New bill would make Illinois gas taxes highest in the nation

A new 30-cent-per-gallon tax hike would make Illinois gas taxes the highest in the nation by far, and pour more money into a broken system.

The Metropolitan Planning Council, or MPC, unveiled a 10-year, $43 billion plan April 4 to fund state and local roads, public transportation, railways and “new and large-scale projects of all types” across Illinois.

How will the MPC fund such a plan in a state that can’t pay its bills? Easy: Massive tax and fee hikes. Illinois state Sen. Heather Steans, D-Chicago, has filed a bill to this effect.

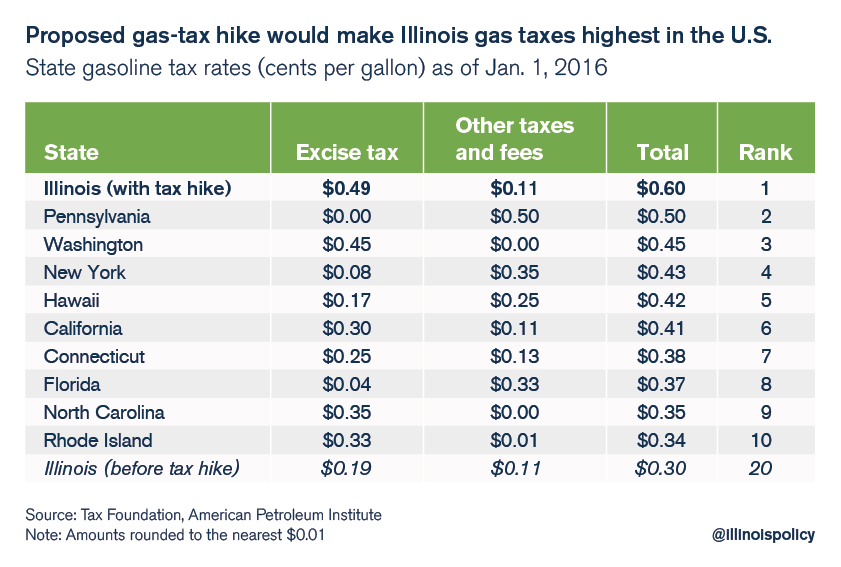

Senate Bill 3279 would impose a 30-cents-per-gallon hike in motor fuel taxes. This would bring Illinois gas taxes to a whopping 60 cents per gallon – far and away the highest rate of any state, according to the Tax Foundation.

Without the hike, Illinois ranked No. 20 as of Jan. 1, 2016, largely because of low gas prices. When prices rise, the Illinois gas-tax structure hits drivers harder than gas taxes in almost any other state. In 2014, for instance, Illinoisans were paying the eighth-highest gas taxes in the nation.

SB 3279 would also hit drivers with a 50 percent hike in the state’s vehicle registration fees, which now cost $101 for a car or truck. The MPC estimates its plan will cost the average person nearly $150 a year.

But before looking to whack Illinoisans with tax and fee hikes, policymakers would be wise to look at the cost drivers behind public construction projects in Illinois.

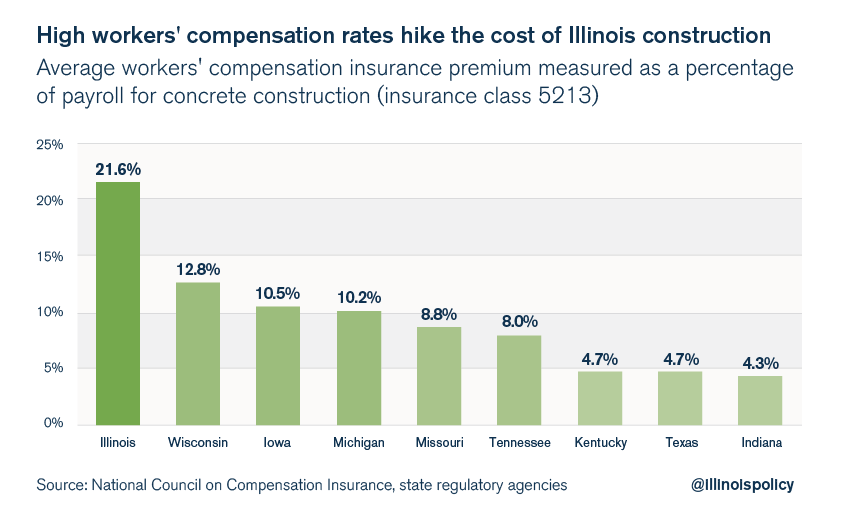

The Land of Lincoln is home to the highest workers’ compensation costs in the Midwest. Take concrete construction, for example, an essential part of work on roads and bridges. The average workers’ compensation insurance premium is nearly 22 percent of payroll for this industry in Illinois. In neighboring Indiana, workers’ compensation costs total a little over 4 percent of payroll.

In other words, for every $1 billion spent on labor for concrete construction, Illinois spends an extra $173 million in workers’ compensation costs alone, compared with Indiana. This is a prime example of how wrong Illinois House Speaker Mike Madigan is when he characterizes workers’ compensation reform as “nonbudgetary,” and thus not worthy of serious discussion.

Prevailing-wage requirements, which are hourly minimum wages placed on government contracts for public work, are another cost driver. If the government funds any part of a project, contractors are required to pay wages set by the Illinois Department of Labor. These workers are paid more than their private-sector counterparts, who are often the very people footing the bill.

In DuPage County, for example, taxpayers are required to pay the equivalent of $128,000 in salary and benefits for a typical laborer on a public project. DuPage County governments must pay carpenters the equivalent of $146,000 in salary and benefits.

Repealing prevailing-wage requirements so governments can bargain more effectively on behalf of taxpayers and bringing workers’ compensation costs in line with peer states would do a world of good for infrastructure spending in Illinois.

Until then, taxpayers should balk at talk of new revenue.