Illinois last in jobs growth, first in manufacturing losses in 2016

Illinois continues to have the worst jobs growth in the region, and tax hikes will only make matters worse.

In 2016, Illinois finished with the region’s weakest jobs growth rate and highest manufacturing jobs losses. Yet, the Senate is considering billions of dollars in tax hikes along with a brand new tax on jobs, a plan that assuredly would make Illinois’ economic situation worse.

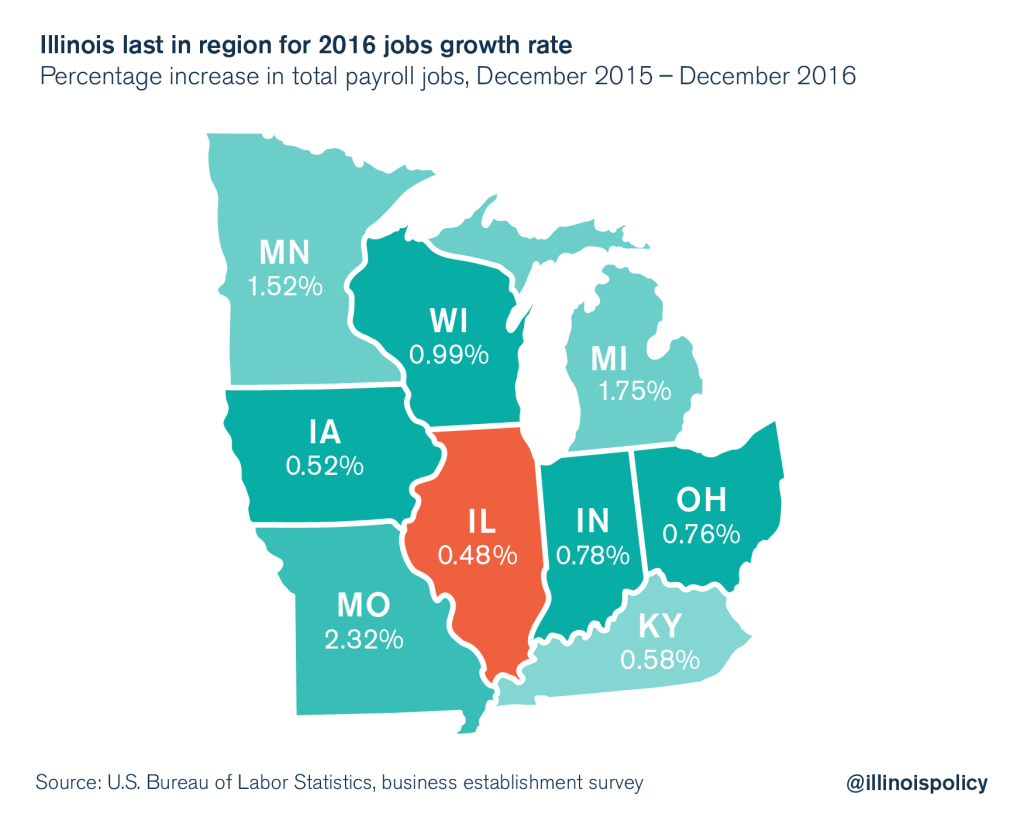

Only 28,400 jobs were created in Illinois in 2016, according to the Bureau of Labor Statistics, which is just under a 0.5 percent annual jobs growth rate. That lands Illinois last in the region for payroll jobs growth.

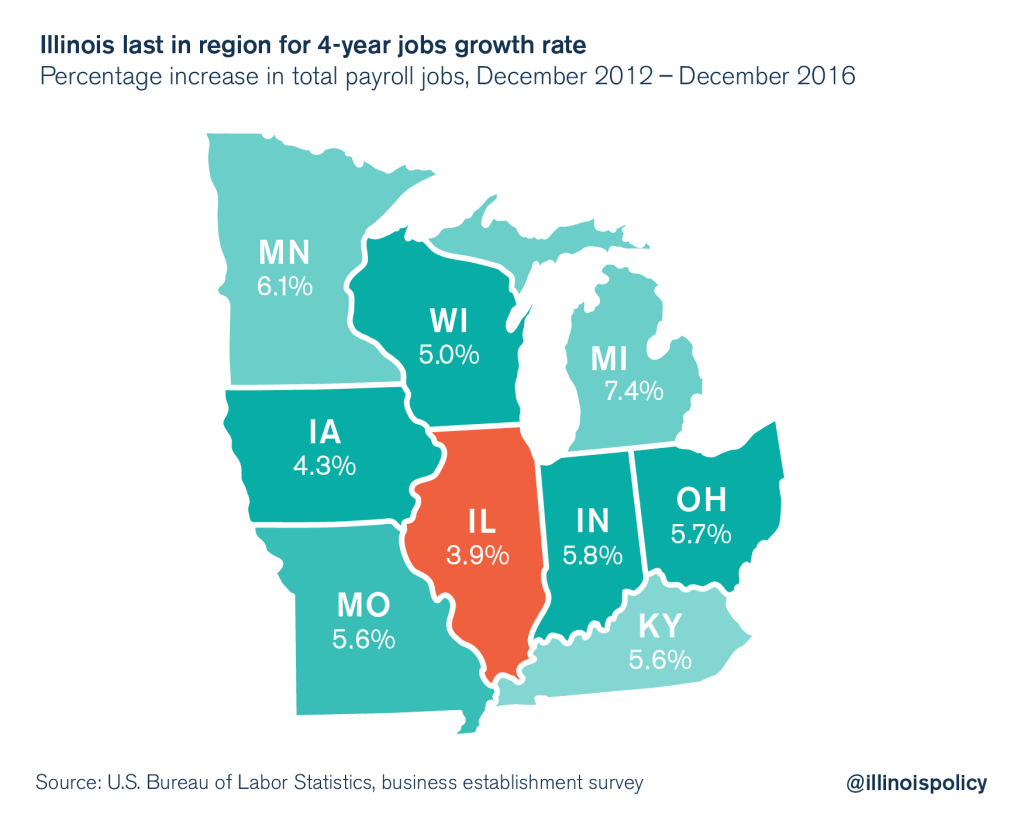

Illinois’ slow jobs progress is part of a longer-term trend. For the four-year period from 2013-2016, Illinois has by far the worst jobs growth rate in the region.

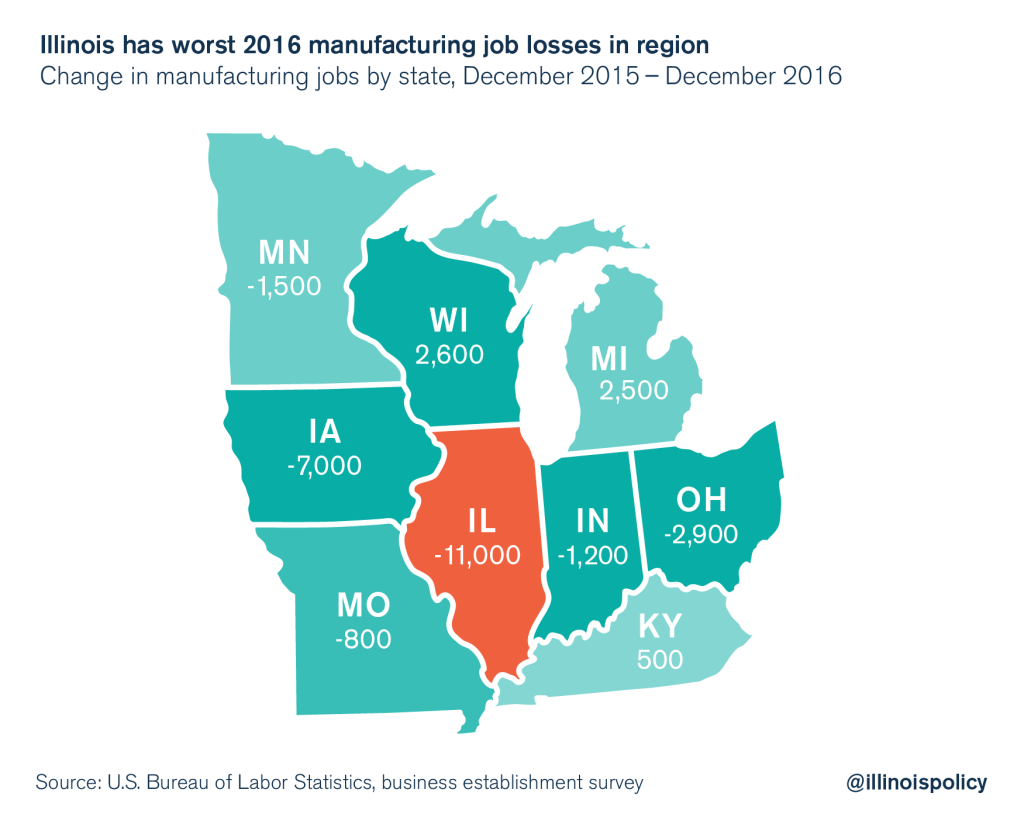

Manufacturing is a particularly sore spot for Illinois. 2016 showed a mix of manufacturing gains and losses for different states across the region. The Land of Lincoln lost 11,000 manufacturing jobs in 2016, easily the worst in the region.

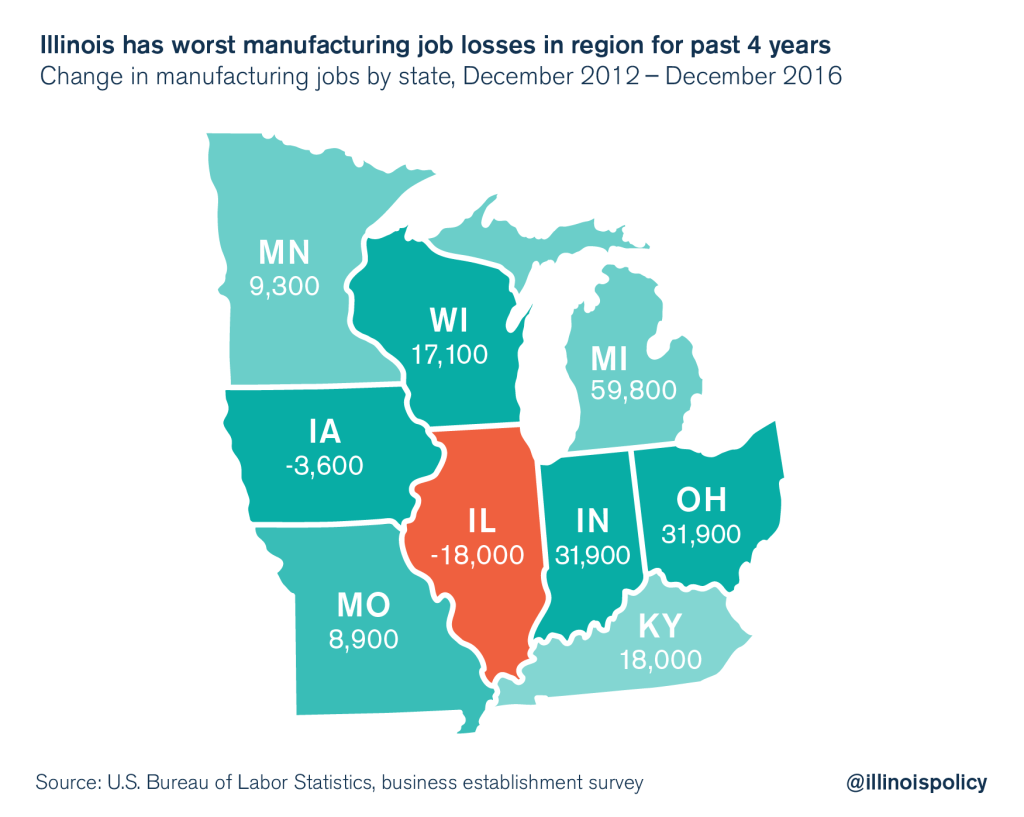

Over the past four years, Illinois has lost 18,000 manufacturing jobs. Iowa is the only other state to lose manufacturing jobs over this time period. Other states in the region have added tens of thousands of manufacturing jobs, in part because they attract business investments that avoid Illinois’ anti-jobs business climate.

Taxpayers continue to flee Illinois. The risk the state now confronts is falling into a financial death spiral as taxpayers leave so quickly that further tax hikes simply eat away at the state’s economic base and long-term prospects. Avoiding that risk is going to require some luck and a series of serious economic and financial reforms.

Spending reforms are needed to rein in the rising tax burden on Illinois homeowners and workers. State pension reform is needed to control pension costs the state covers, and collective bargaining reform is needed to allow local governments to control spending at the local level.

The Illinois budget-making process also desperately needs economic growth. The entire engine of state tax revenue is private sector economic growth. So while the spending burden can be cut through spending reforms, Illinois can grow its tax revenue by expanding the tax base to new workers and businesses.

Illinois has been on the wrong path for decades, and time is running short to save the state. Illinois’ legislature need to enact structural reforms so more jobs will be created in Illinois, and more families will want to stay in the Land of Lincoln. Before rushing ahead with a plan to raise taxes on Illinois families and businesses, the Illinois Senate should take a hard look at how its existing tax and regulatory policies are affecting the state economy.