Lawmakers need to keep their promise to sunset the tax hike in 2015

Illinois politicians pushed through a record income tax increase on families and businesses in January 2011. They promised the tax hike would partially sunset in January 2015. But as that date closes in, lawmakers are crying poor and threatening Illinoisans with massive cuts in services. Illinois lawmakers are using doomsday scenarios as scare tactics to...

Illinois politicians pushed through a record income tax increase on families and businesses in January 2011. They promised the tax hike would partially sunset in January 2015. But as that date closes in, lawmakers are crying poor and threatening Illinoisans with massive cuts in services.

Illinois lawmakers are using doomsday scenarios as scare tactics to convince Illinoisans that they need to pay higher taxes.

State Sen. Don Harmon, a chief proponent of higher taxes in Illinois, says that allowing the tax hike to sunset would mean cutting teachers from the classroom, denying kids access to education and releasing thousands of inmates.

These scare tactics are nothing more than falsehoods. Too often Illinois policy debates focus on how to raise taxes or where to make indiscriminate cuts to the budget.

But that’s not what Illinois needs. Illinois needs to completely overhaul and modernize the way it spends money. Reforming state spending can result in better outcomes and achieve significant budget savings.

In fact, a deeper dive into the budget numbers shows that letting the tax hike sunset will not create the fiscal cliff that’s so often touted by proponents of higher taxes.

General Fund revenues are expected to drop by 4.9 percent ($1.8 billion) in fiscal year 2015 and another 9 percent ($3.1 billion) in fiscal year 2016. That’s an annualized net revenue loss of $4.9 billion during 2016, the first full fiscal year of the sunset. But revenue begins growing again by approximately 3 percent a year after the sunset, reaching nearly $35 billion in fiscal year 2019.

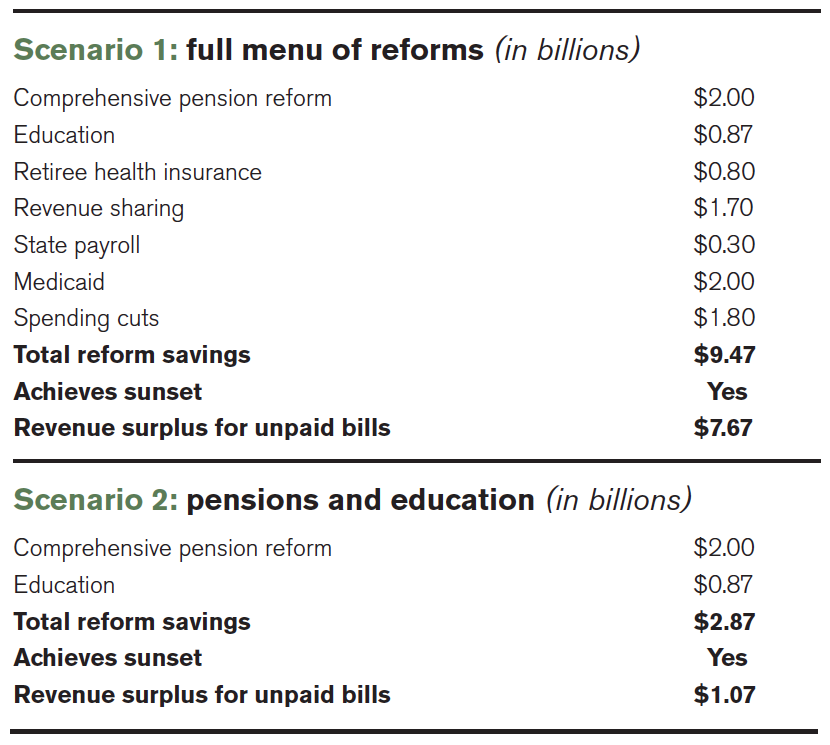

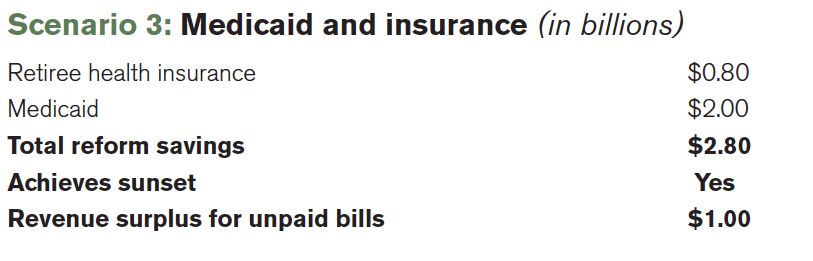

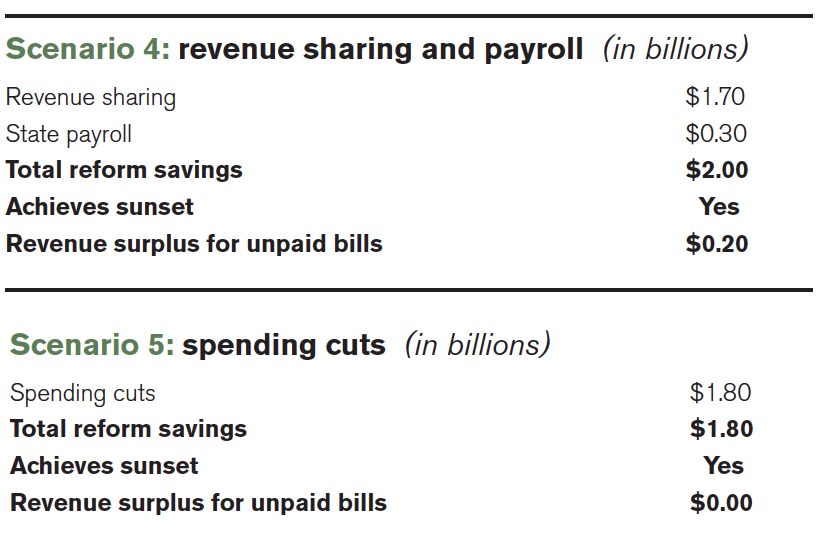

The Illinois Policy Institute’s Budget Solutions 2015 offers a menu of reform options that more than make up for the revenue losses due to the sunset.

The five scenarios presented in Budget Solutions 2015 provide a variety of options to sunset the tax hike and begin paying down Illinois’ backlog of unpaid bills. The full scenario includes every reform option offered in Budget Solutions 2015. This option not only sunsets the tax hike, but also leaves enough to pay the state’s entire $7 billion backlog of unpaid bills.

The other potential scenarios provide reform options that allow the state to more than make up for the revenue losses in both fiscal year 2015 and fiscal year 2016. For example, implementing scenario two in fiscal year 2015 and something similar to scenario three in fiscal year 2016 would completely accommodate for the annualized sunset in the state budget.

There is significant divide both within the parties and across the aisle in the Illinois Statehouse, and everyone may not be able to agree on all the reforms included in Budget Solutions 2015. That’s why we offered a menu of reform options. Politicians can pick and choose the options they like best, or implement moderate versions of several of the reforms offered here.

The bottom line is this: There is absolutely no excuse for lawmakers to not allow the tax hike to sunset.