Illinois property taxes highest in the US, double national average

Illinois homeowners are struggling under the weight of the nation’s highest property-tax bills, according to a new analysis.

When it comes to Illinois taxes, home is where the hurt is. For many families, property taxes have become a second mortgage they can never pay off.

A study released April 27 by global real-estate services company CoreLogic shows Illinoisans face the highest median property-tax rate in the nation at 2.67 percent. This means a typical Illinois homeowner with a house worth $200,000 will pay $5,340 in property taxes each year.

That’s double the national median, according to the study.

CoreLogic’s report follows a November 2015 prediction from the nonpartisan Tax Foundation that the Land of Lincoln would soon be home to the highest property taxes in the U.S.

It’s not a pretty picture. Some Illinois homeowners are paying more in property taxes than they do on their mortgages.

Take Cassandra Bajak, a lifelong Illinoisan and mother of two. Bajak and her husband, an Army veteran, built their Crystal Lake home in 2002. Their children were born and raised there.

Over the last 13 years, the Bajaks’ property-tax bill has doubled. They now pay $1,500 a month in property taxes and insurance. Their mortgage payment is $1,100 a month.

“We’re being taxed out of our home,” Cassandra said.

“It’s basically like we’re renting our home from the government. [The rate] is well over 4 percent of what the house is worth. The only reason we would ever leave our home or this state is property taxes, and that’s what’s going to happen.”

Bajak said she and her husband plan to move their family to Florida within the next two years. Her reasoning is straightforward: “Taxes are less, and schools are the same,” she said.

A disturbing trend

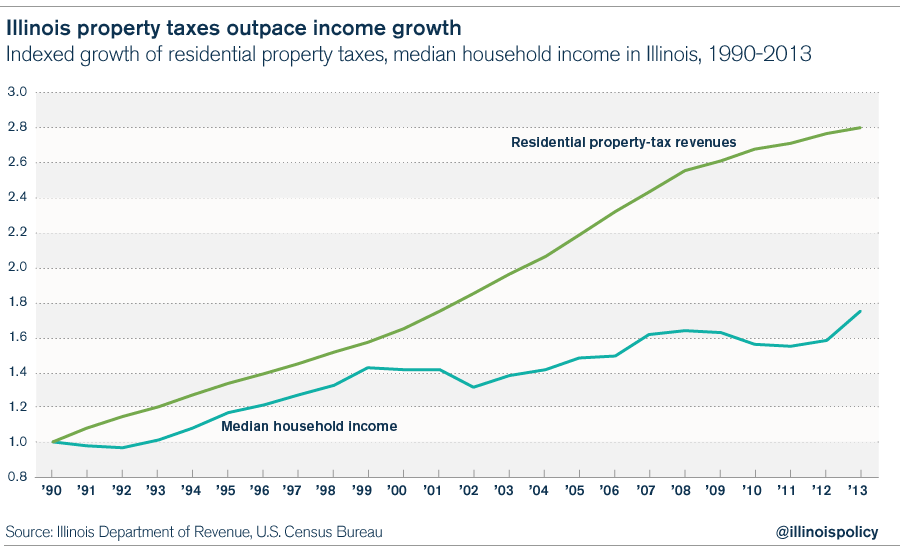

The pace and scale of property-tax growth over the last few decades in Illinois is overwhelming. Since 1990, residential property taxes have grown 3.3 times faster than the state’s median household income.

Simply put, Illinoisans’ property taxes are going up while salaries are stagnant at best.

Illinois Policy Institute research shows nearly every Illinois county has seen dramatic increases in its residents’ average property-tax burden since 2000.

Residential property taxes now eat up an average of 6.4 percent of typical household income in Illinois. In 1990, that share was 3.6 percent. In this shift lies the pain currently felt by Illinoisans whose family budgets have been thrown into disarray.

Follow the money

When it comes to property taxes, four main factors drive the pinch felt in Illinois pocketbooks: government-worker pensions, government-worker health care, prevailing-wage requirements and workers’ compensation costs.

These four factors are all multiplied by the sheer number of taxing bodies in Illinois – at nearly 7,000 – each with its own staffing and programming costs. No U.S. state comes close to Illinois on this number.

Take government-worker pension benefits, for example, which are mandated at the state level, regardless of whether local governments can afford them.

Prevailing-wage laws levy another massive blow to local governments’ bottom lines. These laws can mandate six-figure salaries and benefits for the lucky private-sector employees who work on government projects.

And for an illuminating example regarding workers’ compensation costs, look no further than Williamson County. The county has spent $2.7 million on workers’ compensation claims over the last three fiscal years, nearly four times as much as the previous three-year period.

“[S]ome of this is frivolous,” said Chief Deputy Bob McCurdy, according to The Southern Illinoisan. “We need to make an example of somebody.”

County Board Chairman Jim Marlo echoed McCurdy’s concerns, describing the costs as “eating away” at the county budget.

“It is a system that[’s] easily manipulated in this state and until you get legislative action to change the way claims are handled, the way insurance handles and the way courts handle it, we are going to be faced with this problem,” Marlo said.

Cutting property-tax bills

Illinois politicians in the House of Representatives voted down sorely needed property-tax relief for all Illinois homeowners April 20.

House Bill 695 would have slowed the growth of property taxes across the state by only permitting local governments to increase rates through voter approval. Because this bill would’ve affected home-rule governments, it needed 71 votes to pass, but failed 56-49, with four representatives voting present. More than a dozen Republicans voted no on the measure.

But on April 21, the House approved property-tax relief for some Illinoisans – those who don’t live in home-rule communities. House Bill 696 is nearly identical to HB 695, except it exempts all home-rule communities. Nearly 8 million Illinoisans live in a home-rule municipality such as Chicago, Naperville or Peoria.

Illinoisans need more than a freeze, however, to reduce property-tax bills.

First, cutting down the nearly 7,000 units of government in Illinois requires aggressive action, especially for Illinois’ glut of school districts, which suck money out of the classroom to pay for excessive administration costs.

Additionally, local governments need more flexibility in controlling costs. Allowing cash-strapped localities to narrow the scope of collective bargaining agreements and to take less expensive bids for government work would be a major step forward.

When it comes to skyrocketing, unsustainable pension costs, Illinois’ local governments must also be empowered to take control of their fiscal futures by filing bankruptcy. Workers’ compensation reform to bring Illinois’ out-of-whack costs in line with those of surrounding states is another essential piece of the puzzle.

Local leaders in Illinois must actively avoid the ignominious title of the nation’s leader in taxing homeowners.

Sign the petition

Demand property tax relief

It's time for homeowners to take control of property taxes in Illinois. Sign the petition to freeze property taxes.

Learn More >