Repealing Illinois’ economic loss leaders

State lawmakers from both parties are advancing legislation to repeal three of Illinois’ most costly and misguided policies.

Illinois has three business taxes and fees that bring in very little in terms of revenue, but stand out as major drivers of economic losses for the state. The three loss leaders are: the corporate franchise tax, which hurts small businesses with compliance costs; limited liability company fees, which rob low-income entrepreneurs of startup capital; and the state’s death tax, which shrinks Illinois’ GDP and drives wealth out of the state.

But there’s good news for Illinois entrepreneurs and small businesses: State lawmakers from both parties are pushing bills to slash and repeal all three of these misguided policies.

State Rep. David Harris, R-Arlington Heights, has introduced HB 391 to repeal Illinois’ corporate franchise tax. This tax hits entrepreneurs when they start up a new corporation by taxing the investment of “paid-in capital” in the state of Illinois. The direct effect of this tax is to disincentive investment in Illinois. The damage is repeated each year when small business owners are forced to spend hours upon hours calculating a complicated tax formula to determine their franchise tax liability, which ends up amounting to less than $100 for 95 percent of all Illinois corporations.

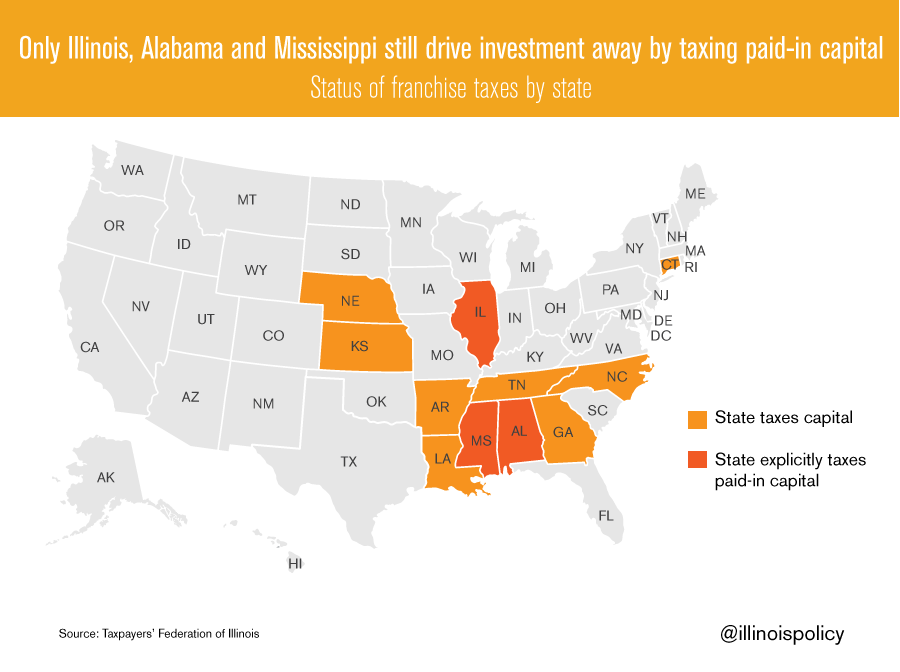

The franchise tax is an outdated economic loser. It likely causes more economic waste in terms of compliance, collection and administrative costs than it raises for the state in revenue. Illinois is one of only three states – along with Mississippi and Alabama – that continues to tax “paid-in capital.” All other states have modernized their business tax codes over the last 100 years. In Illinois, instead of throwing out the franchise tax when the corporate income tax came along, the state kept both taxes.

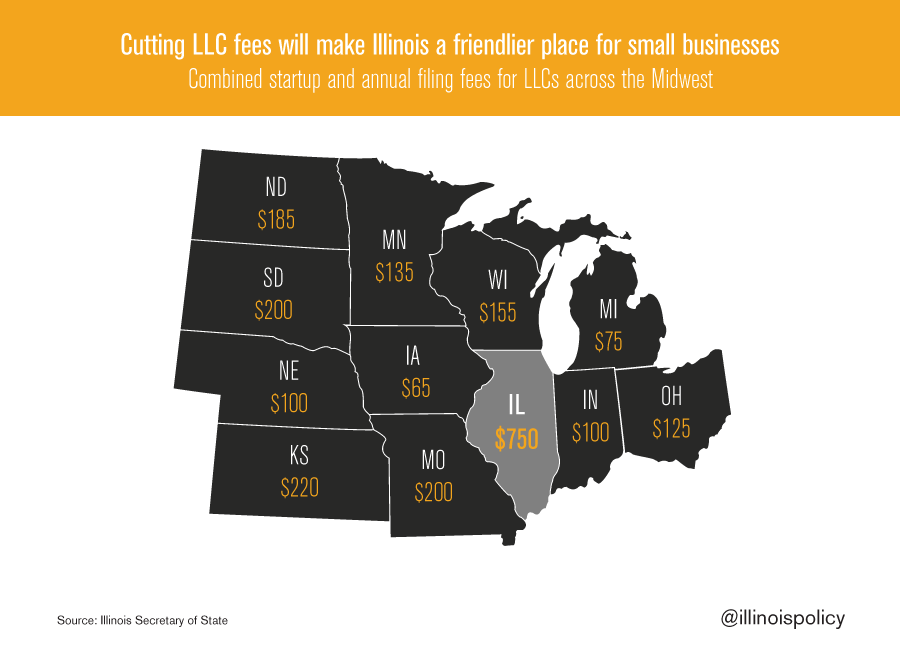

Illinois’ next loss leader is the state’s limited liability company, or LLC, fee schedule. State Rep. Carol Sente, D-Vernon Hills, has filed HB 325 to fix Illinois’ broken LLC fee schedule. Aspiring entrepreneurs are charged $500 just to start an LLC in Illinois, compared to a $150 startup fee for Illinois corporations. This represents a painfully high barrier to entry for Illinois entrepreneurs who don’t have much startup capital. LLC owners are then hit every year for a $250 filing fee simply to mail in their annual paperwork. These startup and annual filing fees are the highest in the region, making Illinois the most expensive place for an entrepreneur to file basic paperwork.

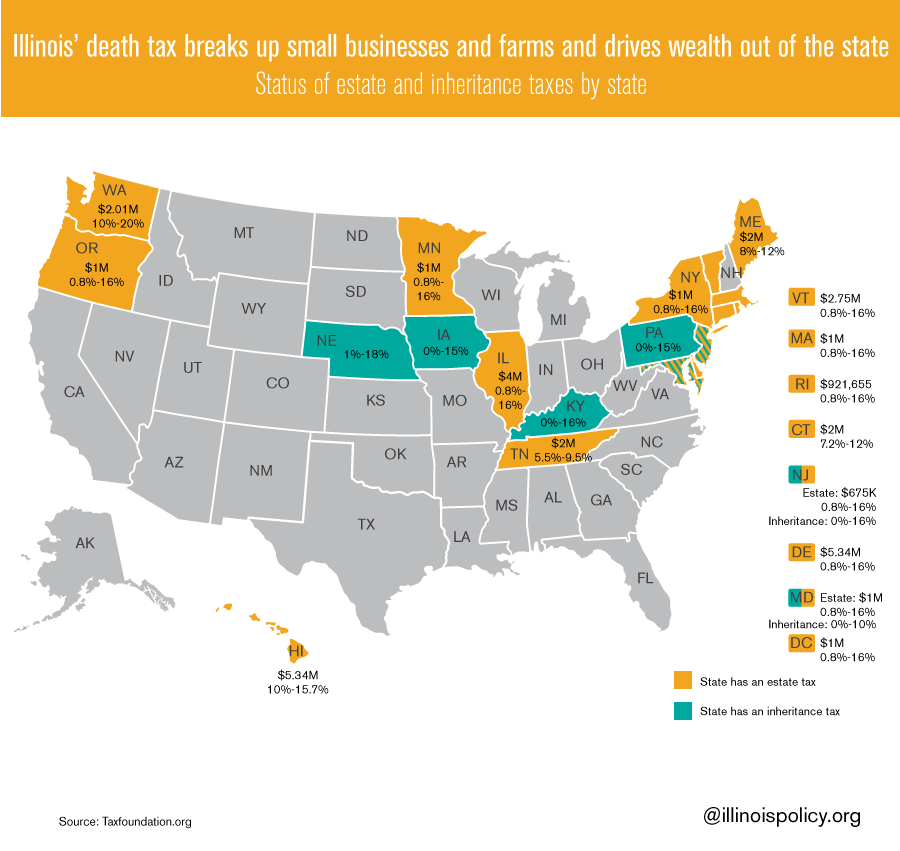

Finally, state Rep. Ed Sullivan, R-Mundelein, has introduced HB 434 to repeal Illinois’ death tax, a major loss leader that hits second-generation entrepreneurs who take over a family farm or small business. These small businesses and farms that are passed down through generations form the backbone of any economy, and provide stability and consistent job opportunities. However, Illinois’ death tax takes a chunk of family businesses and farms each time they are passed down across generations, putting them at a major disadvantage compared to corporations.

The nonpartisan Tax Foundation estimates the death tax costs the U.S. $5 in GDP for every $1 it raises in tax revenue. That is because the death tax breaks up family farms and businesses, hurting local communities and causing a ripple effect of economic damage. The result is even worse for a state-imposed death tax like Illinois’, because it creates a major incentive for business owners to leave Illinois altogether. Illinoisans have been doing just that, leaving the Land of Lincoln in record numbers.

This set of legislative ideas represents a tremendous step forward for helping entrepreneurs and small business pursue their dreams and create more opportunities in Illinois. Fixing these loss leaders would add hundreds of millions of dollars of annual GDP in Illinois, create more investment and jobs, and leave more energy and ingenuity in the state economy.