Illinois’ 2011 income tax hike put brakes on jobs recovery

Illinois’ 2011 income tax hike helped put the brakes on the state’s private-sector jobs recovery. According to data from the Bureau of Labor Statistics, Illinois’ monthly job creation has slowed down since the 2011 tax hike. Meanwhile, the rest of the country has accelerated its jobs growth. The Great Recession began in January 2008, and...

Illinois’ 2011 income tax hike helped put the brakes on the state’s private-sector jobs recovery.

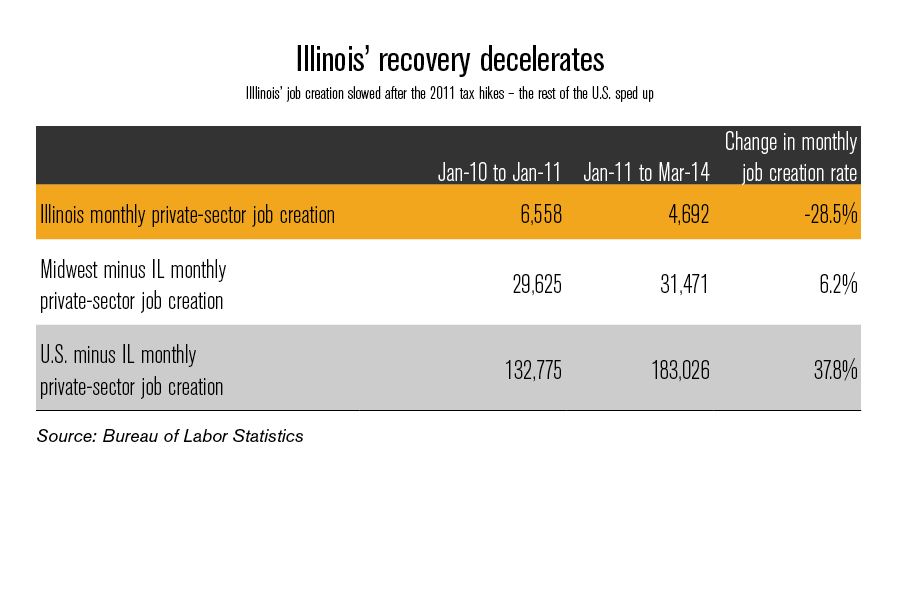

According to data from the Bureau of Labor Statistics, Illinois’ monthly job creation has slowed down since the 2011 tax hike. Meanwhile, the rest of the country has accelerated its jobs growth.

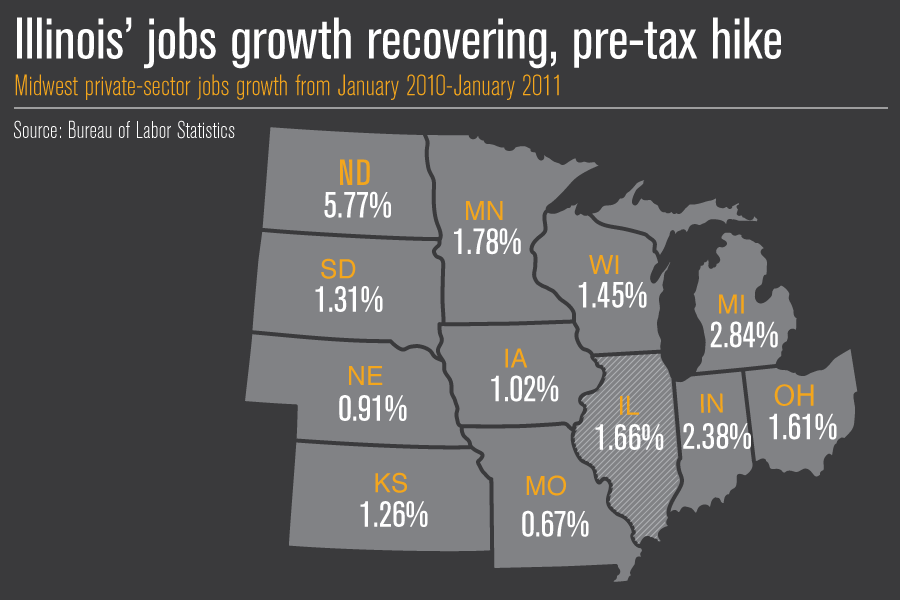

The Great Recession began in January 2008, and private-sector job losses extended through January 2010. But then the jobs recovery began, and Illinois started to bounce back. In fact, the Land of Lincoln did pretty well in its first year of jobs recovery.

Illinois ranked fifth in the Midwest and 14th nationally in private-sector job creation during the first 12 months of the recovery, from January 2010-January 2011.

Then Illinois raised taxes in January 2011. State income taxes jumped by 67 percent for families and small businesses, and by 46 percent for corporations. Consumers were left with one less week of take-home pay – businesses also lost a week’s worth of income.

But that wasn’t all. The 2011 tax hike indicated to anyone in doubt how Illinois planned to address its drastically underfunded pension problems. Businesses and residents saw that the nation’s worst pension crisis would be tackled through heavier taxation on the private sector.

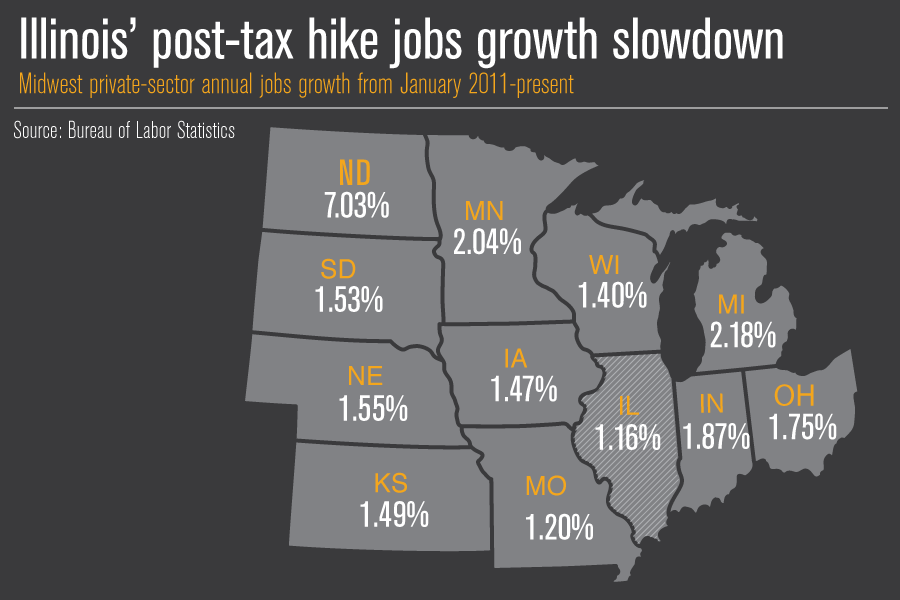

For the 38 months from January 2011-March 2014, Illinois ranked dead last in the Midwest and 39th nationally for private-sector job creation.

Bureau of Labor Statistics data show that Illinois’ annual private-sector job creation has been slower since the January 2011 tax hikes. Meanwhile, the Midwest and the U.S. have created jobs at a faster annual pace since January 2011 compared to their job-growth rates in the first year of recovery.

But the Illinois General Assembly has another opportunity to signal to families and businesses how they plan to address long-term pension problems. In the next three weeks of legislative session, legislators will decide whether to make the 2011 tax hike permanent.

But the Illinois General Assembly has another opportunity to signal to families and businesses how they plan to address long-term pension problems. In the next three weeks of legislative session, legislators will decide whether to make the 2011 tax hike permanent.

The state’s tax hike is legally set to expire at the end of 2014. Political leaders promised that the tax hike would be temporary; the fact that politicians are considering making the tax hike permanent puts the state’s credibility on the line with job creators and investors.

Lawmakers can’t afford to make the same mistake again.