Federal tax changes could pressure Illinois to repeal death tax

A repeal of the federal estate tax would make it imperative that Illinois get rid of its own state death tax to avoid losing even more residents and income to other states.

With Republicans winning the presidential race and controlling both houses of Congress, federal tax code changes may be on the way, and Illinois should prepare by getting its state tax code in order. One of the first changes Illinois should make is to repeal the state’s death tax. The death tax drives out-migration of high-income Illinoisans, and it reduces economic growth in the Land of Lincoln. This tax particularly harms owners of farms and manufacturing firms.

One area of agreement between President-elect Donald Trump and the Republicans who will control Congress is on the need to repeal the federal death tax. U.S. House Speaker Paul Ryan’s tax reform plan includes a full repeal of the federal estate tax, as does the plan put forward by Trump.

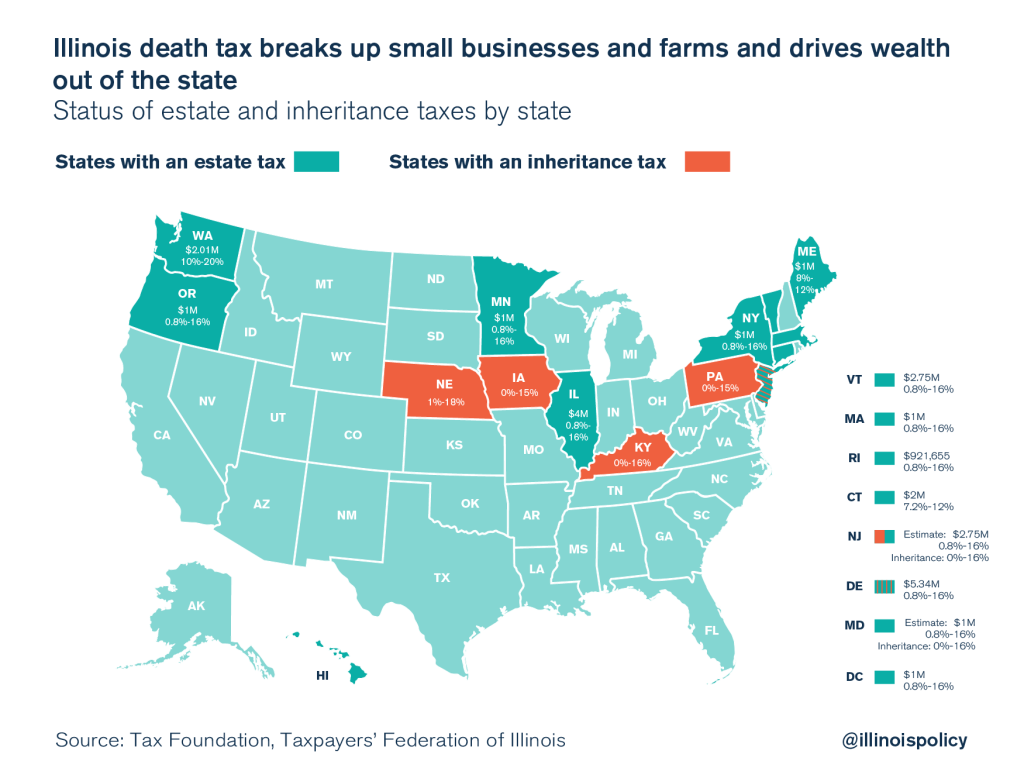

A repeal of the federal death tax would put pressure on Illinois, the District of Columbia and the 16 other states that still have a version of the tax. Under the current system, state death taxes can be deducted against federal death taxes. Without the state deduction against federal taxes, the state-based death tax will become an even greater driver of wealth flight from states that still impose the tax.

Illinois’ death tax drives out the earners the state can least afford to lose

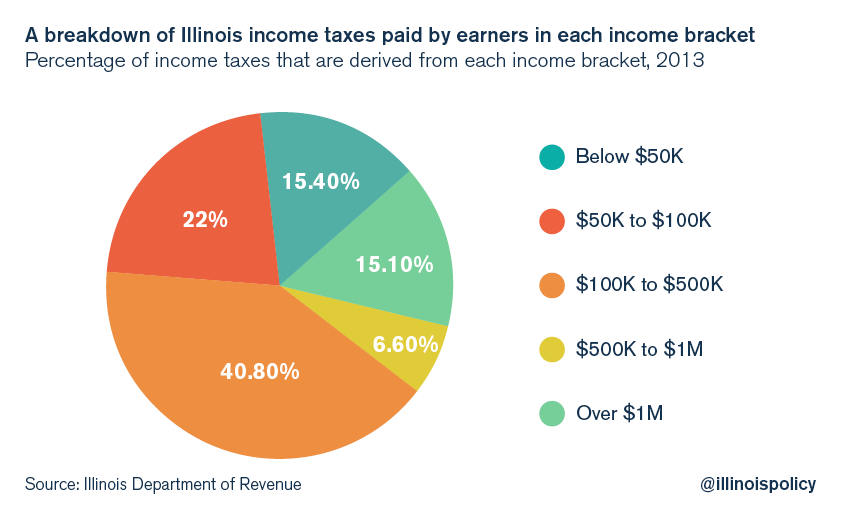

Illinois, like most states, is already dependent on higher-income earners for a large portion of state income taxes. For example, Illinoisans with adjusted gross income, or AGI, of $500,000-$1million make up only 0.7 percent of all Illinois tax returns, but they pay 7 percent of all income taxes. And Illinoisans with more than $1million in annual AGI make up only 0.5 percent of all tax returns, but they pay 15 percent of all income taxes. These are the income earners who are most likely affected by the state’s death tax, and therefore most likely to leave Illinois for another state. Illinois’ one-time bite of estate taxes is likely costing the state several years of income taxes from some higher earners.

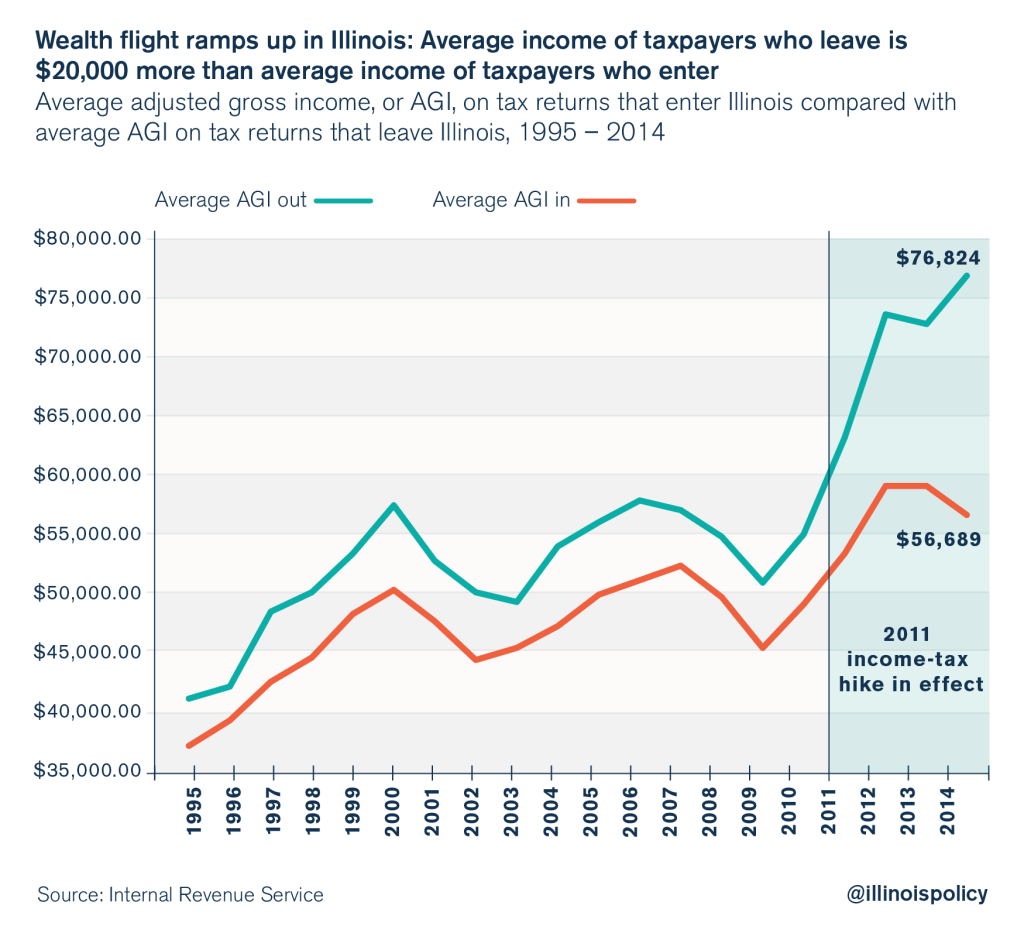

Many higher-income Illinoisans responded to the 2011 income-tax hike by leaving the state. Any future income-tax hikes would likely cause the same result. After the 2011 income-tax hikes, the average income of people leaving Illinois grew to $77,000 per year in 2014, compared with an average income of $57,000 for people moving into the state. This $20,000 income differential is the worst of any state.

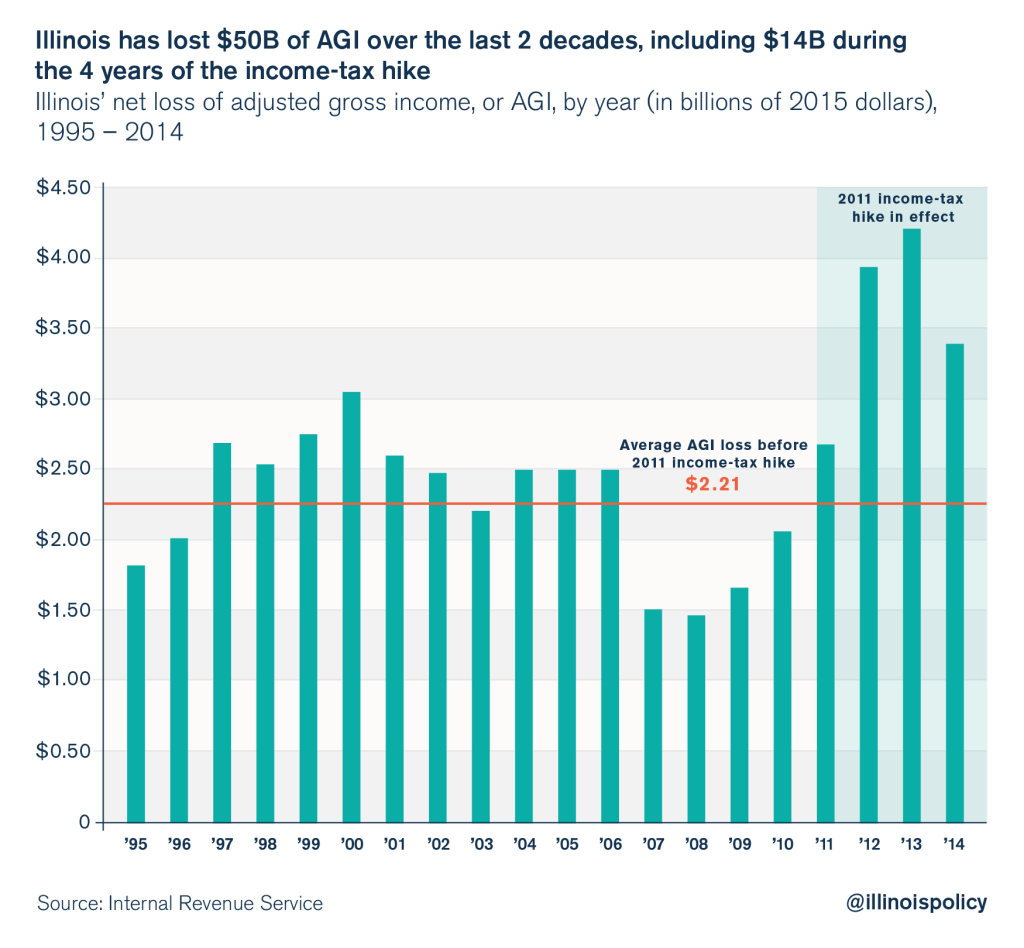

Over the past two decades, Illinois has sustained a net loss of $50 billion in annual adjusted gross income due to migration losses to other states. More than $14 billion of that loss came during the four years of the income-tax hike. This amounts to a severe loss of both economic activity and desperately needed tax revenue.

The largest recipients of wealth from Illinois are states without a death tax and without an income tax – with Florida and Texas in the lead.

Regardless of whether Illinois policymakers enact another income-tax increase, they should repeal the state’s death tax. High-income Illinoisans are already leaving the state. The death tax costs Illinois economic activity and job creation as it drives talented people out of the Land of Lincoln. With the federal estate tax potentially on the chopping block, Illinois should make its own state death tax a thing of the past.