Illinois tax code favors corporate farms over family farms

While neighboring states are making themselves friendlier for farmers, Illinois keeps its unfair death tax in place.

Illinois’ estate tax complicates family farm management in the Land of Lincoln, and it creates an advantage for corporate farms over noncorporate farms. The death tax should be repealed to eliminate a significant disadvantage for farmers who want to pass down their family farms across generations. With the death tax in place, some Illinois farmers are forced to make economically harmful decisions to pay for it, such as selling off land, mortgaging their assets and stockpiling unnecessary cash instead of putting their cash to productive use.

Illinois is a rich and diverse agricultural state, with an amazing 75 percent of the state’s total acreage dedicated to agriculture. Illinois has 74,300 farms spread across 27 million acres, putting the average farm size at 360 acres. The average value for an acre of Illinois farmland is $7,500, according to the United States Department of Agriculture. Iowa is the only Midwestern state with more valuable farmland, at an average of $8,000 per acre.

An Illinois farm of just over 500 acres is potentially subject to the state’s death tax, and that is only considering the value of the land. Farmers also have assets such as machinery and livestock, often making them asset-rich but cash-poor. Being asset-rich and cash-poor while dealing with the estate tax can create the need to sell off land, livestock and machinery to pay the tax when the next generation takes over the farm.

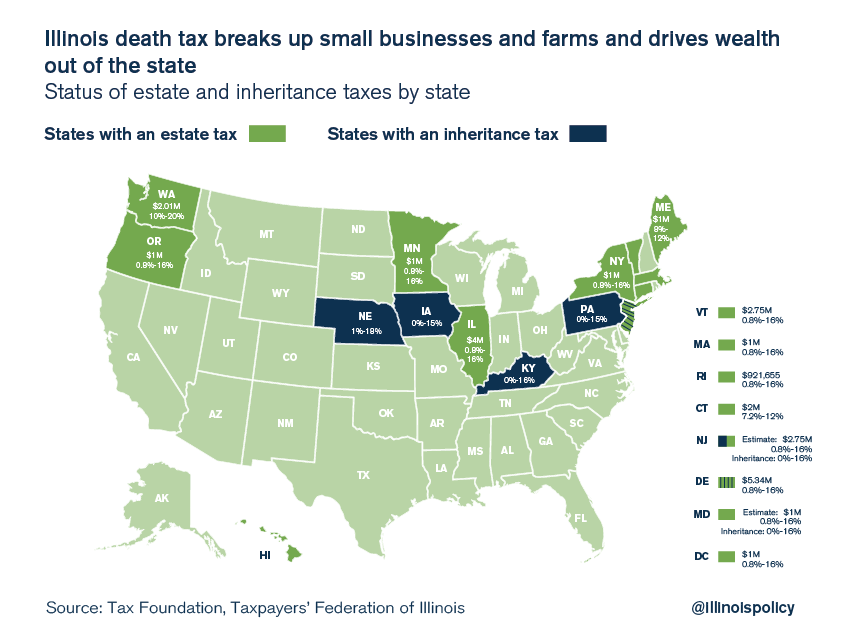

For these reasons, state governments in agricultural states around Illinois have been putting an end to their death taxes. Tennessee finished its repeal of the death tax this year Indiana and Ohio repealed their death taxes in 2013 and a number of other states have taken steps to reduce the burden of the death tax. Only 18 states still maintain some form of estate or inheritance tax.

The estate tax is especially hard on farmers not only because they tend to be asset-rich and cash-poor, but also because they are attached to Illinois and can’t avoid the tax. They can’t move their farmland to another state that is friendlier to farmers and doesn’t levy a death tax. On the other hand, successful business owners in industries like finance can easily move their residences and assets to other states to avoid the tax. Notably, none of the Southern retirement states, such as Florida or Arizona, levy a death tax.

The economic pain isn’t limited to farmers, though. Small businesses with a lot of real estate, such as apartment rental companies, are similarly affected. The death tax is harmful for economic growth across the board. According to the Tax Foundation:

Estate and inheritance taxes have large compliance costs, have been shown to suppress entrepreneurship, and are among the most harmful taxes to economic growth.

Illinois should cut family farmers and small business owners a break and repeal the death tax. It’s not only an unfair burden for Illinois family farmers, it’s also harmful for entrepreneurship and economic growth. It’s a tax that favors corporate businesses over noncorporate businesses, punishes small farmers and drives out-migration. Illinois policymakers should follow the lead of surrounding states and repeal the death tax.