Illinois Supreme Court ruling could give state workers more retirement options

Concept of “consideration” allows state workers to negotiate for new benefits and could pave a path toward pension reform.

When the Illinois Supreme Court struck down Chicago’s pension-reform bill in March, it seemingly put a nail in the coffin for major pension reform in Illinois.

The Chicago bill was a modest reform measure meant to provide relief to a city that is quickly heading toward bankruptcy. Barring future reforms, Chicago taxpayers will be forced to face billions in new taxes over the next 30 years.

But while the ruling blocked that specific pension law, it opened the door for other changes.

The state Supreme Court addressed the concept of “consideration,” noting that government workers have the option to accept a reduction in their pension benefits “for consideration” – that is, in exchange for some new or different benefit.

The court acknowledged that “nothing prohibits an employee from knowingly and voluntarily agreeing to modify pension benefits from an employer in exchange for valid consideration from the employer.”

That’s certainly good news for government workers who feel trapped in a plan that may be bankrupt when it’s their turn to draw a pension.

Consider a young Chicago policewoman who belongs to the Chicago police pension fund. That fund has only 25 percent of the money it needs today to meet its future obligations. It’s effectively bankrupt. Without major pension reform, that fund will likely run out of money in the next decade.

But pursuant to the concept of consideration, the Chicago worker, or her union, would have the right to negotiate an alternative retirement plan for her benefits going forward.

In other words, workers could gain more choice, control and certainty over their retirement future.

Currently, there’s only one group of workers in Illinois – state-university employees – with any control over their retirements. For more than 15 years, members of the State Universities Retirement System, or SURS, have had the option to enroll in 401(k)-style self-managed plans, or SMPs, instead of the standard pension plan.

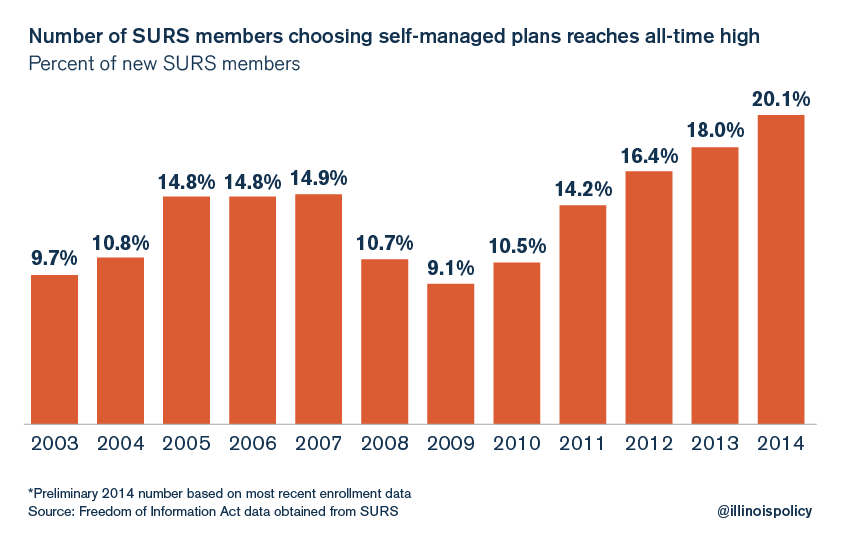

As of 2015, more than 19,000 SURS members have opted to manage their own retirements through the SMP. In fact, a record 20 percent of new SURS employees chose the SMP over the SURS pension plan in 2014.

That group of workers doesn’t have to worry about pension mismanagement or the potential bankruptcy of its plan. Instead, each worker’s money is in an individual account he legally owns and controls. Illinois House Speaker Michael Madigan and the General Assembly can’t touch it.

The Supreme Court’s recent ruling and its discussion of providing and accepting new or different benefits as consideration opens the door to crafting reform plans that offer the same choice that SURS workers have today.

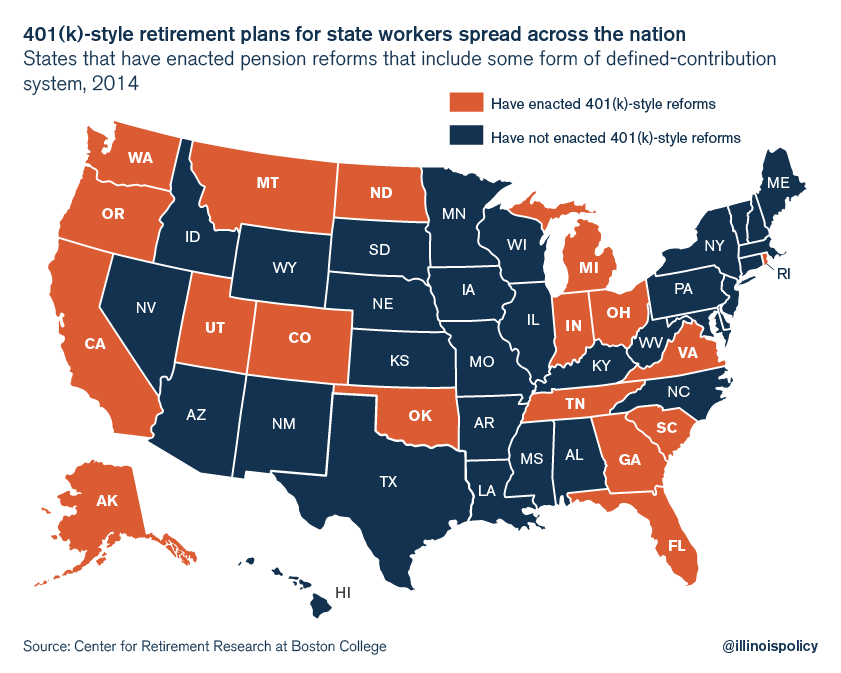

Illinois would not be alone in adopting 401(k)-style retirement reform. Many other states, including Michigan, Rhode Island and Oklahoma, have moved forward and given their workers more options.

Illinois university workers shouldn’t be the only government workers free to control and own their own retirement plans. Teachers, firemen, policemen and other laborers should have that right, too. The Supreme Court’s recent ruling might just allow that to happen.