Are you ready to pay $5,000 in higher taxes?

The average Illinois family will be forced to pay thousands of dollars in higher taxes if Gov. Pat Quinn has his way. Illinois state government is predicting it will collect about $34.9 billion in tax dollars next year. So naturally, that’s how much Illinois state government plans to spend next year, right? Wrong. Quinn is...

The average Illinois family will be forced to pay thousands of dollars in higher taxes if Gov. Pat Quinn has his way.

Illinois state government is predicting it will collect about $34.9 billion in tax dollars next year. So naturally, that’s how much Illinois state government plans to spend next year, right? Wrong. Quinn is pushing a budget for next year that spends more than $38 billion!

Why so high? Because Quinn plans to raise taxes on Illinoisans again.

In 2011, Illinois politicians passed a record state income tax hike. They promised the tax hike would be temporary. Under state law, the state income tax rate will drop to 3.75 percent, from the current rate of 5 percent.

But Quinn wants to take away the tax cut he promised us. He wants hardworking families to keep paying the 5 percent rate.

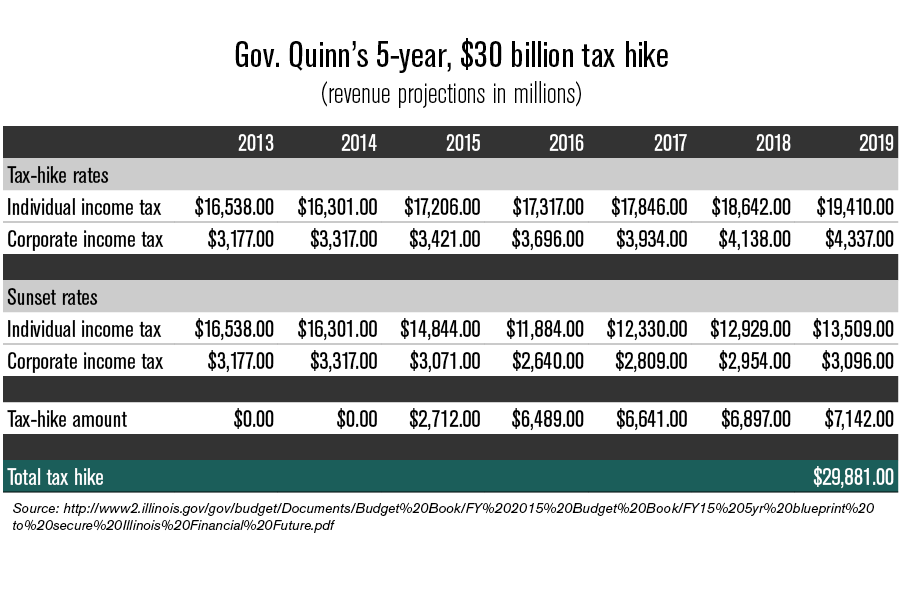

According to Quinn’s own budget estimates, taking away the 2015 tax cut means Illinois families and businesses will fork over to state government more than $30 billion in higher taxes over the next five years alone.

Taking away the Illinois tax cut will force the average Illinois family to pay about $1,000 in higher taxes every year. That means making the tax hike permanent could cost the average family more than $5,000 over the next five calendar years.

Quinn calls his five-year budget plan “responsible.” We taxpayers call it heartbreak.

Quinn refuses to reform spending or make the necessary cuts. In fact, he’s been steadily growing the Illinois state budget at the expense of taxpayers. But he wants us to live by a different standard.

So we want to ask Gov. Quinn: What exactly would you like us to cut from our family budgets?

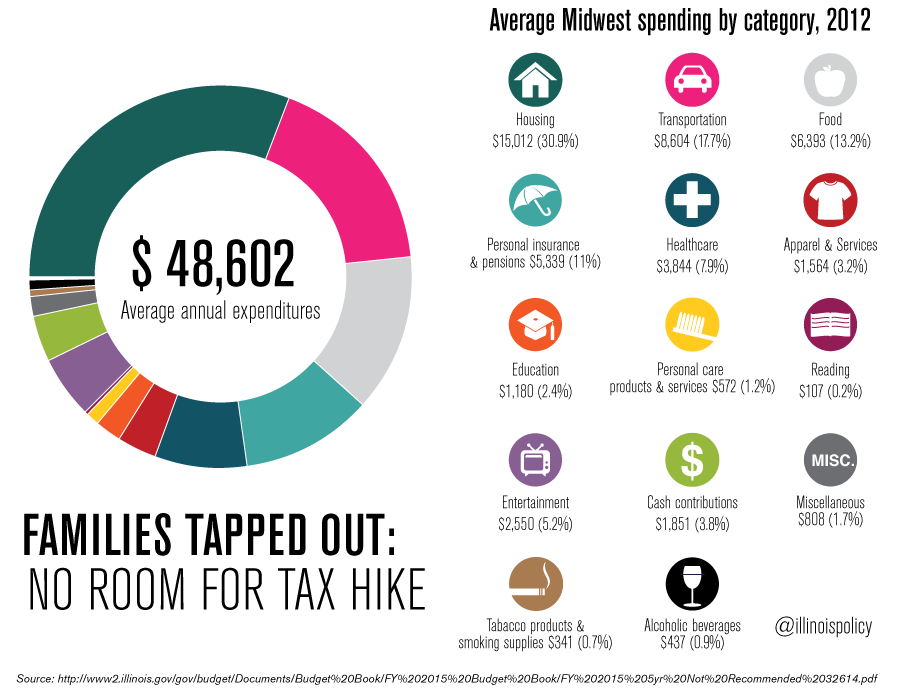

The graphic below shows how average consumers in the Midwest spend their money. It’s a good representation of what the Illinois family budget looks like.

The truth is there’s no room left in family budgets for another tax hike. Tax hikes don’t take money away from your annual salary; tax hikes come out of whatever money is left over after you pay the mortgage or rent, car payments, for groceries, for health care and everything else families struggle to afford.

The $5,000 Quinn is asking for is:

- More than the average Midwest consumer unit spends on health care each year.

- More than four times what the average Midwest consumer unit spends on education each year.

- More than 46 times what the average Midwest consumer unit spends on reading each year.

- More than 2.7 times what the average Midwest consumer unit makes in cash contributions each year.

Quinn is asking Illinois families to sacrifice so they can fork over even more of their hard-earned money to a dysfunctional state government. Meanwhile, he’s refusing to do the same. Quinn would much rather prop up the status quo, waste taxpayer money and maintain sweetheart deals for special interests.

Is that fair?

No.

Quinn and Illinois lawmakers owe it to taxpayers to keep their end of the bargain. Taxpayers were promised that if they paid thousands of dollars in higher taxes from 2011-2014 that they would see tax relief in 2015.

We did our part. Now it’s only fair for them to do theirs.