5 facts show IMRF is just as unsustainable as every other Illinois pension fund

The Illinois Municipal Retirement Fund’s relative health compared with other government-worker pension funds is only due to its ability to force localities to fund it at the expense of other pension funds and vital local services.

Politicians in Springfield are responsible for the public pension crisis that threatens the state’s fiscal solvency, with debt for the five state-run pension funds totaling more than $111 billion. They underfunded pensions and promised benefits to workers that taxpayers cannot afford – bringing virtually every public pension fund in the state to the brink of insolvency.

By contrast, the Illinois Municipal Retirement Fund, or IMRF, which covers local-government workers in all Illinois cities except Chicago, is often touted as the model for how to run a defined-benefit plan.

But widespread adoption of the rules governing the IMRF will not solve the broader pension crisis in Illinois. The IMRF suffers from the fundamental problems that plague all pension plans. The IMRF is able to mask its weaknesses, however, because it transfers its financial pain onto Illinois’ municipalities, year after year.

On the surface, IMRF is doing well. The pension system has a funding ratio of 87 percent – by far the highest of any major pension fund in Illinois. By contrast, the Chicago police and firefighter pension funds are each less than 25 percent funded. And the state’s teachers’ retirement fund has just 40 percent of the funds it needs to pay out future benefits.

However, there is a reason IMRF has higher funding levels than the other government-run pensions. Cities are mandated – through a court-enforced funding guarantee – to fund IMRF pensions before everything else, even if that means cutting budgets for road repair, libraries and police and firefighter pensions.

Ironically, that funding guarantee is what many say is so great about IMRF.

The funding guarantee puts taxpayers on the hook for every single shortfall in the pension fund, whether from bad investments, politicians’ mistakes, growing government-worker benefits or the other general failures of defined-benefit plans.

The “guarantee” forces taxpayers, regardless of their ability to pay, to cover the pension failures that have contributed to fiscal crises across Illinois.

Local-government workers, on the other hand, don’t have that problem. The amount they pay to pensions is a fixed percentage of their salaries, so they don’t have to pay more when shortfalls arise.

Here are five things about the IMRF the defenders of the pension fund status quo won’t tell you:

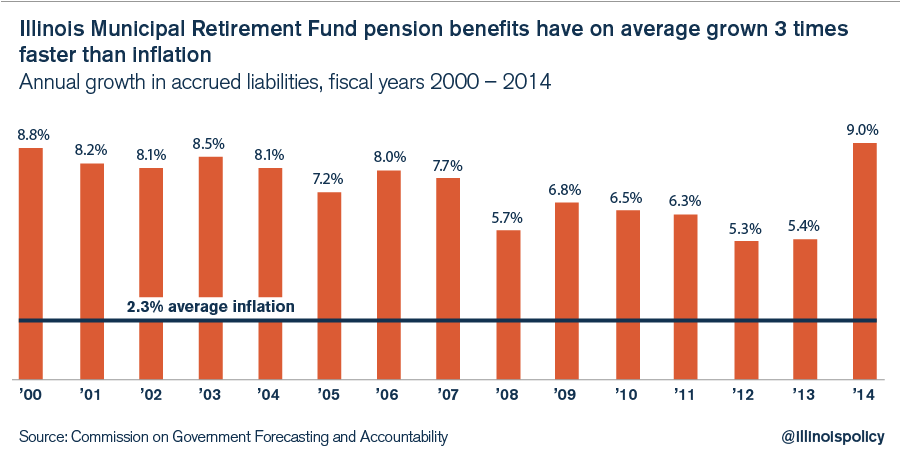

1. IMRF benefits are growing far faster than city budgets and the inflation rate

IMRF accrued pension benefits have been growing at the pace of 7.2 percent a year since 2000, far faster than the 2.3 percent rate of inflation and beyond what city taxpayers can afford.

Since employee contributions for a vast majority of workers are fixed at 4.5 percent a year, this growth in benefits has to be funded by increased contributions from taxpayers.

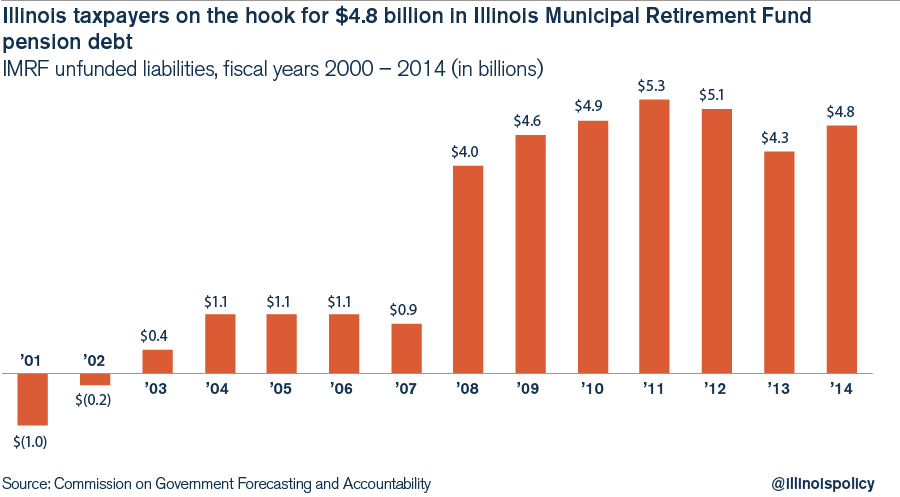

2. An 87 percent funding ratio still means a $5 billion shortfall

In 2000, IMRF actually had a funding surplus. The 2001 market downturn changed that, turning IMRF’s surplus into a shortfall. The 2008 recession made things worse, and the fund’s shortfall grew to $4.8 billion by 2014.

Taxpayers will have to cover that pension shortfall with increased funding.

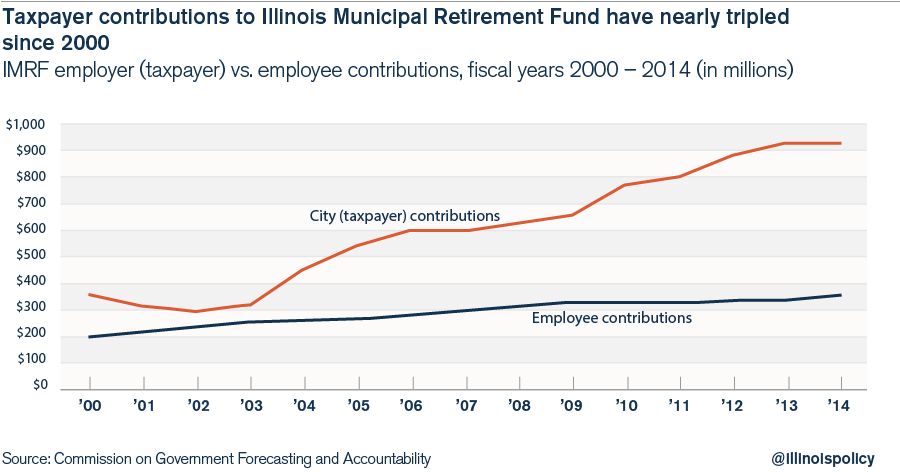

3. Taxpayers contribute far more than employees – and benefits and unfunded liabilities continue to grow

IMRF has demanded more and more money from cities to fund the rapid growth of promised pension benefits as well as to fill the funding gaps left by the 2001 and 2008 stock market corrections.

Employer, meaning taxpayer, contributions to IMRF have grown at the rate of 7 percent a year since 2000, far outpacing local revenue growth and the rate of inflation. Employee contributions, in the meantime, have grown at a significantly slower pace of 4 percent.

Due to this difference, taxpayers contribute far more to the IMRF than the government-worker beneficiaries do. Employers contributed 2.6 times what employees did in 2014, up from 1.8 times in 2000.

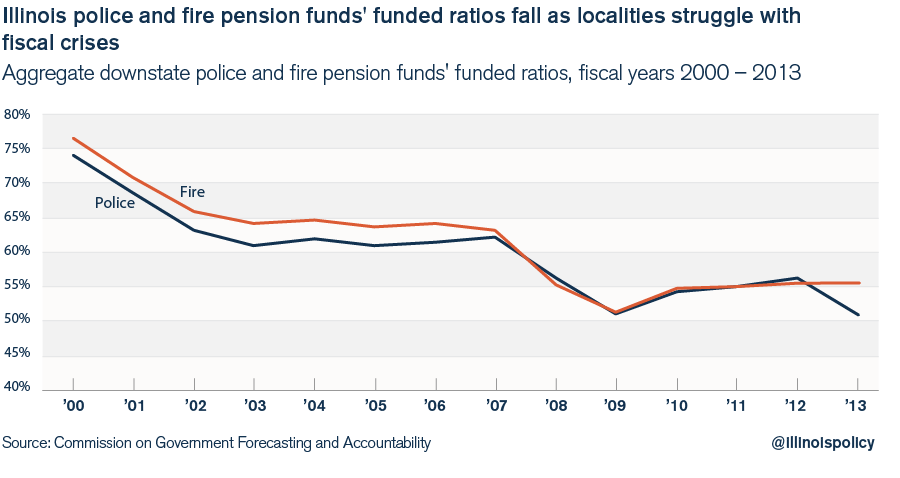

4. IMRF’s funding guarantee pits municipal pensions against local police and firefighter pensions and other services

The rising costs of IMRF liabilities exacerbate the fiscal crises facing hundreds of municipalities across the state.

The money IMRF requires from local employers has to come from somewhere, and cities are increasingly shorting their police and firefighter pension funds, cutting back on local services, and raising taxes and fees to make their IMRF payments.

Downstate police and firefighter pensions are a frequent target of payment cutbacks. Since 2000, the funding levels of police and firefighter pensions have fallen by 20 percentage points. Collectively, the two systems have little more than half the money needed today to pay out future benefits.

Pension costs are consuming more and more of Illinois’ property taxes, which are the highest in the country, according to a study by real estate services firm CoreLogic.

The city of Springfield, for example, now dedicates 98 percent of its city property taxes to pay for its police, firefighter and city-worker pensions.

Other cities have raised taxes and fees to combat rising pension costs. Peoria has added new water and natural-gas utility taxes, and also has doubled its garbage-collection fees to help fund its growing pension commitments.

(Chicago, which is not part of the IMRF, is the most infamous example of a city’s raising taxes and fees in order to fund its broken defined-benefit pension plans).

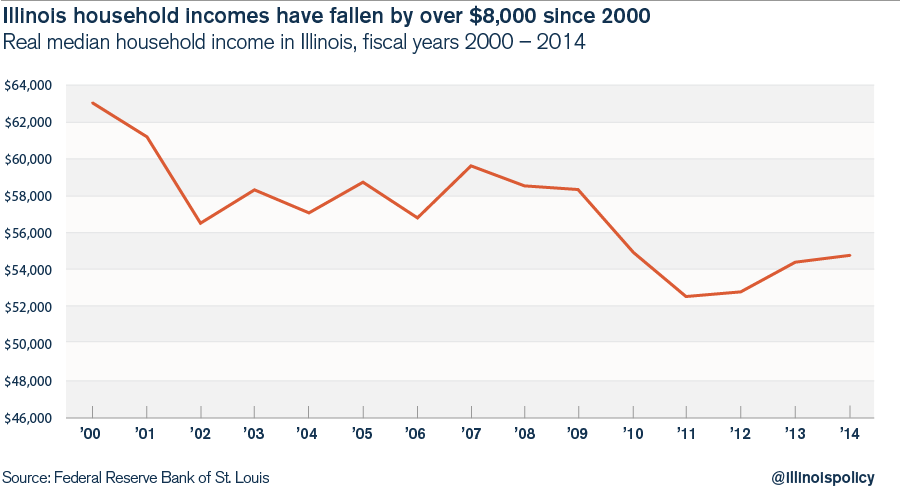

5. IMRF salaries climb, while Illinois household incomes stagnate

IMRF is demanding more and more from cities and their taxpayers at a time when it’s harder than ever for them to make these increased contributions.

Real median household incomes in Illinois have dropped since 2000 and have not yet recovered.

That means cities are struggling to collect revenue from families with less income, while increasing property taxes and cutting local services in order to meet IMRF’s demands for funding.

IMRF is anything but a model retirement system

It’s wrong to tout the IMRF as an example of a successful pension system.

The pension fund’s relative fiscal health is only due to the fact it can force localities to fund it at the expense of those communities’ local vital services.

Cities’ fiscal crises will only end when they are no longer subject to the instability of defined-benefit pension plans and these systems’ funding guarantees.

Some claim the failures of Illinois’ multiple pension plans prove Illinois pensions need funding guarantees and other controls. But simply throwing more and more revenue at broken pension systems won’t solve the problem. IMRF’s funding guarantee is evidence that forcing municipalities to pay for pensions above all else crowds out funds for core government services.

Pension systems are inherently political, opaque and void of accountability. As long as politicians maintain control over pensions, they’ll always find ways to exploit them and pass on the costs to taxpayers.

The solution, along with a slate of other important reforms, is to provide Illinois workers with a real funding guarantee in the form of self-managed retirement plans, giving both taxpayers and localities more budget certainty and granting workers the retirement security they deserve.