GE rejects Chicago as home for corporate headquarters, cites pension debt

General Electric will move its corporate headquarters and 800 jobs to Boston, Mass., from Fairfield, Conn., noting its concerns about Chicago’s government-worker pension debt in its rejection of the Windy City.

General Electric rejected Chicago as the new home for its corporate headquarters, announcing on Jan. 13 that it had chosen to relocate its headquarters and 800 jobs to Boston, Mass., from Fairfield, Conn. Chicago was a finalist for GE’s new headquarters location.

One of the key reasons GE rejected Chicago? Too much pension debt, according to Chicago Tribune sources.

“It seemed too big of a risk,” the source told the Chicago Tribune. “That played into the decision to take Chicago off the short list.”

The condition of the Chicago Public Schools, or CPS, was also one of the key factors in the decision.

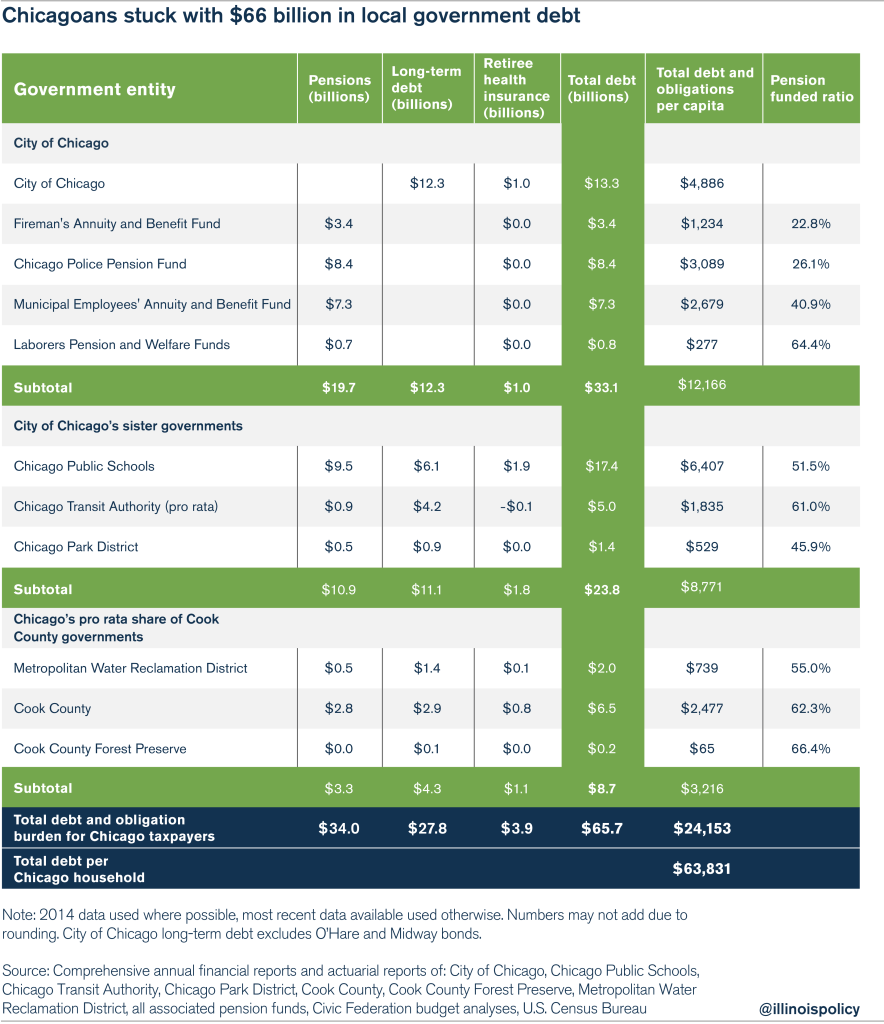

GE’s concern over government-worker pension debt reflects the growing threat of bankruptcy for both the city of Chicago and CPS. The city of Chicago has more than $20 billion in pension debt and another $13 billion in long-term debt (excluding O’Hare and Midway airports debt).

But also affecting the decision of many companies to locate in Chicago is the additional debt of the city’s overlapping governments, including the school district, the city park district and various Cook County governments.

When added together, Chicagoans’ share of that debt totals more than $66 billion. That means nearly $64,000 in future taxes for each Chicago household just for debt-related costs. That figure does not include the taxes needed to operate the city on a yearly basis. Nor does it include Chicagoans’ share of the state’s $111 billion pension shortfall.

Chicago politicians have already hiked taxes to pay for this pension debt. Chicago recently raised its taxes by more than $700 million annually, while Cook County increased its sales tax by 1 percentage point, pushing Chicago’s combined sales-tax rate to 10.25 percent, the highest sales-tax rate in the nation.

Financial institutions are very much aware of Chicago’s financial stresses. Moody’s Investors Service has downgraded the city’s credit four times since 2013, knocking it down seven spots to junk-bond status.

This, along with CPS’ own collapse into junk territory, has created unprecedented panic and distress for the city and CPS as they struggle to repay and refinance current obligations. In June, CPS announced planned layoffs of 1,400 employees as a result of increased pension contributions the district is required to make in the 2016 fiscal year. Those layoffs follow more than 3,000 pink slips and the closure of nearly 50 schools since 2013.

GE’s focus on Chicago’s fiscal squeeze should come as no surprise. Any corporation doing its homework can recognize that the city struggles to maintain the delivery of its core services.

GE did provide a consolation prize for Chicago. The company announced Jan. 11 that GE Healthcare would move its headquarters to Chicago from the U.K. Only the “senior executive leadership team” was expected to make the move. That’s hardly the jobs boost that ordinary Chicagoans desperately need.

The fact that a company as prominent as GE has cited pensions as a reason to avoid Chicago should sound alarm bells for everyone. Every business, entrepreneur and resident is making the same calculation.

It will take bold reform to restore confidence in the city’s future. Bold reform means an overhaul that ends pensions – while protecting what workers have already earned – and empowers government workers with 401(k)-style retirement plans. And it means reining in spending and opening up union contracts to negotiate levels of benefits and wages that are in line with what Chicago taxpayers can afford.

That’s the fiscal path Chicago needs to take if it wants to keep its residents and attract more jobs.