Despite budget impasse, state government, health care and social services employment grow

Government jobs growth continues while Illinois’ private sector suffers from burdensome taxes and regulations.

Government taking too much money from the private economy through taxation and imposing too many regulations has in large part driven Illinois’ sluggish economic growth. As a result, Illinois’ private-sector economy is not producing enough jobs and growth to keep Illinoisans in the state, and out-migration has reached record levels.

Since June 30, 2015, Illinois has operated without a full budget, leading to speculation that the lack of a budget is driving job losses and a slow state economy. This assumption, in turn, has fueled the idea that passing virtually any budget is better than experiencing the fallout from a stalemate between the governor and the General Assembly over the inclusion of fundamental economic reforms as part of a budget plan. Perhaps surprisingly, jobs growth in sectors associated with state government has continued, while much of the private-sector economy has stagnated. Undoubtedly, dislocations and economic pain have occurred due to the budget impasse, especially for families involved in providing or receiving social services. However, Bureau of Labor Statistics, or BLS, data show that state government, health care and social services sectors have still seen jobs growth. Meanwhile, the rest of the tax-generating private sector continues to suffer under the state’s onerous tax and regulatory burden.

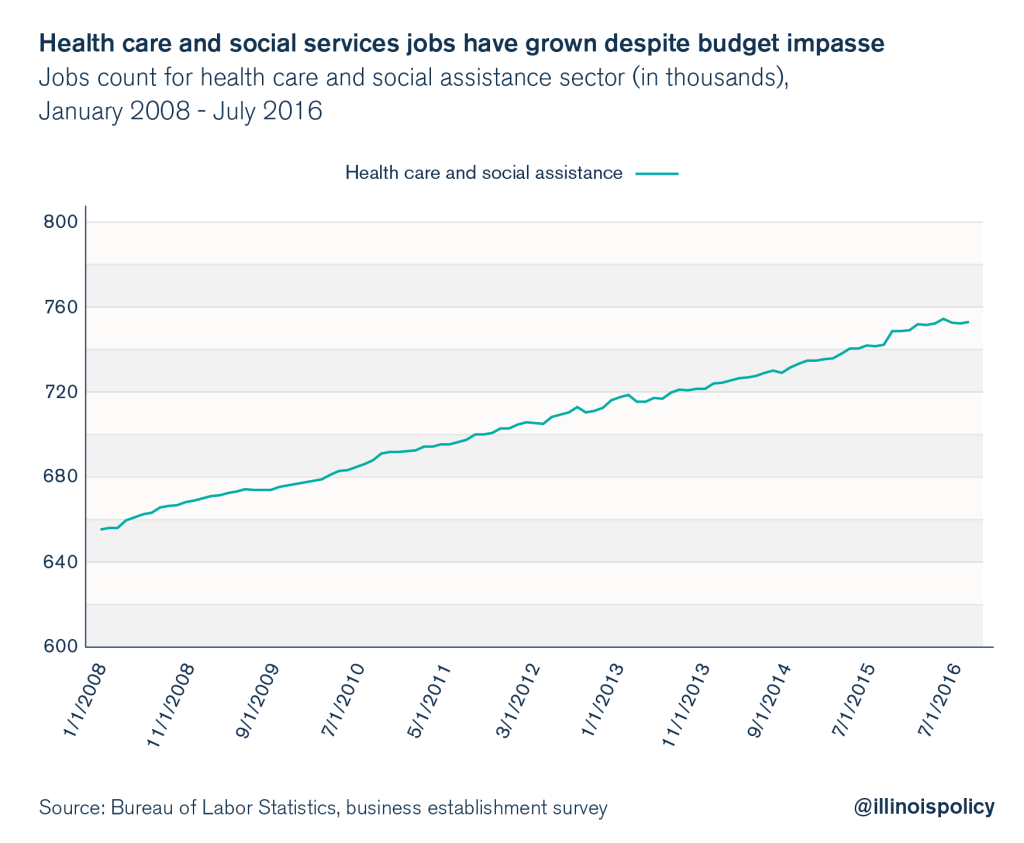

Health care and social assistance employment have continued rising during the budget stalemate

Employment in health care and social assistance has been rising steadily in Illinois for years. Even during the worst jobs months of the Great Recession, from January 2008 to January 2010, health care and social assistance continued adding jobs at a brisk pace, rising by 22,000 jobs during a time when the state lost more than 400,000 net jobs in total.

More recently, jobs in the health care and social assistance sector have increased by 11,200 in the year since the state’s budget impasse began.

Jobs growth in health care and social assistance has been 1.5 percent in the year since the impasse began, on pace with jobs growth in this sector in previous years. This is compared to Illinois’ overall jobs growth rate of 0.7 percent over the same time. It is normal for jobs growth in health care and social services to outpace the economy as a whole as baby boomers require more care. However, those who have warned Illinois’ budget gridlock would cause terrible losses might find it surprising that jobs growth in health care and social services – a sector with more state government involvement than most – has continued unabated during the impasse.

While it is possible job gains in parts of the health care and social services industry not affected by the impasse are simply outweighing losses occurring due to state government, overall employment disruption has not occurred in the sector. Thus the BLS data do not support the claim that the budget-stalemate-induced disruption of state social services and health care spending is slowing down overall jobs growth in the affected sectors, or in the economy in general. The trajectory of jobs gains in health care and social services has remained steadily upward.

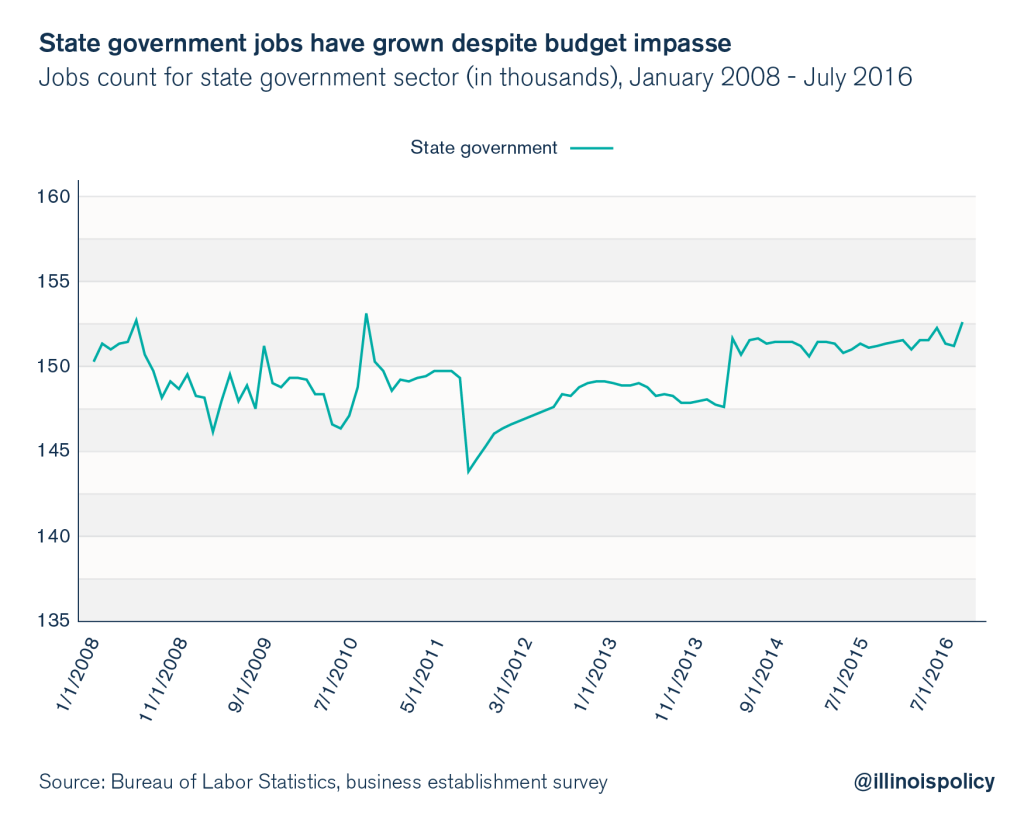

State government employment has increased during the budget stalemate

BLS data similarly show that the budget impasse has not affected employment in state government. While state government employment showed some volatility during the recession timeline, it was still steadier than many private-sector industries. In the past year of budget impasse, state government payrolls have been relatively steady, edging up by 1,200 in the 12-month period.

Illinois’ overall job market has been weak for the past year, and it has been weak for the entire post-recession era. In fact, Illinois is one of a few states that still has fewer people working today than it had working before the Great Recession began. This is at least in part because so many working-age adults have been leaving Illinois.

It is important for Illinois to have a full balanced budget that provides state services for those who need them most. It is equally important, however, to remember that state services and all government spending are made possible through tax dollars first produced in the private sector. If the private sector isn’t growing, neither will the government coffers that fund state services.

Illinois Democrats and Republicans have not been able to agree on much recently. However, the state is pushing itself and its municipalities up against the prospect of required pension payments in the face of soft economic growth, weak job creation, sputtering gains in tax revenues and massive out-migration. These problems should inspire lawmakers to rise above partisan rancor. There is no doubt that Illinois needs to do substantially better on the economic growth side of the equation in order for the state’s financial math to work. Without policies that foster more economic growth, funding Illinois’ obligations will become more difficult each year, with the rising risk that another recession will make Illinois’ financial math impossible.