Illinois lawmakers propose 59 new unfunded mandates for local governments

State lawmakers should first focus on ways in which they can give local governments more autonomy, rather than adding to the hundreds of unfunded mandates municipalities currently face.

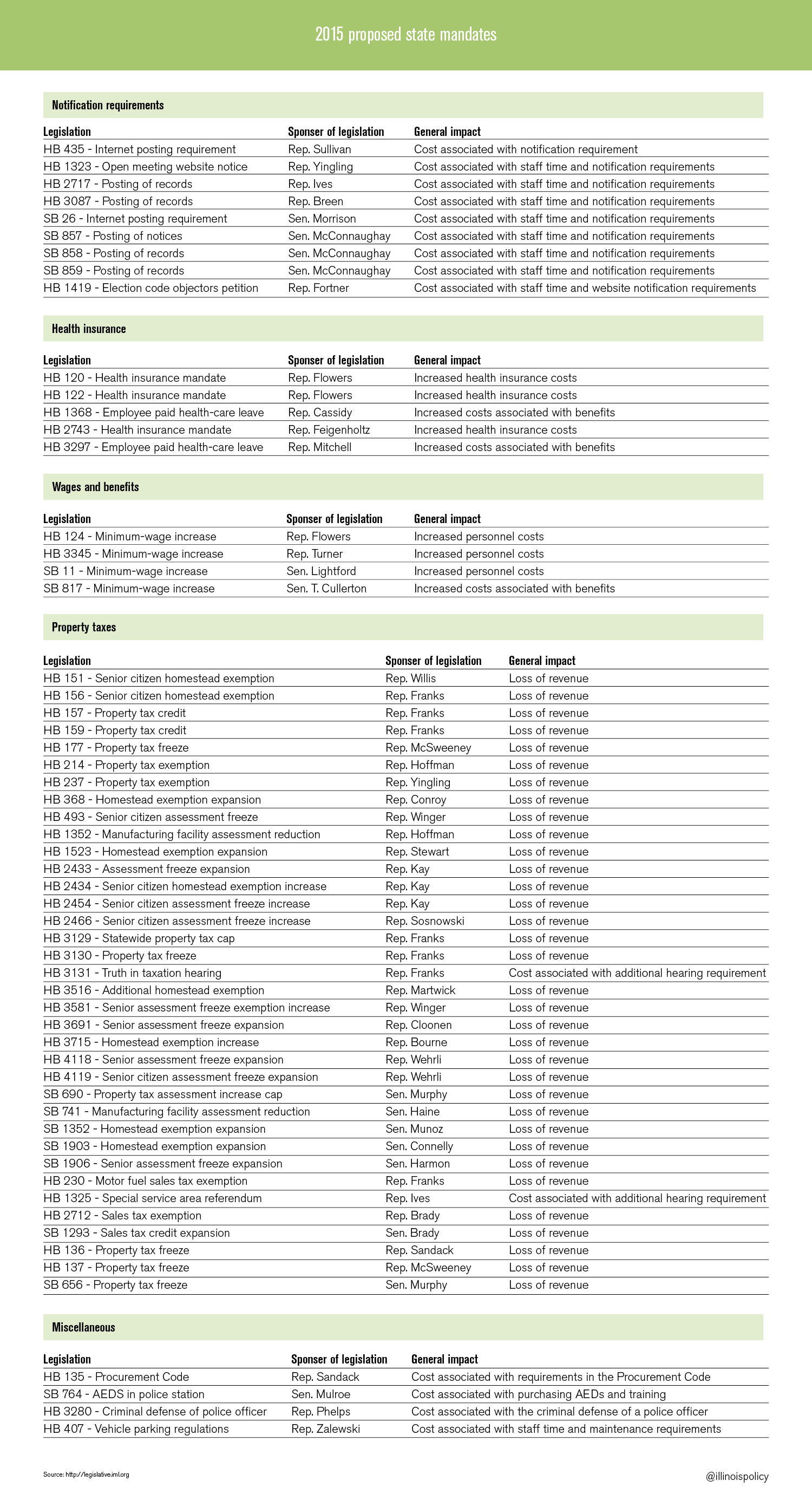

Illinois lawmakers introduced 59 new unfunded mandates during the current legislative session, according to the Illinois Municipal League, or IML. Some of these proposals could have costly implications for cash-strapped local governments across the state. But others look to provide much-needed property-tax relief and empower residents to hold local governments accountable.

Illinois Policy Action supports some of the proposed bills such as those that seek to enhance government transparency at the local level and cap property taxes.

But others are costly mandates for local public-employee benefits, such as paid health-care leave and an expansion of firefighter pension benefits. Rather than being imposed through one-size-fits-all state mandates, these types of decisions regarding benefit levels are best left to local governments.

Local governments in Illinois already face hundreds of unfunded mandates. Before debating which items should or shouldn’t be added to that list, state lawmakers should first focus on ways in which they can give local governments more autonomy.

The problem in Illinois is local governments have little control over how they operate. The state mandates the type of retirement benefits local governments are allowed to offer their employees. The salaries that determine those benefits are often determined in arbitration – a process that usually ends in expensive salary increases. Even the wages local governments are required to pay for small projects, such as painting an office, are determined at the state level through prevailing wage requirements.

Many of these unfunded mandates are limiting the control local governments have over their own budgets and budgeting processes.

Local governments should be allowed to structure themselves in a way that best meets the needs of their budget, taxpayers and public employees. And the state should allow them to do so. Eliminating some of these unfunded mandates would be a good place to start.