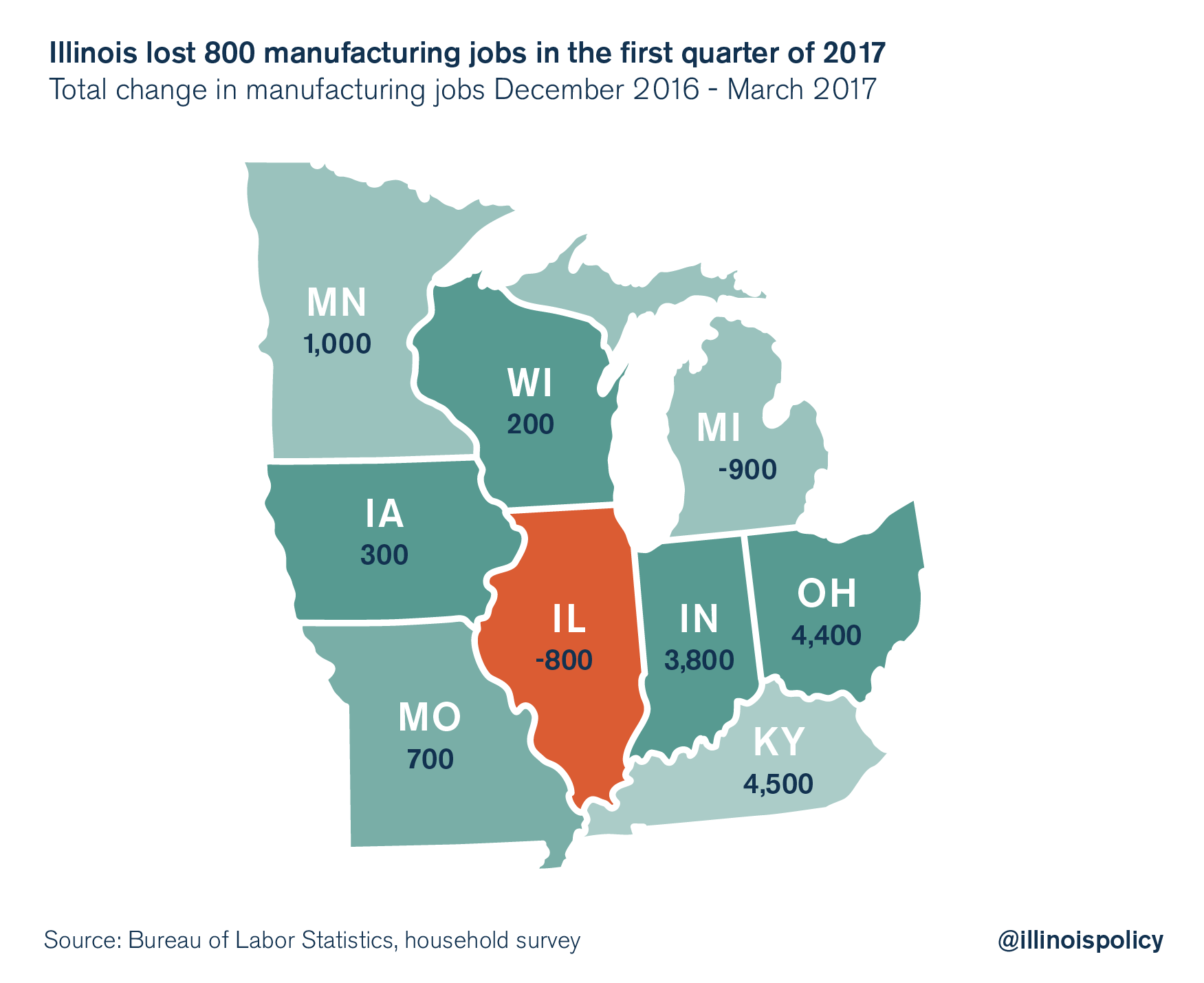

Manufacturing woes continue: Illinois down 800 manufacturing jobs in first 3 months of 2017

Manufacturing has been a persistent sore spot in Illinois’ labor market, with the state losing 5,000 manufacturing jobs in 2015 and 7,700 manufacturing jobs in 2016. Illinois is down 800 manufacturing jobs in the first three months of 2017, with Michigan as the only nearby state to have losses so far in 2017.

It’s important to point out, however, that while Illinois lost manufacturing jobs over the last two years, Michigan gained 17,200.

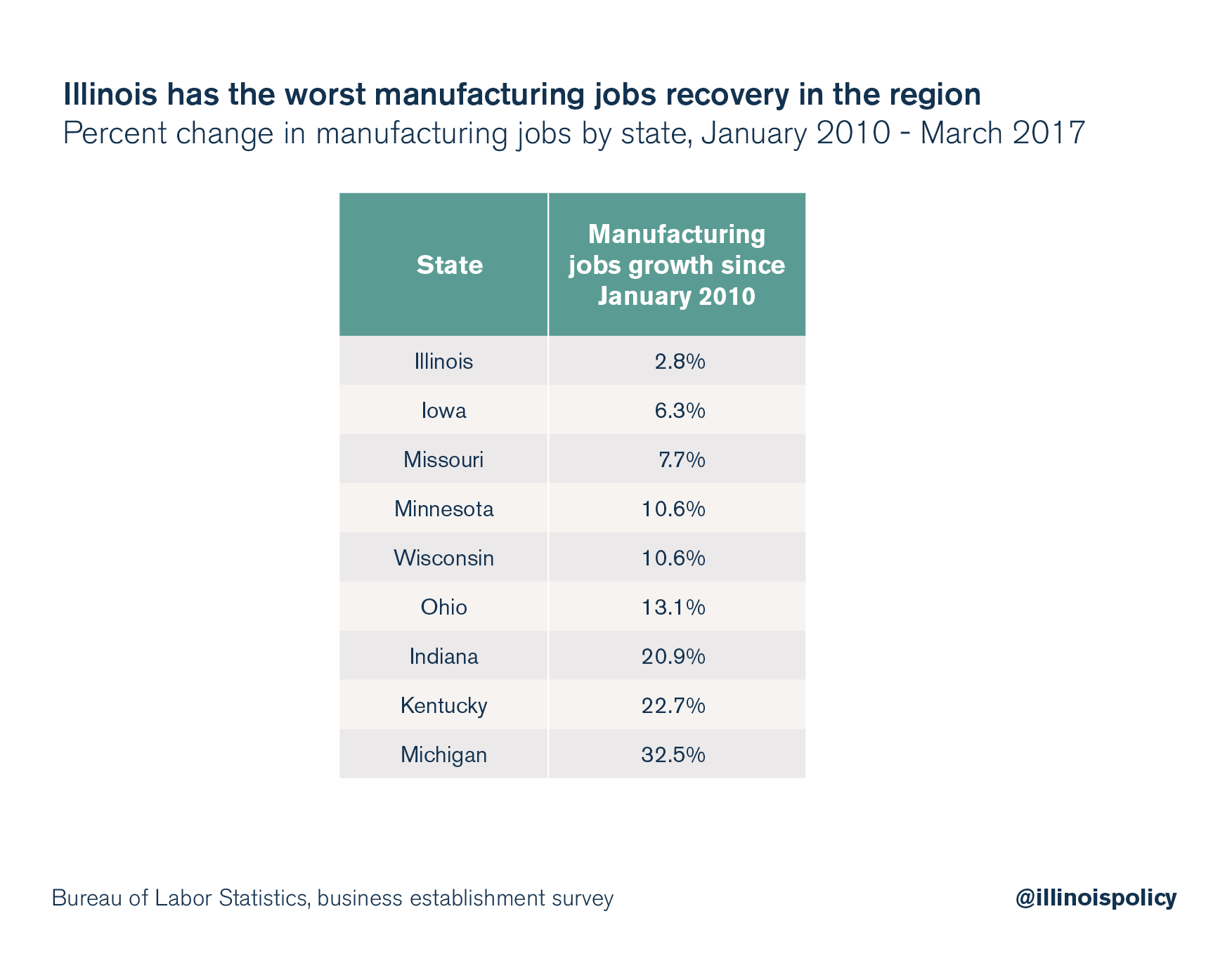

Illinois’ economic weakness creates an opportunity deficit for Illinoisans. For example, while manufacturing jobs have recovered elsewhere in the region, Illinois has lagged behind due in part to the anti-growth, anti-jobs taxes and regulations Illinois heaps on manufacturers. Illinois has experienced only 2.8 percent growth in manufacturing jobs since the bottom of the Great Recession. Nearby states have left Illinois behind and have seen tens of thousands more manufacturing jobs created than Illinois has.

Illinoisans are fleeing to states with more opportunity

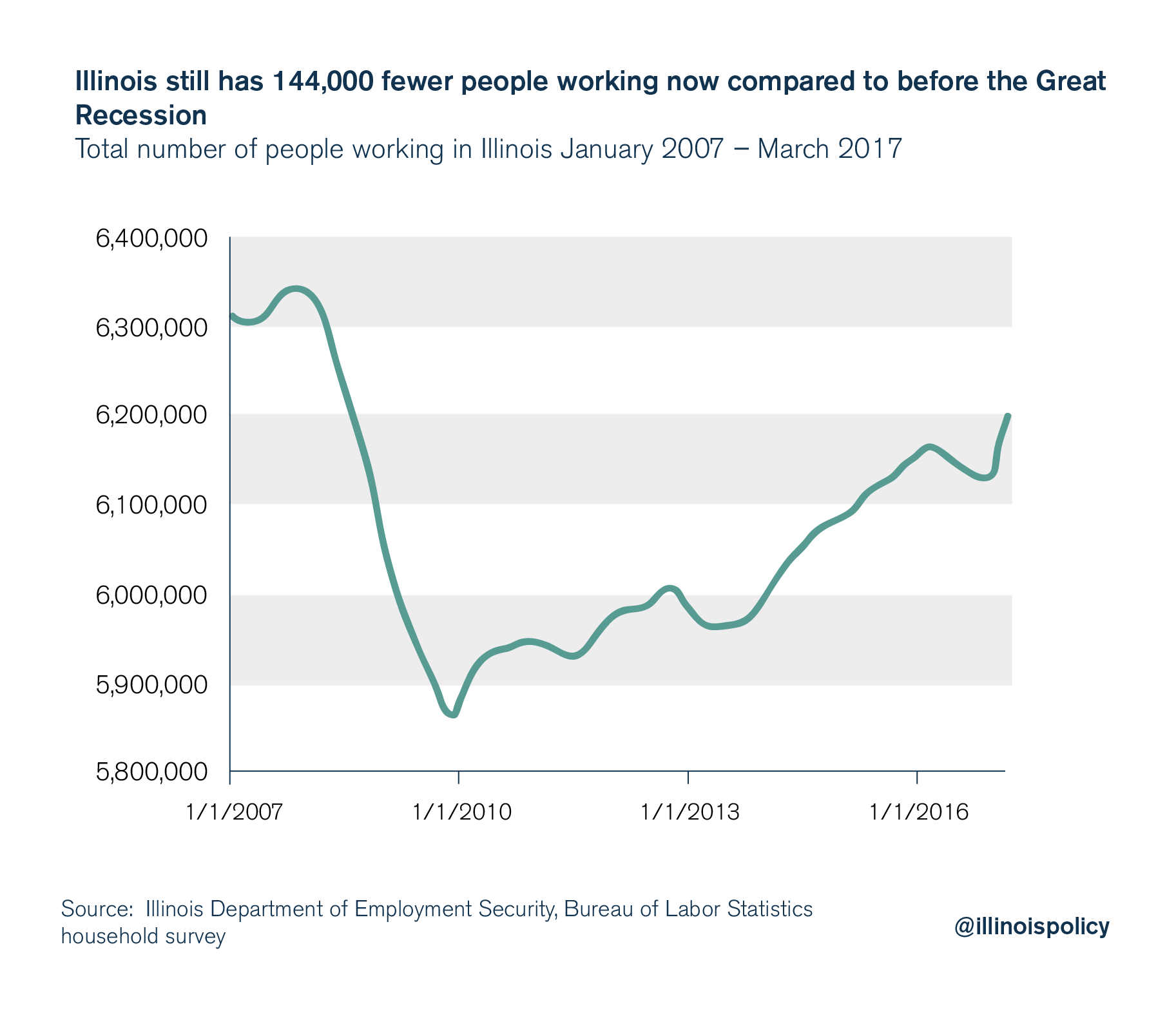

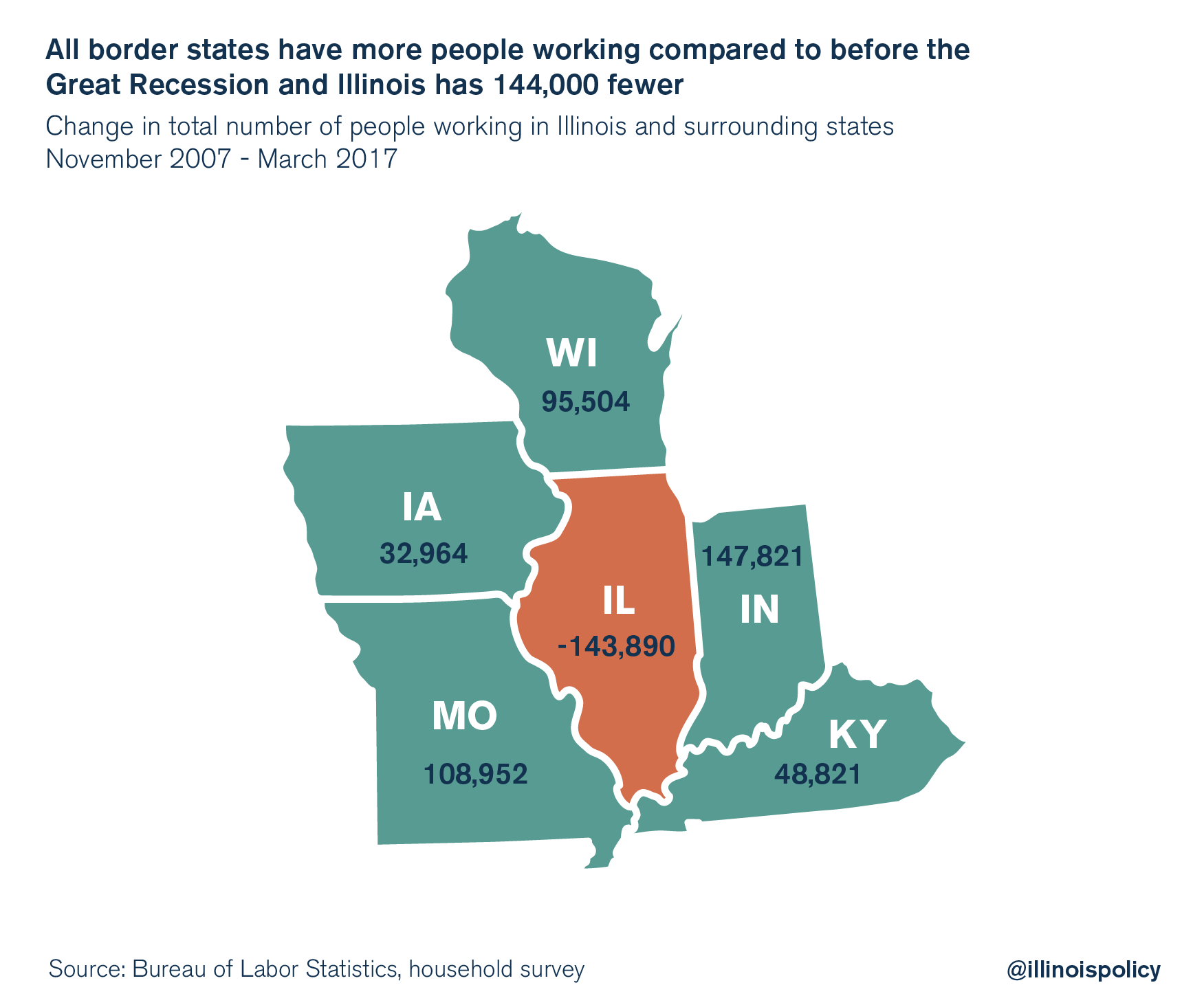

Illinois also has fewer people working compared with before the Great Recession, further revealing Illinois’ opportunity deficit. Illinois’ unemployment rate is the same as it was before the Great Recession. However, Illinois has 144,000 fewer people working compared with its pre-recession peak, and a smaller labor force. One of the major drivers of Illinois’ shrinking labor force is working-age Illinoisans moving to other states.

Illinois’ neighbors have turned Illinois’ opportunity deficit into their own opportunity gains. Over the Great Recession timeline, all of Illinois’ neighbors have more people working, while Illinois has fewer people working. This is not only because surrounding states have experienced a broader economic recovery, but also because working-age Illinoisans have flooded into those states over the last decade.

Illinois’ bordering states have benefited from Illinois’ dysfunction, adding Illinois expatriates to their tax bases while avoiding the policies that are leading Illinois into bankruptcy.

Illinois and its local governments are approaching insolvency in financial terms. However, the deeper bankruptcy is a moral one – a political system that drives away economic production and punishes home ownership while rewarding political clout and cronyism.

State government needs an overhaul before Illinois’ machine politics finally breaks the state’s finances. State taxpayers and homeowners need a balanced budget that reins in government worker unions, reforms pensions and includes legislation that fosters economic growth.