Chicago Public Schools sells $725M in bonds with 8.5% interest rate

The district’s borrowing does take pressure off of the district’s immediate cash-flow problem. However, it does nothing to solve the CPS’ long-term financial crisis and its structural imbalances – in fact it only makes things worse.

Chicago Public Schools, or CPS, just found out the price of its long history of financial mismanagement: punishingly high interest rates and a lack of appetite from lenders.

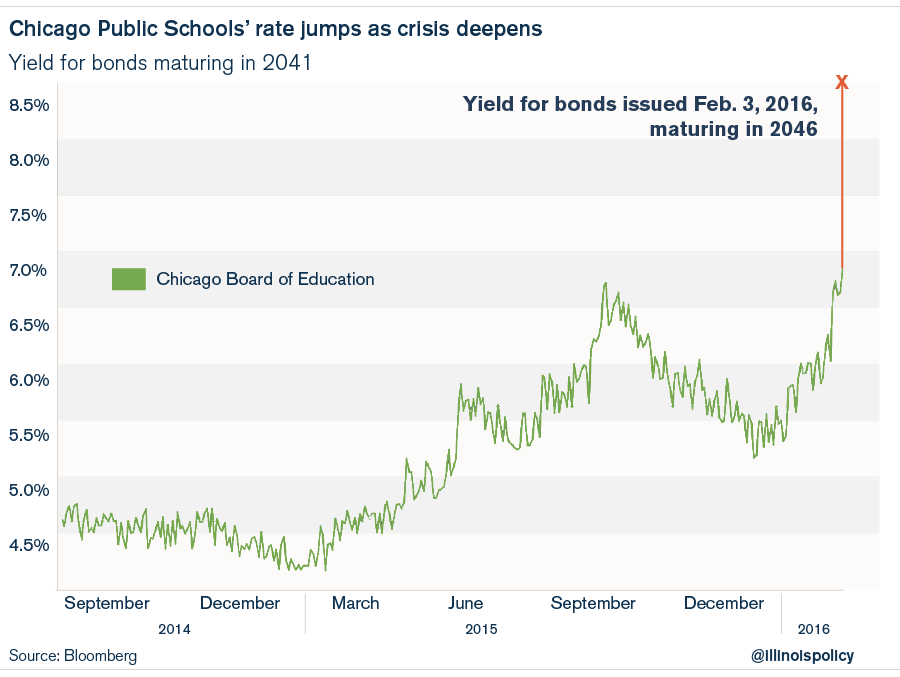

CPS borrowed $725 million on Feb. 3 to refinance old debt and to prop up the district’s deficit-filled budget. The bond issue was a postponed a week earlier due to investor concerns over the district’s fiscal condition.

CPS will pay an extraordinarily high interest rate of 8.5 percent on its tax-exempt bonds, 5.8 percentage points higher than the 2.7 percent interest that triple-A institutions pay.

And despite those massive interest rates, the district only managed to sell $725 million out of an originally expected $795 million in tax-exempt bonds, demonstrating that CPS couldn’t attract enough investors to meet its needs.

The outcome of the Feb. 3 sale is not surprising, as the nation’s three leading ratings agencies have downgraded CPS’ credit repeatedly – deep into junk status.

The district’s borrowing does take pressure off of the district’s immediate cash-flow problem. However, it does nothing to solve CPS’ long-term financial crisis and its structural imbalances – in fact it only makes things worse.

If the district can’t get its structural finances in order, more teacher layoffs, more school closings and large tax increases on Chicagoans are likely.

To avoid that outcome, the district must enact spending reforms; it can no longer continue to kick the can down the road and push massive debts onto the backs of Chicago’s children.

Ending teacher pension pickups is a good first step. But there is much more the district needs to do, such as standing firm on the current negotiations with the Chicago Teachers Union while demanding reasonable concessions, such as a salary freeze.

CPS must also enact reforms that will help stabilize the district’s finances, such as empowering government workers with 401(k)-style retirement plans.