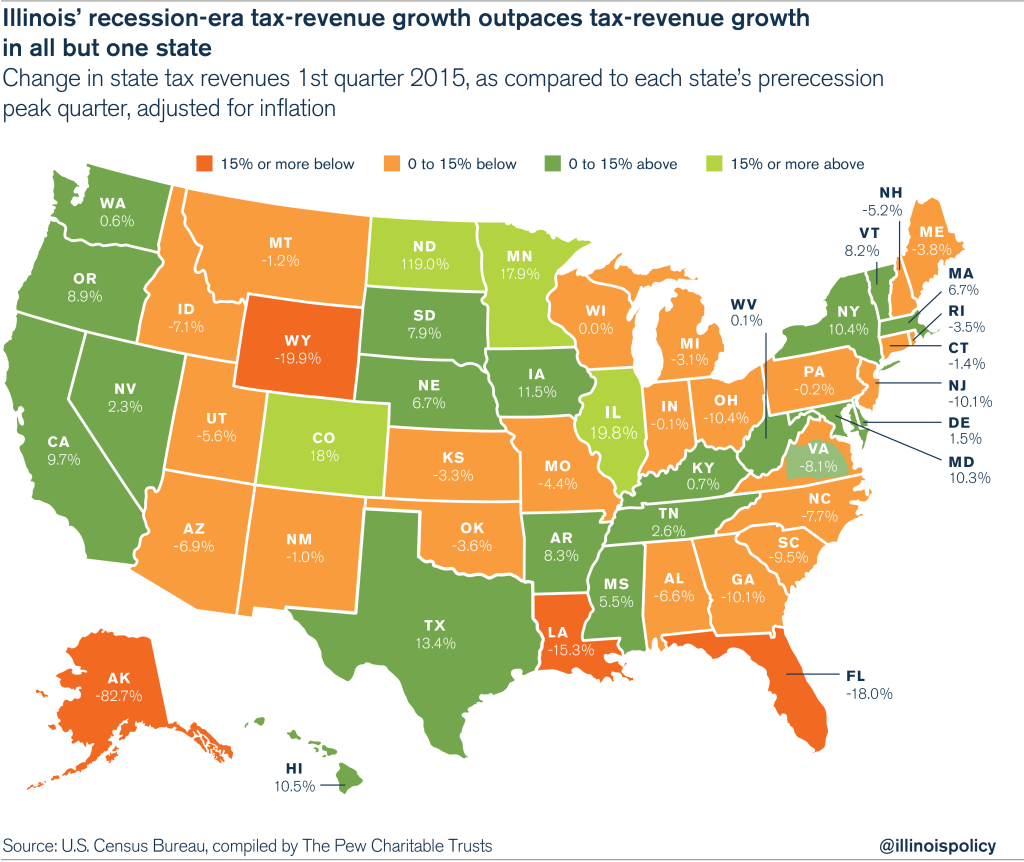

Illinois’ tax revenues increased more than those of any state but North Dakota since Great Recession

A new study from The Pew Charitable Trusts shows that Illinois’ tax revenues are up by 20 percent over their pre-Great Recession peak, debunking the oft-repeated mantra that Illinois is just one more tax hike away from solving its fiscal problems.

Illinois has a spending problem, not a revenue problem – and a new study from The Pew Charitable Trusts confirms that fact. The study shows that as of the first quarter of 2015, Illinois’ tax revenues had grown by almost 20 percent over tax receipts from just prior to the 2008 recession, which is more than any other state except North Dakota.

Even with Illinois’ 2015 income-tax reduction partially factored into the equation, Illinois’ Great Recession-era tax-revenue growth still outpaces that of all states around the Land of Lincoln. In fact, Michigan, Indiana and Missouri are still operating with tax revenues lower than their pre-Great Recession peaks, while Wisconsin and Kentucky are now essentially even with their third-quarter 2008 collections.

The Pew research report is an update on the same report from the third quarter of 2014, which showed tax revenues in Illinois up 22.5 percent over prerecession highs, while 30 other states were collecting less tax revenue than they were before the Great Recession began.

The Pew report belies the oft-repeated mantra that Illinois is just one more tax hike away from solving its fiscal problems. Illinois has already raised taxes more than almost all other states, and has little to show for it. The state’s budget is still a mess, no major spending reforms have been enacted, and Illinois’ reckless tax-and-spend policies have helped suffocate job creation in the state.

The Pew report does not factor in local-government tax collections, but if the study included them, Illinois’ tax collections would likely be even higher – and climbing – as Chicago and Cook County prepare to impose massive tax increases.

Illinois needs tax and spending reform to limit the growing burden on taxpayers. One clear example of such a reform is House Bill 4224, which would cap local property taxes while also providing local governments the ability to control the spending that drives taxes. HB 4224 reforms government-worker collective bargaining and exempts local governments from certain prevailing-wage laws, which dramatically increase the cost of government construction projects.

State government also needs to address key areas of spending reform, starting with Illinois’ unsustainable government-worker pension systems. Illinois’ escalating pension crisis has been obvious for years, and in the absence of a pension-reform bill that can pass constitutional muster, lawmakers should submit a constitutional amendment to voters so Illinoisans can decide whether to alter not-yet-earned pension benefits of government workers going forward.

The Pew report should give all Illinois politicians pause; they should realize that calling for tax hikes without addressing spending is doubling down on a failed policy.

If other states can live within their means, then Illinois can too. Illinois politicians must stop crying poor and realize the state’s coffers have already been fattened with more new tax revenues than those of almost any other state.