All tax hikes, no reform: Illinois politicians should reject ‘budgeteer’ budget plan

Instead of talking about the necessary, structural reforms to help the state, a collection of Illinois lawmakers want to ask taxpayers to give more to continue irresponsible policies.

A group of Illinois lawmakers – including Democrats and some Republicans, referred to as the “budgeteer” group – have released some details of a new plan to cut the more than $4 billion hole in the state budget. The problem is, the specifics of the “budgeteer” plan known so far would punish taxpayers with more than $5 billion in tax increases – the last thing Illinois taxpayers and the state’s faltering economy need.

From what’s been made public to date, structural spending and economic reforms are notably missing from the dialogue. There is no mention of anything to change the major cost drivers responsible for crowding out spending on core government services for nearly two decades, nor does it do anything to make Illinois a more business-friendly state.

Up to now, the plan is not the “grand bargain” its backers claim, and should be rejected immediately.

These “budgeteers” have proposed the following items as part of their $8 billion package:

- An increase in the income-tax rate to 4.85 percent from 3.75 percent, a hike of nearly 30 percent

- An expansion of the sales tax to include some services, as well as a cut in some corporate tax breaks

- Spending cuts in Medicaid, a partial reduction in pension spiking, and a partial shift of pension costs to schools and universities

- A debt-issuance plan of $5 billion to pay down old bills

In all, taxes would increase by $5.4 billion, and spending cuts would yield $2.5 billion in savings.

But the budgeteer plan so far fails on three fronts: Illinoisans can’t afford more tax hikes, the group’s plan to this point is silent on how to slow down the growing costs of government, and the plan doesn’t yet address the reforms needed to bring back jobs and growth to the economy.

Stop asking Illinoisans to accept tax hikes: They’re already overtaxed

Illinoisans already pay some of the highest taxes in the nation. When all local and state taxes are added up, Illinoisans paid the fifth-highest overall rate in the nation in 2012, according to the most recent state-by-state comparison by the nonpartisan Tax Foundation.

Contributing to Illinois’ high overall tax rate are the nation’s highest property taxes, high sales taxes (Chicago has the highest sales tax in the nation), and other taxes that nickel and dime taxpayers, including cell phone taxes (fourth-highest) and gas taxes (ninth-highest).

With all these taxes and a tough jobs environment, it’s no wonder 42 percent of Illinoisans would like to move to another state, according to a recent Gallup poll.

Spending on pensions, state-worker health care and Medicaid is crowding out core government services

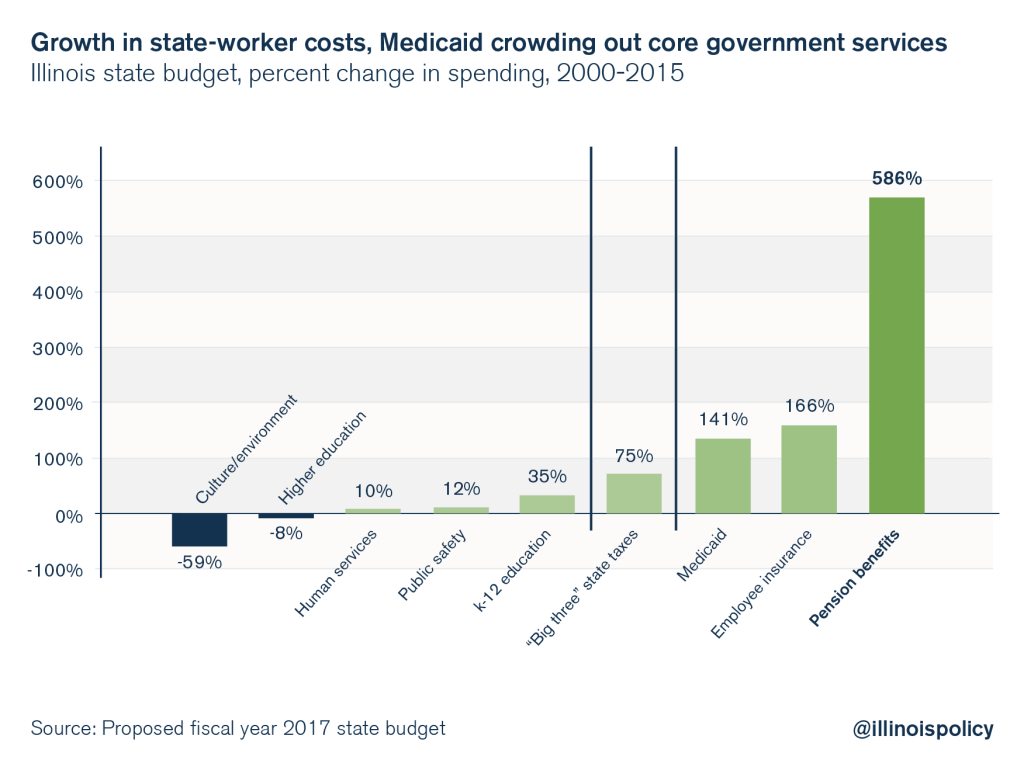

Spending from 2000 to 2015 shows that despite healthy revenue growth over that period, three unreformed cost drivers are wreaking havoc on Illinois’ budget and core government services.

Skyrocketing costs for state workers, including pensions and health care costs, and Medicaid are crowding out everything else. Core government deliverables such as human services and public safety are being underfunded to make way for payments for state-worker benefits and Medicaid; these costs are growing at multiples of the state’s revenues.

For example, pension contributions for state workers rose a staggering 586 percent between 2000 and 2015. Health care for state employees shot up 166 percent, and Medicaid increased by 141 percent. In contrast, higher education was cut by 8 percent and human services grew by just 10 percent.

Lawmakers must stop prioritizing state-worker retirement and health care benefits over the rest of the budget.

Any real reform packages must stop the growth in these major cost drivers. That means laws that reduce their growth and bring them back in line with what taxpayers can afford.

Illinois needs to grow its tax base, not its tax rate

As of now, the budgeteer plan does not include any of the economic and structural reforms necessary to grow the state’s tax base. Growing the tax base means creating a dramatically different economic climate – one attractive to employers and workers alike.

Today, Illinoisans are struggling through one of the worst economic recoveries in the nation, and people and businesses are leaving, taking their money with them. Illinois’ failed policies of the last decade – namely, hiking taxes and overspending – are shrinking the tax base. This has left Illinois with an economy that lags behind those of most other states.

Illinois needs to become a friendlier place to do business. If additional businesses open in the state, they will hire more workers. And more workers will earn income and pay taxes, resulting in more revenue to pay for core government services. All this can happen without politicians reaching into taxpayers’ wallets for a larger share of Illinoisans’ hard-earned money.

Politicians need to pass a balanced budget that embraces reform, not more of the same

The budgeteer group needs to address the following spending and economic reforms:

Spending

- Lower the cost of government by creating a more realistic retirement plan for state workers, as well as a collection of other reforms.

- Demand a truly balanced budget to ensure spending doesn’t outpace revenues.

- Push for consolidation of Illinois’ more than 7,000 units of government, starting with merging the state’s 859 school districts.

- Reform how Illinois delivers K-12 education to children and demand public universities cut administrative costs.

- Reform Medicaid spending practices to deliver better care and save taxpayer dollars.

- Pass a spending cap to keep core cost drivers such as employee compensation in check.

Economic

- Reduce the overall property-tax burden to make Illinois more affordable.

- Reform Illinois’ workers’ compensation system so it is more in line with those in other states.

- Reduce the burden of occupational licensing on small businesses and entrepreneurs.

- End prevailing-wage laws, which harm Illinois’ manufacturing sector.

These are the policies Illinoisans need in any “grand bargain.”