New IRS data show heavy drain of residents and income from Cook County

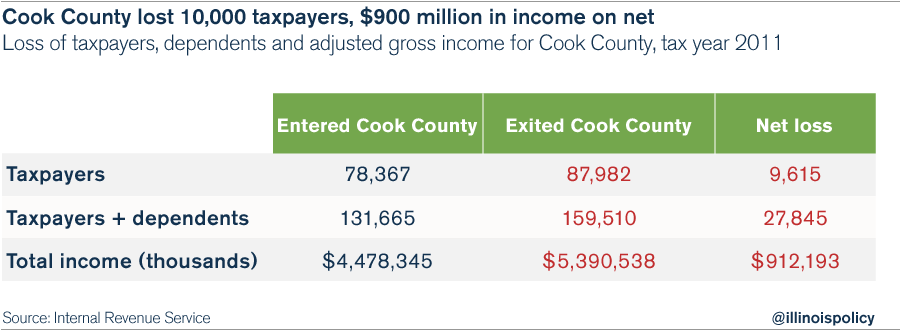

Cook County said goodbye to nearly 10,000 more taxpayers than it welcomed in tax year 2011.

As Chicago seeks to plug a gaping hole in its city budget, city leaders should also focus on the gaping hole in Cook County’s tax base.

Taxpayer exodus in a single 12-month period – tax year 2011 – will cost the city more than $9 billion in taxable income over the next decade, according to a July 31 migration data release from the Internal Revenue Service.

In that period alone – the first year of Illinois’ historic 67 percent income-tax hike – Cook County lost 9,600 taxpayers and 18,000 dependents on net, which means the county lost nearly 28,000 more people than it gained. These taxpayers took their earnings with them to the tune of more than $900 million in adjusted gross income for the year.

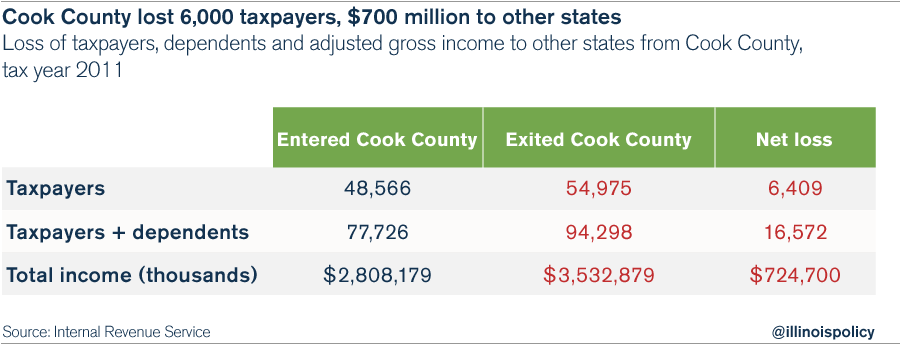

Most people who left Cook County headed to other states entirely, taking $700 million in adjusted gross income across the Illinois border.

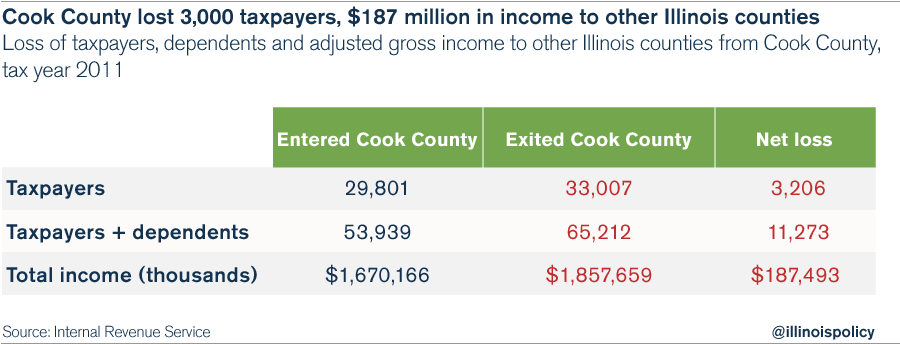

Others simply crossed county lines. Cook County lost close to $190 million and more than 3,200 taxpayers to other Illinois counties in tax year 2011.

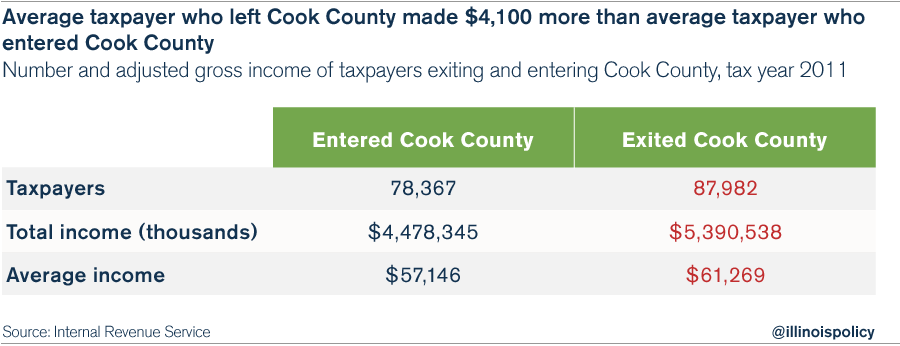

Another troubling takeaway from the IRS data is the fact that those leaving the county earned more than those who entered, on average. The average taxpayer entering the county took home $57,146 annually while the average out-migrant took home $61,269 – a difference of more than $4,100.

Chicago’s population is the same as it was in 1920, and census data suggest Houston will overtake the Windy City as the nation’s third-largest metropolis in a mere 15 years. When each Chicago household is on the hook for more than $63,000 in local-government debt, it’s no wonder they’re packing up and shipping out. Taking hundreds of millions in new tax dollars from residents’ pockets to pay for services already rendered doesn’t scream “bang for your buck.”

Yet discussion in City Hall is still focused solely on new revenues, when the blaring budgetary problem that needs attention is taxpayer flight. As is the case at the state level, pro-growth reforms must be on the table when discussing budgetary issues. To think the two are unrelated is a disservice to residents who choose to stick around and fight another day.

Note: IRS migration data should not be confused with U.S. Census Bureau migration data. The IRS data are an important input for the Census Bureau’s data, but the census data usually show larger changes in the number of people moving. This is because IRS data capture only taxpayers and their dependents, while the Census Bureau also estimates the movement of people who are not filing taxes, such as new students out of college.