Illinois legislators pitch proposals to stop lame-duck tax hikes

Illinois needs structural reforms to fix its fiscal problems, not a tax hike by lawmakers on their way out the door.

More than 10 lawmakers – a significant number of votes – won’t be around for the 100th General Assembly, which kicks off Jan. 11, 2017. Those leaving office don’t face re-election, so they can strike deals with little fear of consequences. And in the past, that might have resulted in a massive tax hike on Illinoisans just as the lights go out on the General Assembly.

But taxpayers may have more protection if lawmakers honor the sentiments expressed in new measures that passed the Illinois House of Representatives Dec. 1.

By an 84-18-2 margin, on Dec. 1, the House passed a constitutional amendment, introduced by state Rep. Jack Franks, D-Marengo, which requires a three-fifths supermajority in the Illinois House and Senate to raise taxes during a lame-duck session. That amendment now moves on to the Illinois Senate. The House also passed House Resolution 1494, filed by state Rep. David McSweeney, R-Barrington Hills, with chief co-sponsor Franks, calling on outgoing General Assembly members to not pass any tax hikes during the lame-duck session. The resolution argues:

“Significant state policies, especially tax policies, should be set by those with the most recent ties to the votes of the people; the persons who set the policy should be persons who have passed the test of accountability to the voters.”

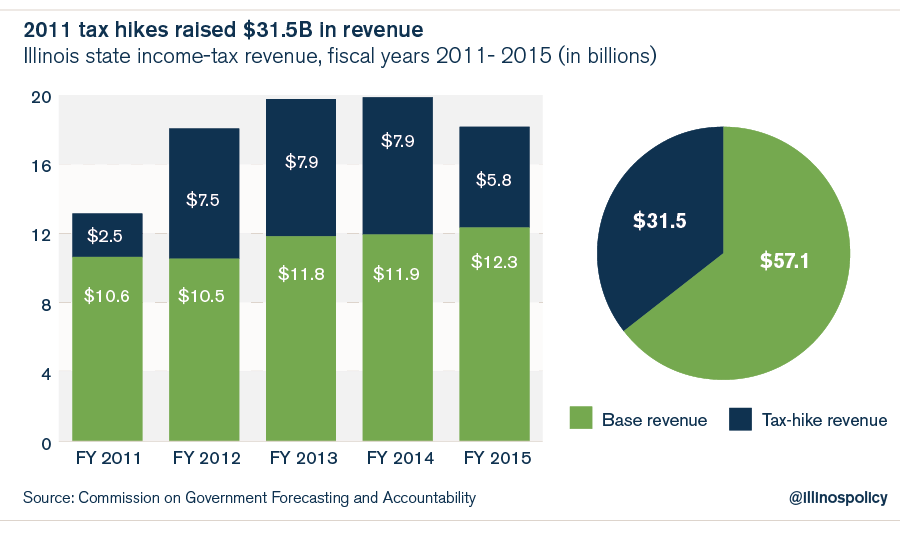

There’s good reason to set this precedent. Consider the damage done by the lame-duck General Assembly in 2011, when it passed Illinois’ largest tax hike just before the end of session.

Illinois’ politicians enacted a record 67 percent personal income tax hike and a 46 percent corporate income tax hike. The tax increase took nearly $32 billion in additional taxes from taxpayers from 2011 through 2014.

Politicians promised the tax hikes would stabilize the state’s pension crisis, pay down the state’s unpaid bills, and help the economy.

But four years later, the tax hike accomplished just the opposite: The pension crisis worsened, Illinois’ bills weren’t paid off, and Illinoisans suffered under the weakest economic recovery in the nation.

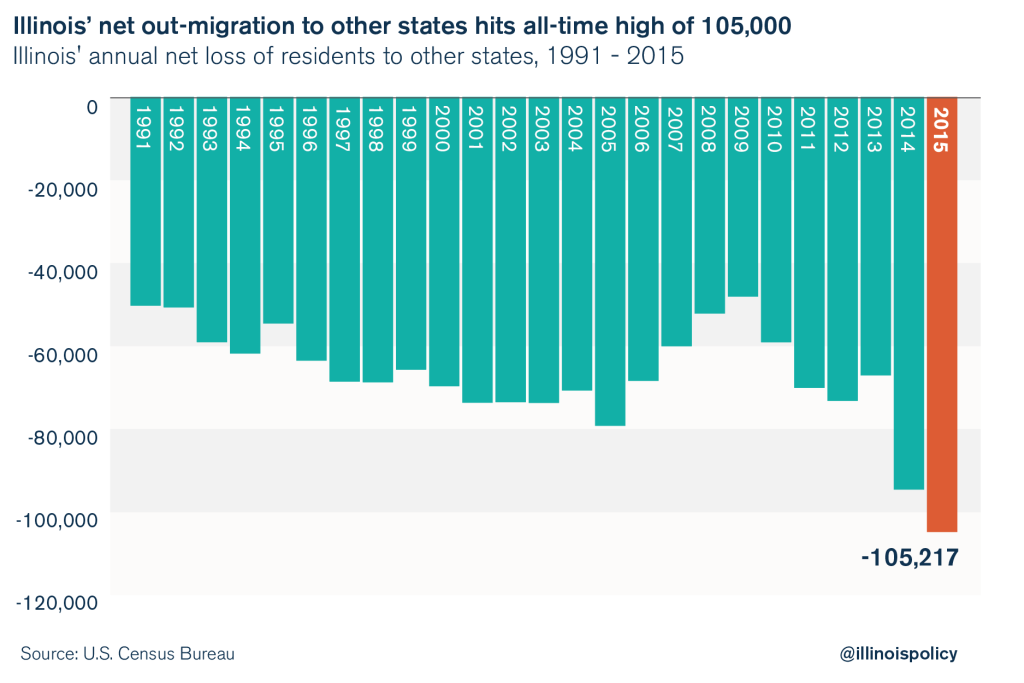

Even worse, Illinoisans left the state in record numbers – to the point where Illinois actually lost population in 2015.

- Illinoisans left in record numbers

The most destructive legacy of the 2011 tax hike has been the acceleration of out-migration and a further destruction of Illinois’ tax base. In 2015, 105,000 residents on net moved out of Illinois, a record loss. That surpassed 2014’s out-migration, which itself was a record loss for the state.

Illinois is now losing the equivalent of one resident every five minutes.

As a result, Illinois’ population actually shrank last year. Illinois lost over 22,000 people, the only state in the Midwest to do so.

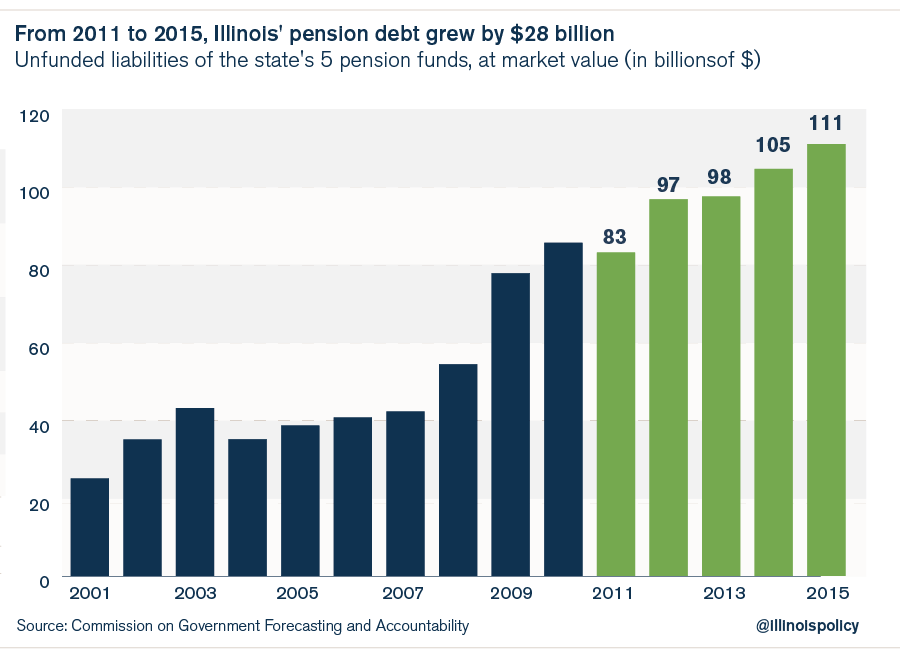

- Illinois’ pension crisis worsened by $30 billion

One of the justifications Illinois’ politicians gave for enacting the 2011 tax increase was that the money would help pay down a portion of the state’s pension debt.

To that end, politicians poured 90 percent of the tax hike’s $32 billion in new revenue into the state’s pension funds.

Perversely, Illinois’ pension debt actually worsened by $30 billion, and the state’s pension funds are now in their poorest shape ever. In fact, the funds have less than 40 cents on hand for every dollar they need today to pay out current and future benefits.

Pouring more money into the state’s broken pension system was clearly not the answer. Until state pensions undergo real reform, more and more state funding is going to be siphoned away from core spending – such as on K-12 and higher education – and toward the pension funds.

- Illinois’ unpaid bills remained unpaid

Paying down Illinois’ growing pile of unpaid bills was another justification for the 2011 tax hikes. In 2011, Illinois had an $8.5 billion bill backlog that Illinois politicians promised would be paid down.

But by 2014 – long before the current budget stalemate began – Illinois still had a $7 billion bill backlog.

For all the harm the income tax hike did to Illinois’ taxpayers and economy, the proceeds barely touched Illinois’ unpaid bills.

Illinois needs structural reforms, not last-minute deals

HR 1494 is right to challenge any tax hikes, especially lame-duck hikes.

In fact, Springfield politicians need to pass structural reforms first. Those reforms include freezing local property taxes; 401(k)-style retirement plans and other commonsense pension reforms; fixing Illinois’ broken workers’ compensation system and anti-business lawsuit climate; eliminating the state’s broken education funding formula and creating a money-follows-the-student model in its place; shrinking bloated administrative staffs at colleges and universities; and passing term limits.

Until these and other major reforms are signed into law, Illinois politicians have no right to ask taxpayers for another penny.