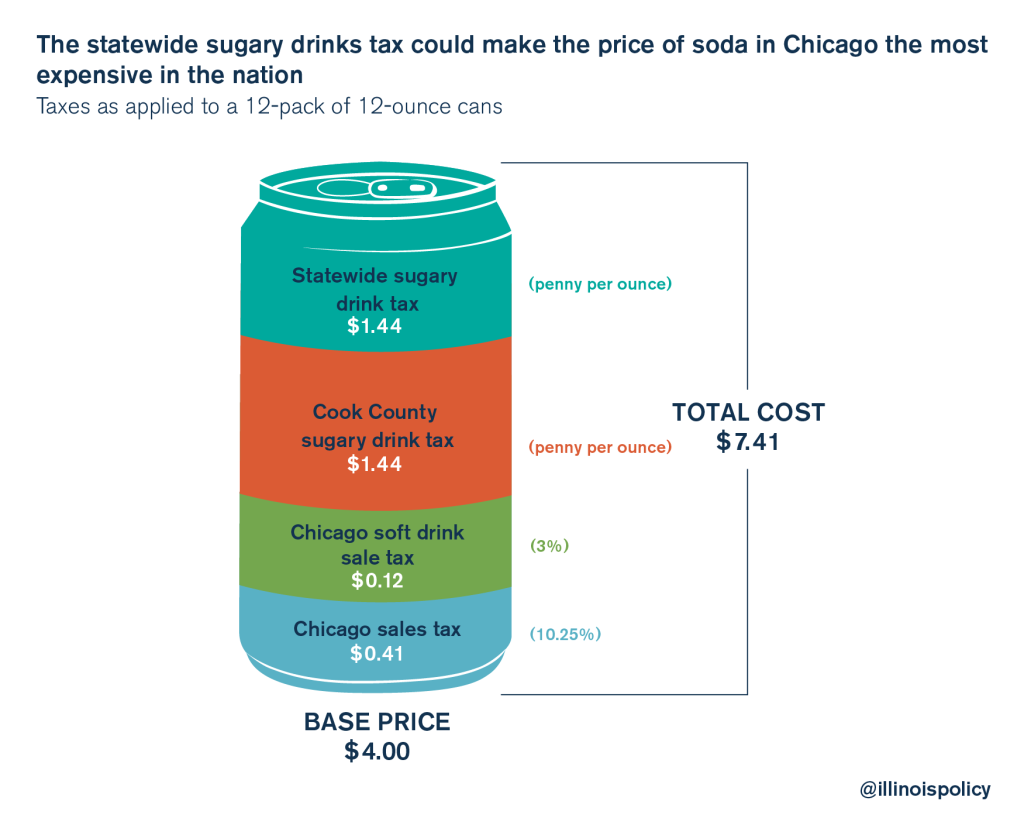

Senate budget proposal could make soda in Chicago the most expensive in the nation

The new statewide sugary drink tax, on top of Cook County’s similar tax and Chicago’s highest-in-the-nation sales tax, would make soda prices in the city skyrocket.

Chicago could soon become home to the most expensive soda in the nation, if a tax hike proposal from the Illinois Senate becomes law.

In addition to a 32 percent income tax hike, Senate Bill 9, introduced by state Sen. Toi Hutchinson, D-Chicago Heights, would add a statewide penny-per-ounce tax on bottled sugar-sweetened beverages, syrups or powders sold or offered for sale to a retailer for sale to a consumer. This cost would be felt across the state, but Cook County residents – whose board just passed a similar, countywide penny-per-ounce tax on sugary drinks – would be hit hardest, especially in Chicago.

Two penny-per-ounce taxes on sugary drinks would match Boulder, Colo., for the steepest such taxes in the nation. But, on top of that, Chicago residents also pay the highest sales taxes of any major city in the nation at 10.25 percent. Additionally, Chicago imposes a 3 percent tax on all non-alcoholic beverages. Taken together, soda prices in Chicago could nearly double.

For example, a 24-pack of Coke at a base price of about $8 would be $14.82 after taxes. A 12-pack at a base price of $4 would be $7.41 after taxes.

And Chicago’s poorest residents would feel the effects the most. According to Gallup, 45 percent of people with incomes less than $30,000 drink regular soda, while one-third of those with incomes from $30,000-$74,999 drink regular soda, and just one-fifth of those with incomes above $75,000 drink regular soda.

Much like the regressive soda and sales taxes politicians have imposed in Chicago and Cook County, Springfield politicians are placing the heaviest burden on poor and middle-income Illinoisans as a “solution” to fiscal woes. These are the groups hurt most by Illinois’ dismal post-recession income recovery – the worst in the Midwest – and shouldn’t be asked to bail out politicians’ decadeslong reckless spending and financial mismanagement.

In addition to the sugary drink tax and personal and corporate income tax hikes, SB 9 does little to nothing for structural reforms the state needs. The plan wouldn’t fix the state’s broken workers’ compensation system; includes a watered-down, two-year property tax freeze; and fails to modernize Illinois’ broken defined-benefit pension system.

Illinois needs real reforms, such as 401(k)-style retirement plans, comprehensive property tax reform and a complete overhaul of its workers’ compensation system. Overburdening struggling Illinoisans with more taxes is not an acceptable substitute.